Markets

Bitcoin profitability for long-term holders decline to 4-year low: Data

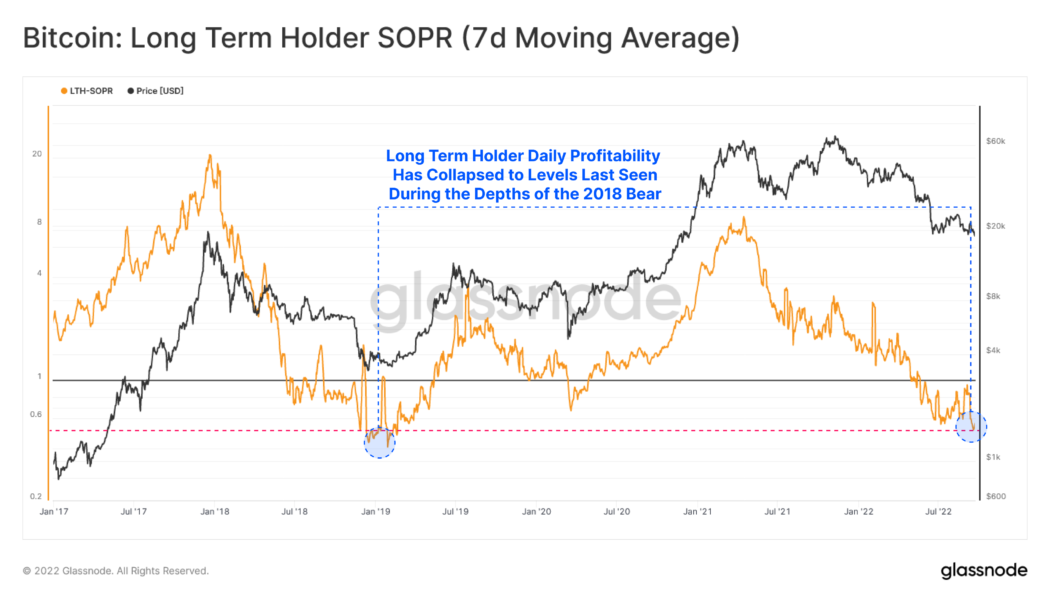

Bitcoin’s (BTC) long-term profitability has declined to levels last seen during the previous bear market in December 2018. According to data shared by crypto analytic firm Glassnode, BTC holders are selling their tokens at an average loss of 42%. Bitcoin long term holders. Source: Glassnode The Glassnode data indicate that long-term holders of the top cryptocurrency selling their tokens have a cost basis of $32,000, meaning the average buying price for these holders selling their stack is above $30,000. The current market downturn added to the declining profitability can be attributed to several macroeconomic factors. The BTC market still has a heavy correlation with the stock market, especially tech stocks, which are currently seeing an even bigger downtrend than crypto. The rising inflat...

Is it Bitcoin’s time to shine? British pound drops to all-time low against the dollar

On Sept. 26, the British pound hit a record low against the U.S. dollar following the announcement of tax cuts and further debt increases to curb the impact of a possible economic recession. The volatility simply reflects investors’ doubts about the government’s capacity to withstand the growing costs of living across the region. The U.S. dollar has been the clear winner as investors seek shelter in the largest global economy, but the British pound’s weakness could be a net positive for Bitcoin. The GBP, or British pound, is the world’s oldest currency still in use and it has been in continuous use since its inception. Fiat currencies are a 52-year old experiment The British pound, as we currently know, started its journey in 1971 after its convertibility with gold ...

