Markets

Bitcoin and Ethereum selloffs are coming to an end soon, says Mad Money’s Jim Cramer

Cramer suggested that Bitcoin could see a recovery like last year’s – a rally that pushed Bitcoin north to the November all-time high In a recent instalment of the Mad Money show, CNBC’s Jim Cramer analysed the markets, as predicted by Tom DeMark. Creator of the Symbolik financial markets analysis tool, Tom DeMark is not just any other head in market matters. With a long-running career in objective and mechanically-driven market indicators, he is credited with several past accurate predictions in the crypto market. Bitcoin and Ethereum set to embark on an uptrend Jim Cramer told viewers that the two leading crypto-assets, Bitcoin and Ethereum, could hit a trend exhaustion bottom this week. After days of massive selloffs that pushed markets to seek lower prices, Cramer pre...

Binance Smart Chain cedes third-place ranking to Fantom decentralised ecosystem

Fantom ranks only behind Terra and Ethereum ecosystems in total value locked as per latest DeFi market data Binance Smart Chain, Solana and Avalanche gave way to Fantom as the blockchain rose to third spot in total value locked (TVL). Gaining more than 60% in 48 hours, Fantom’s DeFi ecosystem leapfrogged Binance Smart Chain (BSC) earlier today with $12.4 billion in TVL ($500 million more than the BSC). The growth of the network has been propelled by activity in its 129 protocols, with dApps such as Matrixswap and Chainstack heavily using the chain in their expansion efforts. At the time of press, the TVL of the Fantom blockchain is $11.97 billion, up 49.5% in the last seven days. Data from DefiLlama indicates that Fantom controls 6.25% of the TVL in DeFi compared to BSC’s 6.07%...

Analysts say Bitcoin’s bounce at $36K means ‘it’s time to start thinking about a bottom’

Bears remain in full control of the cryptocurrency market on Jan. 24 and to the shock of many, they managed to pound the price of Bitcoin (BTC) to a multi-month low at $32,967 during early trading hours. This downside move filled a CME futures gap that was left over from July 2021. Data from Cointelegraph Markets Pro and TradingView shows that the $36,000 level was overwhelmed in the early trading hours on Monday, leading to a sell-off that dipped below $33,000 before dip buyers arrived to bid the price back above $35,500. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts are saying about the macro factors at play in the global financial markets and what to be on the lookout for in the months ahead. “Rate hikes don’t kill risk assets” F...

Here’s why Solana has lost more than other top ten crypto coins over the same period

Solana has fallen to eighth place in market circulating value after being dethroned by Ripple’s XRP The cryptocurrency market is reeling from the extended decline that started at the end of last week. The majority of crypto tokens and coins have taken a huge beating, shedding as much as 40% of their value since Friday. The king cryptocurrency has almost 3% over the past 24 hours and is labouring to stay above $34,000. Ether (ETH) and Cardano (ADA) have all posted bigger losses – both down over 6.50% on the day. Solana price has seen the biggest slump, and this is why The altcoin market has similarly recorded huge losses following the latest selling wave. Notably, Solana has one of the biggest red candles in daily and weekly time frames – down 11.08% in the last 24 hours and almost 40...

ADA sinks below $1.00 after market sell-off knocks off accrued gains

Cardano’s native token ADA is currently trading over 66% below its all-time high set five months ago The recent market slump that started during Friday’s morning session has taken a huge chunk out of the cryptocurrency sector’s circulating value. Bitcoin, Ethereum and Binance Coin down more than 5% on the day Bitcoin (BTC) plunged below $38k on Friday before seeing more dips and dropping below $35k. Down approximately 6.4% in the last 24 hours, it is now trading at $33,653.05 as per data from coinmarkecap. Ethereum (ETH) price, which broke above $3,200 on Thursday’s trading session, is down 27.54% over the last seven days. The second-largest crypto-asset sunk below the $2,400 critical level on Saturday, bottoming around $2,330. On the day, the token has lost 11.21% ...

