MicroStrategy

In this together: Musk and Saylor down a combined $1.5B on Bitcoin buys

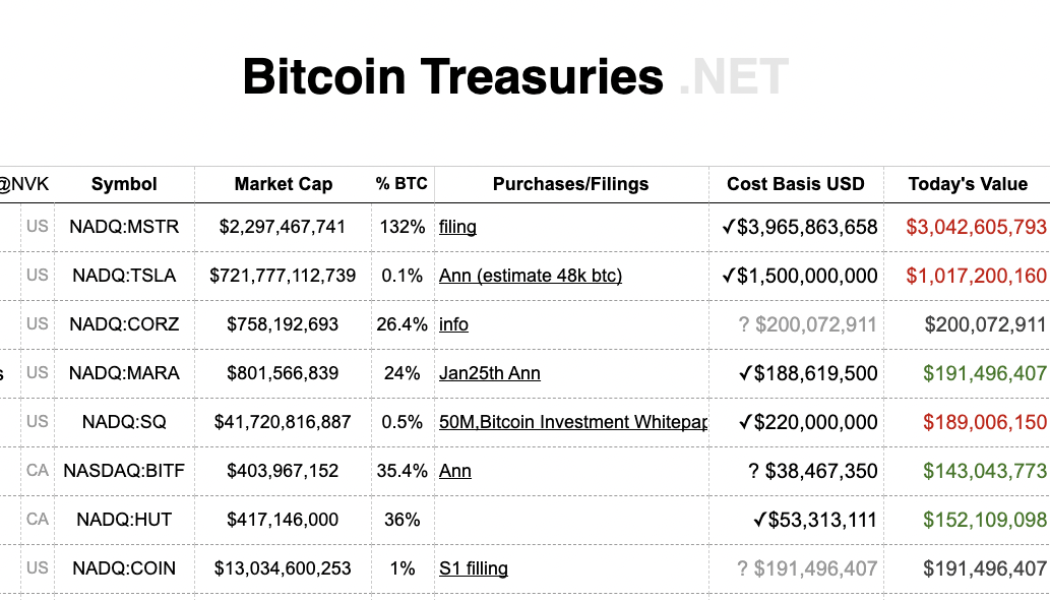

As the bear market bites, holding crypto investments can be a tough pill to swallow. Consider two of the largest bag holders of publicly traded companies. They are down by almost $2 billion dollars on their Bitcoin buys. According to Bitcointreasuries.net, the 130,000 and 43,00 Bitcoin (BTC) held by Microstrategy and Tesla respectively are worth considerable sums less. The top “Hodlers” of Bitcoin according to Bitcointreasuries.net For Microstrategy, Michael Saylor splashed out almost $4 billion ($3,965,863,658) on 129,218 BTC, approximately 0.615% of the 21 million total supply. The Bitcoin price nosedive has ripped away earlier gains: the investment is worth $3.1 billion ($3,074,987,824), a loss of $900 million. Plus, in premarket trading on June 13, Microstrategy ...

Madeira ‘embraces’ Bitcoin, and how its president met Michael Saylor

The tiny Portuguese archipelago of Madeira has “adopted” Bitcoin (BTC) — but what does that mean? The announcement, made during the Bitcoin 2022 conference in Miami, has spurned confusion and misinformation. Miguel Albuquerque, the president of the Regional Government of Madeira, hopped on the stage in April to announce: “I believe in the future, and I believe in Bitcoin.” He also said he would work to “create in Madeira a fantastic environment for Bitcoin.” However, the details remained unclear. Cointelegraph spoke to André Loja, a Madeiran entrepreneur who spearheaded the plan to bring BTC to the archipelago in the Atlantic ocean, to find out how Bitcoin is shaping the islands’ development. Madeira exploded onto the Bitcoin world map on April 7 when JAN3 CEO Samson Mow proudly ...

