Mining

Public Bitcoin mining companies plagued with $4B of collective debt

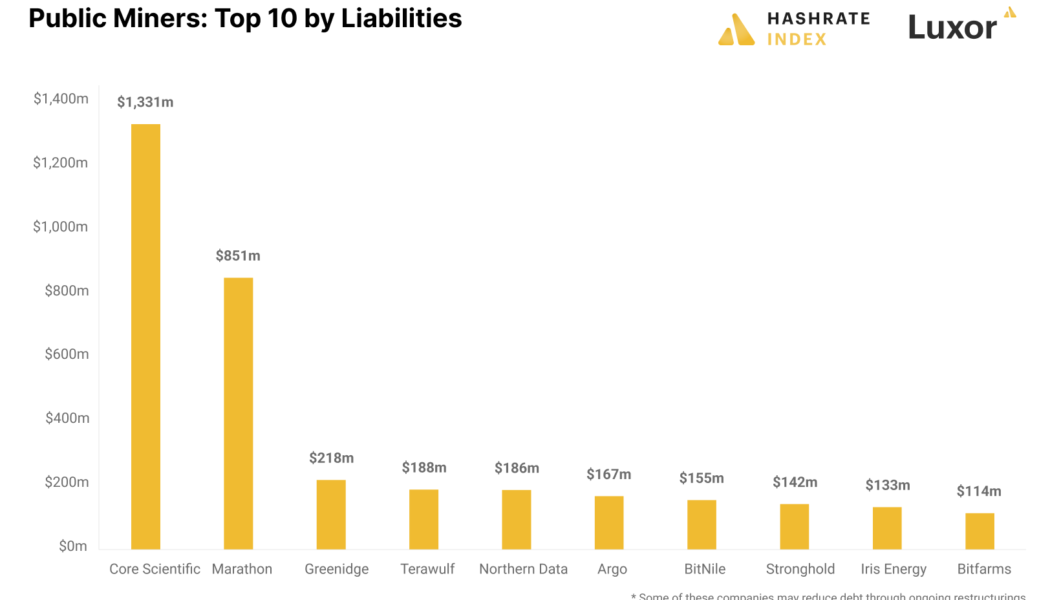

The recent bankruptcy filing of Bitcoin (BTC) miner Core Scientific despite a $72M relief offer from creditors raised questions about the overall health of the bitcoin mining community amid a prolonged bear market. Turns out, the public bitcoin miners owe more than $4 billion in liabilities and require an immediate restructuring to get out of the unsustainably high debt levels. The Bitcoin mining community took up massive loans during the 2021 bull market, negatively impacting their bottom lines during a subsequent bear market. Bitcoin mining data analytics by Hashrate Index show that just the top 10 Bitcoin mining debtors cumulatively owe over $2.6 billion. Public Bitcoin mining companies with highest debt. Source: Hashrate Index Core Scientific, the biggest debtor among the lot — with $1...

U.S. delays crypto tax reporting rules, as it still can’t define what a ‘broker’ is

A key set of crypto tax reporting rules is being delayed until further notice under a decision made by the United States Treasury Department. The rules were supposed to be effective in the 2023 tax filing year, in accordance with the Infrastructure Investment and Jobs Act passed in November, 2021. The new law requires that the Internal Revenue Service (IRS) develop a standard definition of what a “cryptocurrency broker” is, and any business that falls under this definition is required to issue a Form 1099-B to every customer detailing their profits and losses from trades. It also requires these firms to provide this same information to the IRS so that it will be aware of customers’ incomes from trading. However, more than 12 months have passed since the infrastructure bill became law, but ...

