Markets

Here’s why Bitcoin traders expect choppy markets for the remainder of 2021

Inflation concerns and a general sense of trepidation about the future of the global economy continue to put a damper on Bitcoin and altcoin prices and currently the Crypto Fear and Greed index is solidly in the ‘fear’ zone where it has been parked since the beginning of December. Crypto Fear & Greed Index. Source: Alternative Despite the brief bump in prices seen across the markets following the recent Federal Open Market Committee (FOMC) meeting where Fed Chair Jerome Powell indicated that interest rates would remain low for the time being, the overall sentiment in the crypto market continues to wane, signaling that 2021 could end on a bearish note. BTC price could dampen due to macro concerns In a recent report from Delphi Digital, analysts noted that the price of Bitcoin (BTC...

ECOMI, Aragon and Ramp breakout after Bitcoin price pushes above $49K

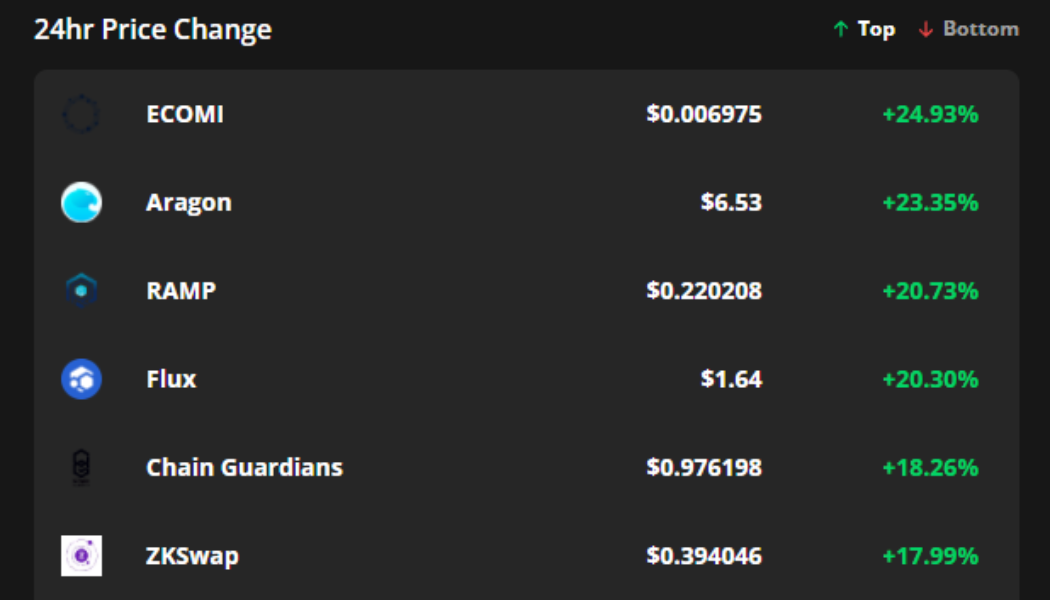

Cryptocurrency prices and investor sentiment reversed course on Dec. 15 after Federal Reserve chairman Jerome Powell confirmed the bank’s plan to hike interest rates in 2022 and slow down the bond purchasing program that had been in play since the emergence of the coronavirus in March 2020. Following the announcement, Bitcoin (BTC) price tacked on a 1.65% gain, bringing the price above $49,000 and Ether trekked back above the $4,000 mark. Altcoins followed suit with their usual double-digit gains and for the moment, it appears as if bulls have taken back control of the market. Top 7 coins with the highest 24-hour price change. Source: Cointelegraph Markets Pro Data from Cointelegraph Markets Pro and TradingView shows that the biggest gainers over the past 24-hours were ECOMI (OM...