Top 5 cryptocurrencies to watch this week: BTC, LUNA, ATOM, ACH*, FTM

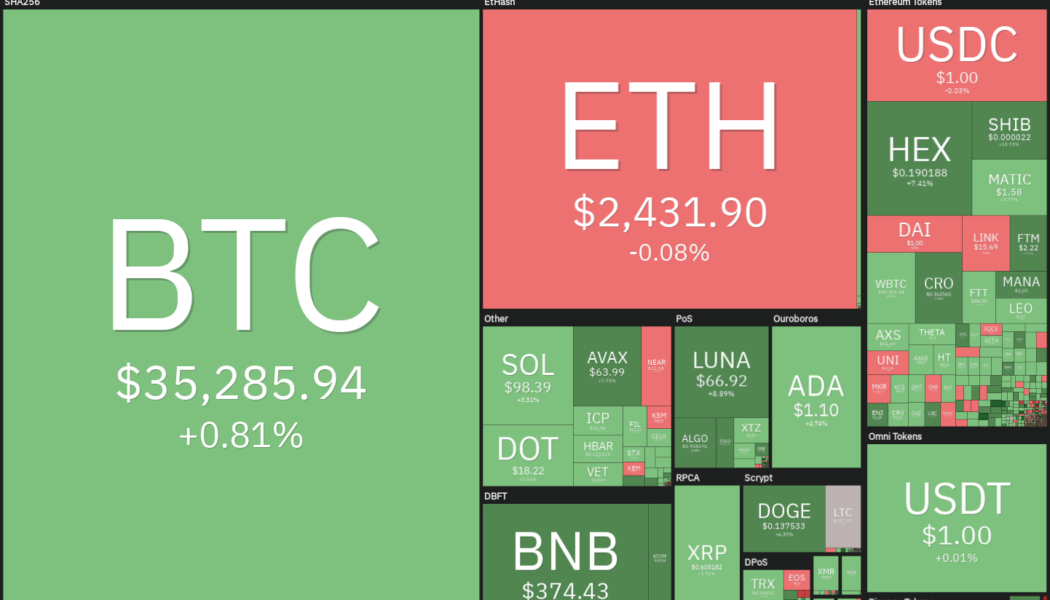

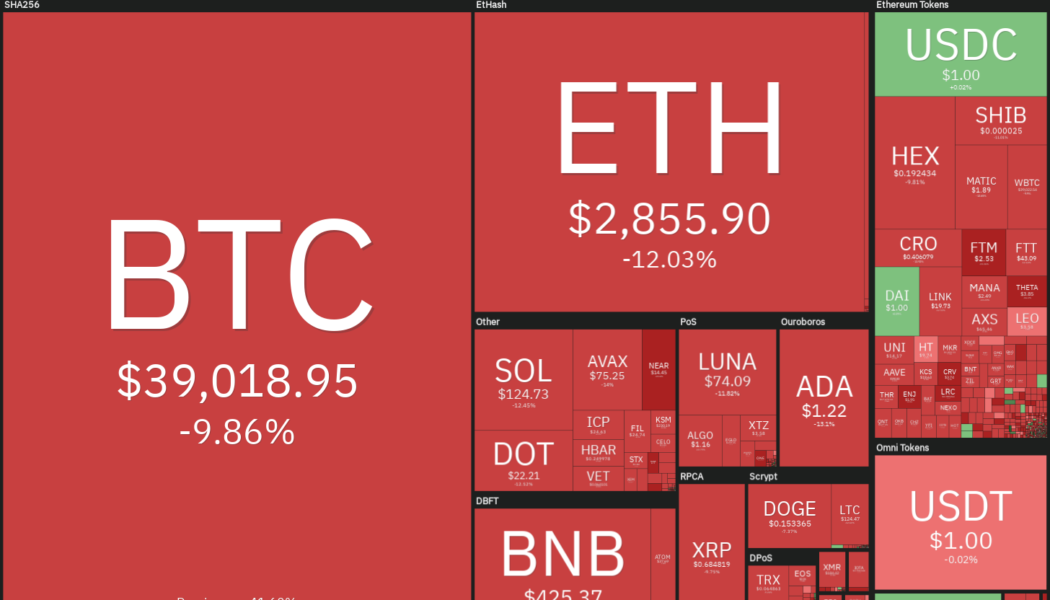

Bitcoin (BTC) fell close to $34,000 on Jan. 21, which reflects a 50% decline from the $69,000 all-time high made on Nov. 10, 2021. Altcoins also could not buck the trend and faced intense selling pressure, which pulled the total crypto market capitalization to $1.6 trillion, a 46% decline from its November 2021 all-time high near $3 trillion. It is not only the crypto markets that are facing selling by investors. The S&P 500 has also plummeted 8% year-to-date. However, gold has outperformed and risen about 1.76% during the period, cementing its billing as a safe haven asset. Crypto market data daily view. Source: Coin360 Several retail traders who purchased Bitcoin near its all-time high are voicing their concerns on social media. However, El Salvador’s President Nayib Bukele does not ...

