Markets

Weekly Report: Shark Tank’s Kevin O’Leary argues that NFTs are growing bigger than Bitcoin

This week, top cryptocurrencies suffered a massive dip as the broader market pulled back following confirmation of plans to hike interest rates. Minutes from the FOMC meeting hinted that the US Federal Reserve was considering a potential rate increase in March. The top crypto assets (not including Tether and USD Coin stables) are all down by double figures over the last 7-days. Solana (SOL), Ethereum (ETH), and Binance Coin (BNB) lead the way in losses with 19.47%, 13.97%, and 13.15% plunges, respectively as of writing. The leading cryptocurrency is also trading in the red – down by 12.01% in the last 7-days. Here’s a look at the top headlines outside the market in the first week of the year. Shark Tank’s Kevin O’Leary bets on NFTs getting bigger than Bitcoin Popular Shar...

Bitcoin price drops to $43.7K after Fed minutes re-confirm plans to hike rates

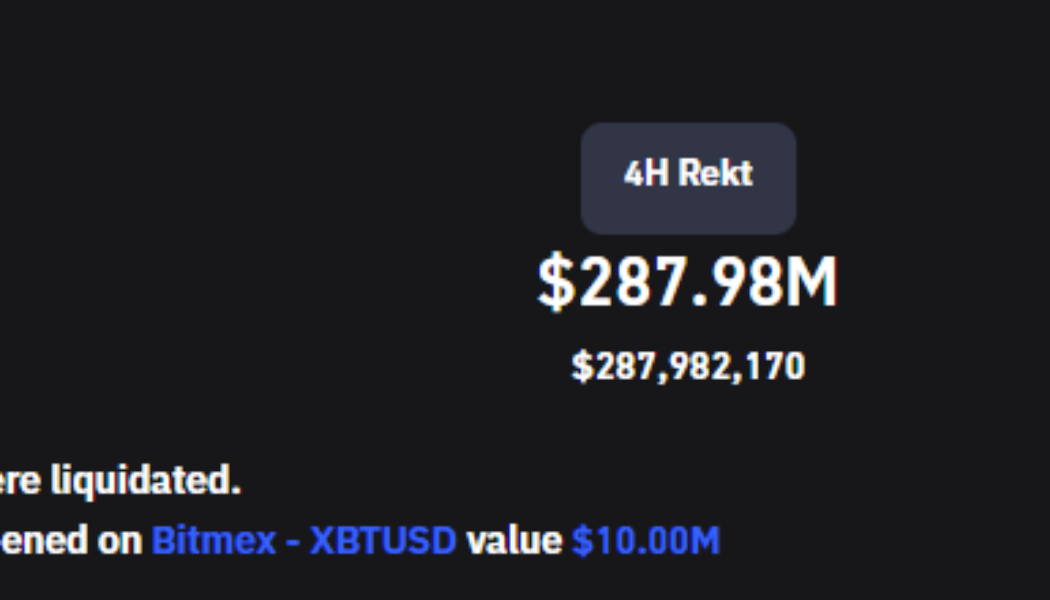

Bitcoin (BTC) and the wider cryptocurrency market fell under as equities markets pulled back at the closing bell after minutes from the Federal Reserve’s December FOMC meeting showed that the regulator is committed to decreasing its balance sheet and increasing interest rates in 2022. As stock markets corrected, BTC price followed suit by dropping below $44,000, setting off a cascade of liquidations that reached $222 million in less than an hour. Total liquidations. Source: Coinglass Data from Cointelegraph Markets Pro and TradingView shows that after oscillating around support at $46,000 for the past couple of days, Bitcoin was hit with a wave of selling that pulled the price to an intraday low of $43,717. BTC/USDT 4-hour chart. Source: TradingView Based on the current situati...

3 reasons why Cosmos (ATOM) price is near a new all-time high

Blockchain network interoperability is shaping up to be one of the main themes for the cryptocurrency ecosystem in 2022. New users are continuing to onboard into the growing world of crypto while both new and established projects search for the chain that will best serve the needs of their protocol and community. One project that has 2022 off to a bullish start thanks to its focus on facilitating the communication between separate networks is Cosmos (ATOM). This project bills itself as “the internet of blockchains” and seeks to facilitate the development of an interconnected decentralized economy. Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $25.06 on Dec. 30, the price of ATOM has rallied 75% to hit a daily high at $43.98 on Jan. 4 as its 24-...

