Markets

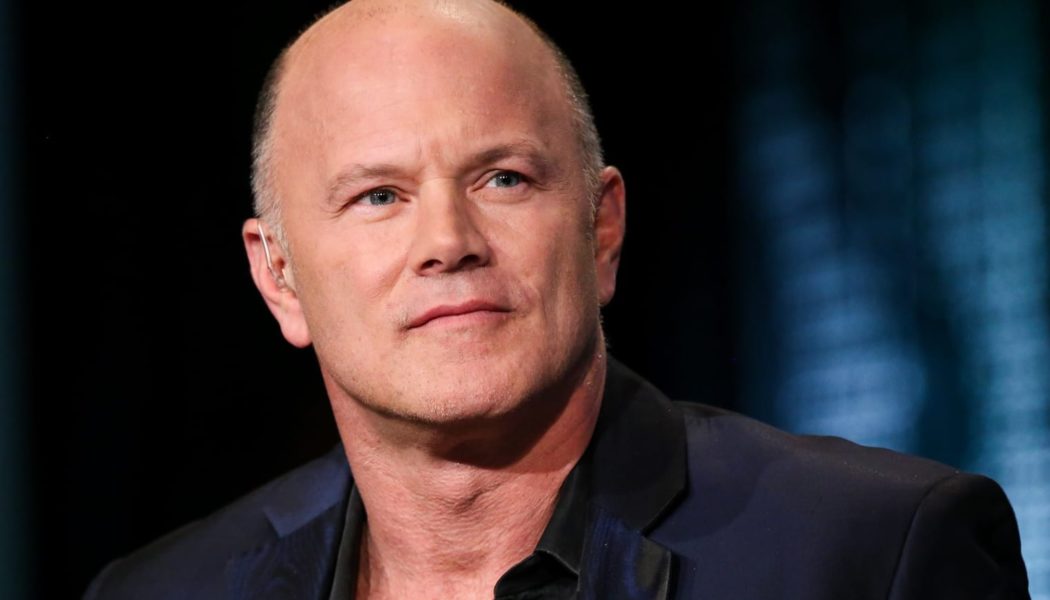

Bitcoin down 11% over the last 7-days: Here’s Galaxy Digital chief’s projected BTC price floor figure

The ex-hedge fund manager predicted last month that Bitcoin could hold at $42,000 Financier and crypto investor Mike Novogratz recently told CNBC that he expects to see Bitcoin fall even further to a price floor much around $40,000 or $38,000. Bloomberg reported the change of heart from the crypto bull who recently opined that Bitcoin could hold at $42,000. Delving into the projection, Novogratz stated that he would put a hold on buying crypto again. The Galaxy Investment chief added that there is a substantial amount of institutional money, ready to pounce on the opportunity to get into the space. “(There is a) tremendous amount of institutional demand on the sidelines,” he said. He insisted he is not tense about the medium-term performance of cryptocurrencies even though...

These 3 cryptocurrencies are taking an even bigger hit during Bitcoin’s price slump