Host of popular cryptocurrency trading YouTube series “Coin Bureau” says Polygon (MATIC) could triple in this cycle

Polygon (MATIC) has seen large swings in 2021. It started the year on a monster bull run that took it to $2.4544 in March. It then nose-dived to $0.6901 in July and then started another that it has maintained to date amid several small pullbacks. During the same period, Polygon has also made several milestones including the recent acquisition of the zero-knowledge (ZK) protocol developer, Mir, for $400 million. The acquisition is expected to add to Polygon’s strengths as it seeks to aggregate various Ethereum-based blockchains and allow them to communicate with one other. To that end, Guy, the host of the highly popular cryptocurrency trading YouTube series “Coin Bureau,” said that the price of Polygon (MATIC) could double or triple in the course of the current cycle depending on how well ...

Data suggests traders view $46,000 as Bitcoin’s final line in the sand

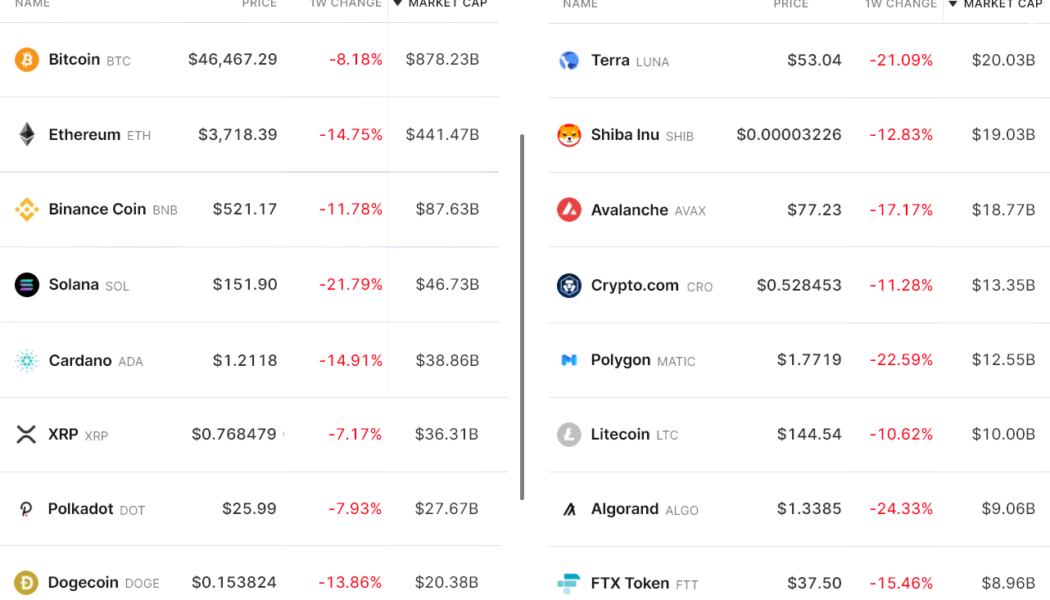

Dec. 13 will likely be remembered as a “bloody Monday” after Bitcoin (BTC) price lost the $47,000 support, and altcoin prices dropped by as much as 25% within a matter of moments. When the move occurred, analysts quickly reasoned that Bitcoin’s 8.5% correction was directly connected to the Federal Open Market Committee (FOMC) meeting, which starts on Dec. 15. Investors are afraid that the Federal Reserve will eventually start tapering, which simply put, is a reduction of the Federal Reserve’s bond repurchasing program. The logic is that a revision of the current monetary policy would negatively impact riskier assets. While there’s no way to ascertain such a hypothesis, Bitcoin had a 67% year-to-date gain until Dec. 12. Therefore, it makes sense for investors to pocket those profits a...

