Markets

Ether drops below $3,800, but traders are unwilling to short at current levels

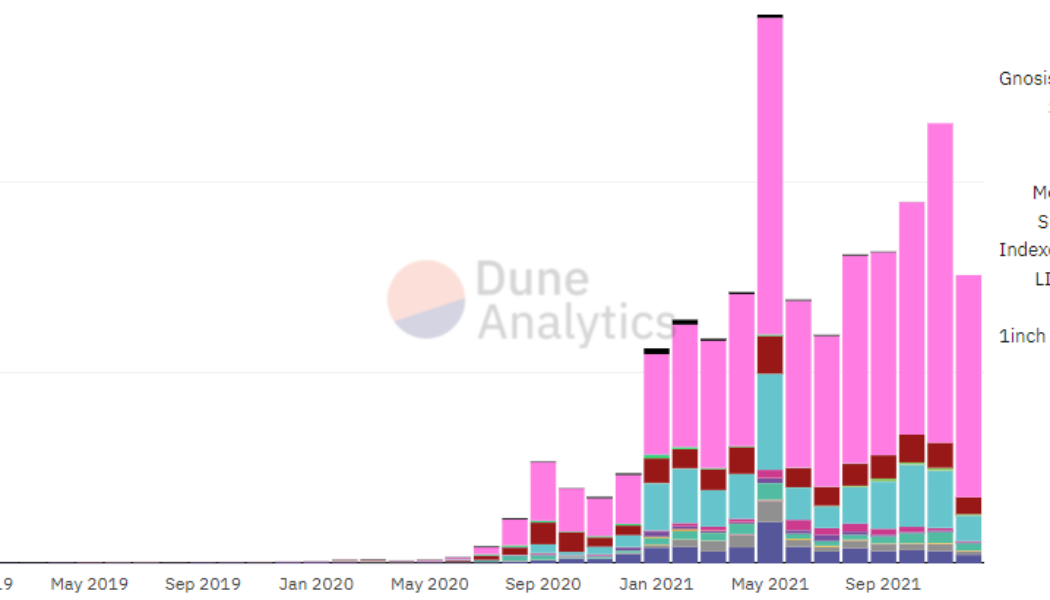

Even though Ether (ETH) reached a $4,870 all-time high on Nov. 10, bulls have little reason to celebrate. The 290% gains year-to-date have been overshadowed by Dec.’s 18% price drop. Still, Ethereum’s network value locked in smart contracts (TVL) increased nine-fold to $155 billion. Looking at the past couple of months’ price performance chart doesn’t really tell the whole story, and Ether’s current $450 billion market capitalization makes it one of the world’s top 20 tradable assets, right behind the two-century-old Johnson & Johnson conglomerate. Ether/USD price at FTX. Source: TradingView 2021 should be remembered by the decentralized exchanges’ sheer growth, whose daily volume reached $3 billion, a 340% growth versus the last quarter of 202...