Price Analysis 9/26: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

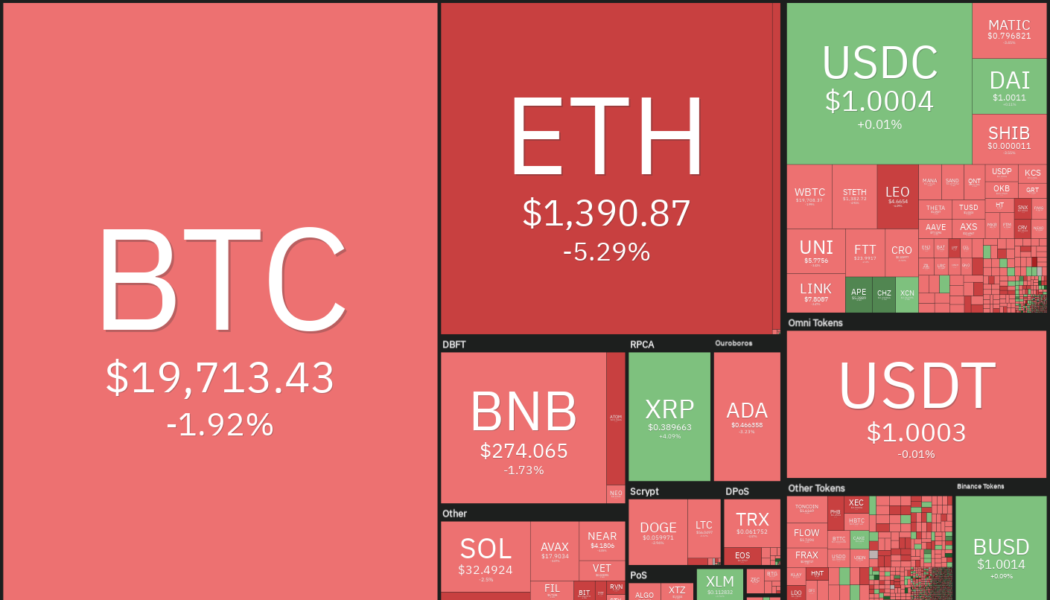

The United Kingdom is in focus following the British pound’s fall to a new all-time low against the United States dollar. The sell-off was triggered by the aggressive tax cuts announced by Prime Minister Liz Truss’s government. The 10-year gilt yields have soared by 131 basis points in September, on track for its biggest monthly increase since 1957, according to Reuters. The currency crisis and the soaring U.S dollar index (DXY) may not be good news for U.S. equities and the cryptocurrency markets. A ray of hope for Bitcoin (BTC) investors is that the pace of decline has slowed down in the past few days and the June low has not yet been re-tested. Daily cryptocurrency market performance. Source: Coin360 That could be because Bitcoin’s long-term investors do not seem to be panicking. Data f...

Price analysis 9/23: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT

The S&P 500 index has declined about 5% this week while the Nasdaq Composite is down more than 5.5%. Investors fear that the Federal Reserve’s aggressive rate hikes could cause an economic downturn. The yield curve between the two-year and 10-year Treasury notes, which is watched closely by analysts for predicting a recession, has inverted the most since the year 2000. Among all the mayhem, it is encouraging to see that Bitcoin (BTC) has outperformed both the major indexes and has fallen less than 4% in the week. Could this be a sign that Bitcoin’s bottom may be close by? Daily cryptocurrency market performance. Source: Coin360 On-chain data shows that the amount of Bitcoin supply held by long-term holders in losses reached about 30%, which is 2% to 5% below the level that coinci...

Bitcoin’s 60% year-to-date correction looks bad, but many stocks have dropped by even more

Bitcoin’s (BTC) and Ether’s (ETH) agonizing 60% and 66% respective drops in price are drawing a lot of criticism from crypto critics and perhaps this is deserved, but there are also plenty of stocks with similar, if not worse, performances. The sharp volatility witnessed in crypto prices is partially driven by major centralized yield and lending platforms becoming insolvent, Three Arrows Capital’s bankruptcy and a handful of exchanges and mining pools facing liquidity issues. For cryptocurrencies, 2022 has definitely not been a good year, and even Tesla sold 75% of its Bitcoin holdings in Q2 at a loss. The quasi-trillion dollar company still holds a $218 million position, but the news certainly did not help investors’ perception of Bitcoin’s corporate adoption. Cryptocurrencies are n...

Price analysis 9/21: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

The Federal Reserve hiked rates by 75 basis points on Sept. 21 and Fed Chair Jerome Powell projected another 125 basis points increase before the end of the year. If that happens, it will take the benchmark rate to 4.4% by the end of the year, which is sharply higher than the June estimates of 3.8%. The Fed also intimated that it only expects rate cuts to be considered in 2024. The expectation of higher rates pushed the 2-year Treasury to 4.1%, its highest level since 2007. This could attract several investors who are looking for safety in this uncertain macro environment. Higher rates are also likely to reduce the appeal of risky assets such as stocks and cryptocurrencies and may delay the start of a new uptrend. Daily cryptocurrency market performance. Source: Coin360 Even though Bitcoin...

