Money Laundering

Crypto adoption via regulation: Setting rules for centralized exchanges

Centralized cryptocurrency exchanges have become the backbone of the nascent crypto ecosystem, making way for retail and institutional traders to trade cryptocurrencies despite a constant fear of government crackdowns and lack of support from policymakers. These crypto exchanges over the years have managed to put self-regulatory checks and implemented policies in line with the local financial regulations to grow despite the looming uncertainty. Cryptocurrency regulation continues to occupy mainstream debates and experts’ opinions, but despite public demand and requests from stakeholders of the nascent ecosystem, policymakers continue to overlook the rapidly growing sector that reached a market capitalization of $3 trillion at the peak of the bull run in 2021. Over the past five years...

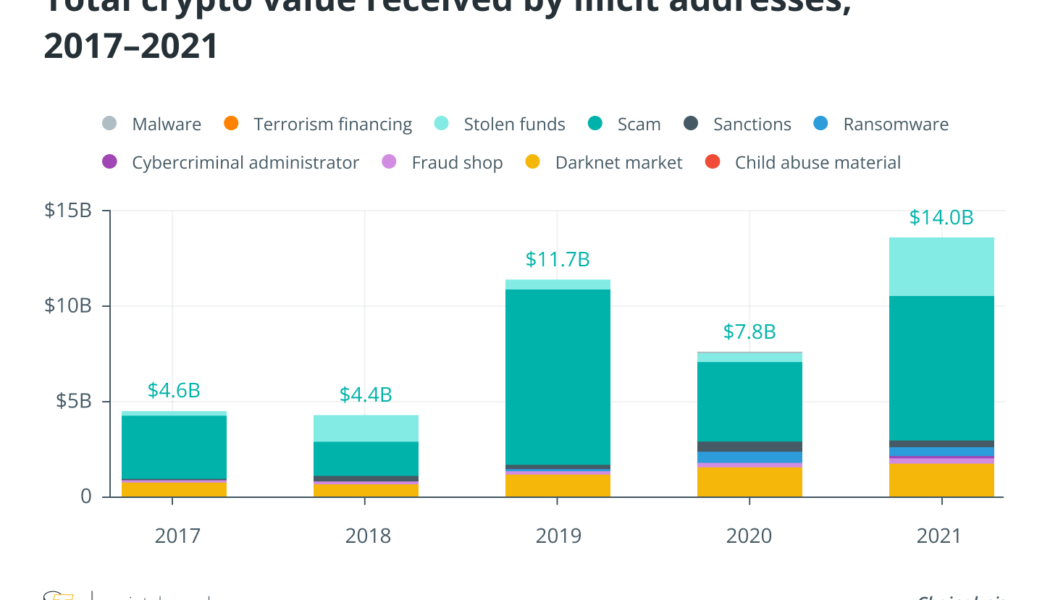

Institutional crypto adoption requires robust analytics for money laundering

Institutions have begun to take crypto seriously and have entered the space in numerous ways. As noted in a previous analysis, this has resulted in banks and fintechs looking at custody products and services for their clients. However, as custodians of clients’ assets, banks must also ensure they are clean assets and stay compliant. This is where on-chain analytics solutions have a huge role to play in understanding patterns in transactions to identify money laundering and other spurious activities within the cryptocurrency and digital assets space. According to a report by Chainalysis, over $14 billion of illicit transactions took place in 2021. Therefore, it is critical to build the foundational infrastructure around Anti-Money Laundering (AML) to support the growing institutional ...

Georgia aims to adopt European crypto standards for Anti-Money Laundering

Georgia, one of the world’s most cryptocurrency-friendly countries, is moving to introduce new crypto regulations to pursue its ambitions to become a global crypto hub. Georgian lawmakers have prepared a new regulatory framework targeting digital business and cryptocurrency trading in the country, Georgian Minister of Economy and Vice Prime Minister Levan Davitashvili announced. Davitashvili said that a draft bill has been sent to the parliament and the amendments are expected to be passed in the autumn session, local news agency Business Media Georgia reported on Monday. According to the minister, the draft bill aims to coordinate local cryptocurrency laws with three major European Union directives, including the Payment Services Directive (PSD2), the Capital Requirements Directive (CRD) ...

