Mastercard South Africa

PayCentral and Mastercard Partner to Launch DigiCentral

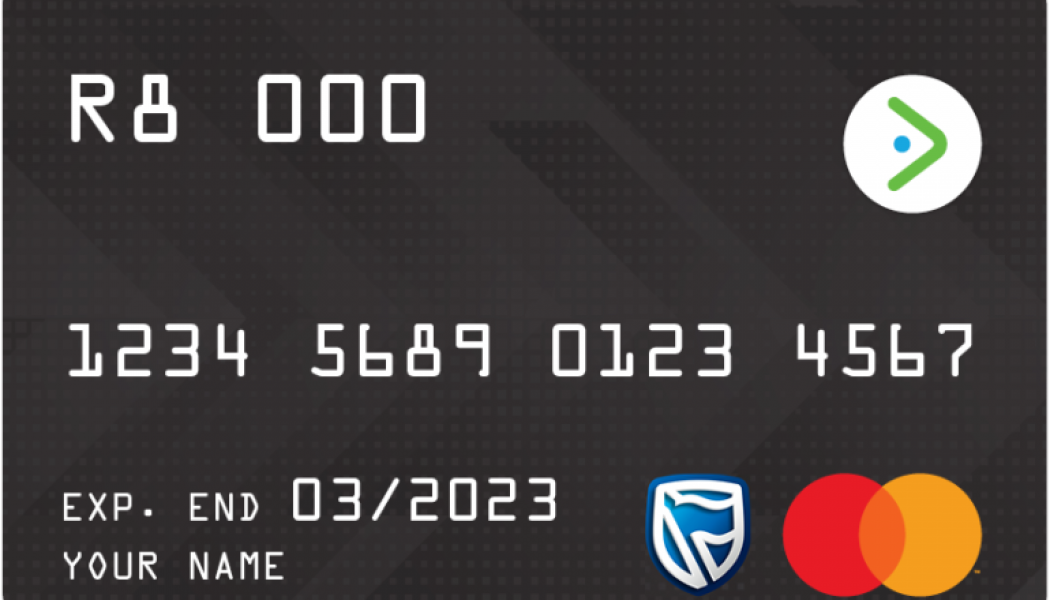

PayCentral has partnered with Mastercard to launch DigiCentral, a secure online platform that provides small business owners with a simple way of paying out incentives, rewards, gifting, corporate expenses and even salaries to their employees through a prepaid virtual card. The virtual card replaces a physical plastic card and can be used for eCommerce and in-store purchases. To complete a purchase online, DigiCentral virtual cardholders receive a 16-digit card number, security code and expiry date, which they would use much like a physical card. It can be linked to online retail apps like Uber, Uber Eats, Checkers 60 Sixty and others. For in-store purchases, the virtual card can be loaded to any Masterpass-enabled digital wallet. Once loaded, the cardholder can use their mobile phone to s...

Mastercard Partners with Payment24 to Streamline Payment Solutions

Mastercard and Payment24 have partnered to offer a payment solution that will help fleet management companies streamline payments, create efficiencies and prevent fraud. Payment24’s platform will use Mastercard’s payment technology which is expected to enable drivers to quickly and seamlessly make fuel payments anywhere Mastercard is accepted, without requiring additional approvals at the pump. Commercial fleet management companies will have more control and visibility into driver’s spend, with the option to add purchasing controls to eliminate fraud. For instance, a company could opt to enable the driver to pay digitally for border post charges or for accommodation and meals, removing the need for costly and unsafe cash advances. The fuel solution is flexible and adaptable to customer nee...

Mastercard Improves Online eCommerce Security Capabilities

As digital commerce continues to accelerate owing to the COVID-19 pandemic, Mastercard has announced that it will offer new security services to merchants in South Africa. The company says that it hopes this will further protect consumers and increase convenience when storing Mastercard cards in merchant databases. Dubbed Mastercard Digital Enablement Service (MDES) for Merchants, the service uses a security measure known as tokenization to protect, speed up and simplify online and in-app Mastercard card purchases, as well as subscription-based and recurring payments like streaming music, video services, and utility bills. “Online shopping has gained significant traction in South Africa, and it is imperative for merchants of all sizes to ensure that they are offering a convenient, enjoyabl...

Ukheshe Joins Forces with Mastercard and Nedbank in South Africa

Mastercard, Nedbank, and Ukheshe have launched Third-Party Processing Services (TPP) in South Africa which will give everyday businesses access to prepaid and virtual cards. Clayton Hayward, CEO of Ukheshe, says that through Ukheshe’s innovative payment solutions, businesses in South Africa can now issue virtual prepaid cards to employees or customers. Providing recipients with improved financial freedom where they have the option to earn rewards, incentives, and have a secure card that can work anywhere in South Africa while building brand association. Ukheshe will leverage Mastercard Processing, which enables it to launch secure prepaid payments programs to its customers with greater speed, flexibility, and convenience. Through this new relationship, prepaid products will be processed th...