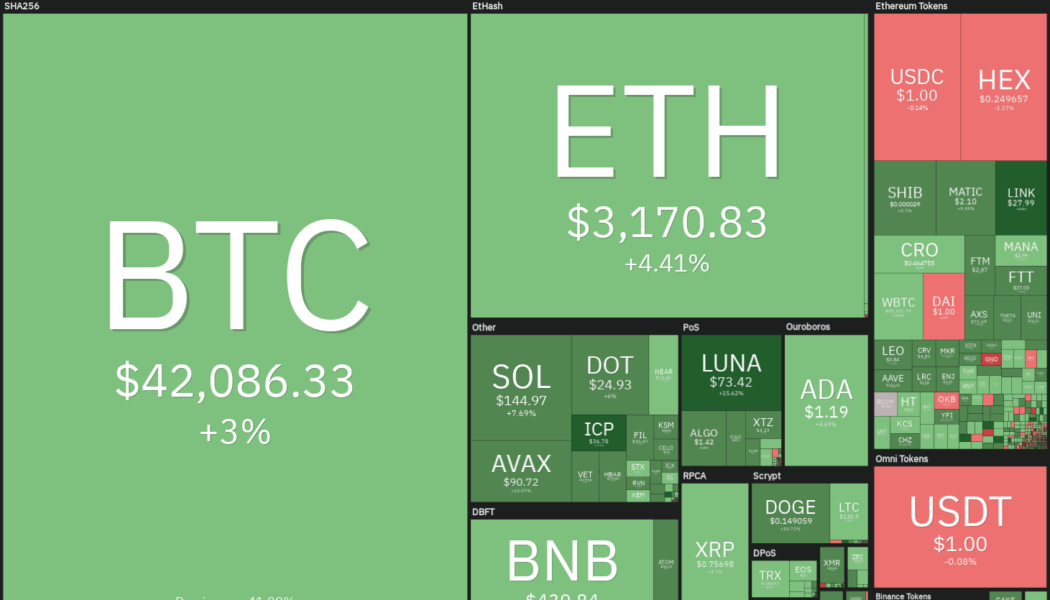

The cost to purchase one Bitcoin (BTC) has dropped almost 10% in the last seven days and has been eyeing extended declines as it drops below $40,000, its interim psychological support, on Jan. 10. BTC/USD weekly price chart. Source: TradingView Nonetheless, the losses suffered by Bitcoin still appear less than that of some of its top crypto rivals’ performances. For instance, Cardano (ADA), the seventh-largest cryptocurrency by market valuation, has dropped by nearly 11% to around $1.15 in the last seven days. Similarly, Ripple (XRP), the eighth-largest by market capitalization, has dipped by around 10% to nearly $0.75 in the same period. Meanwhile, some cryptocurrencies listed among the top 50 digital assets have experienced bigger losses between 15% and 30% in the last week. They i...

