Meta

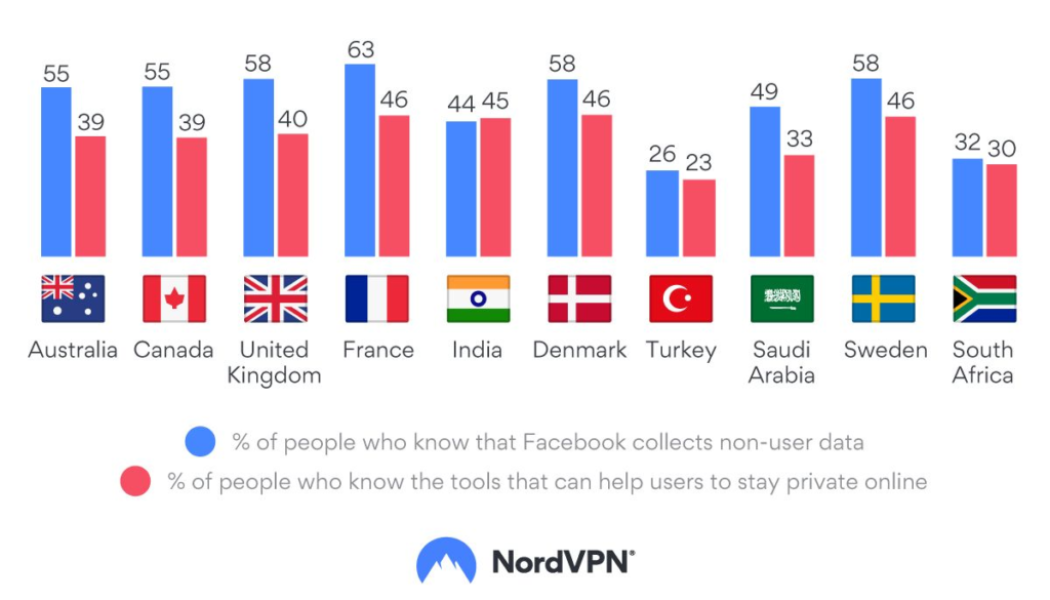

Do South Africans Know How Facebook Collects Their Data?

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Facebook Reels Has Finally Launched in These Sub-Saharan African Countries

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

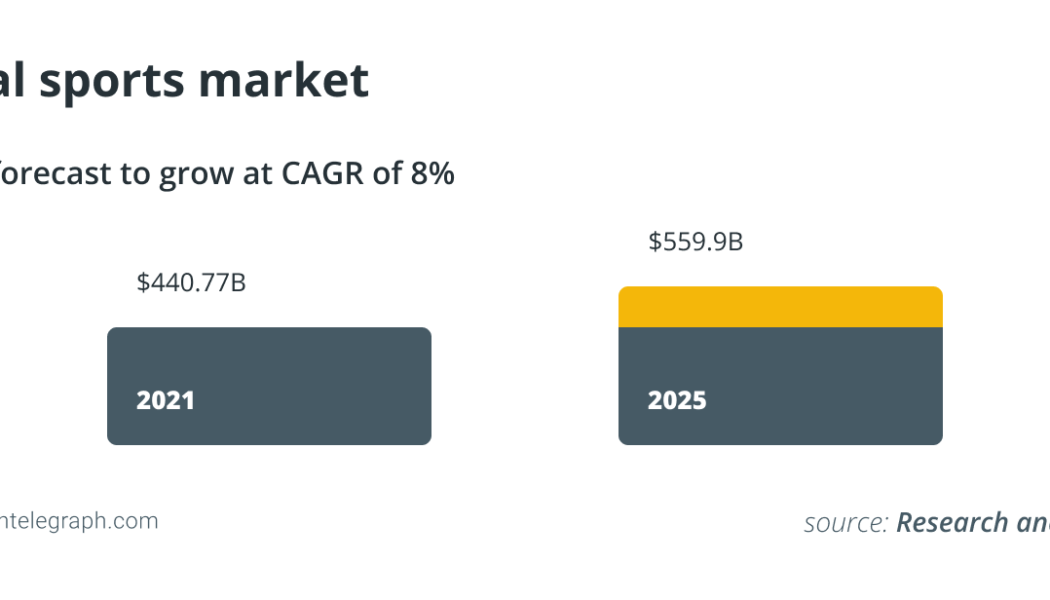

More playing and less earning will make better Metaverse games

If you’re not keen on joining Mark Zuckerberg in the Metaverse, I have bad news for you: You’re already there. You don’t need a virtual reality headset to enter a virtual world. Humans have been representing reality since our distant ancestors first painted on cave walls. If TV, radio, books or newspapers have ever given you access to events that you did not physically attend, you have experienced a kind of metaverse already. Sport and games are another reality that we often partake in virtually — in the stands or behind a screen — when not on the field. So, it’s no coincidence then that, thus far, games dominate what most people understand as the Metaverse, or more widely, Web3. Our innate love of play, our understanding that fulfilling games depend on rules and structures and our w...