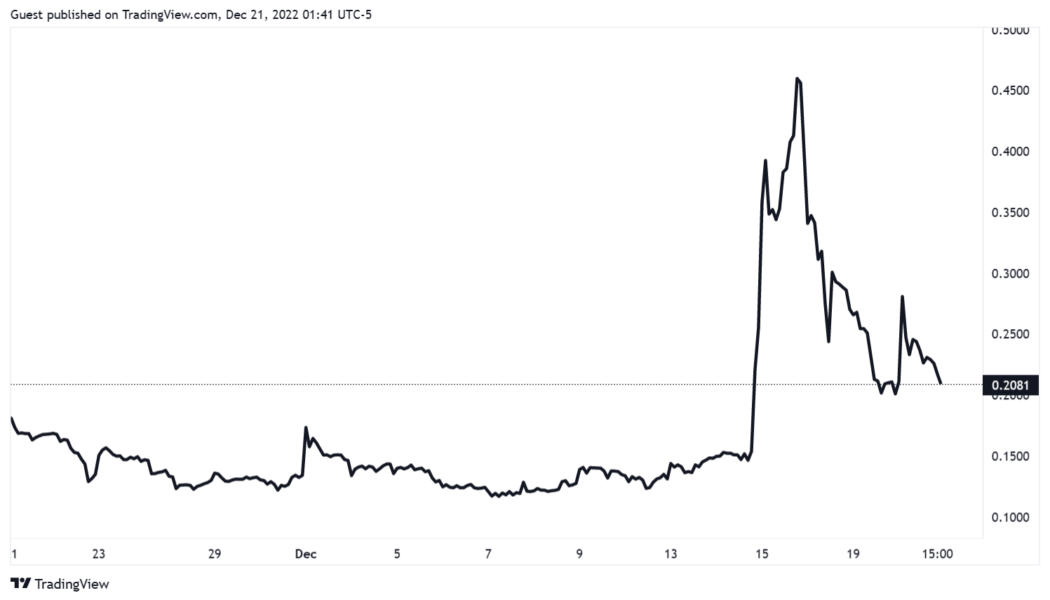

Bitcoin miner Core Scientific reportedly filing for Chapter 11 bankruptcy

Just days after a creditor offered to help Core Scientific avoid possible bankruptcy, reports have emerged confirming the Bitcoin (BTC) mining company’s fate. Core Scientific is reportedly filing for Chapter 11 bankruptcy protection in Texas owing to falling revenue and low BTC prices. On Dec. 14, financial services platform B. Riley offered to provide Core Scientific with $72 million in non-cash financing — $40 million with zero contingencies and $32 million with conditions — to retain value for stakeholders. The decision was made after Core’s valuation fell from $4.3 billion in July 2021 to $78 million at the time of reporting. As a direct result of an extended bear market, Core Scientific had to sell 9,618 BTC in April to stay operational. A CNBC report quoted a person familiar wit...

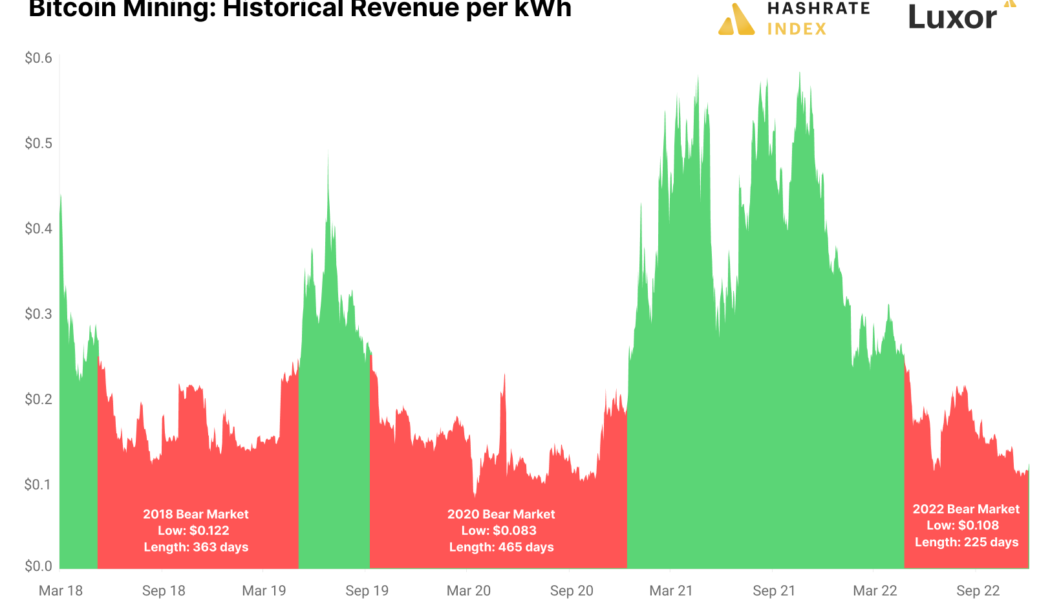

Data shows the Bitcoin mining bear market has a ways to go

Bitcoin (BTC) mining is the backbone of the BTC ecosystem and miners’ returns also provide insight into BTC’s price movements and the health of the wider crypto sector. It is well-documented that Bitcoin miners are struggling in the current bear market. Blockstream, a leading Bitcoin miner recently raised funds at a 70% discount. Current mining activity shares similarities to historic BTC bear markets with a few caveats. Let’s explore what this means for the current Bitcoin cycle. Analysis shows that based on previous cycles the bear market may continue Bitcoin mining profitability can be measured by taking the miner’s revenue per kilowatt hour (kWh). According to Jaran Mellerud, a Bitcoin analyst for Hashrate Index, a BTC mining bear market has a sustained period of revenue per kWh of les...

Bank of Russia wants to ban miners from selling crypto to Russians

The Russian central bank continues to maintain an extremely negative stance on cryptocurrencies, proposing to ban local miners from selling coins to local people. The Bank of Russia has supported the idea of legalizing cryptocurrency mining in Russia as part of a draft bill introduced in mid-November 2022. However, the Russian central bank wants to allow miners to sell their crypto only on foreign exchanges and to non-residents of Russia, the local news agency Interfax reported on Dec. 7. “We believe that cryptocurrency obtained as a result of mining can be sold exclusively using foreign infrastructure and only to non-residents,” the Bank of Russia’s press office reportedly said, adding: “In general, we adhere to the position on the inadmissibility of the circulation of digital currency on...