Michael Saylor assuages investors after market slumps hurts MSTR, BTC

MicroStrategy’s CEO and Bitcoin proponent Michael Saylor is confident his firm’s BTC holdings will more than cover a potential margin call on Bitcoin-backed loans. The American business intelligence and software giant made headlines in 2021 with a number of major investments into Bitcoin. Saylor was a driving force behind MicroStrategy’s decision to convert its treasury reserve into BTC holdings. Global markets have suffered major losses in early May and Microstrategy’s stock has not been spared. MSTR has seen its value drop by 24% and the value of Bitcoin has also slumped considerably along with the wider cryptocurrency markets. This is cause for concern as the company’s subsidiary MacroStrategy took out a $205 million loan from Silvergate Bank in March 2022, with a portion of MicroStrate...

Crypto Biz: The real reason crypto hodlers should care about the Federal Reserve, April 28–May 4, 2022

Wall Street’s slow embrace of crypto means we all have to start watching the Federal Reserve again. Cointelegraph parsed through the latest Federal Open Market Committee (FOMC) policy statement on Wednesday to try and uncover some nuggets of useful information. You can think of it as an exercise in financial esoterics to uncover the hidden meaning behind the Fed’s decision-making. As it turns out, the decision to raise interest rates by 50 basis points was already expected, so the actual FOMC document provided very little new information. But, Fed Chair Jerome Powell sparked a late rally in crypto and stocks on Wednesday when he said 75 basis-point increases aren’t on the table. You wanted the institutions to adopt crypto, didn’t you? Now, the asset class is trading almost in lockstep with...

MicroStrategy may explore ‘future yield generation opportunities’ on 95,643 BTC holdings

Business intelligence firm MicroStrategy said it will consider opportunities for yield generation on 95,643 “unencumbered” Bitcoin (BTC) held by its subsidiary MacroStrategy. In MicroStrategy’s report for the first quarter of 2022 released on Tuesday, the firm said it “may conservatively explore future yield generation opportunities on unencumbered MacroStrategy bitcoins” as a consideration following a $205 million BTC-collateralized loan issued by Silvergate Bank in March. As of March 31, MicroStrategy held a total of 129,218 BTC, which the firm reported had a carrying value of roughly $2.9 billion, reflecting cumulative impairment losses of more than $1 billion and an aggregate cost of $4 billion. “The original cost basis and market value of MicroStrategy’s bitcoin were $3.967 billion an...

MicroStrategy may explore ‘future yield generation opportunities’ on 95,643 BTC holdings

Business intelligence firm MicroStrategy said it will consider opportunities for yield generation on 95,643 “unencumbered” Bitcoin (BTC) held by its subsidiary MacroStrategy. In MicroStrategy’s report for the first quarter of 2022 released on Tuesday, the firm said it “may conservatively explore future yield generation opportunities on unencumbered MacroStrategy bitcoins” as a consideration following a $205 million BTC-collateralized loan issued by Silvergate Bank in March. As of March 31, MicroStrategy held a total of 129,218 BTC, which the firm reported had a carrying value of roughly $2.9 billion, reflecting cumulative impairment losses of more than $1 billion and an aggregate cost of $4 billion. “The original cost basis and market value of MicroStrategy’s bitcoin were $3.967 billion an...

MicroStrategy subsidiary adds another 4,197 BTC to balance sheet

On Tuesday, enterprise software development firm MicroStrategy announced via a filing with the U.S. Securities and Exchange Commission (SEC) that its subsidiary MacroStrategy acquired 4,197 Bitcoin (BTC) ($190.5 million) between February 15 and Tuesday. MacroStrategy has purchased an additional 4,167 bitcoins for ~$190.5 million at an average price of ~$45,714 per #bitcoin. As of 4/4/22 MicroStrategy #hodls ~129,218 bitcoins acquired for ~$3.97 billion at an average price of ~$30,700 per bitcoin. $MSTRhttps://t.co/Z45OuJU5KI — Michael Saylor⚡️ (@saylor) April 5, 2022 The coins were bought at a weighted average price of $45,714, which is roughly equivalent to the price of the digital asset at the time of publication. As a result, MicroStrategy and its subsidiaries now hol...

