Merge

Ethereum’s Merge won’t stop its price from sinking

Ethereum’s long-awaited Merge took place in September, shifting it from a legacy proof-of-work (POW) model to the sustainable proof-of-stake (PoS) consensus algorithm. Many observers expected Ether’s (ETH) price to respond positively as its daily emissions declined 90% with the halt of mining operations. However, the expected price surge never occurred. In fact, Ether has been down by over 7% since the upgrade. So why didn’t the Merge drive up the coin’s price? Post-merge ETH monetary policy Ethereum’s monetary policy was simply to reduce the token’s supply to 1,600 ETH per day. The PoW model, an equivalent of 13,000 ETH were emitted daily as mining rewards. However, this has been wholly eliminated post-Merge, as mining operations are no longer valid on the PoS model. Therefore, only...

KYC to stake your ETH? It’s probably coming to the US

Over the last few years, the cryptocurrency industry has been a primary target for regulators in the United States. The legal battle between Ripple and the United States Securities and Exchange Commission (SEC), Nexo’s lawsuit with the securities regulators of eight states, and the scrutiny targeting Coinbase’s Lend program last year are only a few high-profile examples. This year, even Kim Kardashian had first-hand experience with regulatory scrutiny after agreeing to pay a $1.26 million fine for promoting the dubious crypto project EthereumMax. While Ethereum developers intended to pave the way for key network upgrades in the future, it seems like the recent Merge has further complicated matters between crypto projects and U.S. regulators. Ethereum: Too substantial for the cry...

The floppening? Ethereum price weakens post-Merge, risking 55% drop against Bitcoin

Ethereum’s native token Ether (ETH) has been forming an inverse-cup-and-handle pattern since May 2021 on the weekly chart, which hints at a potential decline against Bitcoin (BTC). ETH/BTC weekly price chart featuring inverse cup-and-handle breakdown setup. Source: TradingView An inverse cup-and-handle is a bearish reversal pattern, accompanied by lower trading volume. It typically resolves after the price breaks below its support level, followed by a fall toward the level at a length equal to the maximum height between the cup’s peak and the support line. Applying the theoretical definition on ETH/BTC’s weekly chart presents 0.03 BTC as its next downside target, down around 55% from Sept. 16’s price. Can ETH/BTC pull a Dow Jones? Alternatively, the ...

Ethereum may now be more vulnerable to censorship — Blockchain analyst

Ethereum’s upgrade to proof-of-stake (PoS) may make it more vulnerable to government intervention and censorship, according to the lead investigator of Merkle Science. Speaking to Cointelegraph following the Ethereum Merge, Coby Morgan, a former FBI analyst, and the Lead Investigator for crypto compliance and forensic firm Merkle Science expressed his thoughts on some of the risks posed by Ethereum’s transition to PoS. While centralization issues have been broadly discussed leading up to The Merge, Moran suggested the prohibitive cost of becoming a validator could result in the consolidation of validator nodes to the bigger crypto firms like Binance, Coinbase, and Kraken. In order to become a full validator for the Ethereum network, one is required to stake 32 Ether (ETH), which is w...

Ethereum Merge: Community reacts with memes, GIFs and tributes

It’s been less than a day since Ethereum’s historic transition to proof-of-stake, with most of the crypto community still abuzz with excitement following the successful Merge. On Sept. 15 at 06:42:42 UTC, the last Ethereum block using the old proof-of-work consensus mechanism was mined. Replacing it is an energy-efficient proof-of-stake consensus mechanism. Many crypto enthusiasts and climate advocates worldwide have been thrilled by the positive impact it will have on the environment and thus, crypto’s reputation. Others have just been in awe of the technological feat of upgrading an entire blockchain network without any stoppages. Ethereum Ethereum30 minutes ago Now pic.twitter.com/cyQb3pAdtt — WolfOfEthereum.eth ️ (@Crypto_Wolf_Of) September 15, 2022 Uniswap Labs founder and CEO ...