Blockstream raising funds for mining at 70% lower company valuation

The depths of a bear market may not be the best time to raise funds but that is exactly what Blockstream is doing. The crypto infrastructure firm is seeking fresh funding, but at a much lower valuation than previous rounds, according to a Dec. 7 Bloomberg report. Blockstream was valued at $3.2 billion when it held its last Series B funding round raising $210 million in August 2021. Today that valuation may have fallen almost 70% to below $1 billion according to the report. The company, founded in 2014, has raised a total of $299 million in funding over four rounds, according to CrunchBase. Blockstream CEO and cryptographer Adam Back did not share details of the latest funding round but did reveal that the capital will be invested into expanding the firm’s mining capacity. “We rapidly sold ...

‘Imminent’ crash for stocks? 5 things to know in Bitcoin this week

Bitcoin (BTC) starts its first full week of December at three-week highs as bulls and bears battle on. After a weekly close just above $17,000, BTC/USD seems determined to make the most of relief on stocks and a weakening U.S. dollar. As the United States gears up to release November inflation data, the dollar looks to be a key item to watch as BTC price action teases a recovery from the pits of the FTX meltdown. All may not be as straightforward as it seems — miners are facing serious hardship, data shows, and opinions on stocks’ own ability to continue higher are far from unanimous. As the end of the year approaches, will Bitcoin see a “Santa rally” or face a new year nursing fresh losses? Cointelegraph presents five areas worth watching in the coming days when it comes to BTC/USD perfor...

Bullish on Bitcoin, US Senator Ted Cruz wants Texas to be a crypto oasis

United States Senator Ted Cruz wants to make the American state of Texas an oasis for Bitcoin (BTC) and cryptocurrencies. Speaking at the Texas Blockchain Summit 2022 in late November, the politician empathized how the crypto industry can be strategic for the U.S. energy supply and technological development. Cruz argued that Bitcoin mining could be used to monetize energy created from oil and gas extraction, rather than burning it. In addition, he emphasized how mining activity can be used as an energy storage and supply alternative: “The beauty of it [Bitcoin mining] is when you’ve got substantial investment, as we do in Texas and Bitcoin mining, when you have an extreme weather event, either extreme heat, which is frequent in the state of Texas or extreme cold, whi...

Mysterious Bitcoin miner shows off oldest signature dated Jan. 2009

Online forums are integral to the Bitcoin origin story, where Satoshi Nakamoto and early contributors collaborated to discuss and create a disruptive financial system from scratch. One of the oldest Bitcoin forums — bitcointalk.org — still preserves historical discussions around creating the Bitcoin (BTC) logo and the payment system. A curious member of the bitcointalk.org forum recently sought to identify Bitcoin miners from the early days. To their surprise, an anonymous member shared a signature dating back to January 2009, just a week after Bitcoin came into existence. The oldest known Bitcoin signature shared by OneSignature. Source: bitcointalk.org “Maybe OP is inviting Satoshi?” questioned another member after confirming the legitimacy of “the oldest signature” found to date. A...

Alameda Research invested $1.15B in crypto miner Genesis Digital: Report

Crypto mining company Genesis Digital Assets was the biggest venture investment made by Alameda Research, FTX’s sister company and in the center of the exchange’s bankruptcy. Documents disclosed by Bloomberg on Dec. 3 show that Genesis Digital raised $1.15 billion from Alameda in less than nine months. The capital infusion was made before the crypto prices downturn, between August 2021 and April of this year. Genesis Digital is the major United States-based Bitcoin mining company, and it’s not related to Genesis Capital, the trading company with $175 million worth of funds locked away in an FTX trading account. Former FTX CEO Sam Bankman-Fried recently recognized participating in Alameda’s venture decisions, including the investment in Genesis Digital, despite...

Quebec’s energy manager to seek government approval to stop powering crypto miners

Hydro-Québec, the firm managing electricity across the Canadian province of Quebec, plans to reallocate energy supplied to crypto mining firms. According to a Nov. 3 tweet from Canadian lawmaker Pierre Fitzgibbon, the government will request a decree from the energy board to release the company from its obligation to power crypto miners in the province. Hydro-Québec allocated 270 megawatts toward the mining firms, but electricity demand in Québec is expected to grow to a point that powering crypto will put pressure on the energy supplier. The report Hydro-Québec filed with the government’s energy board on Nov. 1 said temporarily reducing the power provided to mining firms could help prevent threats to the “reliability and security” of energy for Québec residents. The distributor repo...

Bitcoin mining firm Bitdeer could delay public offering to 2023

Bitdeer, a crypto mining firm spun off from China-based mining manufacturer Bitmain, may see its public offering on the Nasdaq delayed a year depending on a vote from shareholders of the Blue Safari Group Acquisition Corp. In a Nov. 2 Securities and Exchange Commission filing, Blue Safari said it will be holding a shareholding meeting before the end of 2022 to vote on whether to extend the deadline of its deal with Bitdeer. The mining firm announced in November 2021 that it had entered into a definitive merger agreement with Blue Safari in order to go public through a special purpose acquisition company in the United States. The SEC filing stated the shareholders could give the company the option to extend the deadline up to four times until December 2023, as well as move the meeting...