Monero

Bitcoin and these 4 altcoins are showing bullish signs

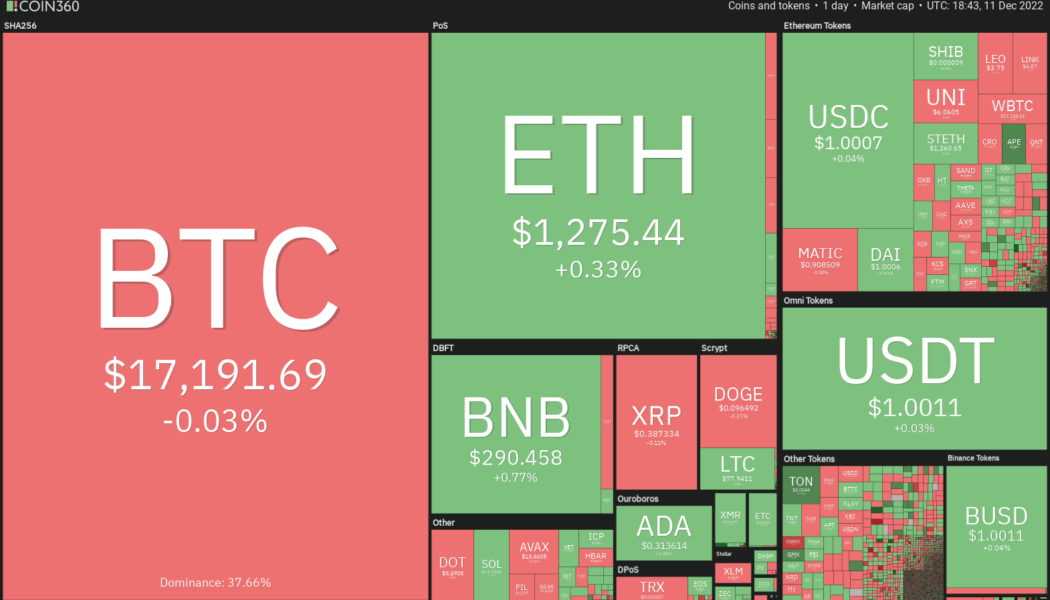

Cryptocurrency markets lack any signs of volatility going into the year-end holiday season. This suggests that both the bulls and the bears are playing it safe and are not waging large bets due to the uncertainty regarding the next directional move. This indecisive phase is unlikely to continue for long because periods of low volatility are generally followed by an increase in volatility. Willy Woo, creator of on-chain analytics resource Woobull, anticipates that the duration of the current bear market may “be longer than 2018 but shorter than 2015.” Crypto market data daily view. Source: Coin360 The crypto winter has resulted in a loss of more than $116 billion to the personal equity of 17 investors and founders in the cryptocurrency space, according to estimates by Forbes. The carnage ha...