Merge is ‘a step in the right direction’ to address crypto’s energy usage — Rostin Behnam

Rostin Behnam, chair of the United States Commodity Futures Trading Commission, or CFTC, said the Ethereum blockchain’s transition to proof-of-stake may help reduce crypto’s energy usage, but hinted legislation would likely still be needed to address the problem. Speaking at a Thursday hearing before the Senate Agriculture Committee, Behnam addressed a question from Minnesota Senator Amy Klobuchar, who brought up the environmental impact of the “significant energy” required of mining cryptocurrencies. Without mentioning the Merge by name, the CFTC chair said the crypto bill currently being considered by lawmakers would require a report on energy usage that could lead to future policy discussion and “incentives to move away from carbon-intensive energy sources.” “We’ve all heard the statist...

The ‘launch of a rocket’ — Observers on the future of Ethereum post-Merge

The Ethereum Merge is set to occur later today with the energy-efficiency focused transition expected to have a major impact on crypto investment and adoption, experts say. Speaking to Cointelegraph in the lead up to the Merge, StarkWare president and co-founder Eli Ben-Sasson noted that the Ethereum Merge will be the “first step in a process that will lead to exceedingly widespread adoption of Ethereum.” The immediate importance of the Merge is the dramatic effect on energy consumption. The Merge is expected to see Ethereum’s energy cut by 99.95% compared to its current Proof-of-Work (PoW) consensus mechanism, which requires large amounts of energy to be used in a competition to solve arbitrary mathematical puzzles. “I think of the Merge like the development of the first solar field...

Only 10 hours to the Ethereum Merge: Here’s what you need to know

Ethereum’s long-awaited transition from proof-of-work (PoW) to proof-of-stake (PoS) is upon us as the Merge looms in less than 10 hours. There’s plenty to consider for the wider cryptocurrency space — and here’s what you need to know. What is the Merge? The Ethereum blockchain will transition away from its energy-intensive consensus mechanism PoW as its execution layer merges with the new PoS consensus layer known as the Beacon Chain. The Beacon Chain went live in December 2020, allowing ecosystem participants to deposit or “stake” ETH to become the new validators of the network, in doing so replacing PoW miners that had previously put in the work to process transactions, produce blocks and secure the network. In its simplest form, the Merge will make the Ethe...

