Mt. Gox

Bitcoin scarcity rises as bad exchanges take 1.2M BTC out of circulation

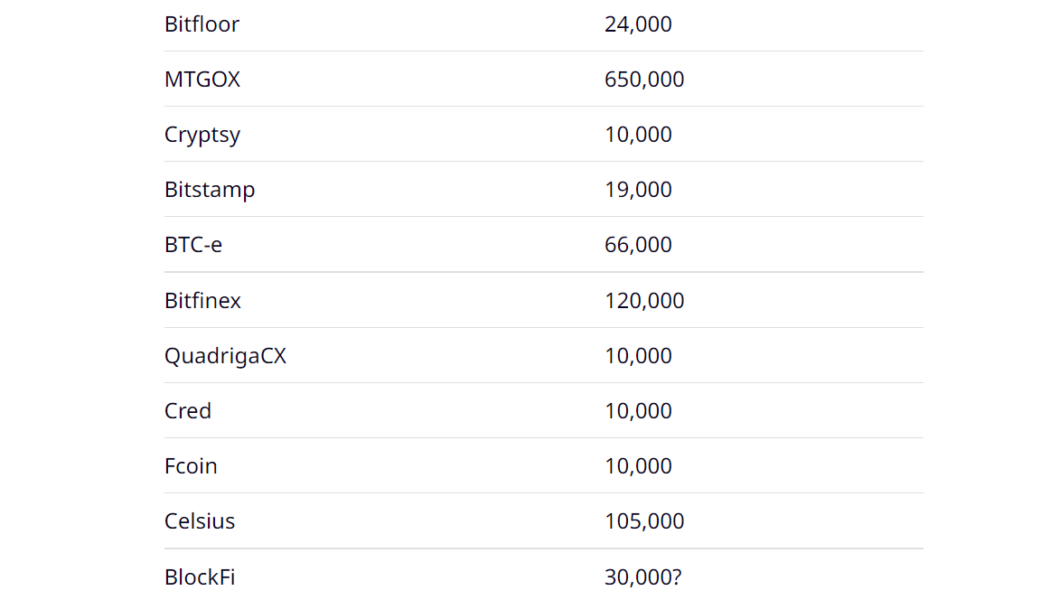

One of the biggest factors differentiating Bitcoin (BTC) from fiat currency and most cryptocurrencies is the hard limit of 21 million on its total circulating supply. However, the demise of numerous crypto exchanges over the last decade has permanently taken out at least 5.7% (1.2 million BTC) of the total issuable Bitcoin from circulation. The lack of clarity around a crypto exchange’s proof-of-reserves came out as the primary reason for their sudden collapses, as seen recently with FTX. Historical data around crypto crashes revealed that 14 crypto exchanges, together, were responsible for the loss of 1,195,000 BTC, which represents 6.3% of the 19.2 Bitcoin currently in circulation. Bitcoin lost due to defunct crypto exchanges. Source: Casa Blog An investigation conducted by Jameson ...

Mt. Gox rumors panic Bitcoin Twitter as BTC price returns below $20K

Bitcoin (BTC) failed to keep $20,000 support on Aug. 27 as fears over a sell-off by users of defunct exchange Mt. Gox added to price pressures. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView Mt. Gox rumors dismissed as “typical crypto” Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it headed to new six-week lows, reaching $19,766 on Bitstamp. Thin weekend liquidity appeared to exacerbate already jittery markets, which reacted badly to unconfirmed rumors that Mt. Gox funds were due for release to creditors on Aug. 28. Claims varied widely at the time of writing, with some believing that a tranche of 137,000 BTC was set for release in one go. Others said that funds would be sent piecemeal, but that payouts would nonetheless begin this wee...

