Markets

Price analysis 9/16: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT

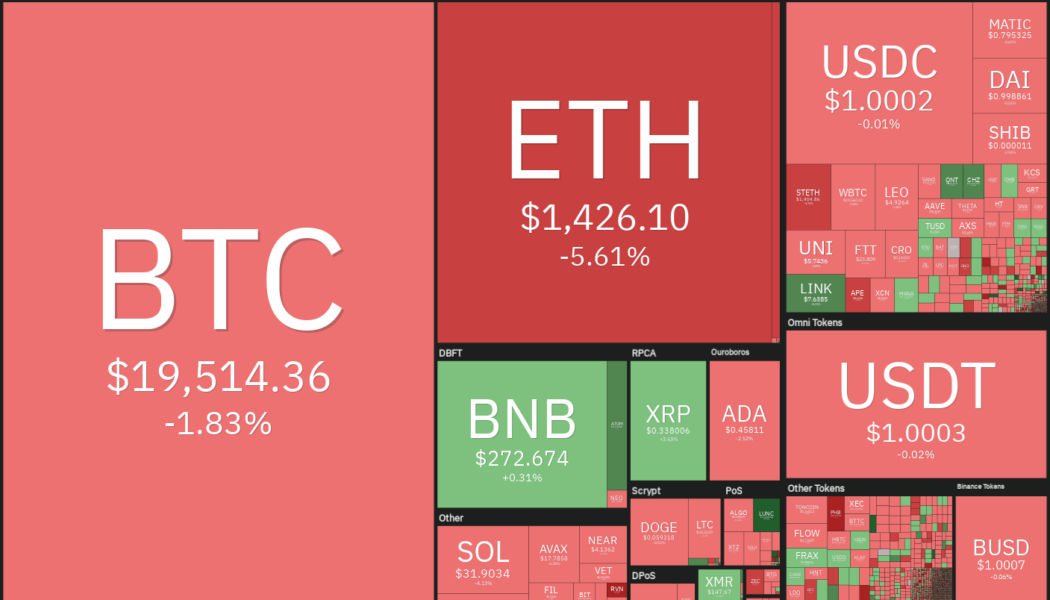

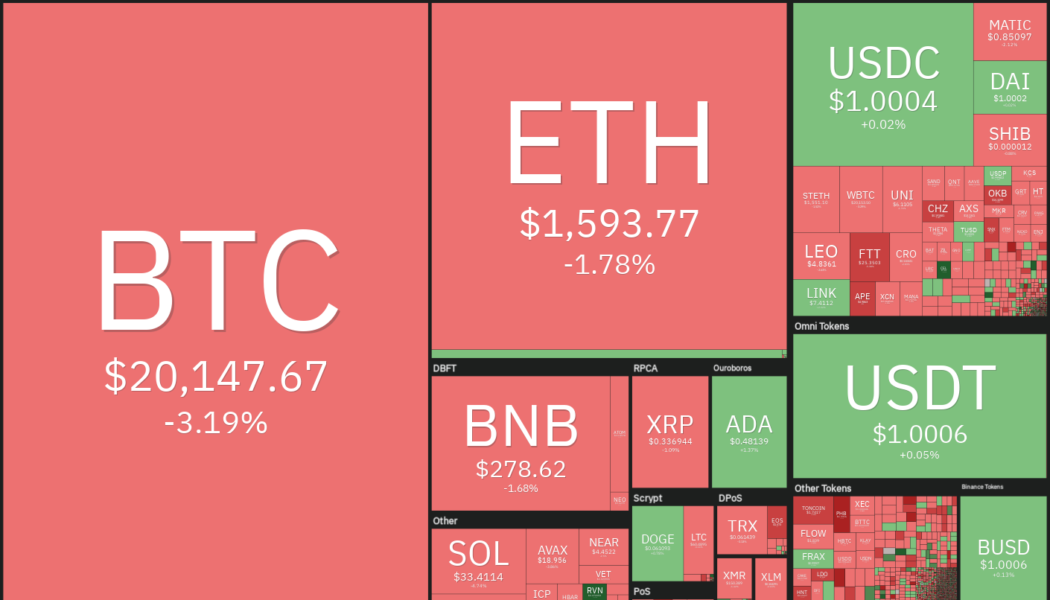

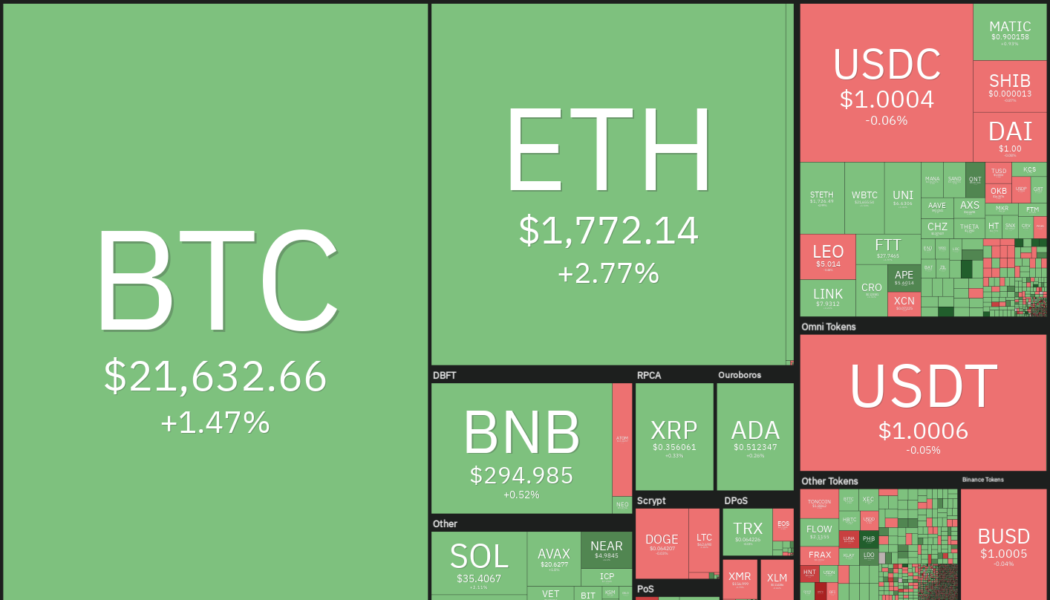

The World Bank has warned of a possible global recession in 2023. In a press release on Sept. 15, the bank said that the current pace of rate hikes and policy decisions is unlikely to be enough to bring inflation down to pre-pandemic levels. Ray Dalio, the billionaire founder of Bridgewater Associates said in a blog post on Sept. 13 that if rates were to rise to about 4.5% in the United States, it would “produce about a 20 percent negative impact on equity prices.” The negative outlook for the equity markets does not bode well for the cryptocurrency markets as both have been closely correlated in 2022. Daily cryptocurrency market performance. Source: Coin360 The macroeconomic developments seem to be worrying cryptocurrency investors who sent 236,000 Bitcoin (BTC) to major cryptocurren...

Tired of losing money? Here are 2 reasons why retail investors always lose

A quick flick through Twitter, any social media investing club, or investing-themed Reddit will quickly allow one to find handfuls of traders who have vastly excelled throughout a month, semester, or even a year. Believe it or not, most successful traders cherry-pick periods or use different accounts simultaneously to ensure there’s always a winning position to display. On the other hand, millions of traders blow up their portfolios and turn out empty-handed, especially when using leverage. Take, for example, the United Kingdom’s Financial Conduct Authority (FCA) which requires that brokers disclose the percentage of their accounts in the region that are unprofitably trading derivatives. According to the data, 69% to 84% of retail investors lose money. Similarly, a study by the U.S. ...

