Monetalis

MakerDAO looks to invest $500M into ‘minimal risk’ treasuries and bonds

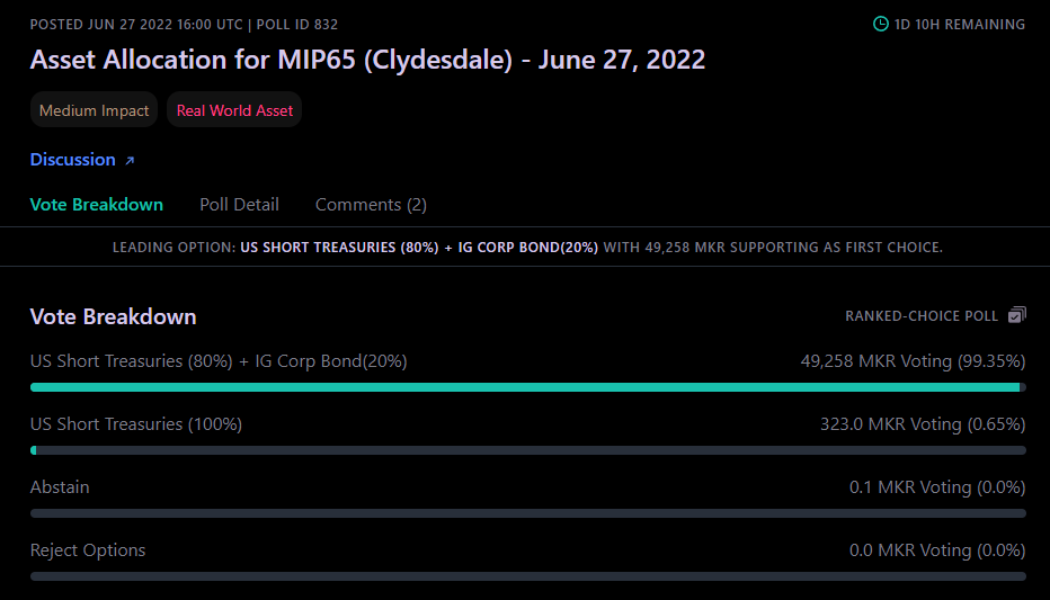

MakerDAO is currently voting on a proposal aimed at helping it weather the bear market and utilize untapped reserves by investing 500 million Dai (DAI) stablecoins into a combination of United States treasuries and bonds. Following a straw poll in a governance Signal Request, the decentralized autonomous organization (DAO) members now must decide whether the dormant DAI should go entirely into short-term treasuries or split 80% into treasuries and 20% into corporate bonds. The Maker Governance votes to determine how to allocate 500 million DAI between different investment strategies. This allocation poll is a result of the passage of MIP65: Monetalis Clydesdale: Liquid Bond Strategy & Execution. A recap on how it would work. 1/ pic.twitter.com/SdF9QT2OM6 — Maker (@MakerDAO) June 27, 20...