MicroStrategy

Crypto Biz: Did Michael Saylor buy the Bitcoin bottom for once?

Business intelligence firm MicroStrategy is showing no signs of backing down on its Bitcoin gambit. Right around the time that Sam Bankman-Fried was being exposed as a fraud, MicroStrategy was scooping up more Bitcoin (BTC) — this time, the firm bought as close to the bottom as it’s ever gotten. While Bitcoin can always go lower, seeing a MicroStrategy buy around $17K is refreshing. Interestingly, MicroStrategy also sold some BTC earlier this month — but not for the reason you think (more on that below.) The final Crypto Biz newsletter of 2022 discusses MicroStrategy’s Bitcoin buy, Fidelity Investments’ foray into the metaverse, Changpeng Zhao’s response to haters and the collective woes of Bitcoin miners. MicroStrategy adds to Bitcoin stake despite steep loss Business intelligence firm Mi...

Microstrategy Bitcoin purchase divides the crypto community

Software analytics company MicroStrategy recently added more Bitcoin (BTC) to the firm’s holdings. Members of the crypto community had mixed reactions to the move. In a recent tweet, MicroStrategy’s executive chairman Michael Saylor announced that the firm had made another Bitcoin purchase. The move puts the firm’s total BTC holdings at 132,500 BTC, purchased for a total of $4.03 billion but worth only around $2.1 billion at the time of writing. Many commended the move, while some brought up some potential negative effects. Michael Saylor, you are a rock star. Your mission Jim aka Michael Saylor, if you choose to accept it, is to bank the unbanked throughout the world. — The Young Gentleman (@YoungGentlaman) December 28, 2022 A community member praised the MicroStrategy chairman, cal...

MicroStrategy adds to Bitcoin stake despite steep loss

According to a new filing with the U.S. Securities and Exchange Commission, software analytics firm MicroStrategy said that it acquired 2,395 Bitcoins (BTC) at an average price of $17,181 for a total of $42.8 million during the period Nov. 1 and Dec. 21. Subsequent to the development, the company sold 704 BTC at $16,776 per coin for a total of $11.8 million on Dec. 22. On Dec. 24, MicroStrategy acquired approximately 810 BTC for $13.6 million in cash, at an average price of $16,845 per coin. In a Bloomberg interview published earlier this year, CEO and blockchain personality Michael Saylor told reporters: “We’re only acquiring and holding Bitcoin, right? That’s our strategy. We’re not sellers.” Today’s filing represents the first publicly reported ...

First time Bear market? Advice from Bitcoin Bull Michael Saylor

First-time bear market? It’s also the first Bitcoin (BTC) bear market for Michael Saylor, one of the world’s biggest Bitcoin bulls. Executive chairman of one of the world’s largest pro-Bitcoin companies, Saylor took a moment out of his busy schedule at the Los Angeles Pacific Bitcoin conference to speak with Cointelegraph. Crucially, Saylor told Cointelegraph that when it comes to Bitcoin, “you have to take a long frame time perspective.” “If you’re buying [Bitcoin] and you’ve got less than a four-year time horizon, you’re just speculating in it. And once you’ve got more than a four-year time horizon, then the obvious thing is you dollar-cost average.” Dollar-cost averaging is a way of reducing exposure to the volatility of an investment. Saylor continued, “You buy the asse...

MicroStrategy takes its BTC maximalism to the next level with new engineer hire

MicroStrategy, the business intelligence and tech company that holds the world’s largest Bitcoin (BTC) reserve, is hiring a Bitcoin Lightning software engineer to create a Lightning Network-based software-as-a-service platform. The new engineer will be responsible for building a Lightning Network-based platform to address enterprise cybersecurity challenges and enable new e-commerce use cases, according to a job posting linked to the MicroStrategy website. Besides “an adversarial mindset,” the applicant should have certificates, knowledge of tools and programming languages, and experience with decentralized finance technologies. MicroStrategy is looking to hire a Bitcoin Lightning Software Engineer to build a Lightning Network-based SaaS platform. #bitcoin pic.twitter.com/XFYrkIaFA9 — Neil...