Indian authorities freeze more crypto funds over money laundering allegations

India’s Directorate of Enforcement (ED) announced Friday that it has frozen the financial accounts of Bengaluru-based financial services company Yellow Tune Technologies, some of which were held by Flipvolt crypto exchange, the Indian branch of Singaporean Vauld. The move is linked to an ongoing investigation into money laundering by China-linked instant loan companies. This is the second time this week the agency has taken action in the crypto sphere in connection with that case. The financial watchdog announced it was freezing Yellow Tune’s bank balances, payment gateway balances and balances in the Flipvolt cryptocurrency exchange for a total of 3.7 billion rupees, or $46.4 million after determining that the company was a shell entity incorporated by two Chinese nationals using ps...

Dutch authorities arrest suspected Tornado Cash developer

Authorities in the Netherlands have arrested a developer that is suspected to be involved in money laundering through the crypto mixing service Tornado Cash. The Fiscal Information and Investigation Service (FIOD), an agency in the Netherlands responsible for investigating financial crimes, officially announced on Friday an arrest of a 29-year-old man in Amsterdam. The man has allegedly been involved in facilitating criminal financial flows and money laundering through the decentralized Ethereum mixer Tornado Cash, the authority said. The FIOD pointed out that it doesn’t rule out multiple arrests in the case, noting that its Financial Advanced Cyber Team (FACT) launched a criminal investigation against Tornado Cash in June 2022. According to the FACT, Tornado Cash has allegedly been used t...

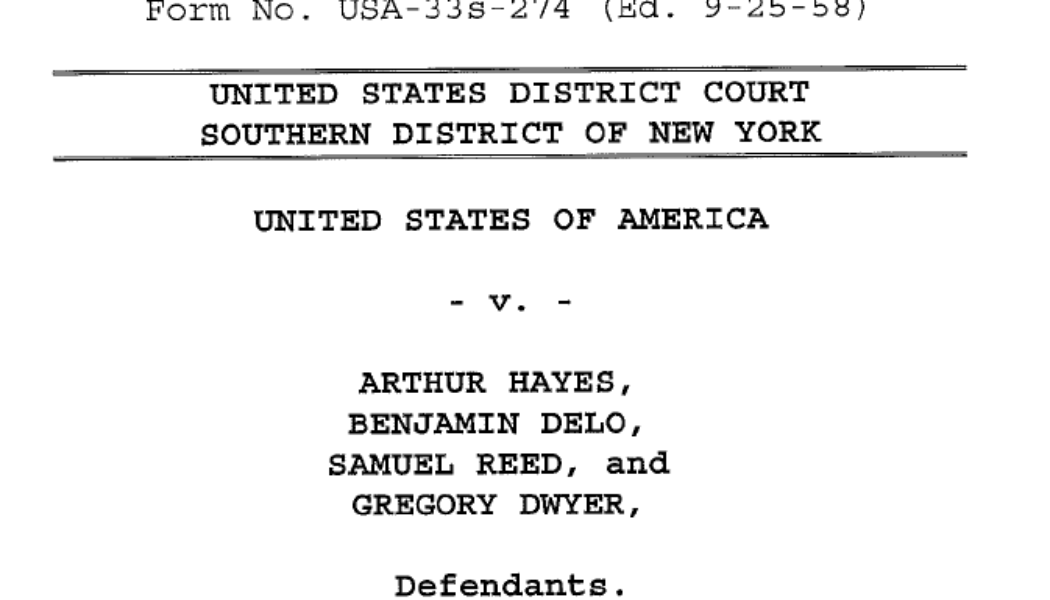

BitMEX co-founder Benjamin Delo avoids jail, receives 30 months probation

Benjamin Delo the co-founder of cryptocurrency exchange BitMEX has been sentenced to 30 months probation for violating the Bank Secrecy Act (BSA), which is an anti-money laundering law. The sentence, handed down at a federal court in New York on June 15th, follows his guilty plea to charges in February of “willfully failing to establish, implement and maintain an Anti-Money Laundering (AML) program” in his role at BitMEX. Prosecutors had argued Delo should serve a year in prison or at least receive a two-year probation along with six months of home detention, as was given to former CEO Arthur Hayes in May. For Delo, his lesser sentence closes the legal saga which started in October 2020 which also saw co-founders Hayes and Samuel Reed along with BitMEX’s first official employee Gregory (Gr...

Arthur Hayes to serve 2-year probation owning up to BitMEX’s AML mishap

Bringing closure to the long-awaited judgment related to the money laundering activities over the BitMEX crypto exchange, one of the four federal district courthouses in New York reportedly sentenced two-year probation and six months of home detention to founder and ex-CEO Arthur Hayes. Arthur Hayes, along with the other BitMEX co-founders — Benjamin Delo and Samuel Reed — and the company’s first non-employee Gregory Dwyer, pleaded guilty to the Bank Secrecy Act (BSA) violations on Feb 24, admitting to “willfully failing to establish, implement and maintain an Anti-Money Laundering (AML) program at BitMEX.” Indictment against BitMEX co-founders and employees for violating BSA. Source: Justice.gov Pleading guilty to supporting money laundering is a punishable offense, often carrying a ...