Bitcoin’s boring price action allows XMR, TON, TWT and AXS to gather strength

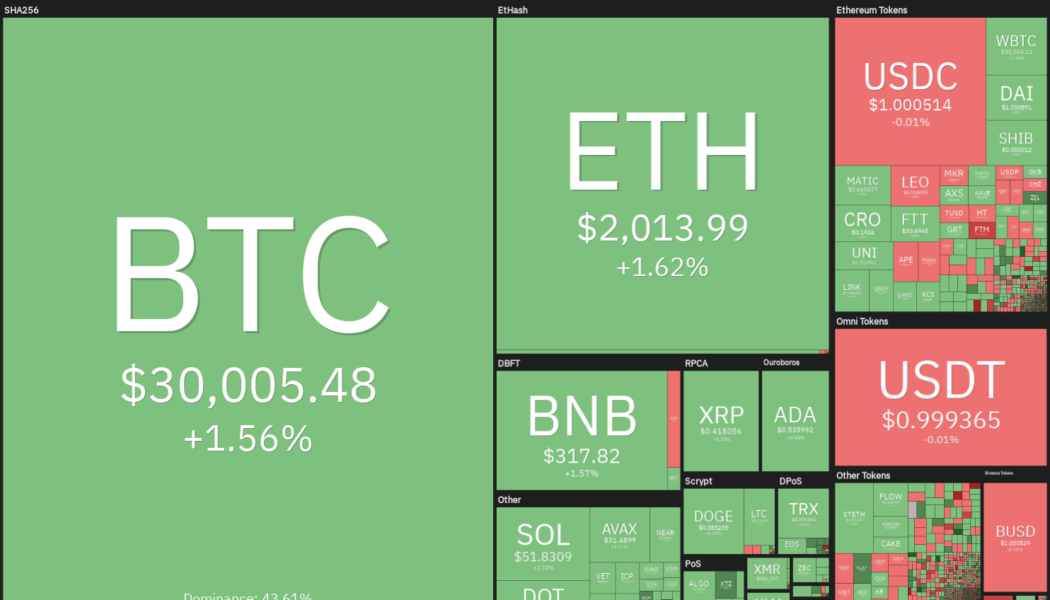

The relief rally in the United States equities markets took a breather this week as all major averages closed in the red. Traders seem to have booked profits before the busy economic calendar next week. The S&P 500 index dropped 3.37%, but a minor positive for the cryptocurrency markets is that Bitcoin (BTC) has not followed the equities markets lower. This suggests that crypto traders are not panicking and dumping their positions with every downtick in equities. Crypto market data daily view. Source: Coin360 The range-bound action in Bitcoin suggests that traders are avoiding large bets before the Federal Reserve’s rate hike decision on Dec. 14. However, that has not stopped the action in select altcoins, which are showing promise in the near term. Let’s look at the charts of Bitcoin ...

