Markets

Price analysis 11/16: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, DOT, UNI, LTC

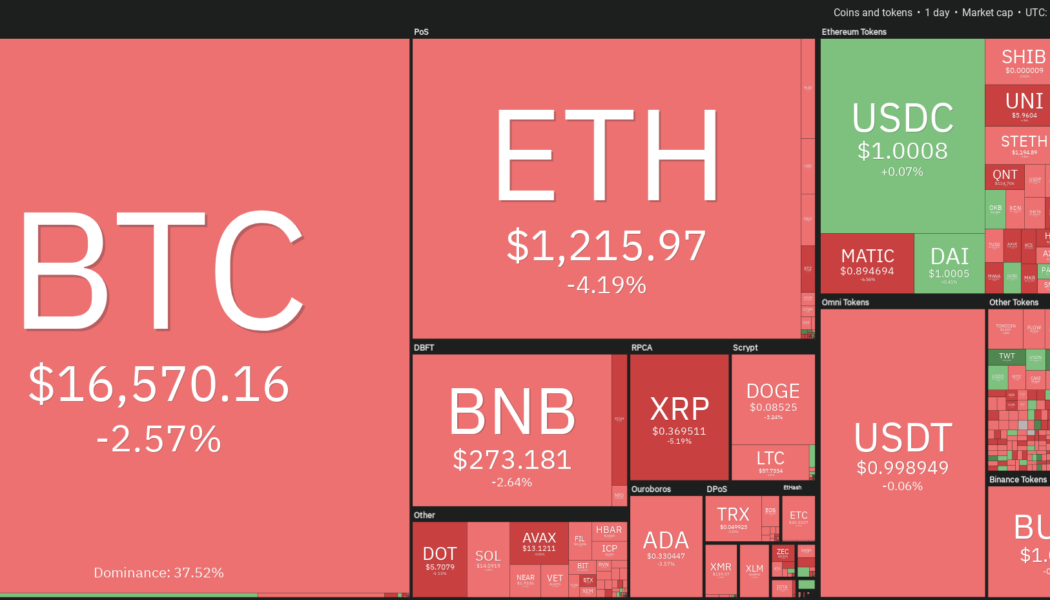

The collapse of FTX cryptocurrency exchange has created a liquidity crisis in the crypto space, which could extend the crypto winter through the end of 2023, according to a research report by Coinbase. According to analysts, the FTX implosion could keep the institutional investors at bay because they are even more likely to tread cautiously for some time. The crisis has negatively impacted several crypto-focused companies who have assets stuck on FTX following the company’s bankruptcy filing on Nov. 11. Investors also fear the contagion could spread, causing further damage to the cryptocurrency ecosystem. Daily cryptocurrency market performance. Source: Coin360 Although several investors were rattled by the collapse of FTX, billionaire venture capitalist and serial blockchain in...

BNB Chain cools off after 24% surge, but strong fundamentals could back the next BNB rally

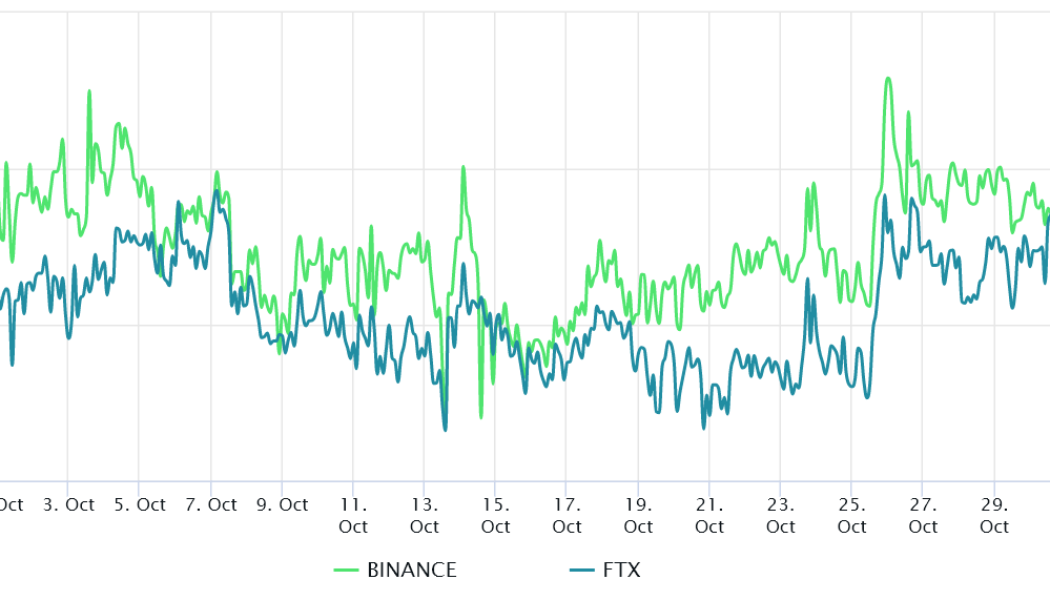

After an impressive 23.7% rally between Oct. 25 and Oct. 31, Binance’s BNB (BNB) coin has faced a strong rejection from the $330 resistance. Is it possible that the two-day 6% sell-off from the $337.80 peak could indicate that further trouble is ahead? Let’s take a look at what the data shows. BNB 12-hour chart on Binance, USD. Source: TradingView Analysts pinned the recent rally to the Oct. 28 news that Binance invested $500 million in Twitter. However, the network’s deposits and decentralized application (DApp) metrics have not accompanied the improvement in sentiment. The strong upward movement was largely based on reports that Binance was preparing to assist Twitter in eradicating bots. The speculation emerged after billionaire Elon Musk raised the $44 billion required to complete...