Price analysis 1/5: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, DOT, AVAX, DOGE

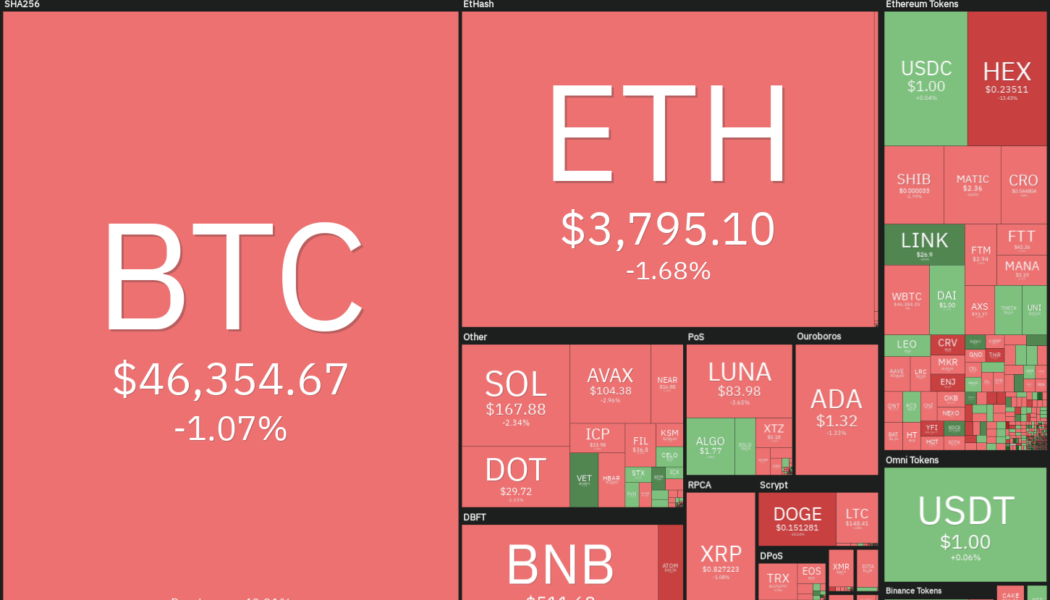

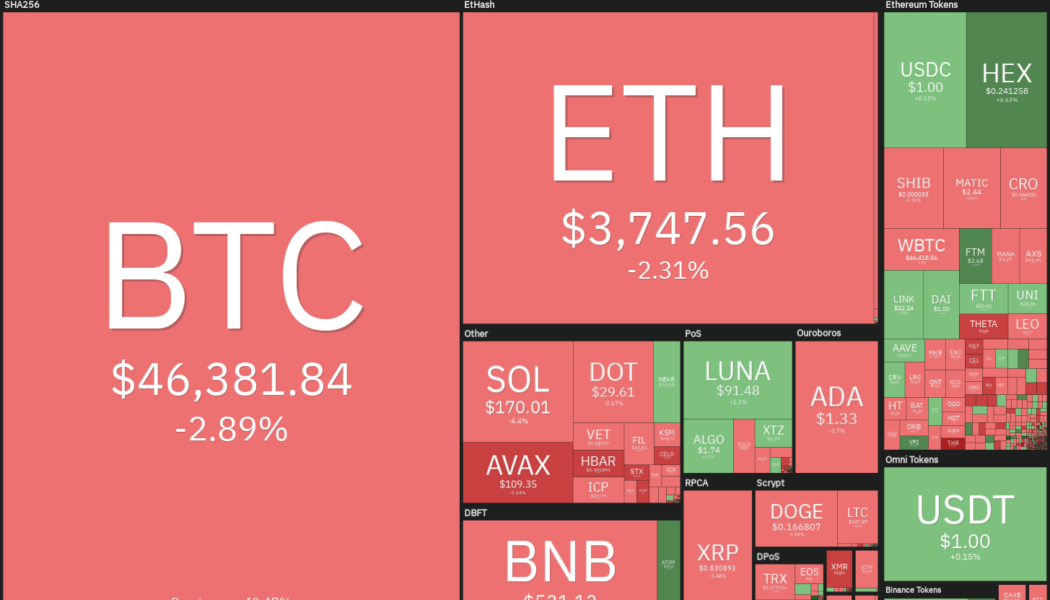

Bitcoin (BTC) and most major altcoins are stuck in a tight range with bulls buying near the support and bears selling at resistance levels. Usually, such tight ranges are followed by an expansion in volatility. Although a few analysts have not ruled out a quick drop to low $40,000s, most traders expect Bitcoin to rebound sharply and move up to $60,000. Goldman Sachs said in a note to investors that if Bitcoin continues to increase its market share over gold as a store of value and crosses the 50% mark, then it could rally to $100,000 over the next five years. Daily cryptocurrency market performance. Source: Coin360 On-chain analytics provider Glassnode said in its report on Monday that Bitcoin’s illiquid supply has increased to more than 76% of the total circulating supply. According to Gl...

