Miners

Chinese Communist Party official pleads guilty to helping Bitcoin miners

According to a report published by state-owned daily news program Xinwen Lianbo on Dec. 29, Xiao Yi, the former Communist Party secretary of the City of Fuzhou, pleaded guilty to corruption charges in the Zhejiang Hangzhou Intermediate People’s Court. During his tenure as director from 2008 to 2021, Yi was accused of accepting over 125 million Chinese yuan ($18 million) in bribes related to construction programs and illicit promotions. In addition to the aforementioned counts, Yi also pleaded guilty to charges related to business transactions between himself and Bitcoin (BTC) miners from 2017 to 2021. It is unclear if the series of charges were related. As reported by Xinwen Lianbo: “During his 2017 to 2021 tenure as the Communist Party Secretary of the City of Fuzhou, Xiao Yi provided sup...

‘Wave lower’ for all markets? 5 things to know in Bitcoin this week

Bitcoin (BTC) starts the week before Christmas with a whimper as a tight trading range gives BTC bulls little cheer. A weekly close just above $16,700 means BTC/USD remains without major volatility amid a lack of overall market direction. Having seen erratic trading behavior around the latest United States macroeconomic data print, the pair has since returned to an all-too-familiar status quo. What could change it? That is the question on every analyst’s lips as markets limp into Christmas with little to offer. The reality is tough for the average Bitcoin hodler — BTC is trading below where it was two years and even five years ago. “FUD” is hardly in short supply thanks to FTX fallout and concerns over Binance. At the same time, there are signs that miners are recovering, while on-chain in...

Bitcoin miners send less BTC to exchanges since 2020 halving despite FTX

Bitcoin (BTC) miners may be sending more BTC to exchanges this month — but overall, their sales have crashed since 2020. Data from on-chain analytics platform CryptoQuant confirms that daily miner transfers to exchanges have decreased by two thirds or more. Miners cool BTC exchange sales after FTX spike After BTC/USD lost 25% in days last week, existing concerns over miner solvency have heightened. Given their cost basis and rising hash rate, commentators warned that many mining participants may not be able to make ends meet — block subsidies and fees would not be enough to cancel out expenses, chiefly electricity. Network fundamentals, however, tell a curious story — hash rate continues to circle all-time highs and not fall significantly, indicating that at least certain miners are mainta...

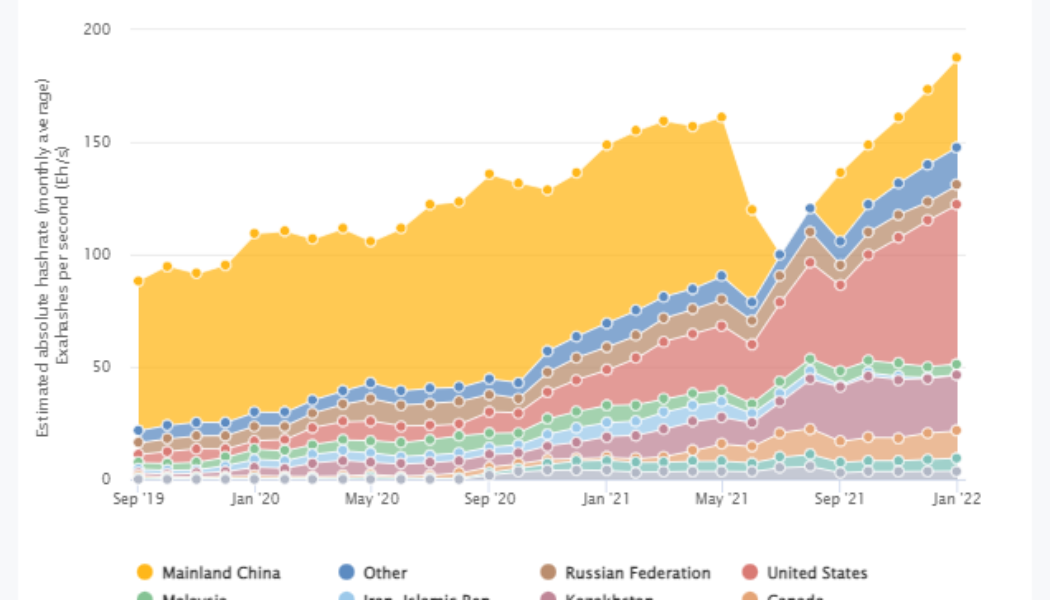

Low hash price, soaring energy costs spell tough Q3 for Bitcoin miners

Energy problems in North America and Europe and prevailing market conditions have spelled another bleak quarter for Bitcoin (BTC) mining operators on both continents. The latest Q3 mining report from Hashrate Index has highlighted several factors that have led to a significantly lower hash price and higher cost to produce 1 BTC. Hash price is the measurement used by the industry to determine the market value per unit of hashing power. This is measured by dividing the dollar per terahash per second per day and is influenced by changes in mining difficulty and the price of BTC. As Hashrate Index reports, Bitcoin’s hash price was afforded some reprieve in the middle of Q3 as heat waves during the American summer led to a drop in hash rate, which corresponded with a slight BTC price recov...