Bitcoin better than physical property for commoners, says Michael Saylor

MicroStrategy CEO and Bitcoin (BTC) advocate Michael Saylor doubled down on his support for Bitcoin as he explained the issues related to transferring the value of physical properties such as gold, company stocks or equity and real estate during the Australia Crypto Convention. Speaking about the underlying proof-of-work (PoW) consensus mechanism, Saylor highlighted that Bitcoin is backed by $20 billion worth of proprietary mining hardware and $20 billion worth of energy. He then pointed out that traditional assets such as gold (in high quantity) and land are nearly impossible to carry forward across geographical boundaries, adding: “If you have a property in Africa, no one’s gonna want to rent it from you if they live in London. But if you have a billion dollars of Bitcoin, yo...

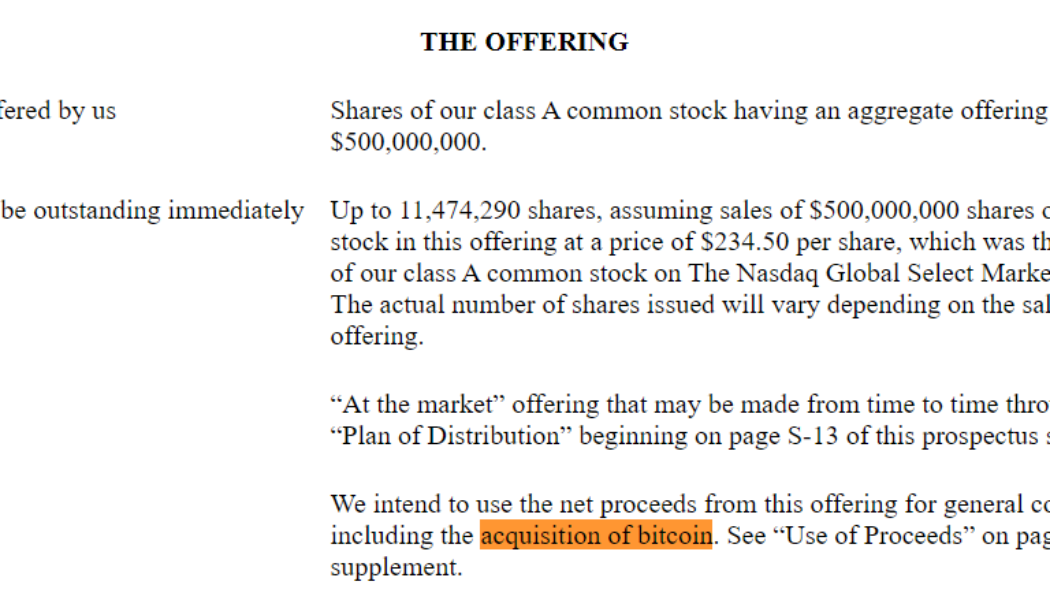

MicroStrategy to reinvest $500M stock sales into Bitcoin: SEC filing

MicroStrategy, the largest institutional Bitcoin (BTC) buyer, entered an agreement with two agents — Cowen and Company and BTIG — to sell its aggregated class A common stock worth $500,000,000, reveals Securities and Exchange Commission (SEC) filing. MicroStrategy, co-founded by Bitcoin bull Michael Saylor, amassed approximately 129,699 BTC over several years at an aggregate purchase price of $3.977 billion. Despite market uncertainties, the business analytics software firm continues to pursue its goal of acquiring more BTC by selling company stocks. The filing confirmed: “We intend to use the net proceeds from the sale of any class A common stock offered under this prospectus for general corporate purposes, including the acquisition of bitcoin, unless otherwise indicated in the applicable...