Top 5 cryptocurrencies to watch in 2022: BTC, ETH, BNB, AVAX, MATIC

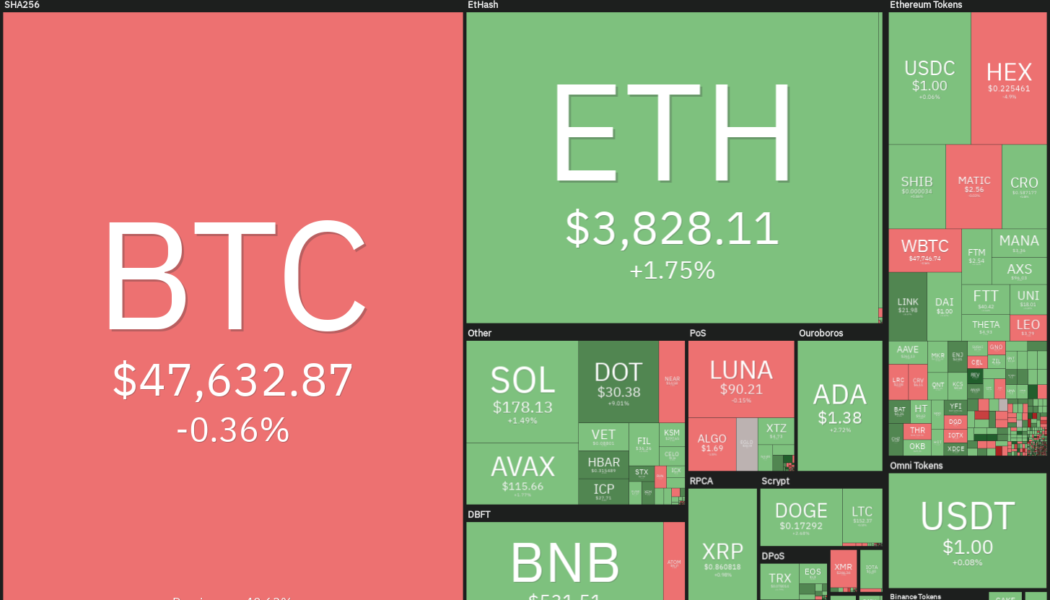

Bitcoin (BTC) witnessed a roller coaster ride in 2021 and even though BTC has corrected sharply from its all-time high at $69,000, the digital asset is still up by 60% year-to-date. During the same period, gold has dropped more than 5%. With inflation soaring in the United States and several other parts of the world, Bitcoin’s outperformance over gold shows that investors may be considering it to be a better hedge against inflation when compared to gold. During the year, the total crypto market capitalization surged to about $3 trillion, but Bitcoin’s dominance fell from about 70% at the start of the year to 40%. This shows that several altcoins have outperformed Bitcoin by a huge margin. Crypto market data daily view. Source: Coin360 As cryptocurrencies gain wider adoption, multiple...

