Mining Pools

1.5M houses could be powered by the energy Texas miners returned

During the winter storm in Texas in December 2022, Bitcoin (BTC) mining operators returned up to 1,500 megawatts of energy to the distressed local grid. It became possible due to the flexibility of mining operations and the ancillary services, provided by the state authorities. In his commentary to Satoshi Action Fund, Texas Blockchain Council president Lee Bratcher stated that miners returned up to 1,500 megawatts to the Texas grid. This amount of energy would be enough to heat “over 1.5 million small homes or keep 300 large hospitals fully operational,” according to the calculations from the Bitcoin advocacy group. While there’s no specification regarding the exact time period in which miners have accumulated such an amount of power, the global Bitcoin mining hashrate dropped by 30...

What is a cryptocurrency mining pool?

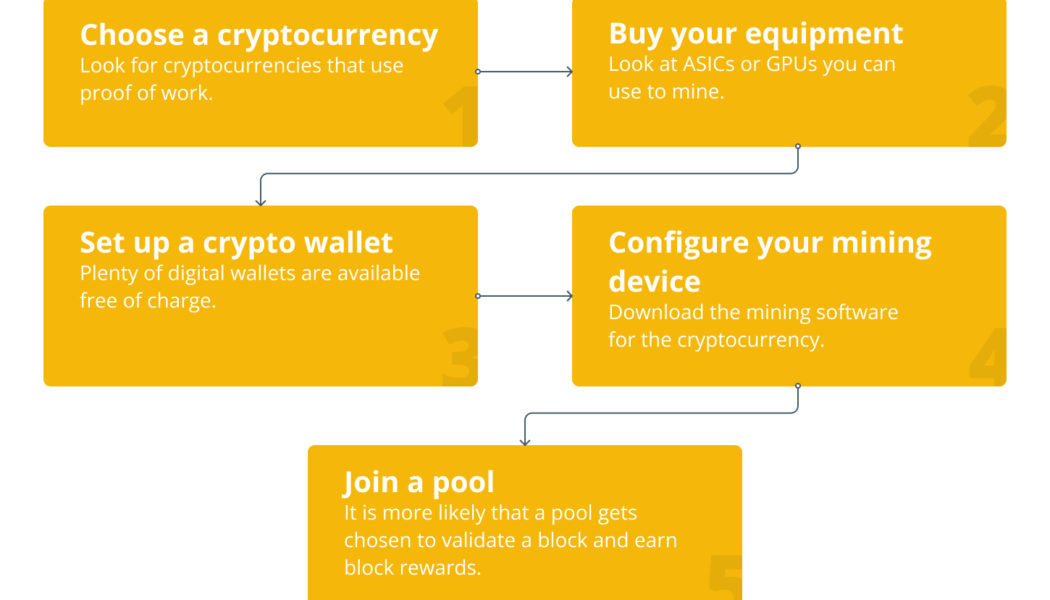

In the early days of Bitcoin (BTC), crypto enthusiasts only required a basic personal computer with an internet connection to generate new BTC tokens through a distributed computing process known as mining. However, with more people chasing the same number of block rewards, Bitcoin’s mining process has become more challenging with time. In fact, the quantum of rewards will progressively reduce by half every four years, making it less rewarding for individual miners who will need to allocate greater computational resources with time. Available on blockchain protocols that employ a proof-of-work (PoW) consensus mechanism, this mining process requires application-specific integrated circuits (ASICs) to be deployed in the form of large rigs so as to complete the complex nature of mathema...

The Bitcoin bottom — Are we there yet? Analysts discuss the factors impacting BTC price

When Bitcoin was trading above $60,000, the smartest analysts and financial-minded folk told investors that BTC price would never fall below its previous all time high. These same individuals also said $50,000 was a buy the dip opportunity, and then they said $35,000 was a generational buy opportunity. Later on, they also suggested that BTC would never fall under $20,000. Of course, “now” is a great time to buy the dip, and one would think that buying BTC at or under $10,000 would also be the purchase of a lifetime. But by now, all the so-called “experts” have fallen quiet and are nowhere to be seen or heard. So, investors are left to their own devices and thoughts to contemplate whether or not the bottom is in. Should one be patient and wait for the forecast “drop to $10,000” ...

Blockchain’s environmental impact and how it can be used for carbon removal

Climate change has become an important issue over the years due to concerns over environmental changes caused by the emission of greenhouse gasses into the atmosphere. Conversations have even reached the crypto space, and blockchain technology is being considered a potential tool to reduce carbon emissions. Cryptocurrencies like Bitcoin (BTC) and Ether (ETH) that use the proof-of-work (PoW) mining algorithm have come under scrutiny due to their alleged energy expenditure. To see where this scrutiny comes from, it first needs to be known how much energy is used when mining PoW cryptocurrencies. Unfortunately, estimating the amount of energy necessary to mine Bitcoin and other PoW cryptocurrencies cannot be calculated directly. Instead, it can be estimated by looking at the network’s ha...