MicroStrategy stock MSTR hits 3-month high after CEO’s exit

MicroStrategy (MSTR) stock opened higher on Aug. 3 as investors digested the news of its CEO Michael Saylor’s exit after a depressive quarterly earnings report. Microstrategy stock up 142% since May lows On the daily chart, MSTR’s price surged by nearly 14.5% to $324.55 per share, the highest level since May 6. The stock’s intraday gains came as a part of a broader recovery that started on May 12 at $134. Since then, MSTR has grown by 142% versus Nasdaq’s 26.81% gains in the same period. MSTR daily price chart. Source: TradingView Bad Q2, Saylor’s resignation The Aug. 3 MSTR rally came a day after MicroStrategy reported a billion dollar loss in its second quarter (Q2) earnings call. Interestingly, the company’s major Bitcoin exposure was a large re...

Michael Saylor will step down as MicroStrategy CEO but remain executive chair

Bitcoin maximalist Michael Saylor has announced that he will step down as the chief executive officer of MicroStrategy, the business intelligence firm he helped co-found in 1989. In a Tuesday notice on its second quarter earnings for 2022, MicroStrategy said Saylor would be assuming the new role of executive chair at the company, while president Phong Le will become CEO. The changes are expected to take effect on Aug. 8. “I believe that splitting the roles of Chairman and CEO will enable us to better pursue our two corporate strategies of acquiring and holding Bitcoin and growing our enterprise analytics software business,” said Saylor. Please join the @MicroStrategy management team at 5pm ET as we discuss our Q2 2022 financial results, executive transition, and answer questions about our ...

Crypto Biz: Coinbase downgraded, 3AC deemed insolvent and Michael Saylor buys the dip

Coinbase has long been considered an important bellwether of the cryptocurrency market. Last year, when the company was expanding its workforce, adding institutional clients and issuing stock, crypto prices were hitting record highs. Now, in the depths of crypto winter, Coinbase finds itself slashing a fifth of its workforce, losing retail trading volume and contending with downgrades of its credit and stock. This week’s Crypto Biz dissects Goldman Sachs’ latest downgrade of Coinbase and also looks at the latest developments surrounding Three Arrows Capital. Goldman Sachs downgrades Coinbase stock to ‘sell’ After a promising debut on the Nasdaq stock exchange in April 2021, it has been nothing but down for Coinbase shares. The company, which once had a fully diluted market capitalization o...

MicroStrategy scoops up 480 Bitcoin amid market slump

Business intelligence firm MicroStrategy has added to its Bitcoin (BTC) holdings, reaffirming CEO Michael Saylor’s bullish outlook on the digital asset despite its recent struggles. In a Form 8-K filing with the United States Securities and Exchange Commission (SEC), Microstrategy disclosed that it had acquired an additional 480 BTC at an average price of roughly $20,817. The total purchase amount was $10 million in cash. With the purchase, MicroStrategy now holds 129,699 BTC, making it the largest corporate holder of Bitcoin. The total value of its holdings is roughly $3.98 billion. MicroStrategy has purchased an additional 480 bitcoins for ~$10.0 million at an average price of ~$20,817 per #bitcoin. As of 6/28/22 @MicroStrategy holds ~129,699 bitcoins acquired for ~$3.98 billion at...

Finance Redefined: Three Arrow Capital and Celsius fall brings a tsunami of sell-off in DeFi

This past week, the decentralized finance (DeFi) ecosystem faced the brunt of the bears fueled by liquidation rumors of Three Arrow Capital (3AC) and Celsius liquidations. MakerDAO decided to cut off Aave (AAVE) from its direct deposit module as a safeguard in light of the possibility that Celsius folds and crashes the price of staked Ether (stETH). Trading firm 8 Blocks Capital called out to platforms holding funds owned by 3AC to freeze the assets as rumors of 3AC’s insolvency stay afloat. Micheal Saylor believes Bitcoin (BTC) and the Lightning Network can solve many of the DeFi ecosystem problems. The top 100 DeFi tokens were hit hard by bears, with the majority of tokens registering multi-month low along with double-digit losses over the past week. Crypto crash wreaking havoc on DeFi p...