Altcoins turn bullish even as Bitcoin price slips below $46K again

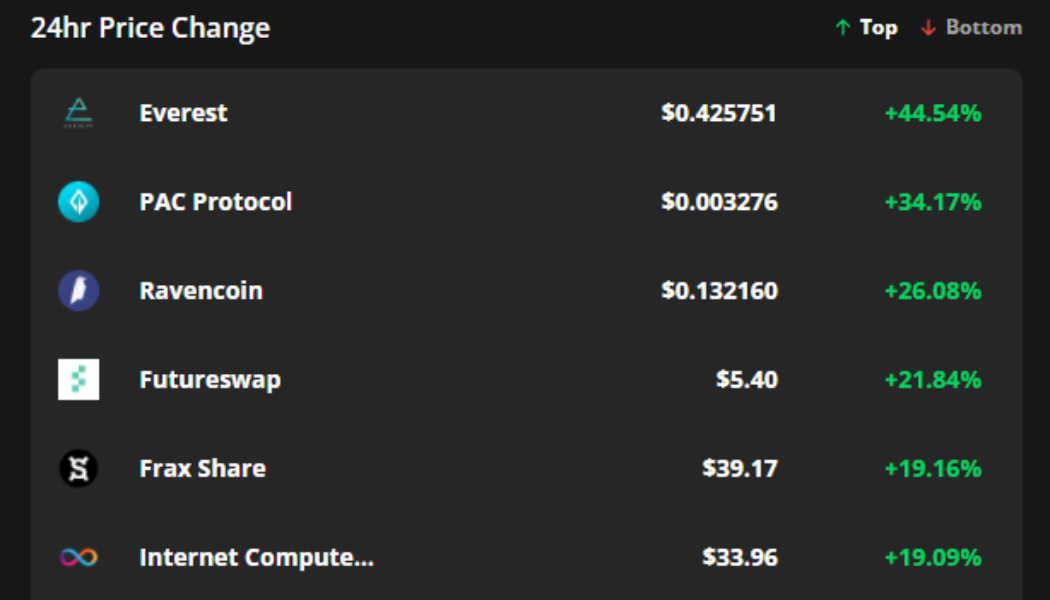

The mood across the cryptocurrency is one of growing anticipation as the price of Bitcoin (BTC) continues to trade just below $47,000. The sideways price action has analysts warning that an “explosive volatility period” is rapidly approaching but few have been willing to predict the direction of the breakout. While Bitcoin price compresses, the altcoin market has come alive and multiple tokens are posting notable gains, especially in the DeFi cohort. Top 7 coins with the highest 24-hour price change. Source: Cointelegraph Markets Pro Data from Cointelegraph Markets Pro and TradingView shows that the biggest gainers over the past 24-hours were Everest (ID), PAC Protocol (PAC) and Ravencoin. Everest expands its interoperability Everest is a blockchain company with a focus on removing b...

Bogdanoff crypto-meme twins pass away at age 72

Raise a glass today to the twin characters behind the famous “pomp eet” cryptocurrency meme. The French television presenters died within one week of each other aged 72. According to Le Monde, the two brothers were hospitalized on Dec. 15 and transferred to the intensive care unit of a Paris hospital after contracting COVID-19. Grichka died on Dec. 28, and Igor died six days later, on Jan. 3. The twins became famous in France in the 80s, hosting a popular TV show called Temps X and selling a best-selling book called Clefs pour la science-fiction, or keys to science-fiction. Despite their TV charm, outlandish views on theoretical physics, and noble Russian bloodline, the twins rose to cryptocurrency market fame due to a viral meme. The twins’ striking high cheekbones, puffed lips and ...