Bitcoin surges toward $39K as stocks volatility keeps Wall Street on edge

Bitcoin (BTC) kept investors guessing with tech stocks as Wall Street opened on Feb. 4, circling $38,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Stocks continue volatility Data from Cointelegraph Markets Pro and TradingView followed a ranging overnight period for BTC/USD, bulls hoping for clearer validation of recent gains. After 15% daily gains the day before, Amazon (AMZN) continued its uptrend on Feb. 4, jumping 10% at the open, while embattled Meta (FB) dipped further. In what has become an increasing focus of attention among analysts, curiously volatile tech stocks thus showed few signs of steadying at the opening bell. Bitcoin, after losing $800 in the hour beforehand, thus recouped all of those losses and more, underscoring its positive stocks correlation. ...

Majority of US consumers say no to Meta owning metaverse data: Survey

A survey of 1,000 United States consumers around growing interest in the metaverse has revealed some interesting results. In a survey commissioned by nonfungible token and metaverse infrastructure provider Advokate Group, 87% of respondents preferred a decentralized metaverse on a blockchain over some of the mega projects planned by tech giants. This became more evident when 77% of the respondents shared concerns over Facebook’s entry into the metaverse, especially since it owns users’ metaverse data. Facebook’s tainted past with mismanagement of private user data has already dismantled its early plans of launching a stablecoin called Diem. The stablecoin project faced heavy scrutiny from the U.S. Congress, and the project eventually came to a crashing end. A similar concern ha...

Diem stablecoin co-founder praises Bitcoin for censorship resistance

Shortly after Meta, formerly Facebook, officially gave up on its stablecoin Diem, some of the key people in the project have become increasingly vocal about the uncensorable nature of Bitcoin (BTC). David Marcus, a co-founder of Diem — originally known as Libra — took to Twitter on Tuesday to predict that Bitcoin will be the No. 1 asset in the next two decades. It’s become clear to me that #Bitcoin will be the one asset and L1 still around in 20+ years with increased compounding relevance over time. The #2 slot (for a different use case) is still tbd. #Ethereum is in the lead for now, but #Solana and others nipping at their heels. 1/2 — David Marcus – dmarcus.eth (@davidmarcus) February 1, 2022 “It’s become clear to me that Bitcoin will be the one asset and L1 still around in 20+ yea...