Price analysis 12/31: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

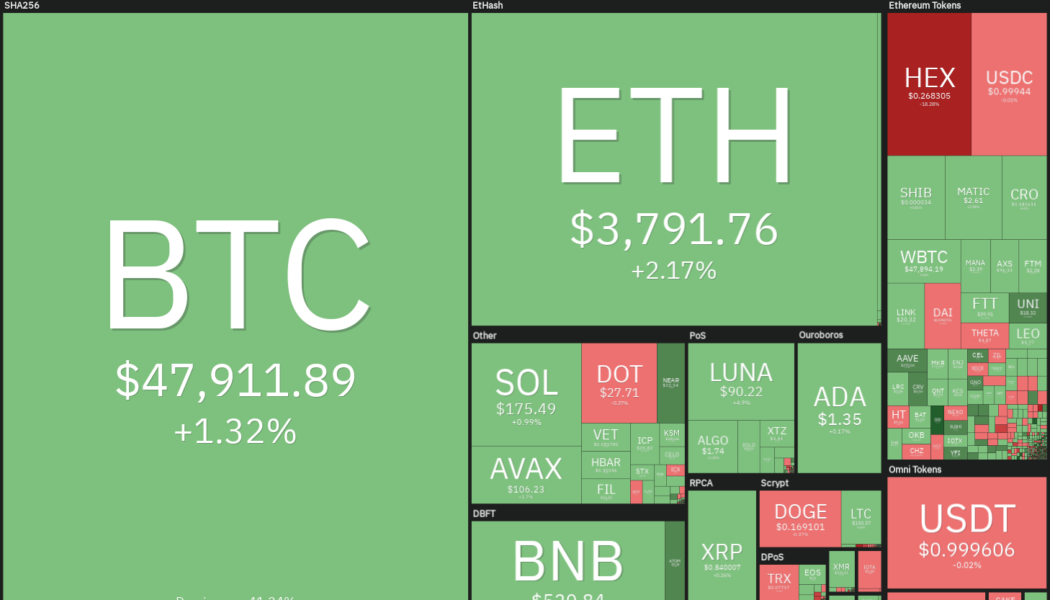

Bitcoin (BTC) and most major altcoins are attempting a rebound off their respective support levels, indicating that buyers continue to accumulate on dips. Data from Coinglass shows that 9,925 Bitcoin left Coinbase Pro, the professional trading arm of Coinbase, on Dec. 30, a possible sign of institutional buying. This is in sharp contrast to the strong inflows seen in Binance and OKEx. Several analysts believe that institutional buying could pick up in January. Economist and trader Alex Krüger expects a Bitcoin rally in early January based on fund flows. He also highlighted that January has produced positive results for Bitcoin between 2018 and 2021, with gains ranging from 7% to 36%. Daily cryptocurrency market performance. Source: Coin360 While investors debate about the next possible dir...

Bitcoin price fell short of analysts’ $100K target, but what about 2022?

