Music Stocks

The Ledger: Music Stocks Are Rebounding at the End of a Rough Year

The Ledger is a weekly newsletter about the economics of the music business sent to Billboard Pro subscribers. An abbreviated version of the newsletter is published online. After a miserable year for music stocks — and stocks in general — 2022 could end on a string of positive notes. As rising interest rates have hammered stocks and erased big gains made during the pandemic, the Billboard Global Music Index, a float-adjusted group of 20 publicly traded music companies, is down 36.1% in 2022, and shares of vital companies such as Spotify and Warner Music Group are down 65.7% and 20.5%, respectively. But in recent weeks, the momentum has reversed dramatically. The Billboard Global Music Index is up 12.6% over the last two weeks and 14.6% in the five weeks since Oct. 28....

The Ledger: Music Stocks Are Rebounding at the End of a Rough Year

The Ledger is a weekly newsletter about the economics of the music business sent to Billboard Pro subscribers. An abbreviated version of the newsletter is published online. After a miserable year for music stocks — and stocks in general — 2022 could end on a string of positive notes. As rising interest rates have hammered stocks and erased big gains made during the pandemic, the Billboard Global Music Index, a float-adjusted group of 20 publicly traded music companies, is down 36.1% in 2022, and shares of vital companies such as Spotify and Warner Music Group are down 65.7% and 20.5%, respectively. But in recent weeks, the momentum has reversed dramatically. The Billboard Global Music Index is up 12.6% over the last two weeks and 14.6% in the five weeks since Oct. 28....

Apple Music’s Price Hike Boosts Music Stocks

Universal Music Group, Hipgnosis Songs Fund and other music stocks got a much-needed boost on Tuesday (Oct. 25) following news of Apple Music’s price hike, as investors bet it would trigger a wave of streaming subscription cost increases. Universal Music Group’s stock closed 11.6% higher, Hipgnosis Songs Fund Ltd ended up 7.8% and Korean music companies SM Entertainment and HYBE finished the trading day 4.8% and 4.4% higher, respectfully, on Tuesday. On Monday, Apple announced that it was raising the standard U.S. and U.K. individual plan price to $10.99 from $9.99. This 10% price hike — Apple’s first — comes amid high inflation and a darkening economic environment in many global markets. If Apple can raise prices at a time like this, that is a sign the music industry can charge more ...

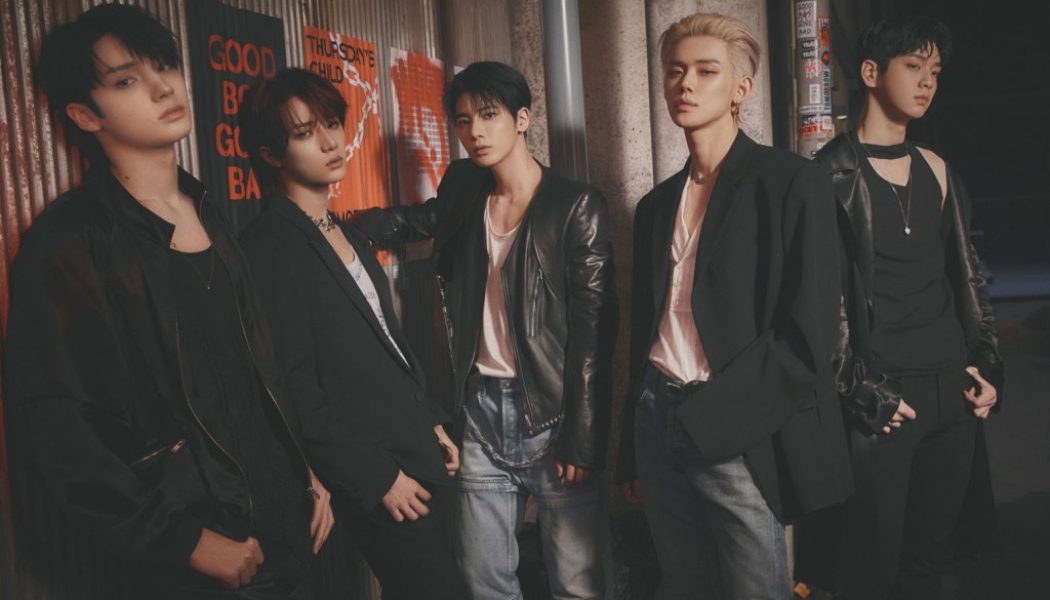

As Music Stocks Keep Slipping, This One K-Pop Company Is Bucking the Trend

South Korean music company SM Entertainment, home to such groups as NCT 127 and SuperM, stands apart in a competitive music business for withstanding stock market downturns that have hit all other publicly-traded music companies. Since December, stocks have been on a downward trend, sparked by the Federal Reserve’s intention to raise the federal funds rate to prevent the economy from overheating and rein in inflation. And while music is often said to be recession-proof, music companies’ stocks are not immune from larger economic trends and investors’ desires for safer options during chaotic times. Even though the global music industry is posting double-digit revenue growth, the share prices of publicly traded music companies have followed the broader trends and stumbled in the face ...