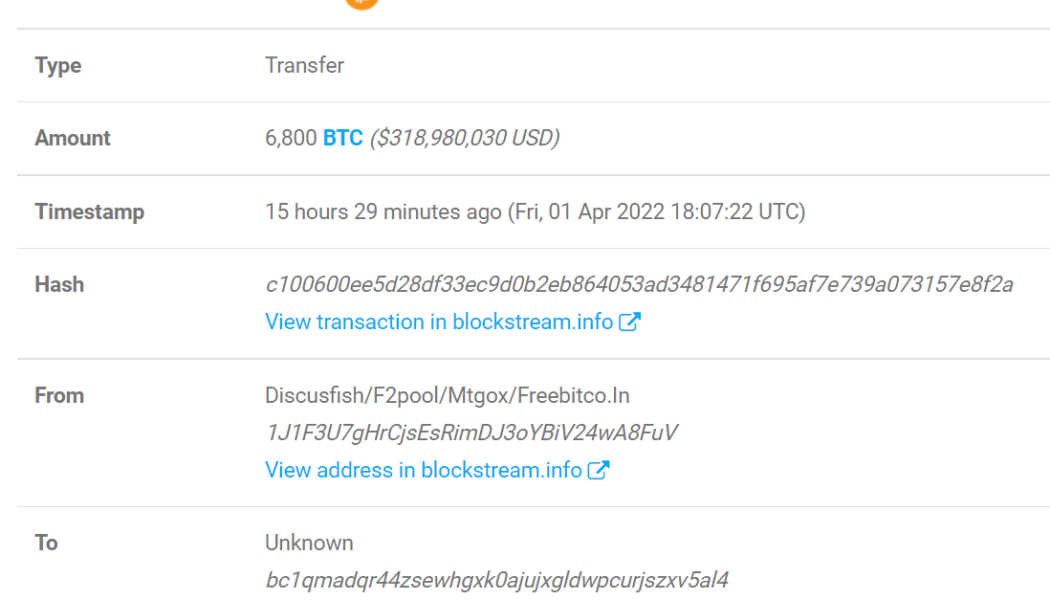

Mt. Gox wallet transfers 6,800 BTC as ex-CEO plans to redistribute $6B

A cold wallet belonging to the infamous Bitcoin (BTC) exchange Mt. Gox transferred 6,800 BTC to an unknown wallet just days after the former CEO Mark Karpeles revealed plans to redistribute BTC worth $6 billion to its creditors. Mt. Gox was a Tokyo-based Bitcoin exchange that shut down in Feb. 2014 after a hack that compromised 850,000 BTC. In a recent interview, Karpeles disclosed that the exchange had roughly 200,000 BTC in possession during the company’s closure, out of which the trustee sold roughly 50,000 BTC for $600 million in the past. According to Karpeles, the remaining 150,000 BTC currently held by Mt. Gox has grown in value over the years — and is worth over $6 billion. After this revelation, the former CEO confirmed plans to redistribute the money and settle scores with ...

Mark Karpeles announces commemorative NFT drop for Mt. Gox users

The former CEO of thnow-defunct crypto exchange Mt. Gox has announced that certain users will be eligible to receive commemorative nonfungible tokens, or NFTs. In a Monday announcement on Twitter, Mark Karpelès said that crypto users who were Mt. Gox customers between 2010 and 2014 — during which time the exchange was hacked and subsequently declared bankruptcy — could register to claim a free NFT. According to the CEO, the offer extends to users who had a balance or have claimed losses from the defunct exchange. “Mt. Gox customers are early adopters, some of them were on BitcoinTalk when Satoshi Nakamoto was still posting,” said the project website. “A new token or NFT airdrop is a great way to engage users and at the same time erase a bit of the loss incurred in Mt. Gox.” You can claim y...

The biggest crypto heists of all time

The biggest crypto heists to date are MT Gox, Bitgrail, Coincheck, KuCoin, PancakeBunny, Poly Network, Cream Finance, BadgerDAO, Vulcan Forged and Bitmart. MT Gox MT Gox was the first large-scale exchange hack, and it remains the most significant Bitcoin (BTC) heist from an exchange. The MT Gox robbery, on the other hand, was not a one-off occurrence. Rather, the site leaked cash from 2011 to February 2014. Hackers stole 100,000 BTC from the exchange and 750,000 BTC from its consumers over a few years. These Bitcoin burglaries were valued at $470 million at the time, but they’re now worth approximately ten times this amount. Shortly after the theft, MT Gox went into liquidation, with liquidators recovering roughly 200,000 of the stolen BTC. Bitgrail Bitgrail was a small Italian excha...