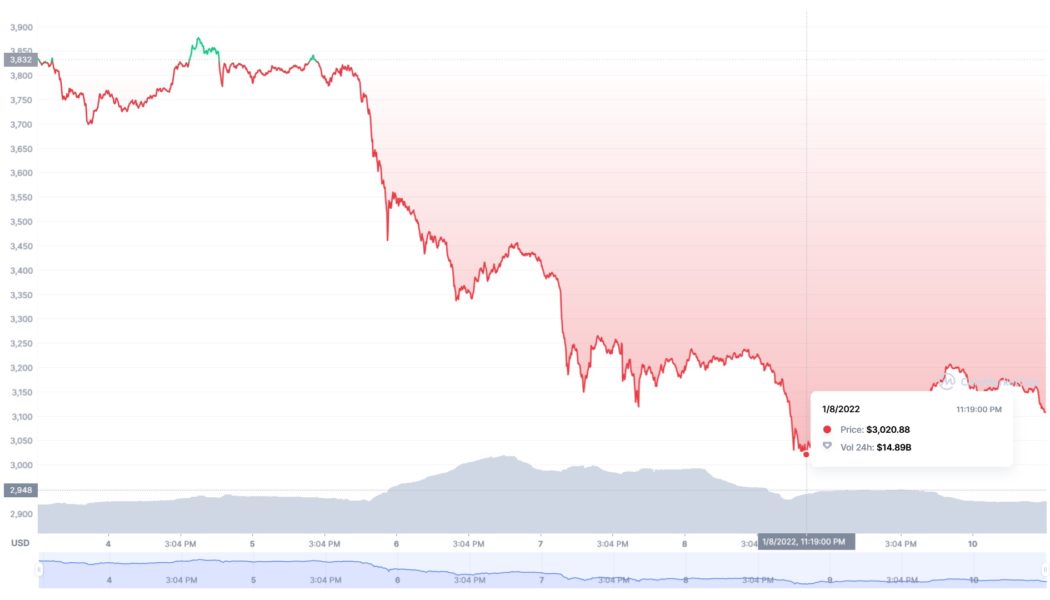

Crypto strategist Justin Bennett sees $3,000 as Ethereum’s turning point

Bennett revealed that he intends to buy ETH at around $3,000 as he expects the market to turn around that point Crypto analyst Justin Bennett has predicted what he expects to see from Ethereum this month, even as crypto markets dwindle and continue on a downward trend. Last Friday, Bennett outlined in a video that Ethereum must recover towards a crucial level over the next few weeks, which he defined as the region around $4,000. The crypto strategist noted that he sees this as a necessity for Ether to have a chance at restoring a major bullish run. “As long as ETH is below $4,000, you have to be a little bit careful. If we do see Ethereum over the coming weeks and months reclaim this area up here at $4,000 on a weekly and monthly closing basis, then yes, I do think we’re going ...

‘Most bullish macro backdrop in 75 years’ — 5 things to watch in Bitcoin this week

Bitcoin (BTC) starts a new week in a strange place — one which is eerily similar to where it was this time last year. After what various sources have described as an entire twelve months of “consolidation,” BTC/USD is around $42,000 — almost exactly where it was in week two of January 2021. The ups and downs in between have been significant, but essentially, Bitcoin remains in the midst of a now familiar range. The outlook varies depending on the perspective — some believe that new all-time highs are more than possible this year, while others are calling for many more consolidatory months. With crypto sentiment at some of its lowest levels in history, Cointelegraph takes a look at what could change the status quo on shorter timeframes in the coming days. Will $40,700 hold? Bitcoin saw a tr...

Top 5 cryptocurrencies to watch this week: BTC, LINK, ICP, LEO, ONE

Bitcoin (BTC) and most major altcoins remain under pressure as supports give way and bears sell at each rally attempt. This negative sentiment pulled the Crypto Fear & Greed Index to 10/100 on Jan. 8, one of its lowest readings ever. In comparison, 2021 had started on a bullish note with the reading hitting levels of 93/100, indicating “extreme greed.” This weak opening in the new year has not unnerved Bloomberg Intelligence analyst Mike McGlone who remains bullish. He said in a recent analysis that Bitcoin may rally to $100,000 and Ether (ETH) to $5,000 this year. Crypto market data daily view. Source: Coin360 However, some analysts argue that Bitcoin may struggle to maintain its bullish trend in an environment where interest rates are rising. Holger Zschaepitz questioned whether Bitc...