The Ledger: Buying Into the K-Pop Craze Just Got Less Risky for US Investors

The Ledger is a weekly newsletter about the economics of the music business sent to Billboard Pro subscribers. An abbreviated version of the newsletter is published online. An exchange-traded fund, or ETF, focused on Korean music started trading on the NYSE Arca exchange on Thursday, giving American investors a means to buy shares of companies that trade on exchanges in South Korea. But the ETF stands out for another reason: a bundle of K-pop stocks will carry less risk than standalone companies that rely on dozens of labels, each with a handful of top artists as well as deep catalogs. Trading under the aptly named ticker KPOP, the ETF includes the stocks of 30 corporations, including several music companies: HYBE, the home of K-pop megastars BTS and up-and-coming acts Tomorrow X Together ...

The Ledger: Concert Companies Are Maintaining a Rosy Outlook for the Rest of 2022

The Ledger is a weekly newsletter about the economics of the music business sent to Billboard Pro subscribers. An abbreviated version of the newsletter is published online. Strong demand for live music is not a surprise given fans’ time away from concerts in 2020 and 2021. But it’s not straightforward, either. Fans are dealing with inflation and high gas and airfare costs. Companies face staffing shortages and higher costs. Artists are flooding markets’ venues seeking to recapture lost business. Still, judging from some companies’ statements around their latest quarterly results, indications point to an exceptional second half of the year. Live Nation’s second quarter earnings showed a company is primed for a record year. Live Nation sold more than 100 million tickets to its concerts this ...

One of Music’s Biggest Wholesalers Is Going Public

Alliance Entertainment, the giant music, video and gaming wholesaler, will be going public and trade on the New York Stock exchange, the company announced Thursday (June 23). The public listing will be done through a reverse merger with Adara Acquisition Corp., a special purpose acquisition company (SPAC). The deal is subject to the approval of the shareholders of Adara Acquisition Corp., which trades on NYSE under the symbol ADARA. If the deal closes — as expected in the fall — Alliance Entertainment will trade under the symbol AENT. The deal has assigned Alliance Entertainment a pre-deal valuation of $480 million. Alliance Entertainment serves as a one-stop for all titles to brick-and-mortar and online retailers. In the first nine-months of its fiscal year ended March 31, the compan...

Music Stocks and Cryptocurrencies Hit by Recession, Inflation Fears

Music and other entertainment stocks fell sharply on Monday (June 13), following a string of worrisome events and expectations the Federal Reserve will make a substantial rate hike to slow inflation. The S&P 500 declined 3.9%, putting the index in bear market territory — down more than 20% from its high in January. The Nasdaq declined 4.7%. Radio broadcaster Cumulus Media fell 20.3% to $9.17, the largest decline of any music-related stock on Monday. Cumulus is “thinly traded and has high leverage,” Noble Capital Markets’ Michael Kupinsky tells Billboard in an email response. “Both are issues when [the stock is] out of favor and the market has its sights on an economic downturn.” Radio stocks had the worst day among music-related companies on Monday as four leading companies’ stocks dro...

The Ledger: Should Music Streamers Follow Netflix’s Lead on Account Sharing?

The Ledger is a weekly newsletter about the economics of the music business sent to Billboard Pro subscribers. An abbreviated version of the newsletter is published online. The music business should watch what Netflix is doing in select Latin American countries to bring in more revenue as painlessly as possible. In the next few weeks, Netflix will begin testing new two features in Chile, Costa Rica and Peru: “Add an extra member,” which allows subscribers to standard and premium plans to add up to two people they don’t live with for a few dollars a month; And “transfer profile to a new account” for people to take their profile information — namely their viewing history and recommendations — to a new account rather than create a new account from scratch. “We recognize that people have many ...

After Months Declining, Music Stocks Tick Up as Fed Raises Interest Rate

Music stocks that had been pummeled in recent months received a respite on Wednesday (March 16) after the Federal Reserve moved to combat inflation and soaring economy by raising the federal funds rate from 0.25% to 0.50%. The federal fund rate is the benchmark rate for inter-bank loans and borrowing costs for credit cards, mortgages and auto loans. Shares of Universal Music Group rose 5.0% on the day to 21.96 euros while Spotify improved 7.9% to $133.58 and Warner Music Group climbed 1.4% to $35.47. The Fed’s move had been expected since its first announced its intention to do so on Dec. 15, 2021. By raising the federal funds rate, the Fed will make borrowing money more costly, reducing businesses and consumer spending to rein in inflation. The Fed stated on Wednesday it “anticipates that...

Music Earnings Q4 2021: Taking Stock of Spotify, WMG, SiriusXM & More Companies

Most public music companies continued hot streaks by turning in good or excellent numbers for the quarter ended Dec. 31, 2021. For the majority of them, however, it would have been difficult not to impress in 2021 compared to 2020. COVID-19 shut down the touring business for three quarters of 2020, hampered brick-and-mortar retail for much of the year and hammered advertising spending, which affected radio broadcasters as well as streaming services. By the end of 2021, businesses’s main problems were rising costs and labor shortages, not unemployment and unpredictable consumer spending. Each component of the music ecosystem had encouraging results. The three majors — Universal Music Group, Sony’s music division and Warner Music Group — had combined revenues of about $25.4 billion, up 19.8%...