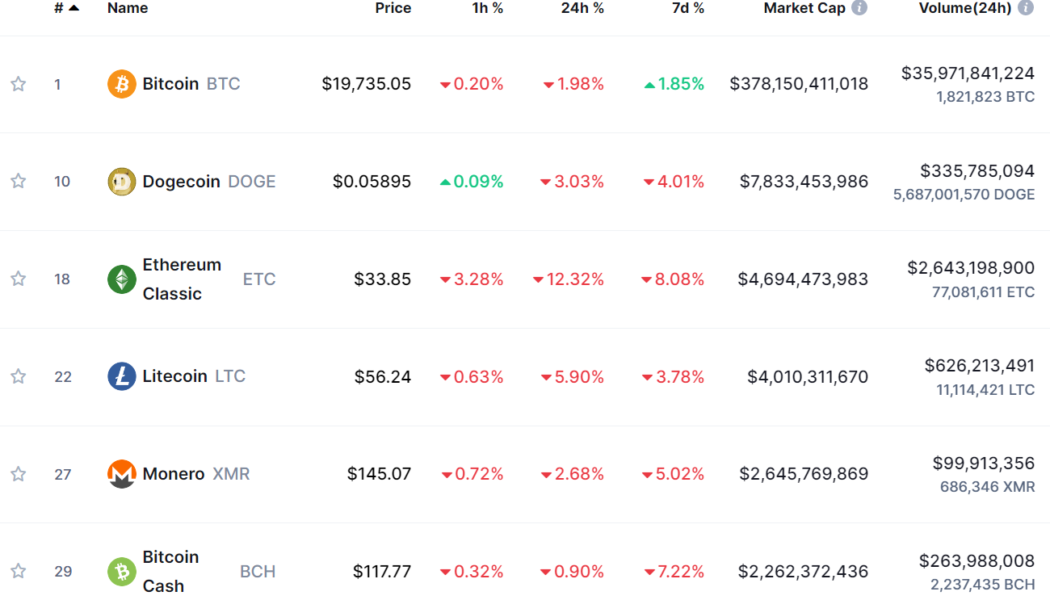

Dogecoin becomes second largest PoW cryptocurrency

Meme-inspired cryptocurrency Dogecoin (DOGE) is now officially the second largest proof-of-work (PoW) crypto in terms of market cap, following the Ethereum network’s proof-of-stake upgrade on Sept. 15. Bitcoin (BTC) of course remains miles ahead of Dogecoin’s market cap of $7.83 billion, though the well-followed memecoin is still comfortably ahead of the third place PoW cryptocurrency Ethereum Classic (ETC) (with a market cap of $4.69 billion), Litecoin (LTC) ($4.01 billion) and Monero (XMR) ($2.65 billion). Ranking of PoW-Based Cryptocurrencies by Market Cap. Source: Coinmarketcap.com. One Dogecoin fan appeared to be in disbelief of Dogecoin’s rise to become the second largest PoW cryptocurrency, stating “who would have thought that this would happen. Congrats #Doge...

Rocky road lies ahead, but here’s 5 altcoins that still look bullish

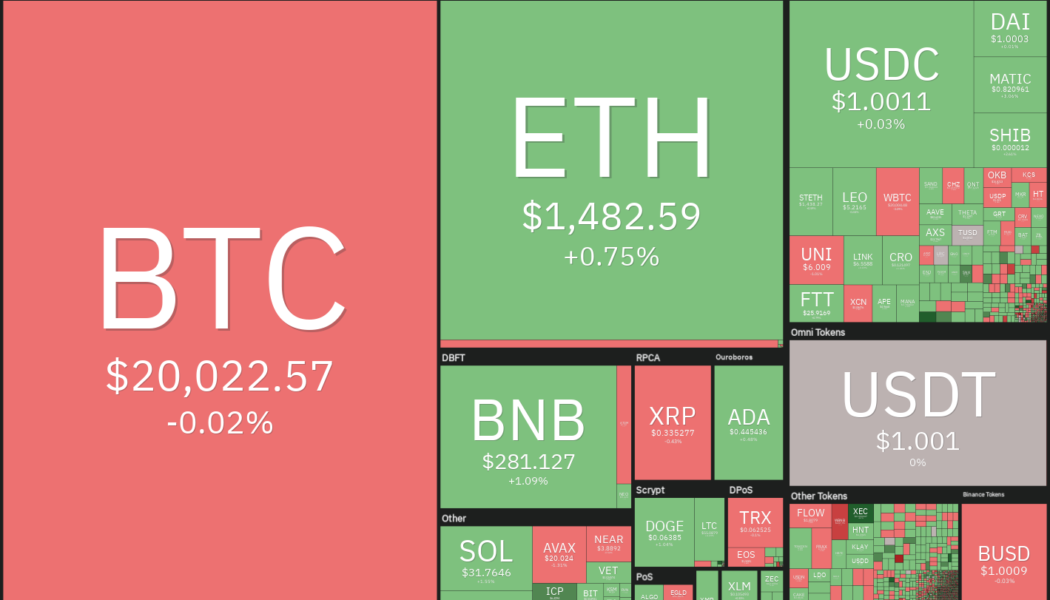

The United States equities markets plunged on Aug. 26 following Federal Reserve Chair Jerome Powell’s speech where he reiterated the central bank’s hawkish stance. Continuing its correlation with the equities market, Bitcoin (BTC) and the cryptocurrency markets also witnessed a sharp selloff on Aug. 26. Bitcoin has declined about 14% this month, making it the worst performance for August since 2015 when the price had dropped 18.67%. That may be bad news for investors because September has a dubious record of a 6% average loss since 2013, according to data from CoinGlass. Crypto market data daily view. Source: Coin360 Although buying in a downtrending market is not a good strategy, traders can keep a close watch on cryptocurrencies that are outperforming the markets because, in case of any ...

Former Monero maintainer Riccardo ‘Fluffypony’ Spagni to surrender for South Africa extradition

Riccardo Spagni, the former maintainer of the privacy coin Monero also known as Fluffypony, faces extradition to South Africa months after his arrest by U.S. authorities. In a Thursday court filing for the Middle District of Tennessee, Magistrate Judge Alistair Newbern ordered Spagni to surrender to U.S. Marshals on July 5 for extradition to South Africa. He will reportedly face 378 charges related to allegations of fraud and forgery between 2009 and 2011 at a company called Cape Cookies. U.S. authorities arrested Spagni in Nashville in July 2021 at the request of the South African government, holding him in custody until September. The court filings hint at allowing Spagni to be in the United States for the Independence Day holiday weekend before being taken to Africa early on Tuesday. No...