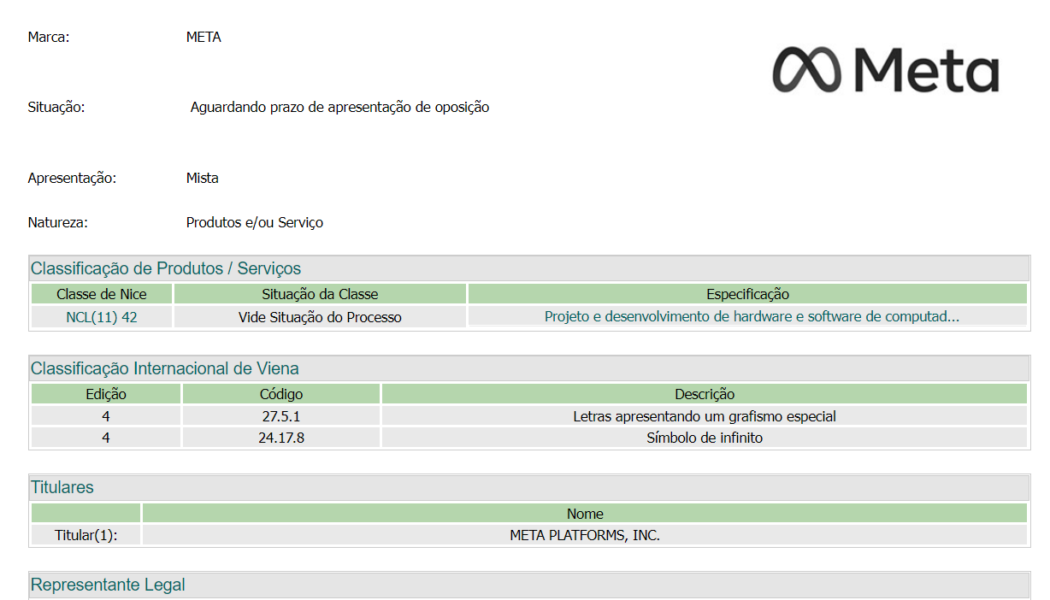

Meta goes Brazil to trademark Bitcoin and crypto services

Meta, the world’s biggest social media platform, has filed a trademark registration with the Brazilian authorities to design, develop and provision hardware and software for various Bitcoin (BTC) and crypto-related services. Meta recently rebranded from Facebook as a move to better align with the Metaverse developments despite regulatory hurdles faced during its numerous previous attempts to enter the crypto space. Accelerating this effort, Meta filed a trademark registration with the Brazilian National Institute of Industrial Property (INPI) for crypto products and services related to trading, wallets and exchanges platforms. Meta’s trademark filing with the Brazilian INMI. Source: INPI Further investigations from Cointelegraph reveal a translated version of the specifications...

Zuckerberg’s Diem reportedly weighing sale after stablecoin plans falter

Meta-backed crypto initiative “Diem” is reportedly trying to sell its assets, seemingly calling time on Facebook founder Mark Zuckerberg’s grand ambitions for a stablecoin to act as the internet’s currency. Diem — which was previously known as Libra — is Meta Platform’s cryptocurrency initiative. According to insider sources speaking with Bloomberg, it is considering selling assets to return capital to its investors. The sources said that Diem is in discussions with investment bankers to determine the best way to sell its intellectual property and cash out on whatever value the project has maintained. It’s unclear how the company will be valued, and there is no guarantee that they will be able to find a buyer. According to the source, about a third of the venture is owned by Meta. The rema...

Meta unveils Metaverse AI supercomputer, claims it will be world’s fastest

Facebook’s parent company Meta says that its newly-created artificial intelligence (AI) “Research SuperCluster” (RSC) will “pave the way” towards building the Metaverse. The social media giant said that it believes RSC is already one of the fastest supercomputers in the world and will snag the top spot when it’s fully operational in mid-2022, according to a Jan, 24 blog post unveiling the hardware. “Developing the next generation of advanced AI will require powerful new computers capable of quintillions of operations per second,” wrote the company. “Ultimately, the work done with RSC will pave the way toward building technologies for the next major computing platform — the metaverse, where AI-driven applications and products will play an important role.” CEO Mark Zuckerberg added in a Jan....

3 reasons why Near Protocol (NEAR) just hit a new all-time high

The layer one (L1) battle is starting to heat up again and multiple protocols have seen their token values rise in recent weeks as traders venture out to see what life is like outside of the Ethereum (ETH) network. One L1 protocol that has seen its token price climb to a new all-time high this week was NEAR, a community-run cloud computing platform focused on interoperability and lightning quick transaction speed. Data from Cointelegraph Markets Pro and TradingView show that, following a pullback that hit a low of $13.10 on Jan. 9, the price of NEAR climbed more than 50% to establish a new record high at $20.36 on Jan. 14. NEAR/USDT 4-hour chart. Source: TradingView Three reasons that contributed to the growing strength of NEAR include the successful completion of a $150 millio...

Samsung launches metaverse store in Decentraland

Samsung is the latest megacorporation to announce a metaventure project, choosing Decentraland for its metaverse project. On Thursday, the consumer electronics giant announced the opening of a virtual replica of its iconic New York physical store in order to enhance customer interaction at a time when COVID-19 is keeping people away from physical shops. The Samsung metaverse store is a replica of a real-world shop situated at 837 Washington Street in New York City’s Meatpacking District in Manhattan. The Samsung 837X shop will now be accessible in the metaverse for a limited time. The company claims that it is one of the largest brand land takeovers in Decentraland, a blockchain-powered metaverse. Customers must first enter Decentraland via a web browser to access the store. Aft...

Bored Ape Yacht Club is a huge mainstream hit, but is Wall Street ready for NFTs?

Within months after its launch in April 2021, Bored Ape Yacht Club (BAYC) has become one of the main reasons Wall Street should take the emerging nonfungible token (NFT) market seriously, thanks to its recent sales turnover of over $1 billion. Celebrities ape into BAYC For the uninitiated, BAYC is a collection of 10,000 cartoons of anthropomorphic apes with stylish clothes and disreputable expressions. Each ape is practically an image file that should be worthless in a sane world. Nonetheless, they have been managing to fetch astonishing sums, sometimes from some of the world’s most renowned celebrities. For instance, Jimmy Fallon, a popular American TV host, bought the image of a Bored Ape that wore a striped T-shirt and heart-shaped shades for almost $220,000 in November ...