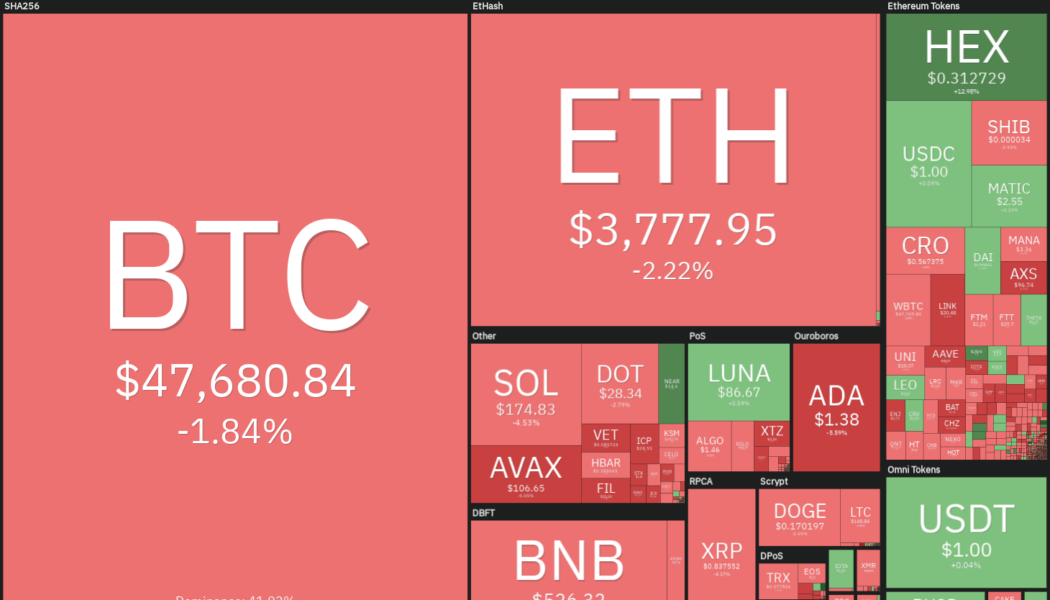

Bitcoin (BTC) is likely to end 2021 well below analysts’ target projections of $100,000. Kraken CEO Jesse Powell, who had also projected a $100,000 price target for Bitcoin, still remains bullish in the long term, but he does not rule out a sharp drop in the short term. One of the negatives that may add pressure to Bitcoin in the short term is the shift in the United States Federal Reserve’s monetary policy. On Dec. 15, the Fed announced that it would wind down its bond-buying program at a faster pace, and it also projected three interest rate hikes in 2022. Crypto market data daily view. Source: Coin360 Sam Stovall, chief investment strategist of CFRA Research, told CNBC that historically, the S&P 500 tends to post negative returns in the 12-month period when the Fed undert...

Institutional tax-loss harvesting weighs on the Bitcoin price as 2021 comes to a close

2021 has been a breakout year for the cryptocurrency market as a whole despite the year-end struggles that have kept the price of Bitcoin (BTC) pinned below $48,000, much to the chagrin of the cadre of folks who had been calling for a $100,000 BTC moonshot. Data from Cointelegraph Markets Pro and TradingView shows that the past 24 hours have been a rollercoaster ride for the top cryptocurrency after a brief dip below $46,000 in the early trading hours on Dec. 30 was quickly bought up to push the BTC price back above $47,500 by midday. BTC/USDT 4-hour chart. Source: TradingView Here’s a look at what several analysts in the market are saying about the year-end price action for Bitcoin and what to expect in 2022 as the mass adoption of blockchain technology and cryptocurrencies continue...

Price analysis 12/29: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

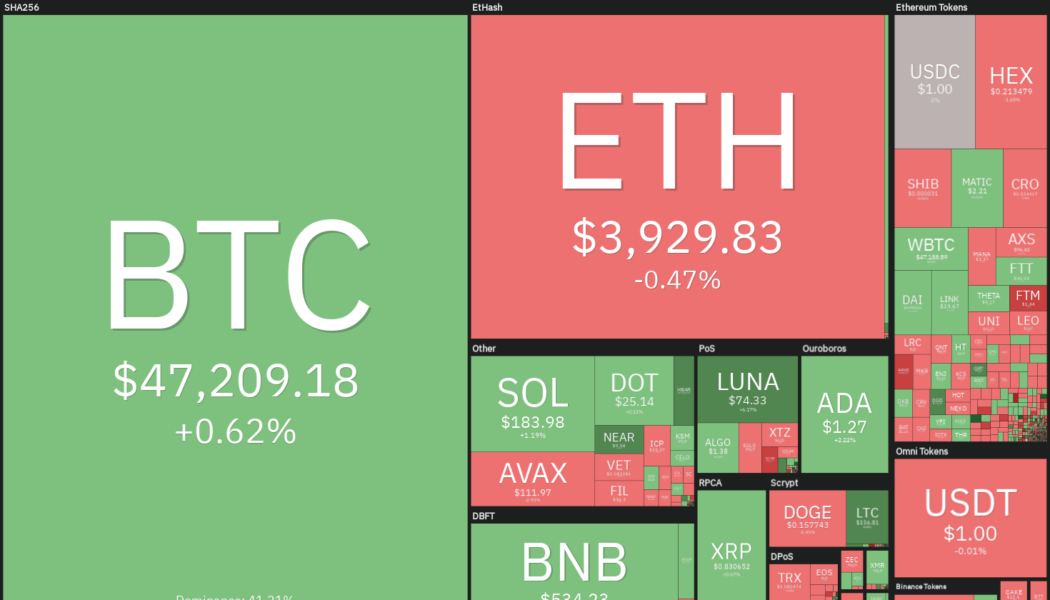

The S&P 500 is trading near its all-time high but Bitcoin (BTC) has plunged about 30% from its all-time high at $69,000. Even after the sharp drop, Bitcoin is up 63%, year-to-date, outperforming the S&P 500, which is up about 30% in 2021. Gold, which is popular as a hedge against inflation, is down roughly 7% this year. Arcane research said in its report that Bitcoin’s outperformance in the high inflationary environment shows that “Bitcoin has proven itself to be an excellent inflation hedge.” Daily cryptocurrency market performance. Source: Coin360 Real Vision CEO Raoul Pal said in an interview with Vlad from The Stakeborg Talks that the recent selling in Bitcoin may have been due to institutional investors booking profits but he believes the selling may be coming to an end. Howev...