Regulations and exchange delistings put future of private cryptocurrencies in doubt

The core principles of cryptocurrency were based on financial independence, decentralization and anonymity. With regulations being the key to mass adoption, however, the privacy aspect of the crypto market seems to be in jeopardy. In 2022, even though no particular country has come up with a universal regulatory outline that governs the whole crypto market, most countries have introduced some form of legislation to govern a few aspects of the crypto market such as trading and financial services. While different countries have set different rules and regulations in accordance with their existing financial laws, a common theme has been the strict implementation of Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. A majority of crypto exchanges operating with a license obt...

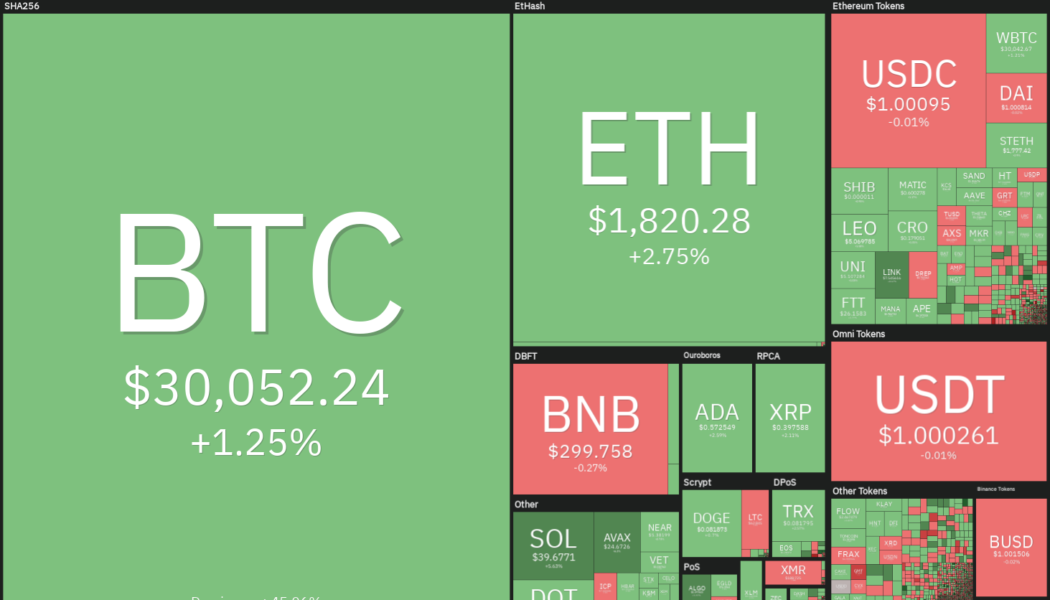

Top 5 cryptocurrencies to watch this week: BTC, ADA, XLM, XMR, MANA

The bears are trying to extend Bitcoin’s (BTC) record of nine consecutive red weekly candles to ten weeks, but the bulls are trying to avert this negative occurrence. Although sentiment remains negative, Arthur Hayes, former CEO of derivatives giant BitMEX, anticipates Bitcoin to bottom out in the range of $25,000 to $27,000. On-chain data from Glassnode shows that smart money may have started accumulating Bitcoin. The net outflows from major cryptocurrency exchanges reached 23,286 Bitcoin on June 3, the highest since May 14. Crypto market data daily view. Source: Coin360 Another positive sign of accumulation is that investment into Bitcoin exchange-traded products (ETPs) was strong in May and has only risen further in the first two days of June, according to an Arcane Research report. The...

