Mastercard research

South African’s are Shopping More Online Thanks to COVID-19, Research Says

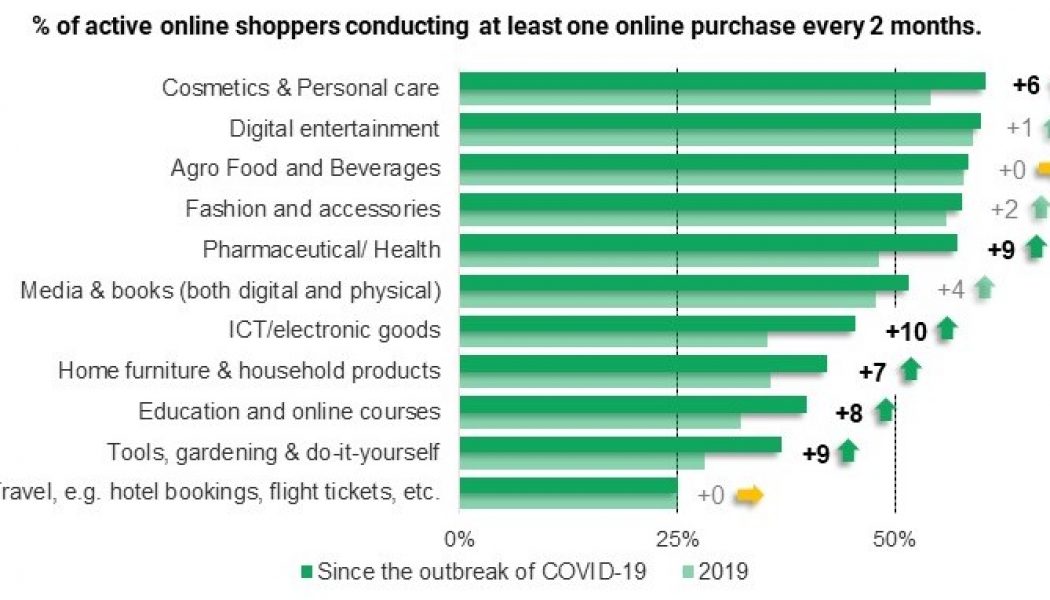

South African’s are spending 68% more online now than they were prior to the pandemic, according to a study by Mastercard. Essential items have seen highest surge online with the majority (81%) of SA consumers saying they purchased data, and over half saying they bought clothing (56%) and groceries (54%) online since the pandemic started. According to the research, the times we are living in have also made consumers more generous with nearly a quarter (23%) saying they have donated more to charity than pre-lockdown. Consumers are supporting their favourite local small businesses, with 63% of respondents saying that they are making a conscious effort to shop online at these stores. With fewer opportunities to browse in the stores or on the high-street, social media has emerged as the main p...