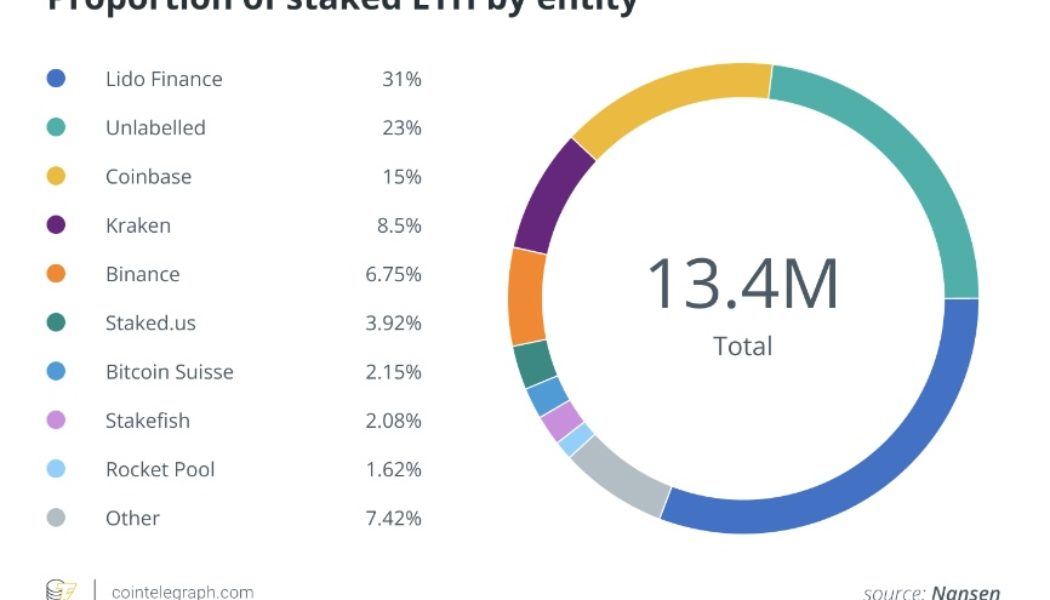

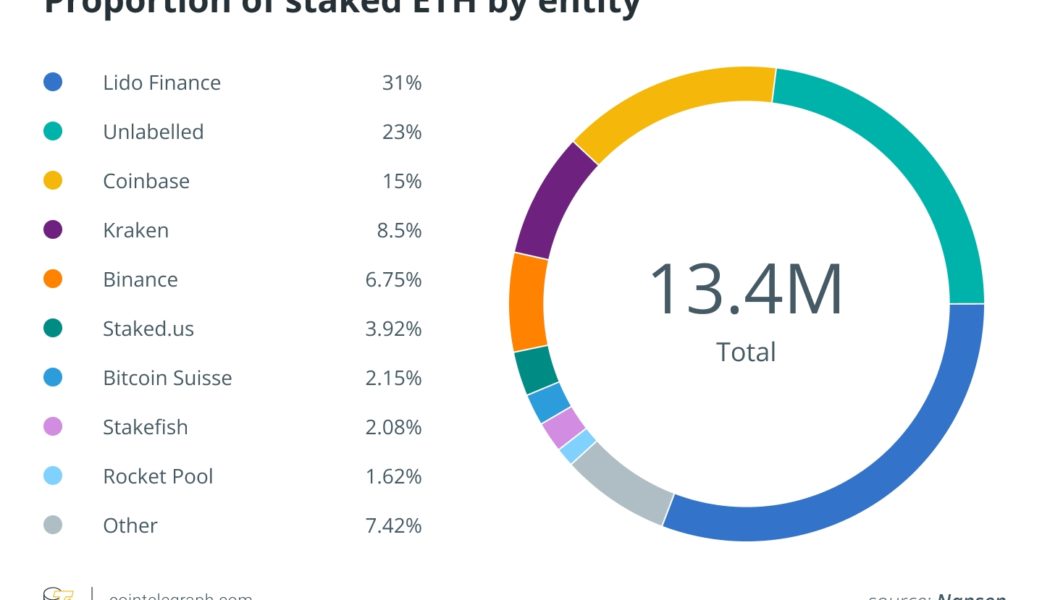

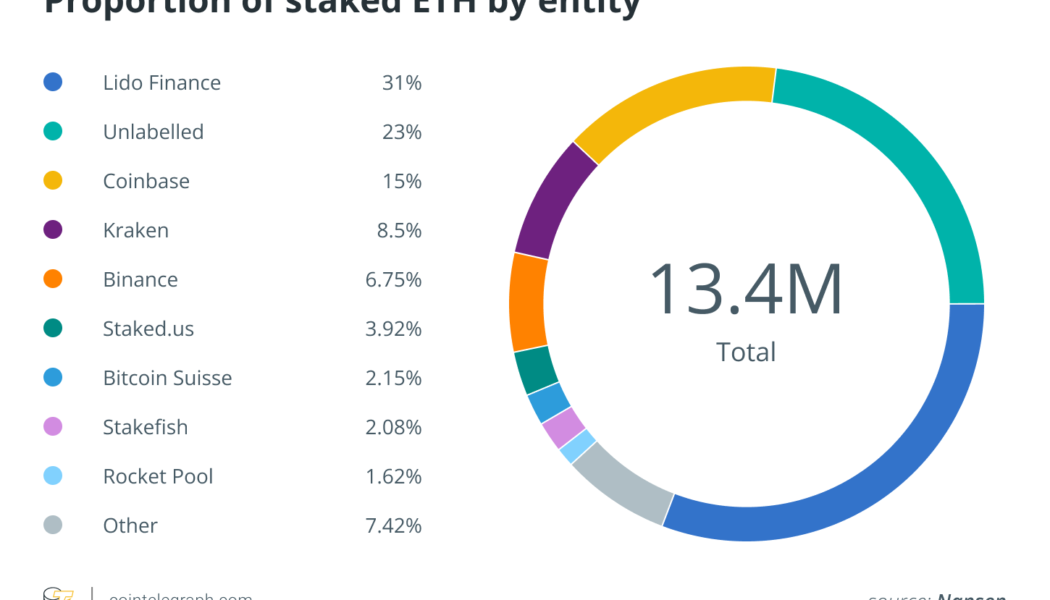

64% of staked ETH controlled by five entities — Nansen

A report from blockchain analytics platform Nansen highlights 5 entities that hold 64% of staked Ether (ETH) ahead of Ethereum’s highly anticipated Merge with the Beacon Chain. Ethereum’s shift from proof-of-work to proof-of-stake is set to take place in the coming days after final updates and shadow forks have bee completed in early September. The key component of The Merge sees miners no longer used as validators, replaced by stakers that commit ETH to maintain the network. Nansen’s report highlights that just over 11% of the total circulating ETH is staked, with 65% liquid and 35% illiquid. There are a total of 426,000 validators and some 80,000 depositors, while the report also highlights a small group of entities that command a significant portion of staked ETH. Three major crypt...