Global GPU price drops to compensate for falling Bitcoin mining revenue

As a direct result of falling Bitcoin (BTC) prices, total revenue earned by miners in transaction fees and mining rewards dropped to its one-year lows at nearly $15 million on July 4. However, a concurrent fall in graphic cards or GPU prices is set to help miners offset their operational costs amid an ongoing bear market. Bitcoin mining revenue fell 79.6% over a period of 9 months, ever since reaching an all-time high of $74.4 million on Oct. 25, 2021. In addition, a global chip shortage and the coronavirus pandemic shot up prices of the most important part of a mining rig — the graphics processing unit (GPU) — further impacting the miners’ bottom line. Bitcoin mining revenue over the past year. Source: Blockchain.com With card manufacturers resuming operations across the world, GPU prices...

Global GPU price drops to compensate for falling Bitcoin mining revenue

As a direct result of falling Bitcoin (BTC) prices, total revenue earned by miners in transaction fees and mining rewards dropped to its one-year lows at nearly $15 million on July 4. However, a concurrent fall in graphic cards or GPU prices is set to help miners offset their operational costs amid an ongoing bear market. Bitcoin mining revenue fell 79.6% over a period of 9 months, ever since reaching an all-time high of $74.4 million on Oct. 25, 2021. In addition, a global chip shortage and the coronavirus pandemic shot up prices of the most important part of a mining rig — the graphics processing unit (GPU) — further impacting the miners’ bottom line. Bitcoin mining revenue over the past year. Source: Blockchain.com With card manufacturers resuming operations across the world, GPU prices...

Bitcoin’s bottom might not be in, but miners say it ‘has always made gains over any 4-year period’

Your favorite trader is saying Bitcoin (BTC) bottomed. At the same time, the top on-chain indicators and analysts are citing the current price range as a “generational buy” opportunity. Meanwhile, various crypto and finance media recently reported that Bitcoin miners sending a mass of coins to exchanges are a sign that $17,600 was the capitulation move that pins the market bottom. There’s so much assurity from various anon and doxed analysts on Crypto Twitter, yet Bitcoin price is still in a clear downtrend, and the metrics don’t fully reflect that traders are buying every dip. A critical component of BTC price that many investors often overlook is the condition and sentiment of Bitcoin miners, which is exactly why Cointelegraph had a chat with Rich Ferolo of Blockware Solutions and ...

Uzbekistan warms up to Bitcoin mining, but there’s a catch

The National Agency of Prospective Projects (NAPP) in Uzbekistan announced its demands toward crypto mining operators. It would only allow the companies that use solar energy to mine Bitcoin (BTC) or other cryptocurrencies. The normative act on the government page, dated June 24, describes the confirmation of “Guidelines on the registration of the crypto assets mining,” and sets the finalization date on July 9. The second article of the document offers an uncompromising wording: “Mining is being carried out only by the legal entity with the use of electric energy, provided by a solar photovoltaic power plant.” As a further complication, the miners should own the solar photovoltaic power plant that they will use for energy. The executive order also obliges any mining operator to obtai...

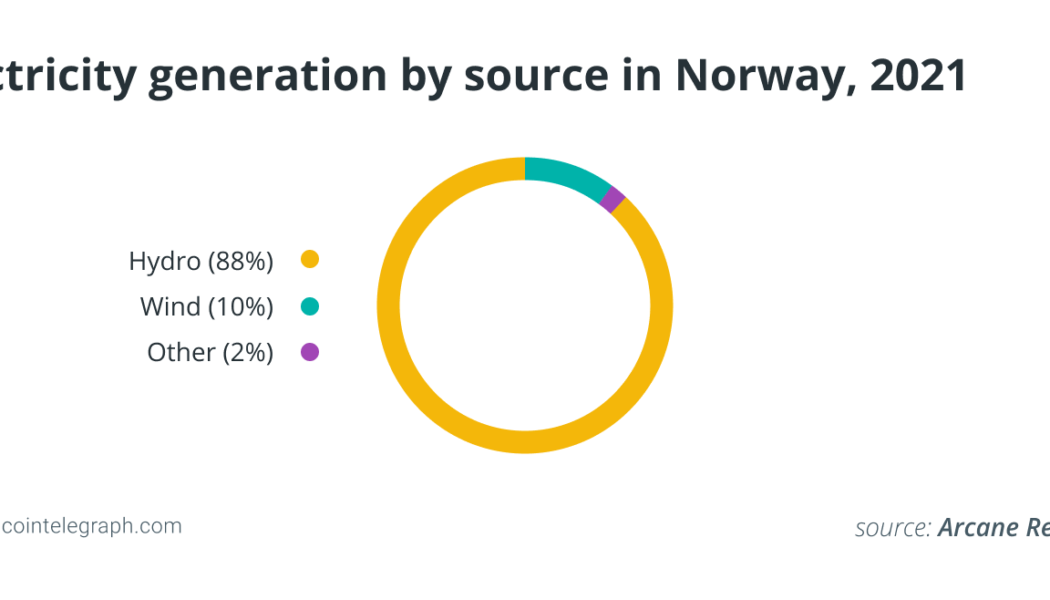

‘Green oasis’ for Bitcoin mining: Norway has almost 1% of global BTC hash rate

Bitcoin (BTC) mining in Norway is 100% renewable and “flourishing,” according to a report by Arcane Research. “A green oasis of renewable energy,” Norway contributes almost 1% to the global hash rate and is almost entirely powered by hydropower. Using data from the Cambridge Bitcoin Electricity Consumption Index and by mapping out the mining facilities, the report concludes that Norway contributes 0.77% to the Bitcoin total global hash rate. By way of comparison, Norway’s population of 5 million contributes a tenth of that—or 0.07% of the global population. Crucially, according to the Norwegian Water Resources and Energy Directorate (NVE), Norway’s electricity mix is 100% renewable, with 88% hydro and 10% wind. That means Bitcoin miners in Norway are solely using “green” energy....

