MasterCard

Visa Launches its First Card Payment Service in Somalia

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent. You Deserve to Make Money Even When you are looking for Dates Online. So we reimagined what a dating should be. It begins with giving you back power. Get to meet Beautiful people, chat and make money in the process. Earn rewards by chatting, sharing photos, blogging and help give users back their fair share of Internet revenue.

Hellopay to Roll Out Mastercard’s ‘Tap on Phone’ Tech in South Africa

Hellopay and Mastercard have partnered to roll out SoftPOS – a contactless acceptance solution that turns any NFC-enabled Android device into a physical point of sale. This move is expected to boost digital payment acceptance at small informal enterprises in South Africa, while supporting consumers’ preference for touch-free payments amidst social distancing. SoftPOS leverages Mastercard Tap on Phone technology developed for micro and small businesses like spaza shops, independent retailers, market stall traders, mobile servicemen and tradesmen who tend to operate in a cash economy due to the costs and complexity of obtaining traditional point of sale devices. “The SMME market represents 98% of businesses in South Africa and has been deeply impacted by the pandemic. We recognise the o...

Mastercard Partners with MTN to Enable MoMo Customers to Transact Globally

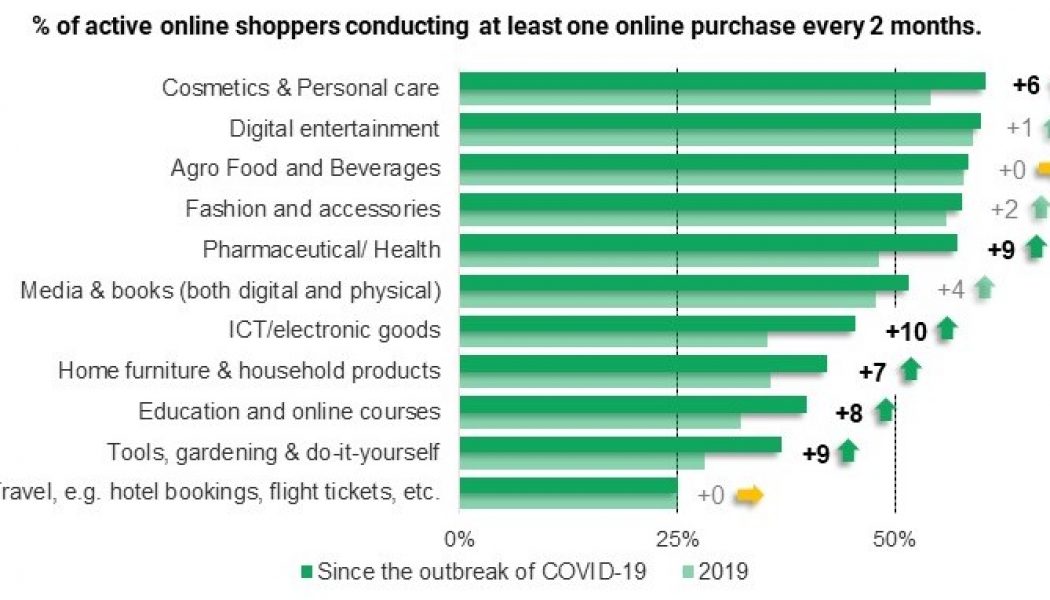

Mastercard has joined forces with MTN to enable millions of MTN MoMo customers in 16 African countries to shop and pay online with global merchants. Through a Mastercard virtual payment solution linked to MTN MoMo (Mobile Money) wallets, consumers can now unlock a host of opportunities and shop from their favourite international brands online while in their home countries or travelling abroad. The announcement comes at a time when eCommerce and online shopping are reaching record levels across Africa. According to the Economy 2021 outlook conducted by the Mastercard Economics Institute, 20-30% of the COVID-19-related surge in eCommerce will remain a permanent feature of overall retail spending. And shopping through mobile is largely how consumers access these opportunities. Across Sub-Saha...

PayCentral and Mastercard Partner to Launch DigiCentral

PayCentral has partnered with Mastercard to launch DigiCentral, a secure online platform that provides small business owners with a simple way of paying out incentives, rewards, gifting, corporate expenses and even salaries to their employees through a prepaid virtual card. The virtual card replaces a physical plastic card and can be used for eCommerce and in-store purchases. To complete a purchase online, DigiCentral virtual cardholders receive a 16-digit card number, security code and expiry date, which they would use much like a physical card. It can be linked to online retail apps like Uber, Uber Eats, Checkers 60 Sixty and others. For in-store purchases, the virtual card can be loaded to any Masterpass-enabled digital wallet. Once loaded, the cardholder can use their mobile phone to s...

South African’s are Shopping More Online Thanks to COVID-19, Research Says

South African’s are spending 68% more online now than they were prior to the pandemic, according to a study by Mastercard. Essential items have seen highest surge online with the majority (81%) of SA consumers saying they purchased data, and over half saying they bought clothing (56%) and groceries (54%) online since the pandemic started. According to the research, the times we are living in have also made consumers more generous with nearly a quarter (23%) saying they have donated more to charity than pre-lockdown. Consumers are supporting their favourite local small businesses, with 63% of respondents saying that they are making a conscious effort to shop online at these stores. With fewer opportunities to browse in the stores or on the high-street, social media has emerged as the main p...

Ukheshe to Acquire Digital Payments Platform, Oltio

Ukheshe has entered into an agreement to acquire Oltio, a digital payments platform that supports Masterpass – Mastercard’s QR payment service in South Africa with more than 300,000 merchants and billers. The use of QR codes in South Africa provides merchants of all sizes – from large retailers chains to individual shop owners and street vendors – a fast, secure and inexpensive way to accept payments. This deal is expected to strengthen Ukheshe’s partnership with Mastercard – combining its ability to solve local market pain points with Mastercard’s global scale, technology and payment expertise. Ukheshe will continue to provide the same support to the banks and other service providers that currently offer Masterpass, ensuring business continuity with no impact to consumer...