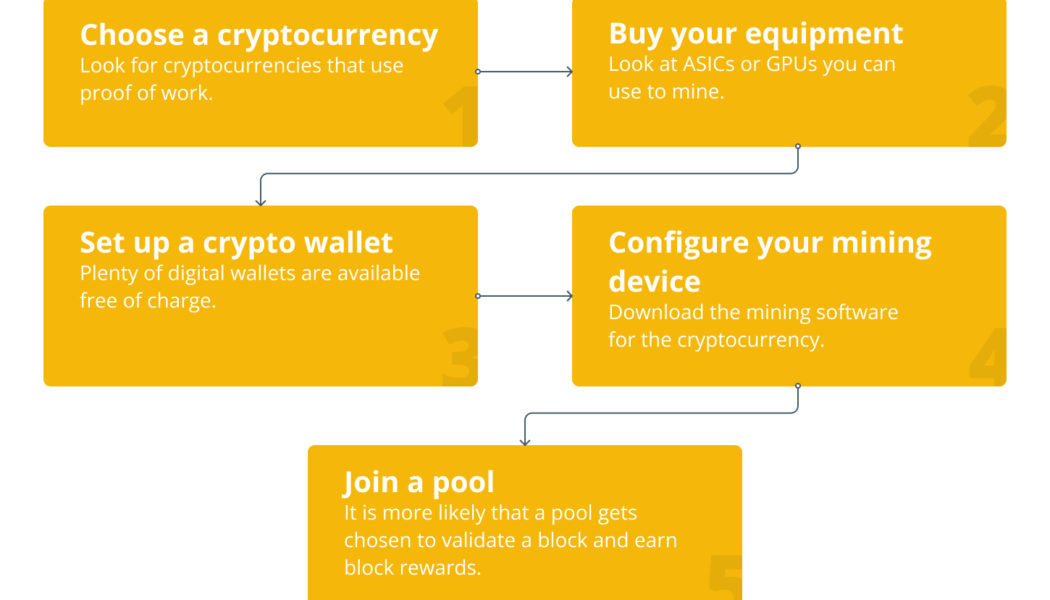

What is a cryptocurrency mining pool?

In the early days of Bitcoin (BTC), crypto enthusiasts only required a basic personal computer with an internet connection to generate new BTC tokens through a distributed computing process known as mining. However, with more people chasing the same number of block rewards, Bitcoin’s mining process has become more challenging with time. In fact, the quantum of rewards will progressively reduce by half every four years, making it less rewarding for individual miners who will need to allocate greater computational resources with time. Available on blockchain protocols that employ a proof-of-work (PoW) consensus mechanism, this mining process requires application-specific integrated circuits (ASICs) to be deployed in the form of large rigs so as to complete the complex nature of mathema...

Largest Ether mining pool Ethermine opens new ETH staking service

Ahead of the rapidly approaching Ethereum (ETH) Merge on Sept. 15, Ethermine, the world’s largest Ethereum mining pool has unveiled a new staking pool for users. Notably however, it is not available to U.S. miners The new service offers Ethermine members a chance to collectively stake their ETH and earn interest on top of their deposits. As little as 0.1 ETH ($159) required to enter. However the smaller the holding, the greater the fee. The platform is currently offering stakers an annual ETH interest rate of 4.43%. At the time of writing, 393 Ether worth roughly $626,000 at current prices has been invested into Ethermine’s new pool. Staking pools such as these hold significance as they offer competitive interest rates and a lower barriers of entry than solo staking as node operators...