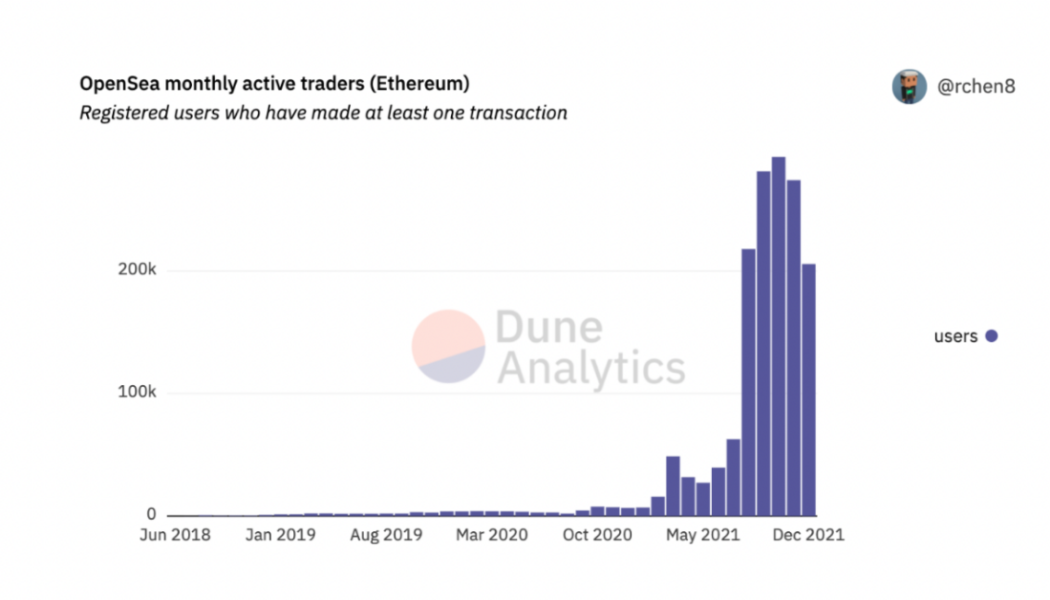

5 NFT marketplaces that could topple OpenSea in 2022

OpenSea has been the dominant decentralized platform for users looking to mint, buy, sell and trade nonfungible tokens (NFTs). Serving more as an NFT aggregator than a gallery, OpenSea locked in $3.25 billion in volume for December 2021 alone, according to data from Dune Analytics and from December 2020 to December 2021, the total volume increased by a whopping 90,968%. No stranger to contention and criticism, OpenSea has had its fair share of perils and pitfalls. Most notably, its former head of product, Nate Chastain, found using insider information to front-run and profit from selling the platform’s front page NFTs. Adding to the overall feeling of distrust, the community felt devalued after newly appointed chief financial officer (CFO) Brian Roberts hinted at going public. However, he ...

Even after the pullback, this crypto trading algo’s $100 bag is now worth $20,673

Exactly one year ago, on Jan. 9, 2021, Cointelegraph launched its subscription-based data intelligence service, Markets Pro. On that day, Bitcoin (BTC) was trading at around $40,200, and today’s price of $41,800 marks a year-to-year increase of 4%. An automated testing strategy based on Markets Pro’s key indicator, the VORTECS™ Score, yielded a 20,573% return on investment over the same period. Here is what it means for retail traders like you and me. How can I get my 20,000% a year? The short answer is – you can’t. Nor can any other human. But it doesn’t mean that crypto investors cannot massively enhance their altcoin trading game by using the same principles that underlie this eye-popping ROI. The figure in the headline comes from live testing of various VORTECS™-based tra...

