NASDAQ

Crypto mining stocks surge to yearly highs after Bitcoin bounces back

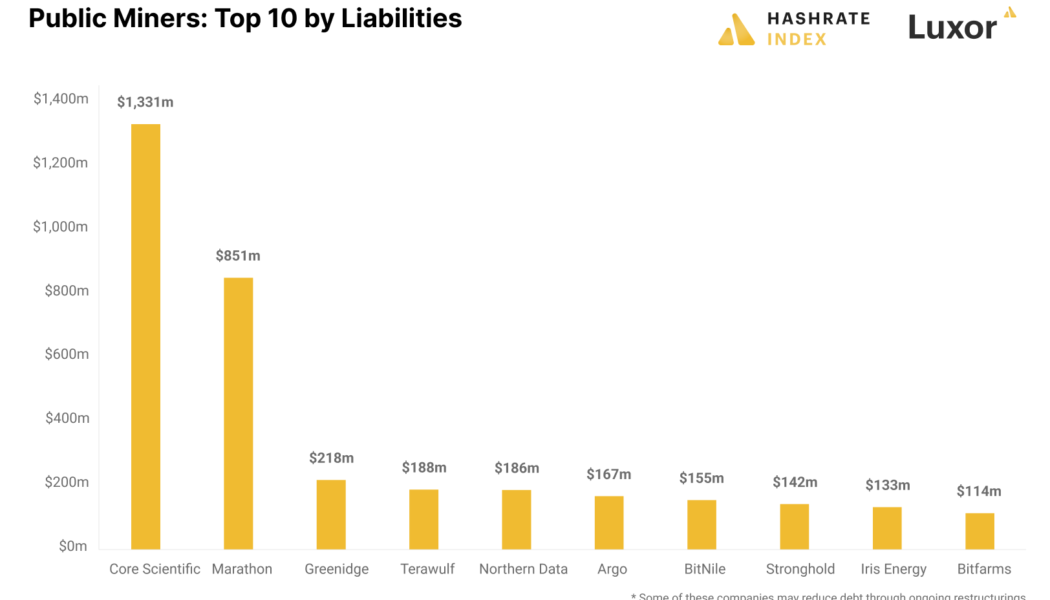

The Bitcoin (BTC) price rebound to a multi-month high has also positively affected mining stocks. Many crypto-mining stocks recorded their best monthly performance in a year. The surge in mining stocks also relieved the troubled miners who had to sell a significant chunk of their mined coins to boost liquidity in 2022. Bitfarms — one of the top BTC mining firms — registered a 140% surge in the first two weeks of January 2023, followed by Marathon Digital Holdings with a 120% surge. Hive Blockchain Technologies saw its stock value nearly double in the same period, while the MVIS Global Digital Assets Mining Index is up by 64% in the first month of the new year. The Luxor Hashprice Index, which aims to quantify how much a miner might make from the processing power used by the Bitcoin network...

Crypto exchange Coincheck plans Nasdaq listing in July 2023

Japanese cryptocurrency exchange Coincheck has confirmed plans to pursue a public stock offering in the United States through Nasdaq — a move that would give the company access to the country’s lucrative capital markets. In documents filed with the U.S. Securities and Exchange Commission on Oct. 28, Coincheck’s majority owner, Monex Group, confirmed that it is proceeding with Nasdaq listing procedures through a merger with special purpose acquisition company (SPAC) Thunder Bridge Capital Partners IV. If all goes according to plan, Coincheck’s Nasdaq listing will take place on July 2, 2023. Coincheck said the SPAC merger would allow the exchange to expand its crypto-asset business and gain direct access to U.S. capital markets. The technology-rich Nasdaq is one of the world’s lar...

Nasdaq needs clear regulations to launch crypto exchange, says VP

Nasdaq, the American stock exchange, has no immediate plans of launching a crypto exchange until there’s better regulatory clarity from policymakers, said Tal Cohen, the company’s executive vice president. In an interview with Bloomberg, Cohen said that the retail side of the crypto market is fairly saturated and there are enough crypto exchanges catering to the needs of retail investors. He added that his firm would continue its focus on crypto custody services that were launched on Sept. 20. Cohen also shed some light on other crypto-related services that the exchange is working on, namely building execution capabilities on the platform to move and transfer assets. The world’s second-largest stock exchange might be hesitant to launch a crypto exchange in the United States, but the f...