Top 5 cryptocurrencies to watch this week: BTC, BNB, XMR, ETC, MANA

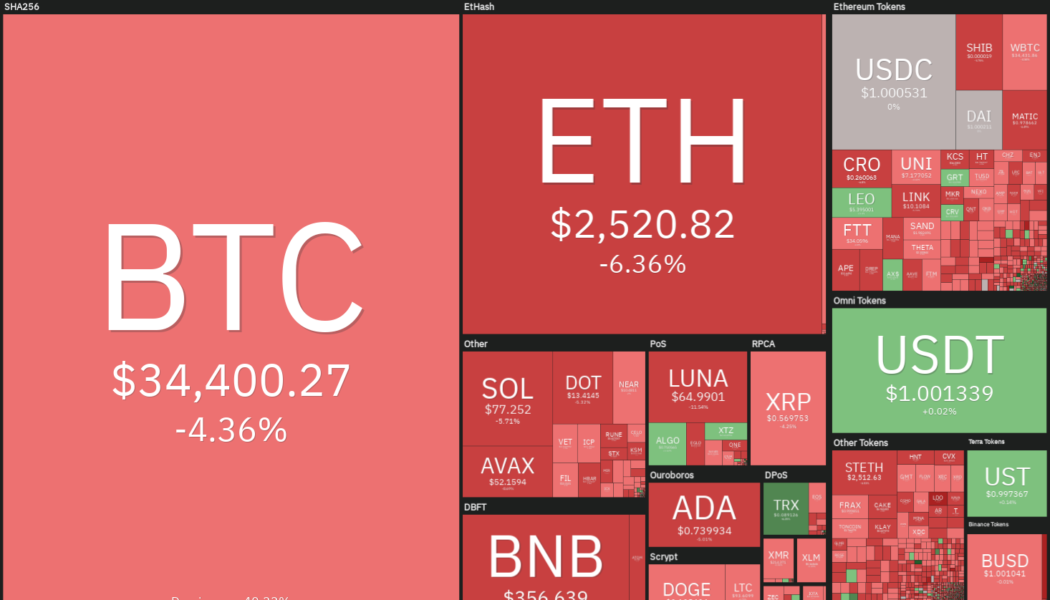

The Dow Jones Industrial Average has declined for eight consecutive weeks, the first such losing streak since 1923. On May 20, the S&P 500 briefly fell into bear market territory, indicating that traders continue to sell risky assets in fear of a recession. Due to its tight correlation with US equities markets, Bitcoin (BTC) has remained under pressure for many weeks. The bulls are attempting to push Bitcoin higher during the weekend and avert an even longer losing streak. Crypto market data daily view. Source: Coin360 Bitcoin’s performance in the first five months has been the worst since 2018, indicating that sellers are in control. However, after several weeks of weakness, the crypto markets may be on the cusp of a bear market rally. What are the critical levels that may signa...

Top 5 cryptocurrencies to watch this week: BTC, BNB, XMR, ETC, MANA

The Dow Jones Industrial Average has declined for eight consecutive weeks, the first such losing streak since 1923. On May 20, the S&P 500 briefly fell into bear market territory, indicating that traders continue to sell risky assets in fear of a recession. Due to its tight correlation with US equities markets, Bitcoin (BTC) has remained under pressure for many weeks. The bulls are attempting to push Bitcoin higher during the weekend and avert an even longer losing streak. Crypto market data daily view. Source: Coin360 Bitcoin’s performance in the first five months has been the worst since 2018, indicating that sellers are in control. However, after several weeks of weakness, the crypto markets may be on the cusp of a bear market rally. What are the critical levels that may signa...