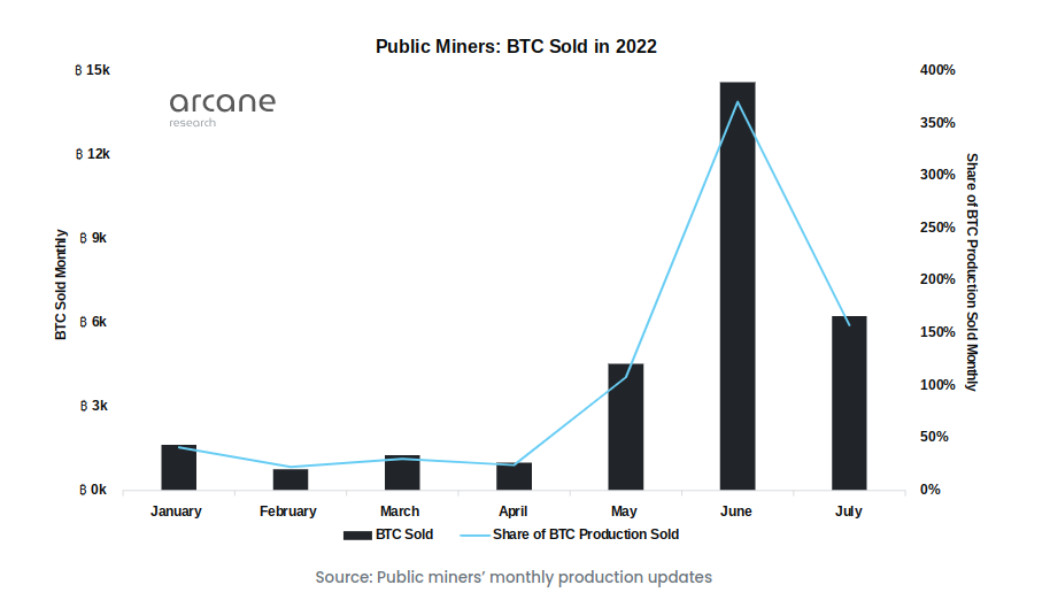

Bitcoin miners hodl 27% less BTC after 3 months of major selling

According to a fresh prediction from crypto analysis firm Arcane Research, miners will continue to sell more BTC than they earn. Miners sold nearly 30% of record BTC stash since May The trip to $25,000 this month decreased pressure on a Bitcoin mining sector which has struggled throughout 2022. At one point, fears abounded that miners’ production cost was far higher than the Bitcoin spot price, and that heavy sales would result in order for miners to stay in business. Worse still, many may have to retire altogether due to their activities no longer being financially viable. Data from the period since May appeared to confirm that major upheaval was taking place. As Arcane notes, one public miner alone — Core Scientific — sold around 12,000 BTC in the period from May to July. While the trend...