Ethereum’s potential fork ETHPOW has crashed 80% since debut — More pain ahead?

The listing of ETHPOW (ETHW) across multiple crypto exchanges has been followed by a huge drop in price despite some initial success. ETHPOW drops 80% On the daily chart, ETHW’s price dropped by more than 80% to $25 on Sept. 10, over a month after its market debut. ETHW/USD daily price chart. Source: TradingView For starters, ETHPOW only exists as a futures ticker, for now, conceived in anticipation that an upcoming network update on Ethereum could result in a chain split. Ethereum will undergo a major protocol change called the Merge by mid-September, switching its existing consensus mechanism from proof-of-work (PoW) to proof-of-stake (PoS). Therefore, Ethereum will obsolete its army of miners, replacing them with “validators,” which are nodes that woul...

Ethereum gone wrong? Here are 3 signs to keep an eye on during the Merge

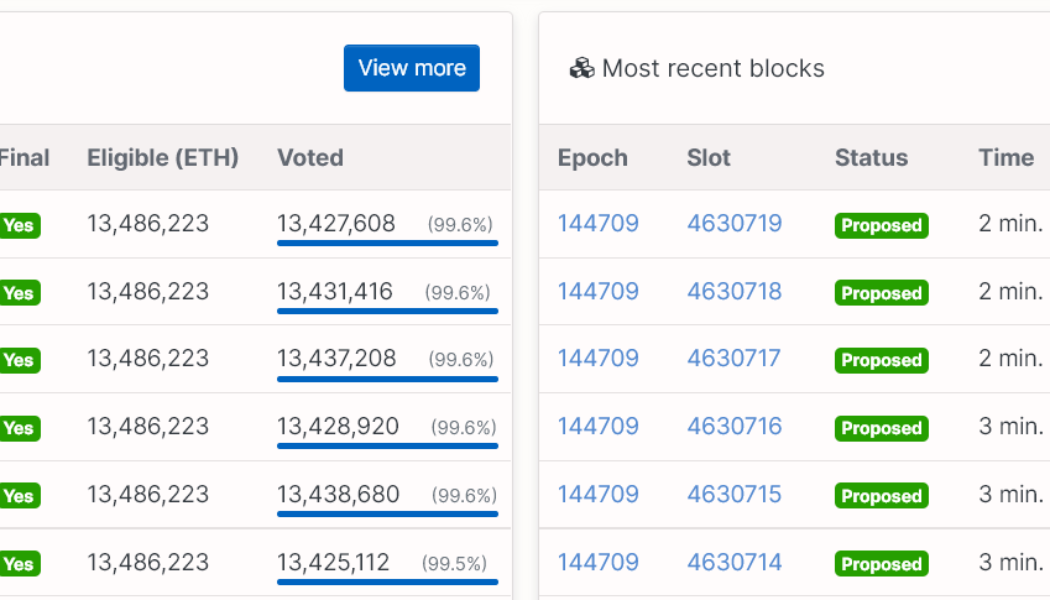

The assumption that Ethereum will just transition to a fully functional proof-of-stake (PoS) network after the Merge somewhat ignores the risk and effort necessary to move an asset that has a $193 billion market capitalization and 400 decentralized applications (DApps). That is precisely why monitoring vital network conditions is essential for anyone willing to trade the event which is scheduled for Sept. 14, according to ethernodes.org. More importantly, traders should be prepared to detect any alarming developments in case things go wrong. Apart from the $34.2 billion in total value locked in smart contracts, another $5.3 billion in Ether is staked on the Beacon Chain. The network is currently used by many tokens, oracle providers, stablecoins, layer-2 scalability solutions, synthetic as...