Here’s why Cardano founder believes a DeFi extinction wave is on the way

The software developer and entrepreneur forecasted that many projects in the DeFi sector wouldn’t last the next five to ten years In a recent YouTube session, Cardano founder Charles Hoskinson shared his outlook on the future of decentralised finance. Hoskinson, who has seemingly vowed to redefine the sector, predicted that many active DeFi projects would fall off the grid within the next five to ten years. He cited the lack of long-term vision and rigorous engineering as the factor that will drive the majority of these projects to the ground. Hoskinson averred that the industry is flooded with many projects run by the ‘hope and prayer’ mindset, which he emphasised isn’t enough to keep them afloat. ‘ “It’s very hard to do this kind of engineering and to ...

Analysts warn that possible downside wick could push BTC price as low as $44K

It looks as though the year-end rally that many crypto traders had hoped for will have to wait until 2022, as Bitcoin (BTC) bears gained the upper hand on Dec. 28 and hammered the price of BTC below support at $48,000. Data from Cointelegraph Markets Pro and TradingView shows that an early morning wave of selling broke through BTC support at $50,000 and was followed by a second wave in the early afternoon that dropped the top cryptocurrency to a daily low of $47,318 before bulls managed to stem the outflow. BTC/USDT 4-hour chart. Source: TradingView Here’s a look at what several market analysts are saying about the reasons behind this latest correction and what to look out for as 2021 comes to a close. A bearish RSI divergence prior to the reversal Insight into the technical reasons ...

New to crypto trading? Here are 5 tips on how to start 2022 on the right foot

It doesn’t matter how experienced you are at trading because nothing can be done to protect a person against the might of cryptocurrencies’ price swings. Currently, Bitcoin’s (BTC) volatility, the standard measure for daily fluctuations, stands at 64% annualized. As a comparison, the same metric for the S&P 500 stands at 17%, while the volatility spec for WTI crude oil is at 54%. However, it is possible to avoid the psychological impact of an unexpected 25% intraday price swing by following five basic rules. Fortunately, these tactics do not require advanced tools or large sums of money to hold through periods of high volatility. Plan to refrain from withdrawing money in less than 2 years Let’s assume that you’ve got $5,000 to invest, but there’s a good possibility that you might need ...

Price analysis 12/27: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

Bitcoin (BTC) and most major altcoins have bounced off their immediate support levels, indicating that the sentiment is improving and traders are buying on minor dips. Billionaire and Mexico’s third-richest person Ricardo Salinas Pliego said in his Christmas and New Year message to stay away from fiat money, terming it as “fake money made of paper lies.” Instead, he advised people to “invest in Bitcoin.” Veteran trader Peter Brandt warned that “chart pattern breakouts should be viewed with great suspicion” during the thinly traded holiday period in the last half of December. Daily cryptocurrency market performance. Source: Coin360 Analysts remain bullish for 2022. Crypto analyst and pseudonymous Twitter user DecodeJar believes that Bitcoin could surpass $100,000 and reach the conservative ...

Analysts say 2022 will be ‘defined by agility and cost-efficiency’ instead of ‘blockchain purity’

The entire crypto market took great strides toward mass adoption in 2021 and now that the year is nearly complete, analysts are setting their price targets for 2022. Many analysts supported calls for a $100,000 (BTC) price before the end of 2021 and although this seems unlikely, most investors expect the key price level to be tackled before Q2 of 2022. Here’s a look at some of the Bitcoin price predictions analysts are expecting in 2022. Bitcoin is still on track to surpass $100,000 Analysts has been more reticent in providing off the cuff Bitcoin predictions ever since PlanB’s stock-to-flow model incorrectly predicted a $98,000 BTC price by the end of November, even though the model had been spot on from August through October. While some traders are now questioning the validity of ...