Crypto Biz: Proof of integrity? Gold industry wants blockchain to solve its biggest problems, March 25–31, 2022

As Bitcoin (BTC) continues to eat away at gold’s market share, the bullion industry is looking to blockchain — the technology first made famous by BTC — to solve its most enduring challenges. How’s that for irony? Someone should really check on Peter Schiff. Speaking of Bitcoin, a MicroStrategy subsidiary confirmed this week that it plans to buy more “digital gold” through a crypto-collateralized loan. Terraform Labs CEO Do Kwon also ramped up his Bitcoin purchases to provide solid backing for Terra’s UST stablecoin. This week’s Crypto Biz takes a deep dive into the gold industry and the latest business developments surrounding Bitcoin. Gold industry taps blockchain for supply chain management and fraud prevention Blockchain has been identified as a potential game-changer for the gol...

Michael Saylor: Financial markets are ‘not quite ready’ for Bitcoin bonds

MicroStrategy CEO and Bitcoin permabull, Michael Saylor believes that traditional financial markets aren’t quite ready for Bitcoin-backed bonds. Saylor told Bloomberg on Tuesday, that he’d love to see the day come where Bitcoin-backed bonds are sold like mortgage-backed securities, but warned that, “the market is not quite ready for that right now. The next best idea was a term loan from a major bank.” MacroStrategy, a subsidiary of @MicroStrategy, has closed a $205 million bitcoin-collateralized loan with Silvergate Bank to purchase #bitcoin. $MSTR $SIhttps://t.co/QYw2ZgeE3U — Michael Saylor⚡️ (@saylor) March 29, 2022 The remarks come two days after MicroStrategy’s (MSTR) Bitcoin-specific subsidiary MacroStrategy, announced that it had taken out a $205 million Bitcoin-...

MicroStrategy subsidiary will purchase Bitcoin after closing $205M crypto-collateralized loan

MacroStrategy, a subsidiary of business intelligence firm MicroStrategy, said it will purchase Bitcoin after obtaining a multimillion dollar loan from Silvergate Bank. In a Tuesday announcement, MicroStrategy said Silvergate issued a $205 million loan “secured by certain Bitcoin held in MacroStrategy’s collateral account.” The firm’s subsidiary MacroStrategy will be using the proceeds of the loan to purchase Bitcoin (BTC), pay fees and interest related to the loan and handle general corporate expenses. “The SEN Leverage loan gives us an opportunity to further our position as the leading public company investor in Bitcoin,” said MicroStrategy CEO Michael Saylor. “Using the capital from the loan, we’ve effectively turned our Bitcoin into productive collateral, which allows us to furthe...

Orange-pilled by Michael Saylor, NorthmanTrader CEO now a Bitcoin supporter

There is still room for humility and humor amidst a gloomy January for Bitcoin (BTC). A former outspoken Bitcoin critic has flipped bullish on Bitcoin after conversations with Michael Saylor, CEO of Microstrategy. What’s more, Sven Henrich, the CEO of market analysis firm NorthManTrader, made light of his change of heart retweeting a jibe from Twitter account Documenting Bitcoin. Excellent https://t.co/tAIwLWJfKv — Sven Henrich (@NorthmanTrader) January 24, 2022 Despite his previous comments that Bitcoin “fixes nothing”, Henrich has followed the crypto markets for three years. He tweeted regularly about Bitcoin price action, offering market analysis as reported by Cointelegraph. However, he had no intentions of buying. In 2022, he is now a “supporter of Bitcoin.” That means an “expos...

SEC rejects MicroStrategy‘s Bitcoin accounting practices: Report

Business intelligence firm MicroStrategy reportedly acted contrary to the Securities and Exchange Commission’s (SEC‘s) accounting practices for its crypto purchases. According to a Bloomberg report, a comment letter from the SEC released Thursday showed that the regulatory body objected to MicroStrategy reporting information related to its Bitcoin (BTC) purchases based on non-Generally Accepted Accounting Principles (GAAP). The business intelligence firm has been reporting that it used these methods of calculating figures for its BTC buys, excluding the “impact of share-based compensation expense and impairment losses and gains on sale from intangible assets.” Essentially, this negates some of the effects of the volatility of the crypto market. GAAP rules are seemingly not design...