Look out below! Analysts eye $40K Bitcoin price after today’s dip to $45.7K

On Monday, Bitcoin’s short-term outlook worsened after the price fell to an intra-day low at $45,672, a far cry from the weekend’s promising rally above the $50,000 level. With the year nearly complete, and all-time highs nearly 33% away, traders are most likely readjusting their expectations and pushing the $100,000 BTC target a bit further into 2022. Daily cryptocurrency market performance. Source: Coin360 Day traders, 4-hour chart watchers and over-leveraged longs are likely freaking out (unless they went short from $50,000 over the weekend or at this morning’s weakness), but let’s zoom out a little bit to see where Bitcoin price stands. BTC/USDT daily chart. Source: TradingView On the daily timeframe, we can see the price struggling to breakout away from the trend of daily lower ...

Bitcoin price slips below $47K as stocks, crypto prepare for this week’s FOMC meeting

Bitcoin (BTC) bulls are once again on the defensive foot after the breakout momentum that put the price above $50,000 on the weekend evaporated and pulled the price under $47,000. Analysts say the slight pullback in equities markets and the upcoming Federal Open Market Committee (FOMC) meeting are the primary reasons for Dec. 13’s pullback and a few suggest that a revisit to the swing low at $42,000 could be on the cards. BTC/USDT 4-hour chart. Source: TradingView Here’s a look at what analysts are saying about the current Bitcoin price action and what they expect in the short term. Fed tapering talks put pressure on the market The current headwinds facing BTC are in large part being influenced by regulatory matters in the United States, as highlighted in a recent report from D...

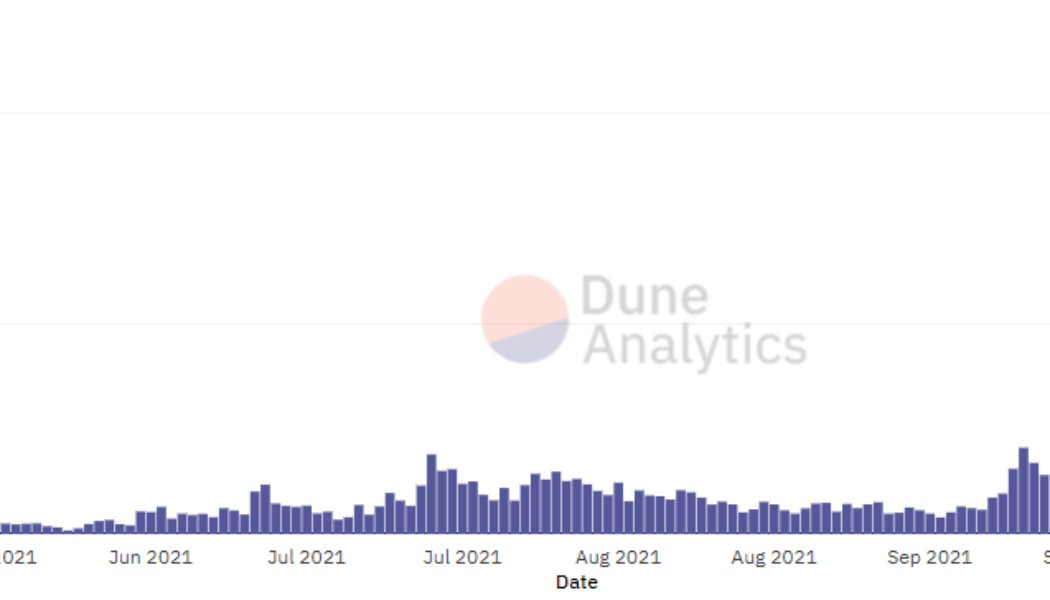

ZK-rollups step into the limelight after the quest to scale Ethereum evolves

Scalability on the Ethereum (ETH) network has been a point of contention within the cryptocurrency ecosystem for years, primarily due to high fees and network congestion during periods of peak demand. The latest solution to emerge as the final fix to Ethereum’s scalability woes are Zero-knowledge rollups (ZK rollups), a form of scaling that runs computations off-chain and submits them on-chain via a validity proof. Zk rollup season — cryptowarlord.eth ( ͡° ͜ʖ ͡°) (@CryptoWarlordd) December 7, 2021 Earlier in the year, protocols that opted to use optimistic rollups such as Optimism and Arbitrum dominated the headlines and were touted as the best solution to scaling on Ethereum, but aside from Arbitrum, the hype for those protocols has quieted down and traders have pointed out that even opti...