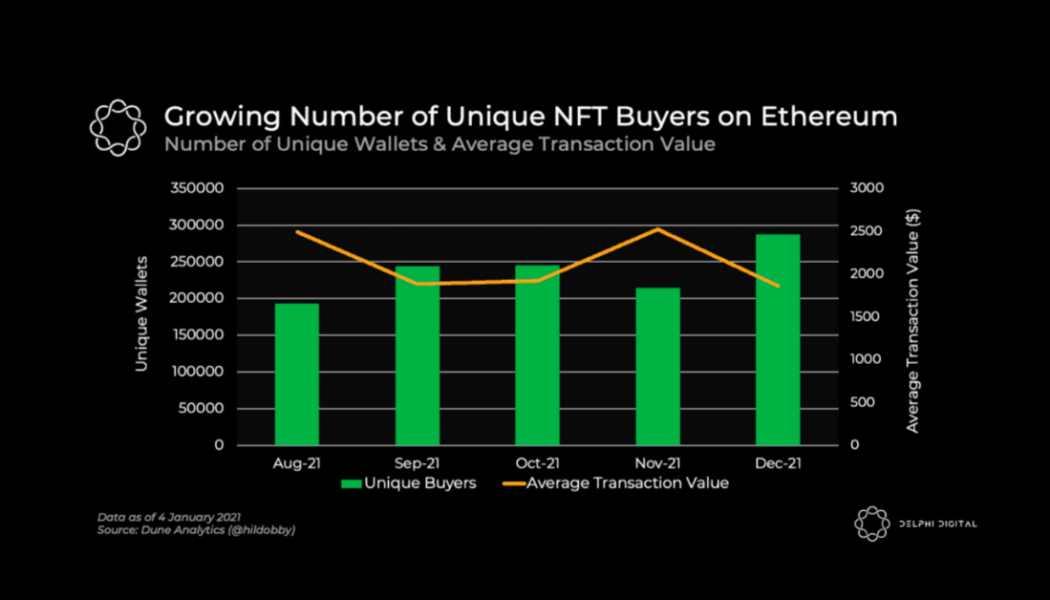

5 NFT-based blockchain games that could soar in 2022

After the popularity of DeFi, came the rise of nonfungible tokens (NFTs) and to the surprise of many, NFTs took the spotlight and remain front and center with the highest volume in sales, occuring at the start of January 2022. Growing number of unique NFT buyers on Ethereum Source: Delphi Digital While 2021 became the year of NFTs, GameFi applications did surpass DeFi in terms of user popularity. According to data from DappRadar, Bloomberg gathered: “Nearly 50% of active cryptocurrency wallets connected to decentralized applications in November were for playing games. The percentage of wallets linked to decentralized finance, or DeFi, dapps fell to 45% during the same period, after months of being the leading dapp use case.” Blockchain, play-to-earn game Axie infinity, skyrocketed an...

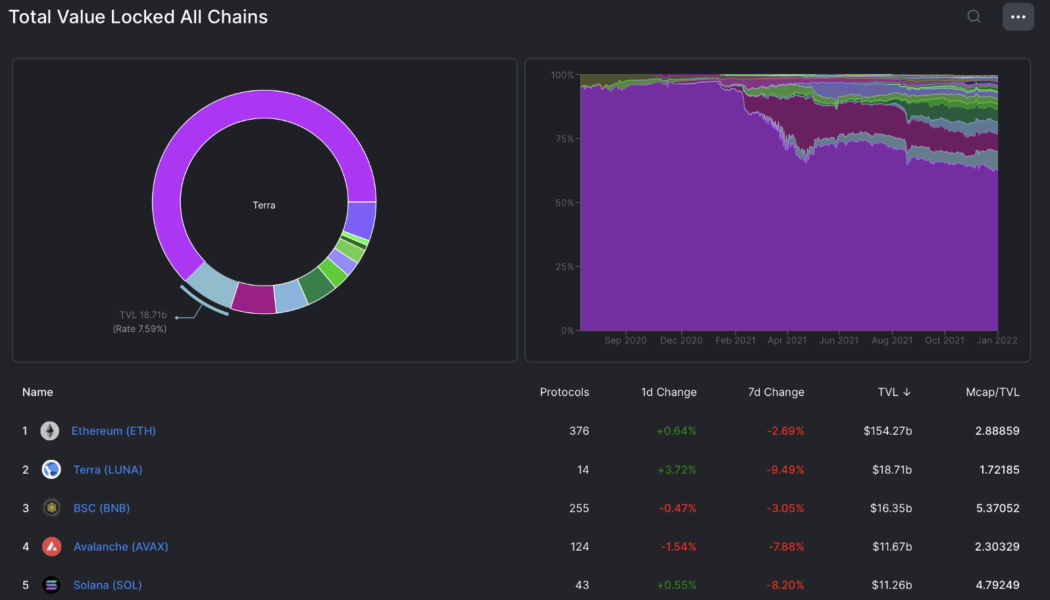

Here’s how Terra traders use arbitrage to profit from LUNA and bLUNA

The end of the year is normally a time to wind down and prepare for the holiday season, but the last few weeks of 2021 saw a crypto market that showed no signs of resting. One of the headline-grabbing stories related to Terra reaching an all-time high in terms of the total value locked (TVL), and the project surpassed Binance Smart Chain (BSC) as the second-largest decentralized finance blockchain after Ethereum. After reaching the $20-billion TVL mark on Dec. 24, Terra’s TVL has come down to around $19.3 billion at the time of writing according to data from Defi Llama, but this is in no way, shape or form a bearish signal. Top 5 total value locked on the top 5 blockchains. Source: Defi Llama Currently, Terra has only 14 protocols built on the chain, compared to the 257 protocols on ...