Blurring the line between crypto and TradFi could redefine global finance

Despite the current struggle in the global economy, the gap between traditional finance (TradFi) and crypto seems to be closing with each passing day. For example, earlier this month, Vienna-based fintech unicorn Bitpanda announced that it was adding commodities to its list of investment options, thus allowing investors to rake in profits from short-term price fluctuations related to traditional instruments such as oil, natural gas and wheat. In a recent interview with Cointelegraph, the company’s CEO, Eric Demuth, noted that the bear market had had no major impact on investor demand. He claims that more people are now looking for solutions that can bring the world of TradFi and decentralized finance (DeFi) together. Not only that, there are lessons to be learned about what works out...

Crypto and stocks soften ahead of Fed rate hike, but XRP, ALGO and LDO look ‘interesting’

Prices remain soft across the market as traders await Federal Reserve Chair Jerome Powell’s statement on the size of the next interest rate hike. At the moment, the market consensus is a 0.75 bps rate hike and a sliver of analysts are banking on 1%. Stocks also appear en-route to close the day in the red, with the Dow down 0.75%, and the S&P 500 and Nasdaq registering a 0.79% and 0.64% loss. Bitcoin continues to fight what appears to be a losing battle at the $19,000 mark, while Ether (ETH) dug a little deeper into its post-Merge dip by making an intra-day low at $1,329. While BTC, Ether and altcoins aren’t making any notable moves that defy the current downtrend, from the perspective of market structure and technical analysis, there are a few interesting developments occurr...

The market isn’t surging anytime soon — so get used to dark times

Global markets are going through a tough period — including the cryptocurrency market. But judging by talk from the peanut gallery, it seems like some observers haven’t received the memo. “Feel like we’re relatively safe through mid-terms,” Twitter’s “CryptoKaleo” — also known simply as “Kaleo” — wrote in a Sept. 12 tweet to his 535,000 followers, referring to the United State’s November mid-term elections. The prediction was accompanied by a chart indicating his belief that Bitcoin’s (BTC) price would surge to $34,000 — a 50% gain from its roughly $20,000 level as of last week — before the end of the year. “Of course we can bleed lower,” fellow pseudonymous Twitter mega-influencer Pentoshi wrote in a Sept. 9 missive to his 611,000 followers. “But the market at this value...

Crypto market bloodbath leads to $432M in liquidation

The crypto market turmoil entered the third week of September as most of the cryptocurrencies started the week on a bearish note. The total crypto market cap dipped below $1 trillion again, with several cryptocurrencies recording a double-digit downfall over the past 24 hours. The ongoing bearish turmoil has led to nearly half a billion in liquidations for the leverage crypto traders over the past 24 hours. Data from Coinglass highlight that 130,087 traders were liquidated with a total liquidations value of $431.51 million. Bitcoin (BTC) leverage traders lost $44.5 million, followed by Ether (ETH) traders with a total liquidation of $8.39 million. Long traders made a significant chunk of losses on majority of the exchanges with the average difference between the amount of long and short li...

Here is why a 0.75% Fed rate hike could be bullish for Bitcoin and altcoins

The S&P 500 and the Nasdaq Composite index suffered their worst weekly performance since June as investors remain concerned that the Federal Reserve will have to continue with its aggressive monetary policy to curb inflation and that could lead to a recession in the United States. Bitcoin (BTC) remains closely correlated to the S&P 500 and is on track to fall more than 9% this week. If this correlation continues, it could bring more pain to the cryptocurrency markets because Goldman Sachs strategist Sharon Bell cautioned that aggressive rate hikes could trigger a 26% fall in the S&P 500. Crypto market data daily view. Source: Coin360 The majority expect the Fed to hike rates by 75 basis points in the next meeting on Sept. 20 to Sept. 21 but the FedWatch Tool shows an 18% probab...