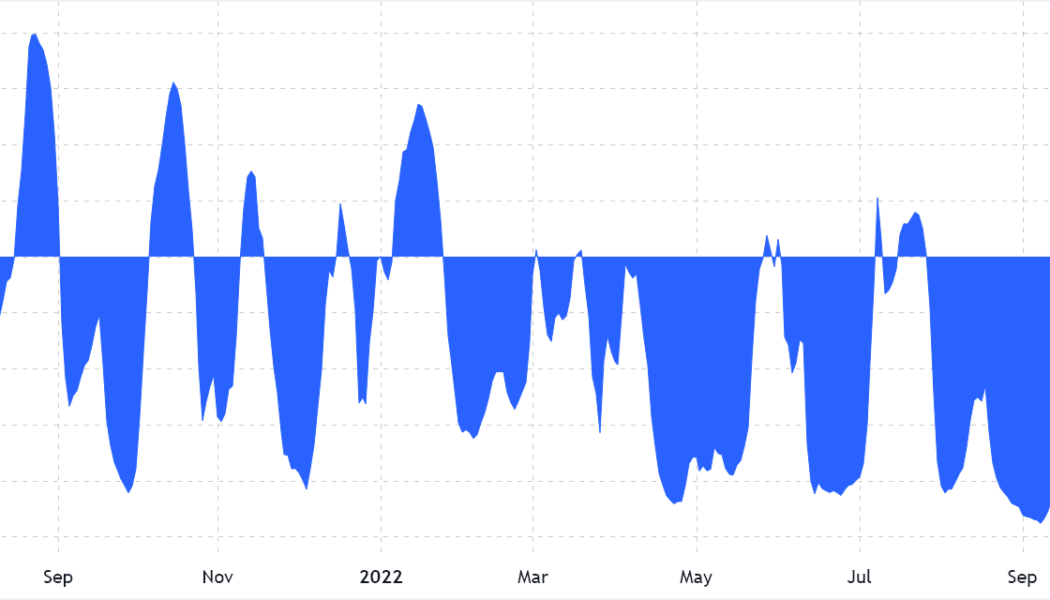

Data challenges the DXY correlation to Bitcoin rallies and corrections ‘thesis’

Presently, there seems to be a general assumption that when the U.S. dollar value increases against other global major currencies, as measured by the DXY index, the impact on Bitcoin (BTC) is negative. Traders and influencers have been issuing alerts about this inverse correlation, and how the eventual reversal of the movement would likely push Bitcoin price higher. Analyst @CryptoBullGems recently reviewed how the DXY index looks overbought after its relative strength index (RSI) passed 78 and could be the start of a retrace for the dollar index. This is literally the only thing you need to look at: The $DXY is crazy overbought right now and due a correction. $BTC is the most oversold it ever has been on the monthly timeframe. BITCOIN AND THE DOLLAR SHARE AN INVERSE CORRELATION. $BTC will...

Price analysis 9/14: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

The United States equities markets and the cryptocurrency markets had been rising leading up to the Sept. 13 release of the August consumer price index data, but the rally fell apart once the data showed inflation rising, rather than falling. The negative data dashed any hope of a Federal Reserve pivot in the near term and it triggered a sharp decline in risky assets. The market capitalization of U.S. stocks plunged by about $1.6 trillion on Sept. 13 and the market cap of the cryptocurrency markets slipped below $1 trillion. Daily cryptocurrency market performance. Source: Coin360 Statistician and independent market analyst Willy Woo, believes that Bitcoin (BTC) may have to fall further before it reaches the maximum pain experienced during previous bottoms. Woo expects Bitcoin price to dec...

Hot CPI report puts a dent in Bitcoin and Ethereum rally, stocks also lose ground

Crypto and stock markets are feeling the pain after the Sept. 13 inflation report printed an unexpectedly hot figure that showed headline inflation rising by 0.1% month-over-month. Even with gas prices falling to multi-month lows and a cooling housing market, core inflation saw a 0.6% month-over-month bump and year-to-year inflation sits at 8.3%. This chart from @TheTerminal shows why this #CPI number is so disappointing. The contribution of energy has declined, as expected; but services inflation is now rising sharply. Not what the #FOMC will have wanted to see. pic.twitter.com/BsfwFsuyD5 — John Authers (@johnauthers) September 13, 2022 While market participants and investors had estimated the next Federal Reserve interest hike to be a hefty 0.75 basis points, many also subscribed to a lo...

Bitcoin margin long-to-short ratio at Bitfinex reach the highest level ever

Sept. 12 will leave a mark that will probably stick for quite a while. Traders at Bitfinex exchange vastly reduced their leveraged bearish Bitcoin (BTC) bets and the absence of demand for shorts could have been caused by the expectation of cool inflation data. Bears may have lacked confidence, but August’s U.S. Consumer Price Index (CPI) came in higher than market expectations and they appear to be on the right side. The inflation index, which tracks a broad basket of goods and services, increased 8.3% over the previous year. More importantly, the energy prices component fell 5% in the same period but it was more than offset by increases in food and shelter costs. Soon after the worse-than-expected macroeconomic data was released, U.S. equity indices took a downturn, with the tech-he...

Time for a breakout? Bitcoin price pushes at key resistance near $23K

On Sept. 12, Bitcoin is doing Bitcoin things as usual. Since Sept. 9 the price has broken out nicely, booking a near 16% gain and rallying into the long-term descending trendline which appears to have resistance at $23,000. BTC/USDT 1-day chart. Source: TradingView Perhaps BTC and the wider market are turning bullish ahead of the Ethereum Merge which is scheduled for Sept. 14, or maybe the elusive bottom is finally in. Weekly chart data from TradingView shows that on June 27 and Aug. 15, Bitcoin’s relative strength index had dropped to lows not seen since 2019. BTC/USDT 1-day chart. Source: TradingView Currently, the metric has rebounded from a near oversold 31 to its current 38.5 reading. Some traders might also note a bullish divergence on the metric, where the RSI follows an ascen...