Crypto Biz: DID you see what Africa is doing with Web3?

If you’ve spent any time reading about blockchain and Web3, you know that this industry is filled with big buzzwords and half-baked concepts. But, concepts such as decentralized identity services, or DIDs, bring real meaning and utility to Web3. If you haven’t yet wrapped your mind around DID, it refers to a self-owned, independent identity that enables trusted data exchange. In other words, it puts digital identity management and administration directly in your hands instead of some third party’s. In this week’s Crypto Biz, we take a look at a Web3 partnership designed to bring DID-powered payment solutions to Africa. We also chronicle Maple Finance, the European Central Bank and Nasdaq. Payments platform Fuse integrates ChromePay to bring DID services to Africa Is Web3 even possibl...

Bitcoin’s in a bear market, but there are plenty of good reasons to keep investing

Let’s rewind the tape to the end of 2021 when Bitcoin (BTC) was trading near $47,000, which at the time was 32% lower than the all-time high. During that time, the tech-heavy Nasdaq stock market index held 15,650 points, just 3% below its highest-ever mark. Comparing the Nasdaq’s 75% gain between 2021 and 2022 to Bitcoin’s 544% positive move, one could assume that an eventual correction caused by macroeconomic tensions or a major crisis, would lead to Bitcoin’s price being disproportionately impacted than stocks. Eventually, these “macroeconomic tensions and crises” did occur and Bitcoin price plunging another 57% to $20,250. This shouldn’t be a surprise given that the Nasdaq is down 24.4% as of Sept. 2. Investors also must factor in that the index’s historical 120-day vo...

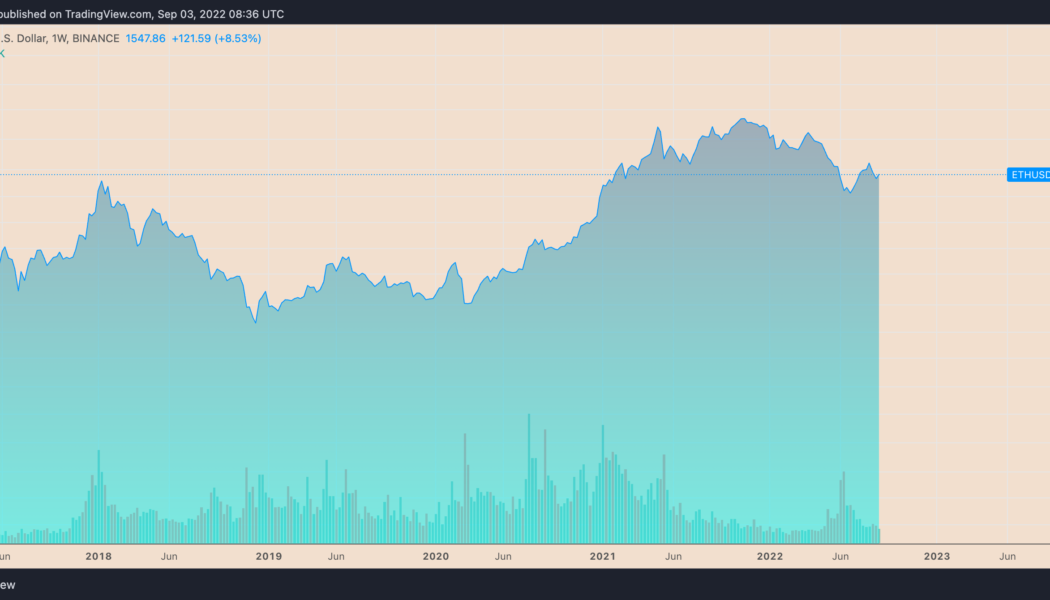

Surge or purge? Why the Merge may not save Ethereum price from ‘Septembear’