Stranded no more? Bitcoin miners could help solve Big Oil’s gas problem

The energy usage and environmental impact of Bitcoin (BTC) mining have been frowned upon and been under the scanner by various international financial institutions. The International Monetary Fund (IMF) mentions how Bitcoin mining consumes “vast amounts of computing power and electricity.” Bitcoin mining is an energy-consuming process, as it is a proof-of-work (PoW) blockchain network that involves providing cryptographic proof to the network that a quantified amount of a specific computational effort has been used. The information used to verify this is stored in a block to be accepted into the network by other participants. Elon Musk, one of the richest men in the world and the co-founder and CEO of Tesla, in February 2021 announced that the car manufacturing company will accept Bi...

Bitcoin network hash rate explodes to a new all-time high of 248.11 EH/s

The Bitcoin (BTC) network has recorded a new hash rate all-time high of 248.11M TH/s as of Feb. 12, 2022, further securing the decentralized ecosystem through a growing network of global BTC miners. The hash rate correlates to the computing power required by a miner’s computer equipment to confirm a transaction. The recent spike in BTC’s network hash rate ensures further security against attacks by deterring bad actors from confirming fraudulent transactions. Bitcoin hash rate over the past year. Source: YCharts As evidenced by the above screenshot, the network hash rate jumped 31.69% — from 188.40 EH/s to 248.11 EH/s — in just one day. Moreover, the Bitcoin network’s hash rate levels rose 54.33% over the past year. Bitcoin hash rate over the past one month. Source: YCharts Pre...

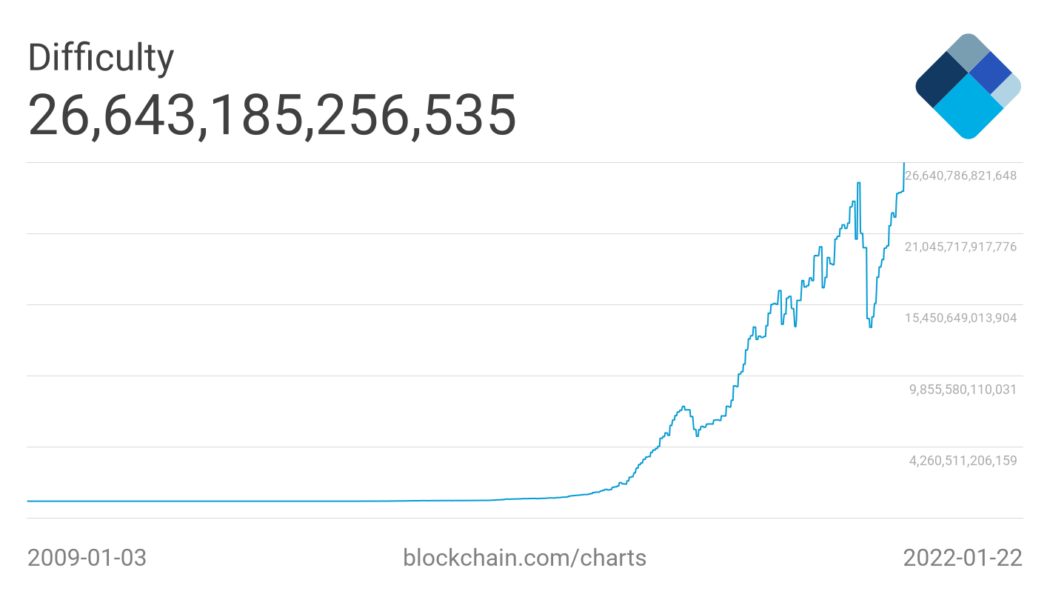

Bitcoin records all-time high network difficulty amid price fluctuations

The Bitcoin (BTC) network has recorded a new all-time high mining difficulty of 26.643 trillion with an average hash rate of 190.71 exahash per second (EH/s) — signaling strong community support despite an ongoing bear market. The Bitcoin network difficulty is determined by the overall computational power, which co-relates to the difficulty in confirming transactions and mining BTC. As evidenced by the blockchain.com data, the network difficulty saw a downfall between May and July 2021 due to various reasons including a blanket ban on crypto mining from China. BTC network difficulty. Source: Blockchain.com. As the displaced miners resumed operations from other countries, however, the network difficulty saw a drastic recovery since August 2021. As a result, on Saturday, the BTC network reco...