Merge

Surge or purge? Why the Merge may not save Ethereum price from ‘Septembear’

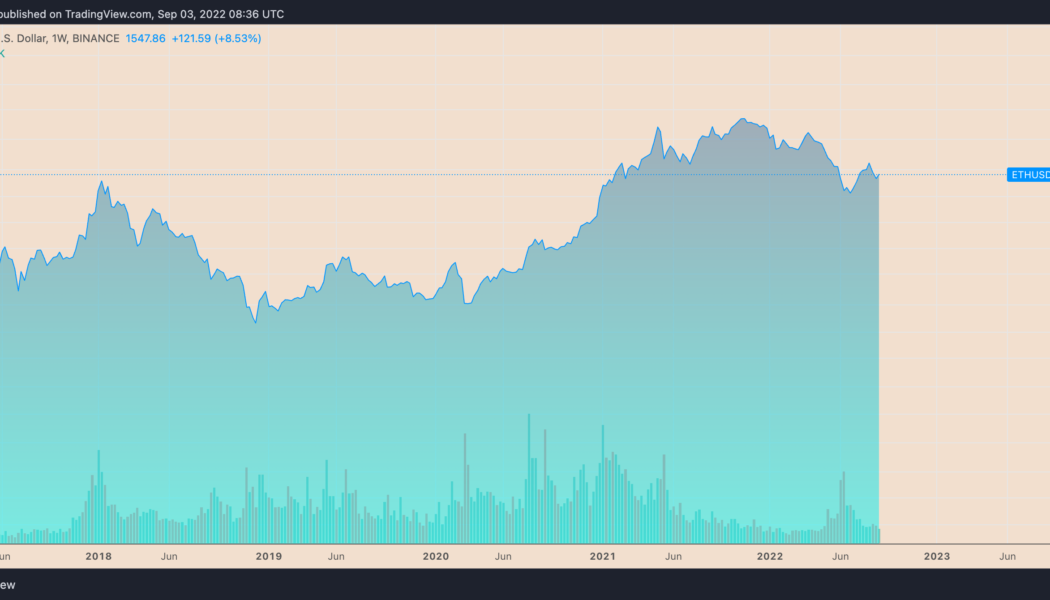

Ethereum’s native token, Ether (ETH), is not immune to downside risk in September after rallying approximately 90% from its bottom of around $880 in June. Much of the token’s upside move is attributed to the Merge, a technical upgrade that would make Ethereum a proof-of-stake (PoS) protocol, slated for Sep. 15. But despite logging impressive gains between June and September, Ether still trades almost 70% below its record high of around $4,950 from November 2021. Therefore, its possibility of heading lower remains on the cards. ETH/USD weekly price chart. Source: TradingView Here are three Ethereum bearish market indicators that show why more downside is likely. Sell the Ethereum Merge news Ethereum options traders anticipate Ether’s price to reach $2,200 f...

Buterin and Armstrong reflect on proof-of-stake shift as Ethereum Merge nears

Ethereum co-founder Vitalik Buterin and Coinbase CEO Brian Armstrong believe that a gradual mind shift and important community contributions led to their backing of Ethereum’s upcoming move from a proof-of-work (PoW) to aproof-of-stake (PoS) consensus. The two industry titans joined Coinbase protocol specialist Viktor Bunin on the Around the Block podcast for an enlightening discussion centered on The Merge, which is set to take place in mid-September 2022. Buterin reflected on his history of considering proof-of-stake as a potential consensus mechanism for the Ethereum blockchain, which was initially met with skepticism due to a number of unsolved problems that made it seemingly unviable. According to the Ethereum co-founder, one of the project’s first blog posts in 2014 proposed an...

Lower costs, higher speeds after Ethereum’s Merge? Don’t count on it

As we approach the date of Ethereum’s Merge, users have speculated about what it will mean for projects and the wider ecosystem. Some argue the Merge will have little impact on gas fees and believe transaction speeds might improve. However, in general, most ordinary users will not notice much change. The real changes for average users will only be seen after the sharding mechanism is introduced six months later. The Merge will reduce energy consumption and increase security The Merge is a planned update to the Ethereum network scheduled for Sept. 15. It will move transaction validation from proof-of-work (PoW) to proof-of-stake (PoS). PoS has been part of Ethereum’s plans for many years, but the level of technical sophistication it requires has taken time to develop. It means a transition ...

Circle plans to only support Ethereum PoS chain after Merge is complete

On Tuesday, Circle, the issuer of the USD Coin (USDC) stablecoin, pledged its full support for the transition of Ethereum to a proof-of-stake, or PoS, blockchain after the much-anticipated Merge upgrade. The firm views the Merge as an important milestone in the scaling of the Ethereum ecosystem, writing: “USDC has become a core building block for Ethereum DeFi innovation. It has facilitated the adoption of L2 solutions and helped broaden the set of use cases that today rely on Ethereum’s vast suite of capabilities. We understand the responsibility we have for the Ethereum ecosystem and businesses, developers and end users that depend on USDC, and we intend to do the right thing.” Currently, USDC is both the largest dollar-backed stablecoin issued on Ethereum and the largest ERC-20 asset ov...

