MasterCard

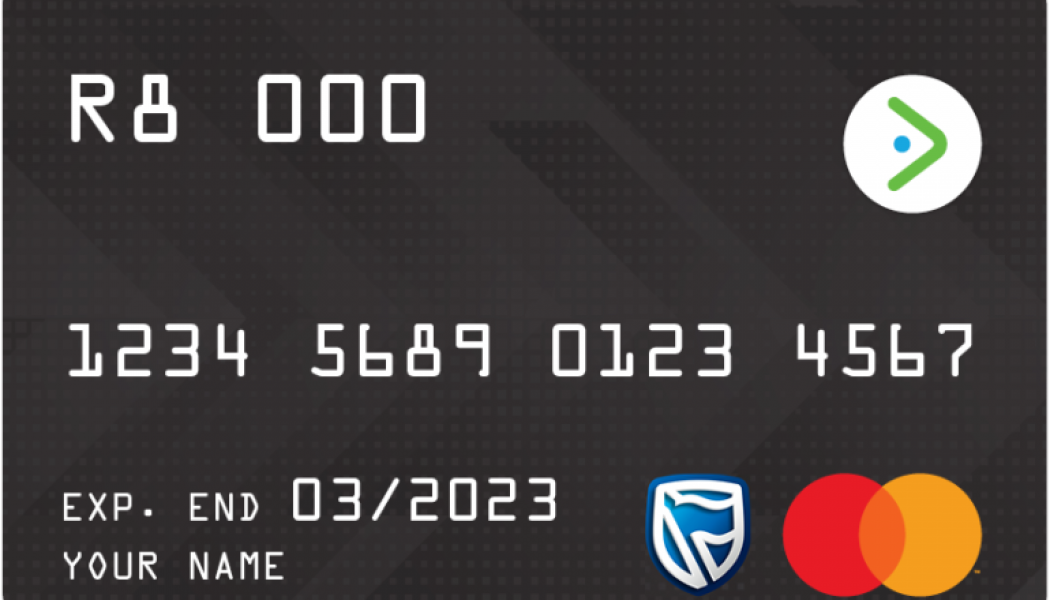

Mastercard Partners with Payment24 to Streamline Payment Solutions

Mastercard and Payment24 have partnered to offer a payment solution that will help fleet management companies streamline payments, create efficiencies and prevent fraud. Payment24’s platform will use Mastercard’s payment technology which is expected to enable drivers to quickly and seamlessly make fuel payments anywhere Mastercard is accepted, without requiring additional approvals at the pump. Commercial fleet management companies will have more control and visibility into driver’s spend, with the option to add purchasing controls to eliminate fraud. For instance, a company could opt to enable the driver to pay digitally for border post charges or for accommodation and meals, removing the need for costly and unsafe cash advances. The fuel solution is flexible and adaptable to customer nee...

Mastercard Launches AI-Powered Cyber Security Solution

Mastercard has officially launched Cyber Secure – an AI-powered range of tools that are expected to help banks prevent potential breaches. According to the financial services company, banks can use these capabilities to identify and prioritize threats and vulnerabilities throughout their cyber environment. Additionally, acquiring banks can help merchants understand their own cyber risk, preventing hundreds of millions of dollars in potential fraud. As the digital economy expands, both in size and complexity, so too do its points of vulnerability that may be subject to attack. One example of this is the rapidly advancing Internet of Things – 2.5 quintillion bytes of data are generated by people and their devices every day, with 90% of this generated in the last two years alone. It is estima...

Mastercard’s Girls4Tech Programme Reaches 1 Million Milestone

Mastercard has revealed that its science, technology, engineering and mathematics (STEM) programme, Girls4Tech, has reached its initial goal of educating one million girls. The programme has a new and inspiring ambition to reach five million girls by 2025. The programme, which launched in 2014, offers activities and curriculum built on global science and math standards. Starting as a hands-on, in-person session run by employee volunteers, the programme has expanded into new topics such as artificial intelligence and cybersecurity. “Our goal is to build foundational STEM knowledge and develop critical 21st-century skills girls need for their studies and career success. Our programme sparks their curiosity in STEM and teaches them real-world applications of those skills,” say...

Mastercard and Zimswitch Partner to Transform Payments Sector in Zimbabwe

Mastercard and Zimswitch have partnered in an attempt to modernise Zimbabwe’s payment infrastructure – something that the companies believe will support the country’s Reserve Bank’s vision of an interoperable payment system that supports inclusive economic growth and boosts the digital economy. “We see this partnership as a positive development that will help us achieve our long-standing vision and our strategic plan to modernise payments systems and infrastructure, and build an inclusive financial sector that supports the socio-economic development of the country,” says John Mangudya, Governor of the Reserve Bank of Zimbabwe. Utilising Mastercard’s global network, Zimswitch will launch a co-branded contactless card programme that features EMV technology to enable safer, smarter and more s...

Mastercard Improves Online eCommerce Security Capabilities

As digital commerce continues to accelerate owing to the COVID-19 pandemic, Mastercard has announced that it will offer new security services to merchants in South Africa. The company says that it hopes this will further protect consumers and increase convenience when storing Mastercard cards in merchant databases. Dubbed Mastercard Digital Enablement Service (MDES) for Merchants, the service uses a security measure known as tokenization to protect, speed up and simplify online and in-app Mastercard card purchases, as well as subscription-based and recurring payments like streaming music, video services, and utility bills. “Online shopping has gained significant traction in South Africa, and it is imperative for merchants of all sizes to ensure that they are offering a convenient, enjoyabl...

Ukheshe Joins Forces with Mastercard and Nedbank in South Africa

Mastercard, Nedbank, and Ukheshe have launched Third-Party Processing Services (TPP) in South Africa which will give everyday businesses access to prepaid and virtual cards. Clayton Hayward, CEO of Ukheshe, says that through Ukheshe’s innovative payment solutions, businesses in South Africa can now issue virtual prepaid cards to employees or customers. Providing recipients with improved financial freedom where they have the option to earn rewards, incentives, and have a secure card that can work anywhere in South Africa while building brand association. Ukheshe will leverage Mastercard Processing, which enables it to launch secure prepaid payments programs to its customers with greater speed, flexibility, and convenience. Through this new relationship, prepaid products will be processed th...