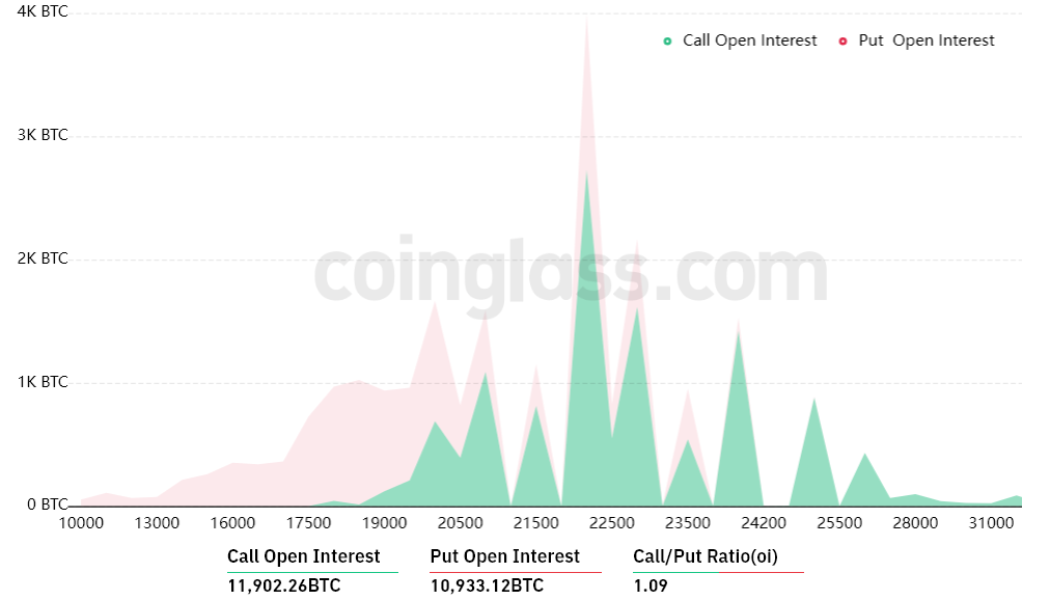

Ethereum’s native token, Ether (ETH), is not immune to downside risk in September after rallying approximately 90% from its bottom of around $880 in June. Much of the token’s upside move is attributed to the Merge, a technical upgrade that would make Ethereum a proof-of-stake (PoS) protocol, slated for Sep. 15. But despite logging impressive gains between June and September, Ether still trades almost 70% below its record high of around $4,950 from November 2021. Therefore, its possibility of heading lower remains on the cards. ETH/USD weekly price chart. Source: TradingView Here are three Ethereum bearish market indicators that show why more downside is likely. Sell the Ethereum Merge news Ethereum options traders anticipate Ether’s price to reach $2,200 f...

MicroStrategy stock MSTR hits 3-month high after CEO’s exit

MicroStrategy (MSTR) stock opened higher on Aug. 3 as investors digested the news of its CEO Michael Saylor’s exit after a depressive quarterly earnings report. Microstrategy stock up 142% since May lows On the daily chart, MSTR’s price surged by nearly 14.5% to $324.55 per share, the highest level since May 6. The stock’s intraday gains came as a part of a broader recovery that started on May 12 at $134. Since then, MSTR has grown by 142% versus Nasdaq’s 26.81% gains in the same period. MSTR daily price chart. Source: TradingView Bad Q2, Saylor’s resignation The Aug. 3 MSTR rally came a day after MicroStrategy reported a billion dollar loss in its second quarter (Q2) earnings call. Interestingly, the company’s major Bitcoin exposure was a large re...

Bitcoin price eyes $24K July close as sentiment exits ‘fear’ zone

Bitcoin (BTC) dropped volatility on the last weekend of July as the monthly close drew near. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView 200-week moving average in focus for July close Data from Cointelegraph Markets Pro and TradingView showed BTC/USD retaining $24,000 as resistance into July 30. The pair had benefitted from macro tailwinds across risk assets in the second half of the week, these including a flush finish for United States equities. The S&P 500 and Nasdaq Composite Index gained 4.1% and 4.6% over the week, respectively. With off-speak trading apt to spark volatile conditions into weekly and monthly closes thanks to thinner liquidity, however, analysts warned that anything could happen between now and July 31. “Just gonna sit back and watch the market up ...