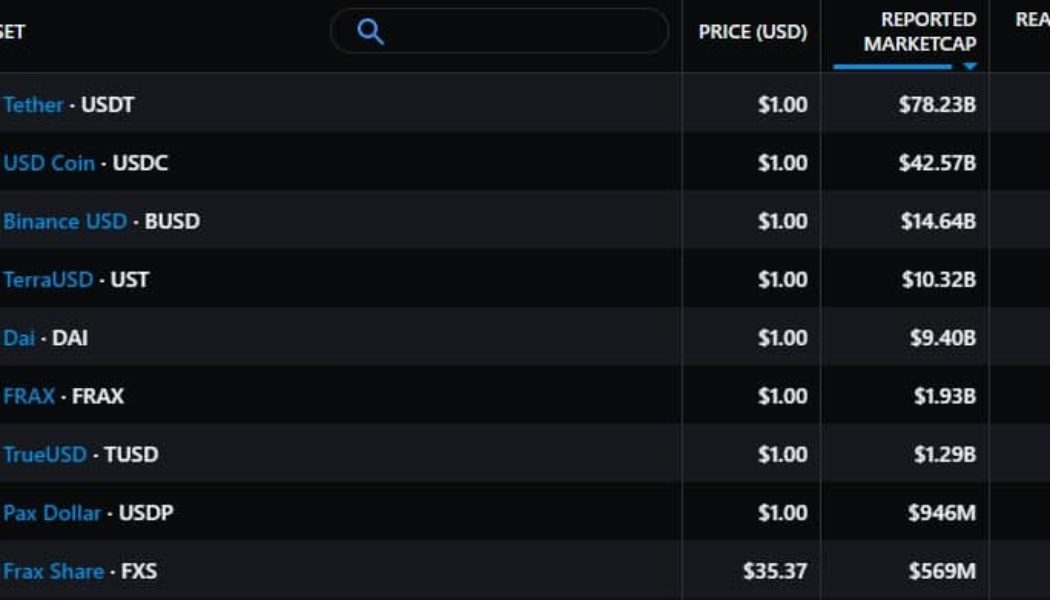

Crypto regulation concerns make decentralized stablecoins attractive to DeFi investors

Stablecoins have emerged as a foundational part of the cryptocurrency ecosystem over the past couple of years due to their ability to provide crypto traders with an offramp during times of volatility and their widespread integration with decentralized finance (DeFi). These are necessary for the health of the ecosystem as a whole. Currently, Tether (USDT) and USD Coin (USDC) are the dominant stablecoins in the market, but their centralized nature and the persistent threat of stablecoin regulation have prompted many in the crypto community to shun them and search for decentralized alternatives. Top 9 stablecoins by reported market capitalization. Source: Messari Binance USD (BUSD) is the third-ranked stablecoin and is controlled by the Binance cryptocurrency exchange. DAI, the top rank...