5 cryptocurrency projects that made waves in 2021

2021 was a breakout year for the cryptocurrency market in many respects and most investors are absolutely thrilled that Bitcoin (BTC) price established a new all-time high of $68,789. In the same timeframe, Ether (ETH) went on a parabolic rally which saw its price gain 565% from Jan. 1 to hit a record high at $4,859 on Nov. 10. While it was a banner year for large cap cryptocurrencies, some of the biggest gains and most impactful developments came from the altcoin market where decentralized finance (DeFi) and nonfungible tokens (NFTs) rallied by thousands of percent and helped to usher in a new level of awareness and adoption for blockchain technology and cryptocurrencies. Here’s a look at five altcoin projects that made significant contributions to the cryptocurrency ecosystem in 2021. Un...

Price analysis 12/24: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

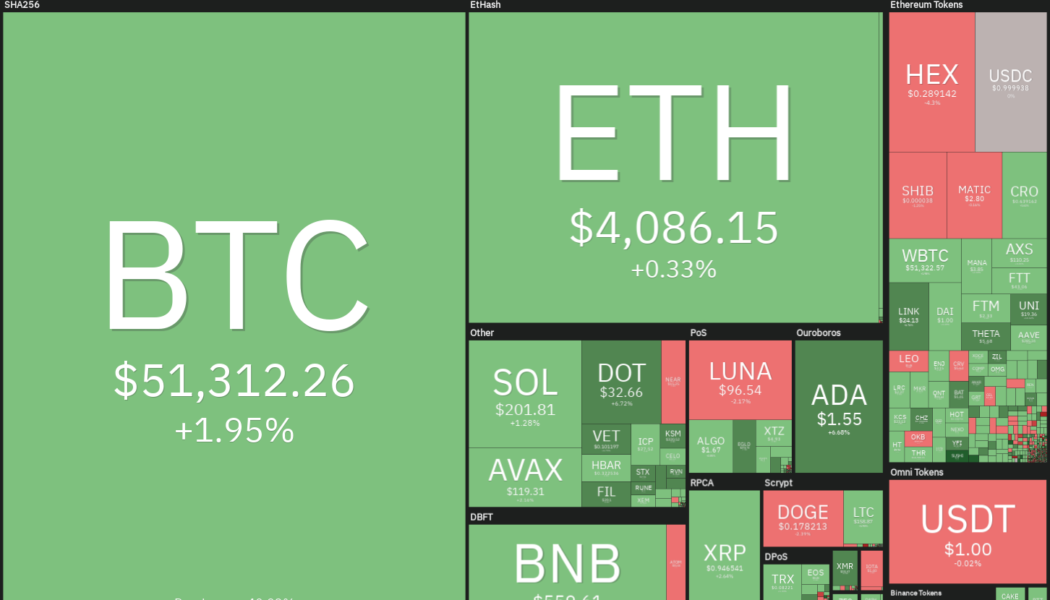

Bitcoin (BTC) bounced back above the psychological level at $50,000 and the S&P 500 hit a new all-time closing high on Dec. 23, suggesting that the panic selling caused due to the omicron variant is subsiding and the much-awaited “Santa rally” may have started. Data from on-chain analytics firm Glassnode shows that about 100,000 Bitcoin are going from “liquid” to “illiquid” state every month, which means that the coins are being sent to addresses “with little history of spending.” This suggests accumulation by investors. Daily cryptocurrency market performance. Source: Coin360 In another sign that investors are not dumping their coins on small corrections, data from CryptoRank shows that the total Bitcoin on crypto exchanges has dropped from 9.5% of the total Bitcoin supply in October ...