AUSTRAC releases 2 new guides to help spot illicit crypto use

Australian financial compliance enforcement agency AUSTRAC has released two new guides to help entities to spot when customers are using crypto for illicit means, or when they are being forced to pay the creators of ransomware. But it warned that debanking customers merely on suspicion of such activity was a harmful practice with serious negative effects. In an announcement posted earlier today, AUSTRAC noted that the growing acceptance, value and adoption of crypto and blockchain tech has been accompanied by an increase in cybercrime. “Cyber-enabled crime is an increasing threat to Australians. According to the Australian Cyber Security Centre (ACSC), 500 ransomware attacks were reported in the 2020-21 financial year, an increase of nearly 15 percent from the previous year,” AUSTRAC state...

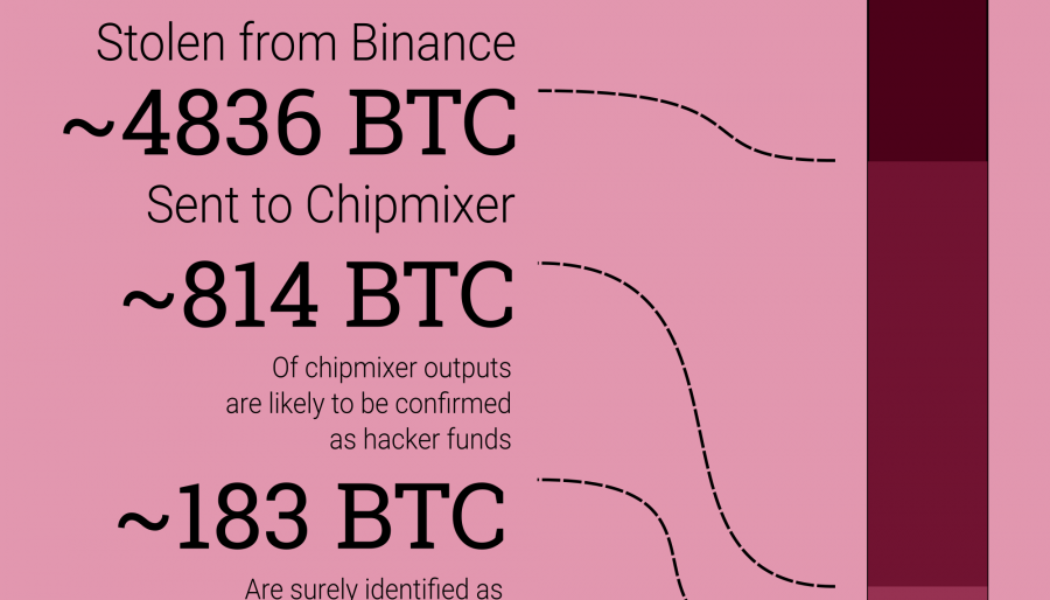

NCA wants regulation for coin mixers, but the crypto industry is already one step ahead

The United Kingdom’s National Crime Agency (NCA) seeks to regulate the crypto coin mixers under the country’s laws against money laundering. Coin mixing tools are popular in the decentralized world as they maintain the privacy of transactions. These tools often mix several transactions to obscure the origin of a particular transaction. Then the recipient receives the transactions from a mixing “black box” comprised of hundreds of transactions from various wallets. While privacy-focused, these tools often face regulators’ ire as they are also a known way for hackers and criminals to wash their funds. Gary Cathcart, the NCA’s head of financial investigation, claimed that these transaction mixing tools offer a layer of anonymity to criminals that can be use...

Seizure of Bitfinex funds is a reminder that crypto is no good for money launderers

As public understanding of how digital assets work becomes more nuanced along with the mainstreaming of crypto, the language of Bitcoin’s (BTC) “anonymity” gradually becomes a thing of the past. High-profile law enforcement operations such as the one that recently led to the U.S. government seizing some $3.6 billion worth of crypto are particularly instrumental in driving home the idea that assets whose transaction history is recorded on an open, distributed ledger are better described as “pseudonymous,” and that such a design is not particularly favorable for those wishing to get away with stolen funds. No matter how hard criminals try to obscure the movement of ill-gotten digital money, at some point in the transaction chain they are likely to invoke addresses to which personal details h...