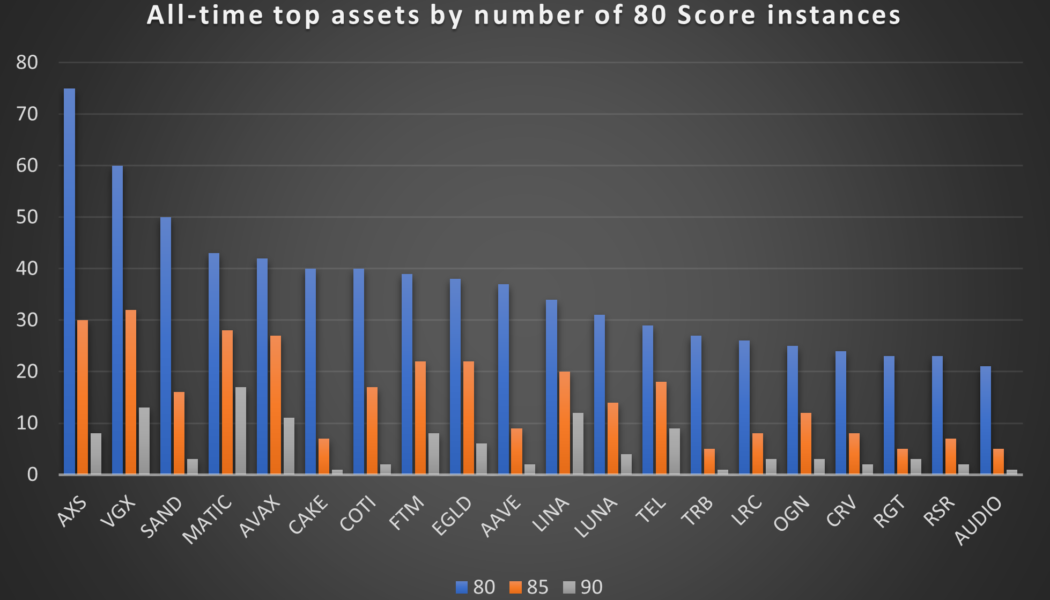

Here are the most predictable tokens of 2021 – for those who knew where to look

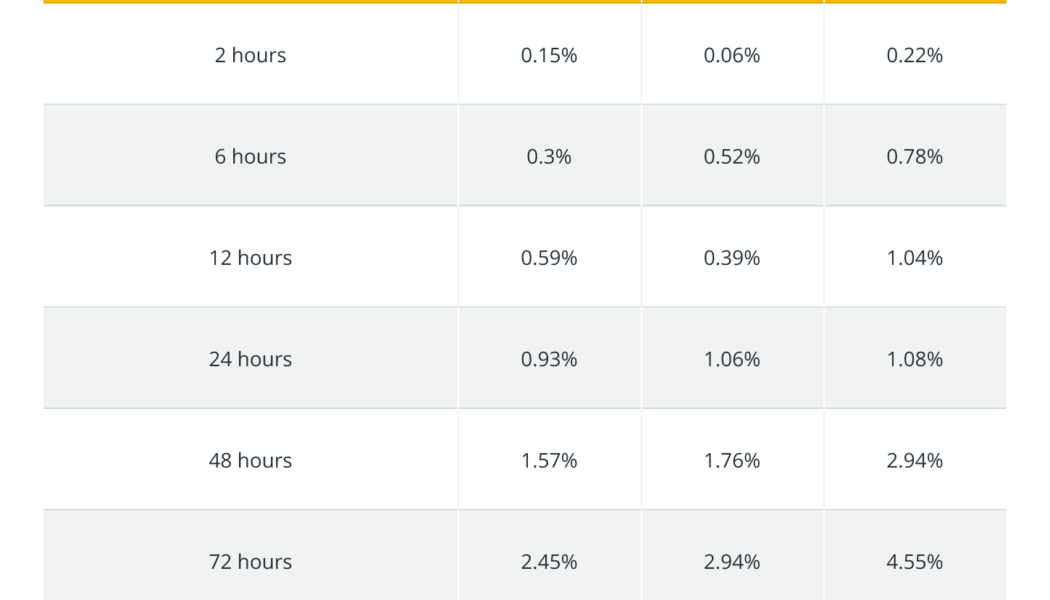

Digital assets’ past performance is never a guarantee of future price movement. There are never two identical situations in the crypto marketplace, so even historically similar patterns of a token’s behavior can be followed by starkly different price action charts. Still, crypto assets’ individual history of price action often rhymes, giving those who can ready this history right a massive edge over other traders. And, importantly, some tokens are much more likely than others to exhibit recurring behavior, which makes their bullish setups more recognizable ahead of time. Cointelegraph Markets Pro, a subscription-based data intelligence platform whose job is to search for regularities in crypto assets’ past trading behavior and alert traders to historically bullish conditions around individ...