Ethereum price rises by 50% against Bitcoin in one month — but there’s a catch

Ether (ETH), Ethereum’s native toke, has been continuing its uptrend against Bitcoin (BTC) as euphoria around its upcoming network upgrade, “the Merge,” grows. ETH at multi-month highs against BTC On the daily chart, ETH/BTC surged to an intraday high of 0.075 on Aug. 6, following a 1.5% upside move. Meanwhile, the pair’s gains came as a part of a broader rebound trend that started a month ago at 0.049, amounting to approximately 50% gains. ETH/BTC daily price chart. Source: TradingView The ETH/BTC recovery in part has surfaced due to the Merge, which will have Ethereum switch from proof-of-work (PoW) mining to proof-of-stake (PoS). Ethereum’s “rising wedge” suggests sell-off From a technical perspective, Ether stares at potential interim loss...

Uniswap’s 80% gains in July are in danger with UNI price painting a classic bearish pattern

Uniswap (UNI) looks ready to post its best monthly performance in more than a year as it rallied approximately 80% in July, but signs of an extended pullback in the near term are emerging. Uniswap price nearly doubles in July UNI’s price is having one of its best months ever, reaching nearly $9 on July 30 versus nearly $5 at the beginning of the month, best returns since January 2021’s 250% price rally. UNI/USD monthly price chart. Source: TradingView Merge FOMO an UNI “fee switch” proposal Uniswap’s gains primarily surfaced due to similar upside moves in a broader crypto market. But they turned out to be relatively massive due to an ongoing euphoria surrounding “the Merge.” Notably, the Ethereum blockchain’s potential transition ...

All ‘Ethereum killers’ will fail: Blockdaemon’s Freddy Zwanzger

Blockdaemon’s ETH ecosystem lead Freddy Zwanzger believes Ethereum will retain its leadership position in the crypto ecosystem over the coming years due to its utility as a smart contract platform and upgrades to the network following the Merge. Speaking to Cointelegraph during the Ethereum Community Conference (EthCC) this week, Zwanzger said: “It’ll continue to be a leader. I mean, obviously, the first and most important smart contract platform, and that’s not going to change.” Blockdaemon is an institutional-grade blockchain infrastructure platform that offers node operations and infrastructure tooling for blockchain projects. The Blockdaemon employee also took aim at so-called “Ethereum killers” — competing Layer 1 blockchains — which have tried to topple Ethereum fro...

What’s next for the future of Ethereum? Mihailo Bjelic from Polygon explains

With the transition to a scalable, energy light proof-of-stake blockchain (dubbed “the Merge”) at play for Ethereum, many have cast doubts on the popular coin’s future given the magnitude and complexity of the upgrade involved. But among prominent stakeholders, one particular project remains heavily bullish on Ethereum’s future, which is non-other than layer-two scaling solution Polygon. At the annual Ethereum Community Conference in Paris, Cointelegraph’s Events Manager Maria A. spoke to Polygon’s vice president of growth Mihailo Bjelic regarding the topic. Here’s what Mihailo had to say with regards to the Merge: “This is an upgrade on a live network that has millions of users, billions in capital, and tens of thousands of applications. It is never easy, but the Merge has been in t...

Will Ethereum Merge hopium continue, or is it a bull trap?

Ethereum is outperforming the broader cryptocurrency market as the highly anticipated Merge approaches, but the bigger picture is still largely bearish. Ethereum (ETH) has gained a whopping 48% over the past seven days, outperforming its big brother Bitcoin, which has only managed to achieve 19% in the same period. It’s also up 66% from its market cycle bottom of $918 on June 19, reaching its current price of $1549. However, the current Ethereum rally could be a bull trap with the macroeconomic clouds darkening. A bull trap is a signal indicating that a declining trend in a crypto asset has reversed and is heading upwards when it will actually continue downwards. The primary driver of recent momentum for the asset has been linked to announcements regarding its final switch to pr...

Ethereum traders gauge fakeout risks after 40% ETH price rally

Ethereum’s native token Ether (ETH) saw a modest pullback on July 17 after ramming into a critical technical resistance confluence. Merge-led Ethereum price breakout ETH’s price dropped by 1.8% to $1,328 after struggling to move above two strong resistance levels: the 50-day exponential moving average (5-day EMA; the red wave) and a descending trendline (black) serving as a price ceiling since May. ETH/USD daily price chart. Source: TradingView Previously, Ether rallied by over 40% from $1,000 on July 13 to over $1,400 on July 16. The jump appeared partly due to euphoria surrounding “the Merge” slated for September. Meanwhile, a golden cross’s appearance on Ethereum’s four-hour chart also boosted Ether’s upside sentiment among technical a...