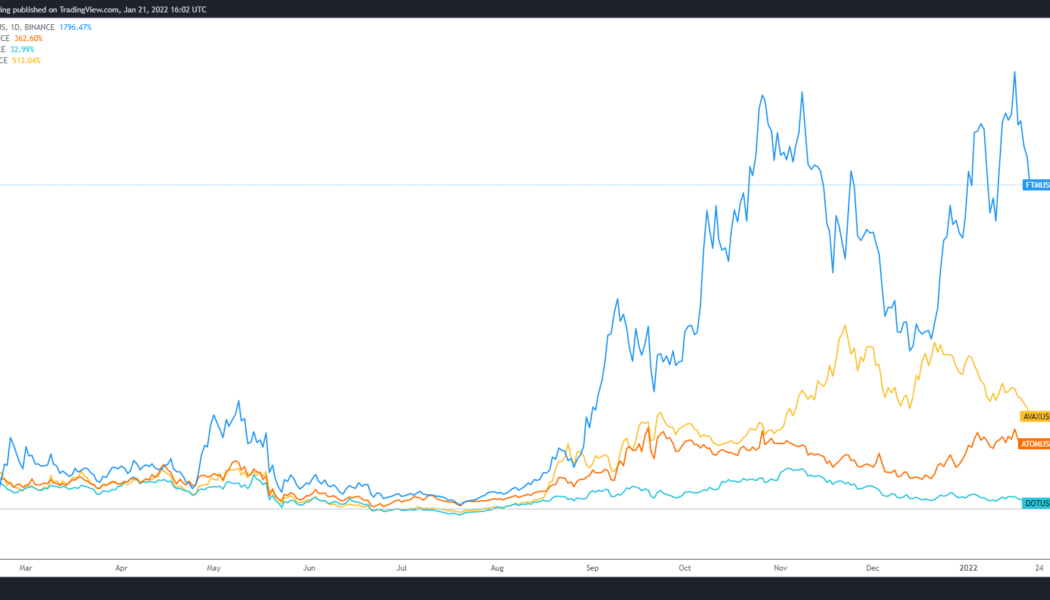

3 possible reasons why Polkadot is playing second fiddle in the L1 race

2021 was a sort of “coming-of-age” for many layer-one (L1) blockchain protocols because the growth of decentralized finance (DeFi) and nonfungible tokens (NFTs) forced users to look for solutions outside of the Ethereum (ETH) network where high fees and network congestion continued to be barriers for many. Protocols like Fantom (FTM), Avalanche (AVAX) and Cosmos (ATOM) saw their token values rise and ecosystems flourished as 2021 came to a close. Meanwhile, popular projects like Polkadot (DOT) underperformed, comparatively speaking, despite the high expectations many had for the sharded multi-chain protocol. FTM/USDT vs. AVAX/USDT vs. ATOM/USDT vs. DOT/USDT daily chart. Source: TradingView Setting aside the specific capability that each protocol offers in terms of transactions ...

Weekly Report: MicroStrategy chief says firm will hold onto Bitcoin stash amid crypto market tumble

The cryptocurrency market has continued bleeding on the second straight day. Bitcoin has sunk further, hitting a six-month low. It is currently trading at around $35,500, 6.28% down on the day. Ether and other altcoins have also haemorrhaged, erasing a chunk of gains from recent rallies. The crash has been attributed to the global stock sell-off and a looming crypto ban in Russia. Here are other top cryptocurrency headlines that you might have missed this week: Singapore’s top financial regulator goes after cryptocurrency ATM operators Cryptocurrency ATM operators in Singapore were on Monday ordered to halt their operations in accordance with recently published guidelines. The issued ‘request’ outlawed crypto businesses from lending services at physical crypto ATMs. Singa...

