Morgan Stanley

Google invested a whopping $1.5B into blockchain companies since September

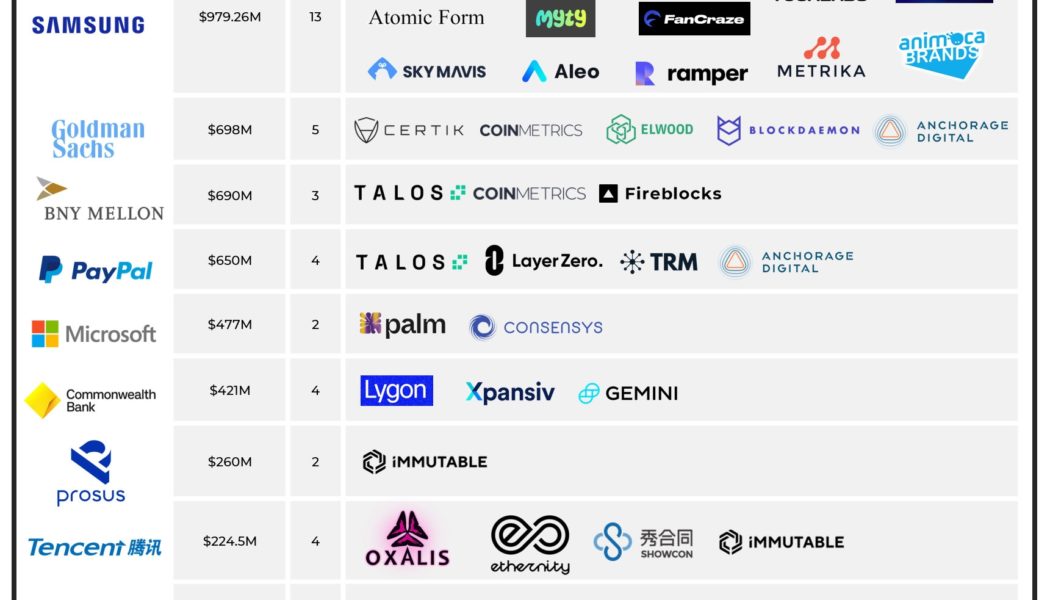

Google parent company Alphabet poured the most amount of capital into the blockchain industry compared to any other public company, investing $1.5 billion between Sep. 2021 and Jun. 2022, a new report shows. In an updated blog published by Blockdata on Aug. 17, Alphabet (Google) was revealed as the investor with the deepest pockets compared to the top 40 public corporations investing in blockchain and crypto companies during the period. The company invested $1.5 billion into the space, concentrating on four blockchain companies including digital asset custody platform Fireblocks, Web3 gaming company Dapper Labs, Bitcoin infrastructure tool Voltage, and venture capital company Digital Currency Group. This is in stark contrast to last year, where Google diversified its much smaller $60...

Morgan Stanley encourages investors to buy battered El Salvador eurobonds

El Salvador’s Bitcoin (BTC) bet has somewhat backfired, with the top cryptocurrency currently trading at a 70% discount from its top. At a time when the Latin American nation is struggling with its debt, Morgan Stanley has given a buy call for the battered eurobond. Simon Waever, global head of emerging-market sovereign credit strategy at Morgan Stanley, told investors in a Tuesday note that El Salvador’s bonds are overly punished by the market conditions, despite the country having better financial metrics than many of its peers, reported Bloomberg. The note to investors read: “Markets are clearly pricing in a high probability of the autarky scenario in which El Salvador defaults, but there is no restructuring.” Waever noted that a country’s debt shouldn’t trade lower than $0.437 on the d...

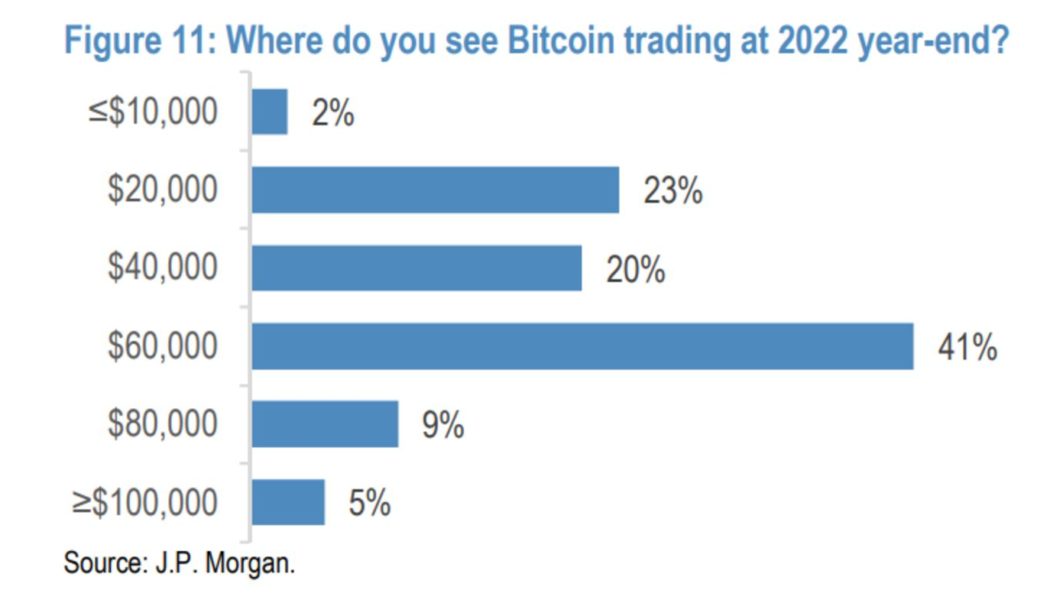

Wall Street still not convinced on Bitcoin $100K this year: JPMorgan survey

One of the world’s largest investment banks has its Bitcoin (BTC) price predictions ready for 2022. In a recent poll, JPMorgan Chase asked its clients, “Where do you see Bitcoin trading at 2022 year-end?” Just 5% said they saw the digital coin reaching $100,000, and 9% saw it breaking previous all-time highs, reaching over $80,000. The bank is known for its wealthy client portfolio. While some BTC bulls may welcome the news that 14% of JPMorgan’s clients expect at least a twofold increase, it’s not the fireworks the crypto market is accustomed to. On balance, however, the survey is generally positive. Most clients (55%) see BTC trading at $60,000 or above at the end of the year, with only one quarter expecting prices to slide from the recent lows of $40,000. “I’m not surprised by Bit...