Price analysis 1/3: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

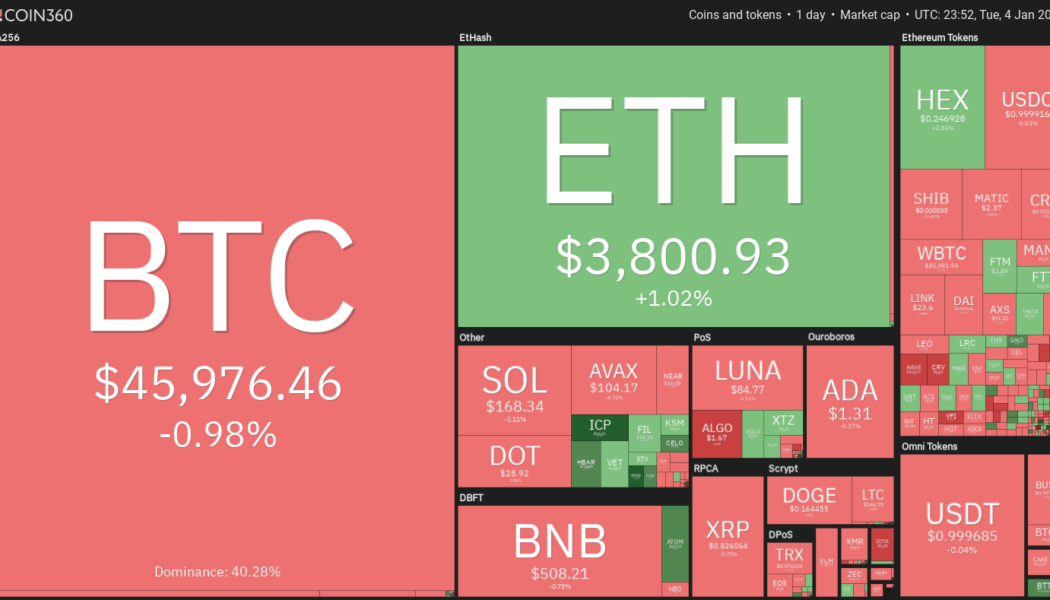

Bitcoin’s (BTC) price action has been uneventful in the first few days of the new year and it continues to languish below the psychological level at $50,000. The Crypto Fear and Greed Index is in the fear zone registering a value of 29/100. On-chain analytics resource Ecoinometrics said stages of extreme fear rarely remain for long, which means “there is a limited downside at 30 days.” Bitcoin continues to garner support from various quarters. Wharton School finance professor Jeremy Siegel said in an interview with CNBC that Bitcoin has replaced gold as an inflation hedge in the minds of Millennials. Daily cryptocurrency market performance. Source: Coin360 Savvy investors have been turning to Bitcoin to protect their portfolios against the possible debasement of fiat currencies. Hung...

Bitcoin traders expect $60K by month’s end, marking $45K as ‘accumulation’

The bearish pressures facing the cryptocurrency market at the end of 2021 have continued into the first week of 2022 after the price of Bitcoin (BTC) dropped below $47,000 on Jan. 1 and the asset still faces stiff headwinds on the shorter timeframe charts. Data from Cointelegraph Markets Pro and TradingView shows that, after climbing above $47,500 to start the new year, the price of BTC fell under pressure in the afternoon on Dec. 3. Currently, the price has dropped to $46,500 where bulls now look to mount a defense. BTC/USDT 4-hour chart. Source: TradingView Here’s a look at what several analysts in the market are saying about the path ahead for Bitcoin in 2022 as the global economic system continues to grapple with inflation. BTC needs to reclaim support at $48,670 Analy...

Yearn.finance risks pullback after YFI price gains 100% in less than 3 weeks

Yearn.finance (YFI) looks poised for a price correction after rising five days in a row to approach $42,000. Notably, an absence of enough buying volume coupled with overbought risks is behind the bearish outlook. The YFI price rally so far YFI’s price surged by a little over 47% in five days to $41,970 as traders rotated capital out of “top-cap” cryptocurrencies such as Bitcoin (BTC) and Ether (ETH) and looked for short-term opportunities in the altcoin market. #DeFi assets are showing some nice signs of growth to kick off 2022. $YFI, $UNI, and $AAVE are all ticking up nicely thus far with the first Monday of the year looking #bullish for several #altcoins. https://t.co/8ujolCvt5z pic.twitter.com/ASpf1dUbtn — Santiment (@santimentfeed) January 3, 2022 Yearn.finance was among the beneficia...

Top 5 cryptocurrencies to watch this week: BTC, LUNA, FTM, ATOM, ONE

Bitcoin (BTC) continues to languish below the psychological level at $50,000 in the first few days of the New Year, indicating a lack of aggressive buying by traders. Former BTCC CEO Bobby Lee said the exodus of the Chinese traders who had until Dec. 31 to exit Chinese exchanges may have kept prices lower into the year-end. However, President Nayib Bukele of El Salvador, the first country to adopt Bitcoin as legal tender, believes that Bitcoin could rally to $100,000 this year. President Bukele also said that two more countries will accept Bitcoin as legal tender in 2022. Crypto market data daily view. Source: Coin360 The increased crypto adoption by institutional investors in 2021 is another long-term positive. According to CoinShares, net inflows into crypto funds in 2021 were more than ...