Altcoin Roundup: 3 metrics that traders can use to effectively analyze DeFi tokens

Much to the chagrin of cryptocurrency proponents who call for the immediate mass adoption of blockchain technology, there are many “digital landmines” that exist in the crypto ecosystem such as rug pulls and protocol hacks that can give new users the experience of being lost at sea. There’s more to investing than just technical analysis and gut feelings. Over the past year, a handful of blockchain analysis platforms launched dashboards with metrics that help provide greater insight into the fundamentals supporting — or the lack thereof — a cryptocurrency project. Here are three key factors to take into consideration when evaluating whether an altcoin or decentralized finance (DeFi) project is a sound investment. Check the project’s community and developer activity One of the basic wa...

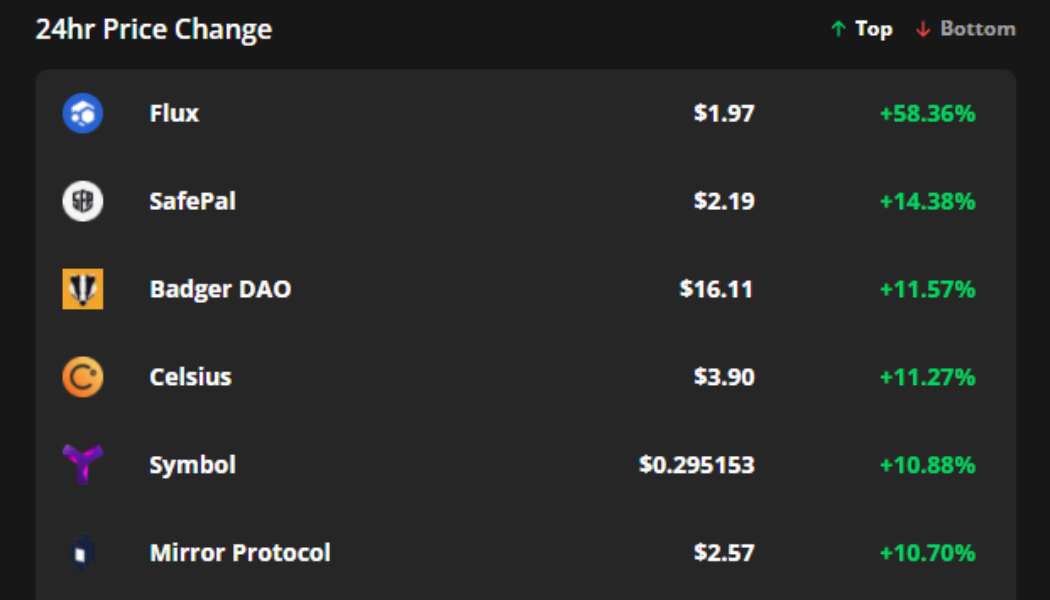

FLUX, SFP and Badger DAO surge even as Bitcoin price falls to $47K

The year-long mantra that the crypto market would see a blow-off top in December has proven to be a dud thus far and for the last week, most cryptocurrencies have been under sell pressure and Bitcoin (BTC) is encountering difficulty in trading above $47,000. That said, it’s not all bad news for cryptocurrency holders on Dec. 10 because several altcoins have managed to post double-digit gains due to new exchange listings and protocol upgrades. Top 7 coins with the highest 24-hour price change. Source: Cointelegraph Markets Pro Data from Cointelegraph Markets Pro and TradingView shows that the biggest gainers over the past 24-hours were Flux (FLUX), SafePal (SFP) and Badger DAO (BADGER). FLUX benefits from the “Binance bump” Flux is a GPU mineable proof-of-work p...