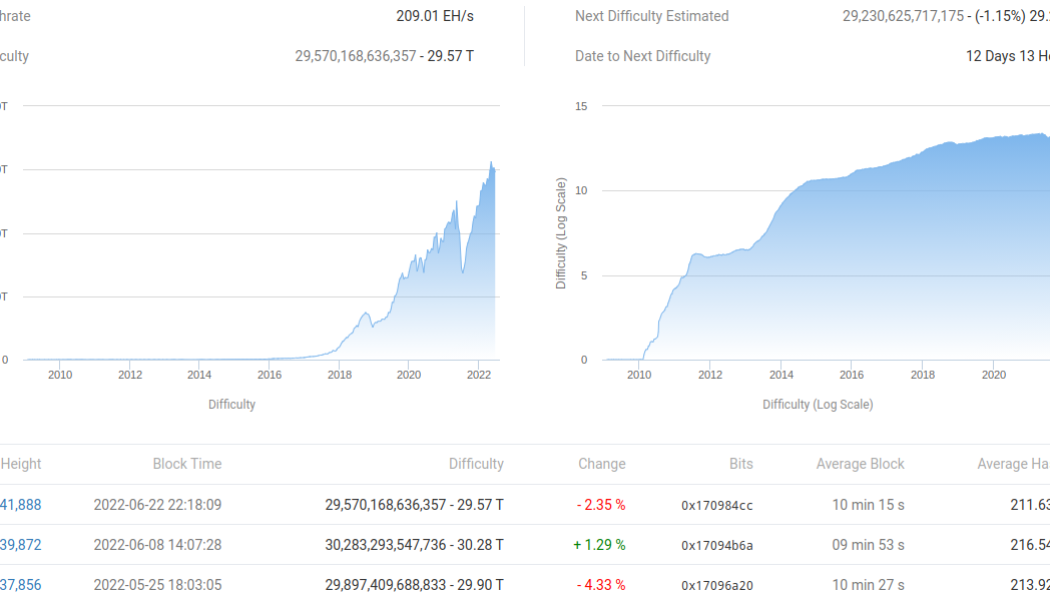

Bitcoin miner ‘capitulation event’ may have already happened — Research

Bitcoin (BTC) miners may have already sparked a “capitulation event,” fresh analysis has concluded. In an update on June 24, Julio Moreno, senior analyst at on-chain data firm CryptoQuant, hinted that the BTC price bottom could now be due. BTC price bottom “typically” follows miner capitulation Miners have seen a dramatic change in circumstances since March 2020, going from unprecedented profitability to seeing their margins squeezed. The dip to $17,600 — 70% below November’s all-time highs for BTC/USD — has hit some players hard, data now shows, with miner wallets sending large amounts of coins to exchanges. This, CryptoQuant suggests, precedes the final stages of the Bitcoin sell-off more broadly in line with historical precedent. “Our data demonstrate a miner capitulation event that has...

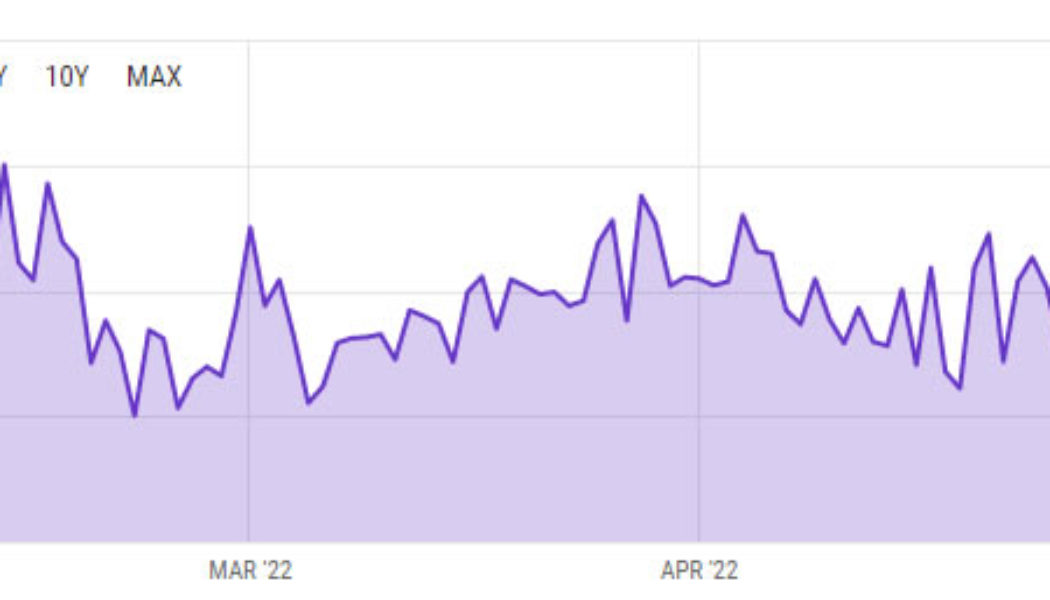

Bitcoin daily mining revenue slumped in May to eleven-month low

Bitcoin (BTC) mining revenue and profitability have continued to slide along with the asset’s price this year as the crypto winter deepens. May has been one of the worst months for Bitcoin miners in the past year as revenue and profitability continue to tank. Bitcoin daily mining revenue tanked as much as 27% in May, according to data from Ycharts sourcing data from Blockchain.com. On May 1, the analytics provider reported daily revenue of $40.57 million for BTC miners, but by the end of the month, it had fallen to $29.37 million. Daily mining revenue hit an eleven-month low of $22.43 million on May 24. BTC daily mining revenue YTD – ycharts.com Daily mining revenue spiked to a peak of around $80 million in April 2021 but has since fallen 62% to current levels. May ended the...

Iran bans cryptocurrency mining for four months

Iran is temporarily banning cryptocurrency mining after some of the country’s major cities experienced repeated blackouts. President Hassan Rouhani said that the ban would last until September 22nd. The country has experienced summer blackouts in years past, and while the current round of outages is mostly being blamed on a drought that’s affecting the country’s ability to generate hydroelectric power, it seems that the Iranian government is eager to cut down on any aggravating factors. Power-hungry cryptocurrency mining operations, for instance. According to the BBC, Iran operates a program where Bitcoin miners must register with with the government, pay extra for electricity, and sell their coins to the central bank. President Rouhani stated that the legal mining operations in the countr...

- 1

- 2