Bitcoin fails to break the $21K support, but bears remain shy

Bitcoin (BTC) rallied on the back of the United States stock market’s 3.4% gains on Oct. 28, with the S&P 500 index rising to its highest level in 44 days. In addition, recently released data showed that inflation might be slowing down, which gave investors hope that the Federal Reserve might break its pattern of 75 basis-point rate hikes after its November meeting. In September, the U.S. core personal consumption expenditures price index rose 0.5% from the previous month. Although still an increase, it was in line with expectations. This data is the Federal Reserve’s primary inflation measure for interest rate modeling. Additional positive news came from tech giant Apple, which reported weak iPhone revenues on Oct. 27 but beat Wall Street estimates for quarterly earnings and margin. M...

Here are top tips by the crypto community to get through the bear market

The crypto bear market of 2022 has wiped out more than 70% of the market capitalization from the top. The total crypto market cap breached $3 trillion at the bull market’s peak last year but currently struggling to remain above $1 trillion. At a time when the majority of the cryptocurrencies are moving sideways with no significant bullish momentum recorded in months, it can get a little frustrating, especially for those who jumped in at the market top in hopes of making some quick money. As crypto-winter worsens, the Reddit crypto community shared their coping mechanisms and some “serious” tips to remain on top of their mental health during this cyclic event. One Reddit user wrote that they are in it for the long term, thus, they ignore the charts and daily fluctuations. “I igno...

Ethereum’s Merge won’t stop its price from sinking

Ethereum’s long-awaited Merge took place in September, shifting it from a legacy proof-of-work (POW) model to the sustainable proof-of-stake (PoS) consensus algorithm. Many observers expected Ether’s (ETH) price to respond positively as its daily emissions declined 90% with the halt of mining operations. However, the expected price surge never occurred. In fact, Ether has been down by over 7% since the upgrade. So why didn’t the Merge drive up the coin’s price? Post-merge ETH monetary policy Ethereum’s monetary policy was simply to reduce the token’s supply to 1,600 ETH per day. The PoW model, an equivalent of 13,000 ETH were emitted daily as mining rewards. However, this has been wholly eliminated post-Merge, as mining operations are no longer valid on the PoS model. Therefore, only...

Women remain bullish on crypto investment despite market lull: Survey

The crypto market downturn is proving a difficult storm to weather for both investors and businesses alike in the industry. However, according to new data, this hasn’t stopped women from being bullish on crypto. A new survey conducted by BlockFi, a crypto trading and investment platform, asked women across the United States about their views of and participation in the crypto industry between Sept. 2021 and Mar. 2022. According to the findings one in ten women chose crypto as their first investment, with 17% of that being Millennial women investors and 11% Gen Z. Findings even revealed that of the women surveyed 7% of Gen X, which includes individuals born between 1965-1980, reported crypto as their first investment. However, as past data has revealed, more education and clarity surroundin...

Bitcoin will surge in 2023 — but be careful what you wish for

The Bitcoin (BTC) community is divided about whether the token’s price is going to surge or crash in the year ahead. A majority of analysts and technical indicators suggest it could bottom between $12,000 and $16,000 in the months to come. This correlates with a volatile macroeconomic environment, stock prices, inflation, Federal Reserve data and (at least according to Elon Musk) a possible recession that could last until 2024. On the other side, influencers, BTC maximalists and a range of other fanatical “shills” maintain its price could skyrocket to $80,000 and beyond. There is evidence to support both sides. One issue is that they may be looking at different time horizons. There’s a strong case to be made that BTC is likely to drop sharply in the months ahead but potentially rise ...

Price analysis 10/21: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, MATIC

The 10-year Treasury yield in the United States rose to its highest level since 2008. Although this type of rally is usually negative for risky assets, the U.S. stock markets recovered ground after the Wall Street Journal reported that some officials of the Federal Reserve were concerned about the pace of the rate hikes and the risks of over-tightening. While it is widely accepted that the U.S. will enter a recession, a debate rages on about how long it could last. On that, Tesla CEO Elon Musk recently said on Twitter that the recession could last “probably until spring of ‘24,” and added that it would be nice to spend “one year without a horrible global event.” Daily cryptocurrency market performance. Source: Coin360 Bitcoin’s (BTC) price has witnessed a massive drop from its all-time hig...

Bitcoin, venture capital and security tokens flash green: Report

The blockchain industry does not exist in a bubble. The impact of the rest of the world’s economic turmoil seems to be stomping all over the progress of the “blockchain revolution.” Traditional markets like the S&P 500 index crashed by more than 11.5% in September, while the tech-heavy Nasdaq 100 index plummeted by 12.5%. However, Bitcoin (BTC) may have seen a decoupling, having only dropped 3% during this same period. For some, these are signs of a bottom for Bitcoin, but it does not necessarily mean an immediate reversal is upon the market. Are there other positive flashing signals we can see in the charts? Every month, Cointelegraph Research releases an Investor Insights report that analyzes key indicators from different sectors of the blockchain industry. Gauges from 10 segme...