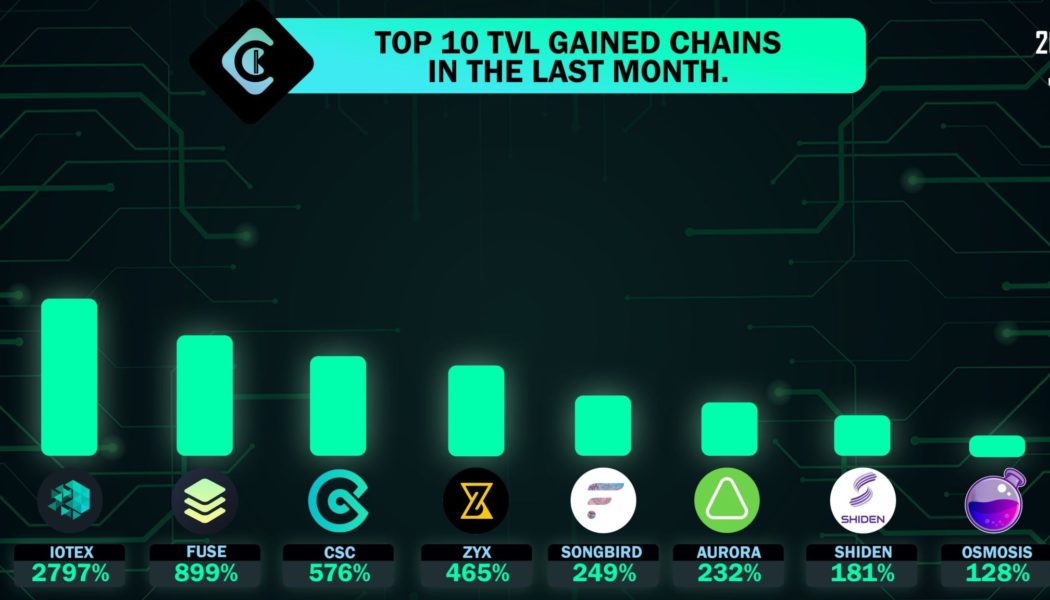

MetisDAO TVL surges by 99,800% as the layer-2 race heats up

Attracting liquidity has become a de facto arms race in the growing decentralized finance (DeFi) landscape. Projects constantly battle to attract investors’ funds by offering enticing yields for crypto holders willing to take a risk and lock up their assets, and protocols use these funds to build out their products and attract attention from larger investors. One protocol that has been gaining traction in the total value locked (TVL) race is MetisDAO, a layer-two rollup platform designed to fully support the application and business migration from Web2 to Web3. Top 10 TVL gainers over the past month. Source: CCK Ventures Alongside the growth in the TVL on its protocol, the METIS token has also received a boost of momentum, with data from Cointelegraph Markets Pro and CoinGecko showin...

Bitcoin falls to $36K, traders say bulls need a ‘Hail Mary’ to avoid a bear market

Bitcoin (BTC) price continues to sell-off and the knock-on effect is an even sharper correction in altcoins and DeFi tokens. At the time of writing, BTC price has sank to its lowest level in 6 months and most analysts are not optimistic about an immediate turn around. Data from Cointelegraph Markets Pro and TradingView shows that a wave of selling that began late in the day on Jan. 20 continued into midday on Friday when BTC hit a low of $36,600. BTC/USDT 1-day chart. Source: TradingView Here’s a check-in with what analysts have to say about the current downturn and what may be in store for the coming weeks. Traders expect consolidation between $38,000 and $43,000 The sudden price drop in BTC has many crypto traders predicting various dire outcomes along the lines of an ext...

Altcoin Roundup: 3 emerging P2E gaming trends to keep an eye on in 2022

Blockchain-based play-to-earn (P2E) gaming had a breakout year in 2021, and as the cryptocurrency ecosystem evolves in 2022, the P2E gaming sector and those that invest in it will need to consider what the next steps are. During bull markets, vaporware, speculation and euphoria can lead to unrealistic valuations and expectations, and this appears to also have impacted the P2E sector. Now that the hype is “over,” investors and developers will need to identify new value propositions that catalyze growth and steady investment into the blockchain gaming sector. Here’s a closer look at some of the trends that could emerge in the P2E ecosystem in 2022. Profit-sharing communities The first trend to keep an eye on in 2022 is projects that are looking to harness interest in nonfungible tokens to cr...

Price analysis 1/21: BTC, ETH, BNB, ADA, SOL, XRP, LUNA, DOT, AVAX, DOGE

Bitcoin (BTC) and most major altcoins continue to witness a bloodbath on Jan. 21 and the result of the most recent downturn has been a $200 billion reduction in market capitalization. A new report by Huobi Research, in collaboration with Blockchain Association Singapore, forecast Bitcoin to enter a bear market in 2022. The liquidity tightening measures undertaken by the U.S. Federal Reserve and other central banks across the world and the regulatory action by authorities could play spoilsport and keep crypto prices under check. Daily cryptocurrency market performance. Source: Coin360 The calls for a bear market have not shaken up the resolve of MicroStrategy CEO Michael Saylor who is determined to hold on to the company’s Bitcoin holdings. Saylor said in a recent interview...