3 Bitcoin trading behaviors hint that BTC’s rebound to $24K is a ‘fakeout’

Bitcoin (BTC) price rallied toward $24,200 on July 28 after a near 10.5% surge that began a day earlier. The gains appeared after Federal Reserve Chairman Jerome Powell signaled intentions to slow down their prevailing tightening spree. They prompted some Bitcoin analysts to predict short-term upside continuation, with CryptoHamster seeing BTC at $26,000 next. It seems that the downside breakout was a false one, and the bullish flag has been validated. Let’s see how fast $BTC can reach those targets. #bitcoin $BTCUSD $ETH $ETHUSD #ビットコイン #биткойн #比特币 https://t.co/v6x4Ka23L7 pic.twitter.com/nKoEV8440X — CryptoHamster (@CryptoHamsterIO) July 28, 2022 But BTC’s potential to recover entirely from its ongoing bearish slumber appears low for at least three key reasons. Bitcoin bulls...

Coinbase stock has potential to double in 2022 after plunging 90% from record high

Coinbase stock (COIN) price has nearly doubled since its June lows with a potential for much more upside this year, according to a mix of technical and fundamental indicators. COIN’s symmetrical triangle reversal COIN has been undergoing a strong bullish reversal after falling by almost 90% from its record high of $368.90 in November 2021. Coinbase stock price was up over 95% to $75.27 as of July 20’s close when measured from its May 12 local bottom of $40.83. Its recovery led to a symmetrical triangle pattern formation with the price forming a sequence of lower highs and higher lows. Symmetrical triangles in downtrend typically turn out to be bearish continuation patterns. They resolve after the price breaks below their lower trendlines to fall further. But in rare instances, ...

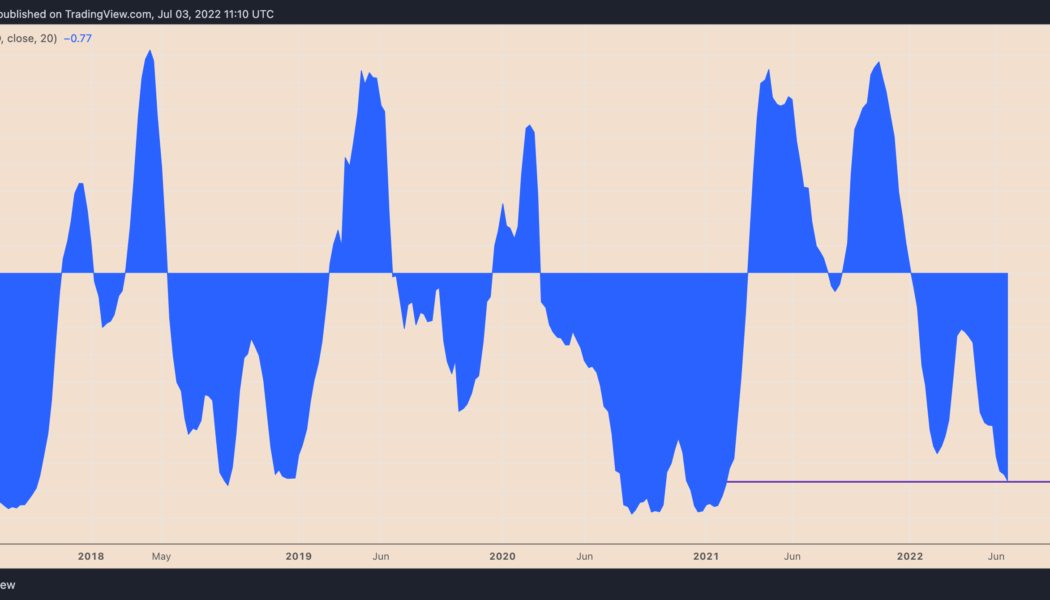

Bitcoin’s inverse correlation with US dollar hits 17-month highs — what’s next for BTC?

Bitcoin (BTC) has been moving in the opposite direction of the U.S. dollar since the beginning of 2022 — and now that inverse relationship is more extreme than ever. Bitcoin and the dollar go in opposite ways Notably, the weekly correlation coefficient between BTC and the dollar dropped to 0.77 below zero in the week ending July 3, its lowest in seventeen months. Meanwhile, Bitcoin’s correlation with the tech-heavy Nasdaq Composite reached 0.78 above zero in the same weekly session, data from TradingView shows. BTC/USD and U.S. dollar correlation coefficient. Source: TradingView That is primarily because of these markets’ year-to-date performances amid the fears of recession, led by the Federal Reserve’s benchmark rate hikes to curb rising inflation. Bitcoin, for example,...