Crypto traders eye ATOM, APE, CHZ and QNT as Bitcoin flashes bottom signs

The United States equities markets rallied sharply last week, ending a three-week losing streak. The S&P 500 rose 3.65% last week while the Nasdaq Composite soared 4.14%. Continuing its close correlation with the U.S. equities markets, Bitcoin (BTC) also made a strong comeback and is trying to end the week with gains of more than 7%. The sharp rally in the stock markets and cryptocurrency markets are showing signs of a bottoming formation but it may be too early to predict the start of a new bull move. The equities markets may remain on the edge before the release of the U.S. inflation data on Sept. 13 and the Federal Reserve meeting on Sept. 20-21. Crypto market data daily view. Source: Coin360 Along with taking cues from the equities markets, the cryptocurrency space has its own impo...

3 major mistakes to avoid when trading cryptocurrency futures markets

Many traders frequently express some relatively large misconceptions about trading cryptocurrency futures, especially on derivatives exchanges outside the realm of traditional finance. The most common mistakes involve futures markets’ price decoupling, fees and the impact of liquidations on the derivatives instrument. Let’s explore three simple mistakes and misconceptions that traders should avoid when trading crypto futures. Derivatives contracts differ from spot trading in pricing and trading Currently, the aggregate futures open interest in the crypto market surpasses $25 billion and retail traders and experienced fund managers use these instruments to leverage their crypto positons. Futures contracts and other derivatives are often used to reduce risk or increase exposure and are not r...

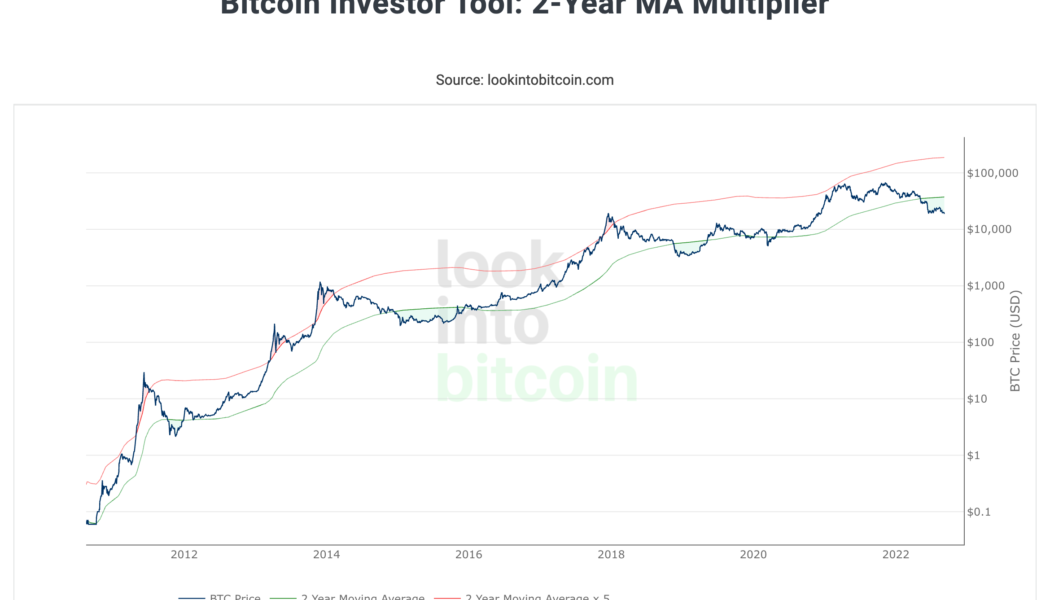

3 reasons why Bitcoin traders should be bullish on BTC

Bitcoin (BTC) has been in a rut, and BTC’s price is likely to stay in its current downtrend. But like I mentioned last week, when nobody is talking about Bitcoin, that’s usually the best time to be buying Bitcoin. In the last week, the price took another tumble, dropping below $19,000 on Sept. 6 and currently, BTC bulls are struggling to flip $19,000–$20,000 back to support. Just this week, Federal Reserve Chairman Jerome Powell reiterated the Fed’s dedication to doing literally whatever it takes to combat inflation “until the job is done,” and market analysts have increased their interest rate hike predictions from 0.50 basis points to 0.75. Basically, interest rate hikes and quantitative tightening are meant to crush consumer demand, which in turn, eventually leads to a decrease in...