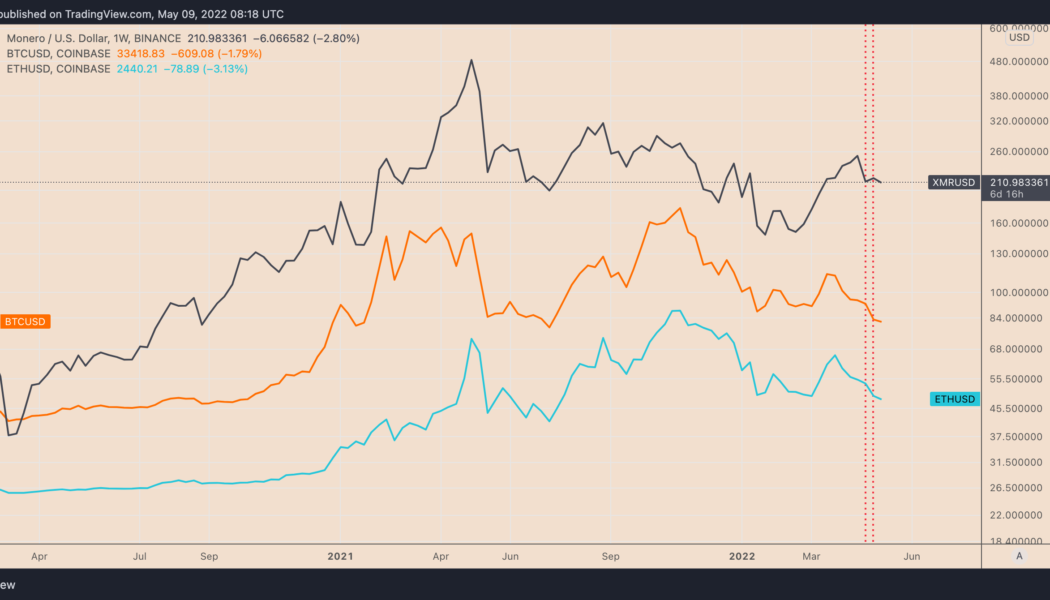

Monero avoids crypto market rout, but XMR price still risks 20% drop by June

Monero (XMR) has shown a surprising resilience against the United States Federal Reserve’s hawkish policies that pushed the prices of most of its crypto rivals — including the top dog Bitcoin (BTC) — lower last week. XMR price closed the previous week 2.37% higher at $217, data from Binance shows. In comparison, BTC, which typically influences the broader crypto market, finished the week down 11.55%. The second-largest crypto, Ether (ETH), also plunged 11% in the same period. XMR/USD vs. BTC/USD vs. ETH/USD weekly price chart. Source: TradingView While the crypto market wiped off $163.25 billion from its valuation last week, down nearly 9%, Monero’s market cap increased by $87.7 million, suggesting that many traders decided to seek safety in this privacy-focused coin. XMR near ...

Top 5 cryptocurrencies to watch this week: BTC, ALGO, XMR, XTZ, THETA

The S&P 500 and the Nasdaq have declined for five consecutive weeks, indicating that traders continue to reduce exposure to risky assets. Bitcoin’s (BTC) close correlation with United States equity markets has resulted in its price remaining under pressure. Bitcoin has extended its decline during the weekend and is now on track for its sixth successive weekly loss, the first such occurrence since 2014. The weakness in Bitcoin has pulled down the entire crypto markets, whose market capitalization has dipped below $1.6 trillion. Crypto market data daily view. Source: Coin360 When the sentiment is bearish, traders sell on every negative news. The de-peg of Terra’s U. S. dollar stablecoin TerraUSD (UST) also appears to be increasing sell pressure across the crypto market. After Bitcoin’s s...

Monero ‘falling wedge’ breakout positions XMR price for 75% rally

Monero (XMR) price dropped by nearly 10% three days after establishing a week-to-date high around $290 on April 24. Nonetheless, several technical indicators suggest that the XMR/USD pair is poised to resume its uptrend over the next few months. Falling wedge breakout underway Notably, XMR’s price broke out of its “falling wedge” structure in late March. It continued its move upside in the later daily sessions, with rising volumes indicating bullish sentiment among Monero traders. Traditional analysts consider falling wedges as bullish reversal patterns, i.e., the price first consolidates within a contracting, descending channel, followed by a strong bounce to the upside. As a rule, the falling wedge’s breakout target comes to be near the level at length equal to th...

- 1

- 2