Markets

New week kicks off with marginal dips in the crypto markets

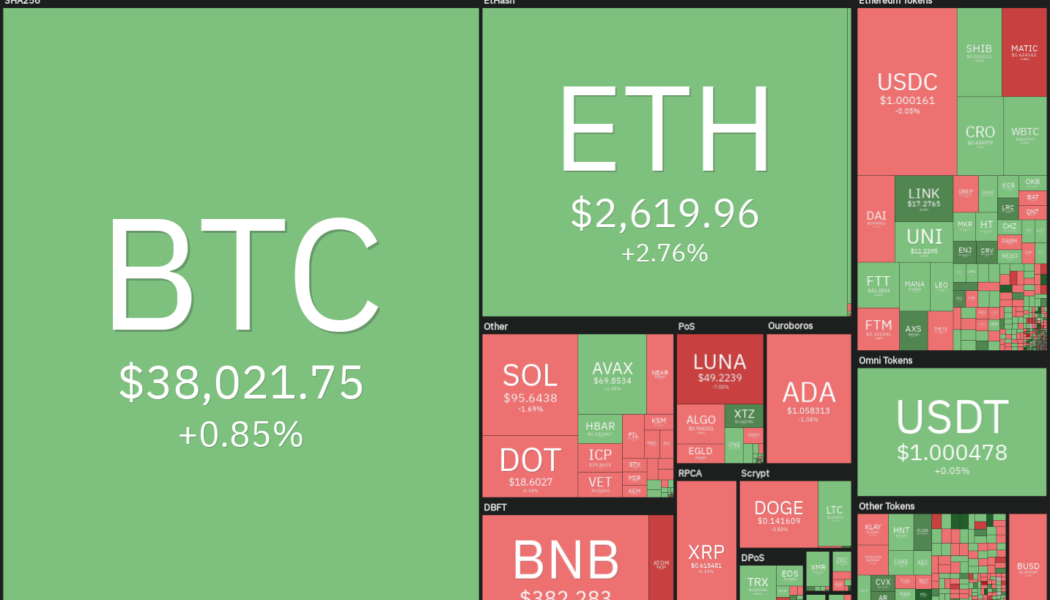

Top crypto assets are down by between 2% and 5% over the last 24 hours. At the time of press, Bitcoin is holding $37,076, and Ethereum $2,544. Terra continues to lose significantly, declining 25% over the last week. The volatility that has plagued crypto markets in January continued into the last week of the month. Market swings sent the prices rocking with major crypto-asset tokens in the red into the start of the new week. Now having a market cap of $705.98 billion according to CoinMarketCap, Bitcoin has plunged 2.6% in the last 24 hours and is currently trading at $36,975. Though the world’s market-commanding digital asset resided north of $38k in bits over the weekend, it has remained inconsistent, and so has Ethereum’s native coin ETH. ETH is currently down 1.85% on the day, but ...

Monthly Report: SEC’s campaign against Bitcoin Spot ETFs continues

January has been a rough month for the cryptocurrency market. Many crypto coins have bled in the last three weeks erasing gains from the broader market rally at the end of last year. Meanwhile, the larger crypto ecosystem has seen several developments this month. However, no direct crypto ETF has been approved in the US and odds for one being given the green light within Q1 of 2022 are long. Here is a breakdown of this and other important headlines in January, from regulations to crowdfunding. The US SEC is yet to approve a Bitcoin spot ETF The SEC’s preference for ETFs that track Bitcoin futures rather than the digital asset itself has remained unchanged. Citing a failure to reach the standards of a surveillance-sharing agreement, the SEC said on January 20th that it would not accep...

Top 5 cryptocurrencies to watch this week: BTC, LINK, HNT, FLOW, ONE

Bitcoin’s (BTC) relief rally rose above $38,500 on Jan. 29, but the bulls are struggling to sustain the higher levels. For the past few days, Bitcoin’s sentiment has closely followed the U.S. equity markets. Hence, analysts warned traders to be careful and not to read much into any possible weekend rallies when traditional markets are closed because it could be a trap. However, analysts at trading suite Decentrader said in a recent report that a “near-term relief bounce” is possible. The report also highlighted that “meaningful buyers” were stepping in and that could result in “a potential change in the higher time frame trend from bearish to bullish.” Crypto market data daily view. Source: Coin360 The recent downturn in Bitcoin seems to have turned the JPMorgan analysts bearish as they be...

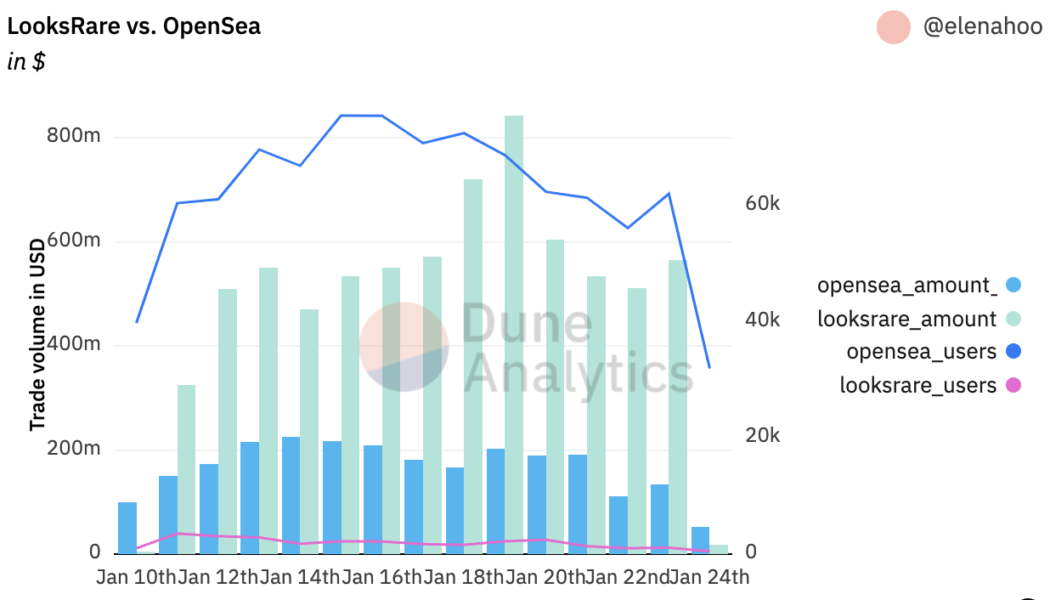

Clever NFT traders exploit crypto’s unregulated landscape by wash trading on LooksRare

LooksRare made its debut on Jan.10 and the recently launched NFT marketplace has drawn a lot of attention, not only because its daily trade volumes were more than double Opensea’s on the second day of trading, but also because it has become the new playground for wash traders. Wash trading is a series of trading activities involving the same trader buying and selling the same instrument simultaneously, creating artificially high trading volume and a manipulated market price for the asset in play. In the United States, wash trading in traditional financial markets has been illegal since 1936 and the most recent highly publicized scandal related to wash trading is the manipulation of LIBOR in 2012. While wash trading has been highly regulated and closely monitored by exchanges and regulators...

Altcoin Roundup: Cross-chain bridge tokens moon as crypto shifts toward interoperability

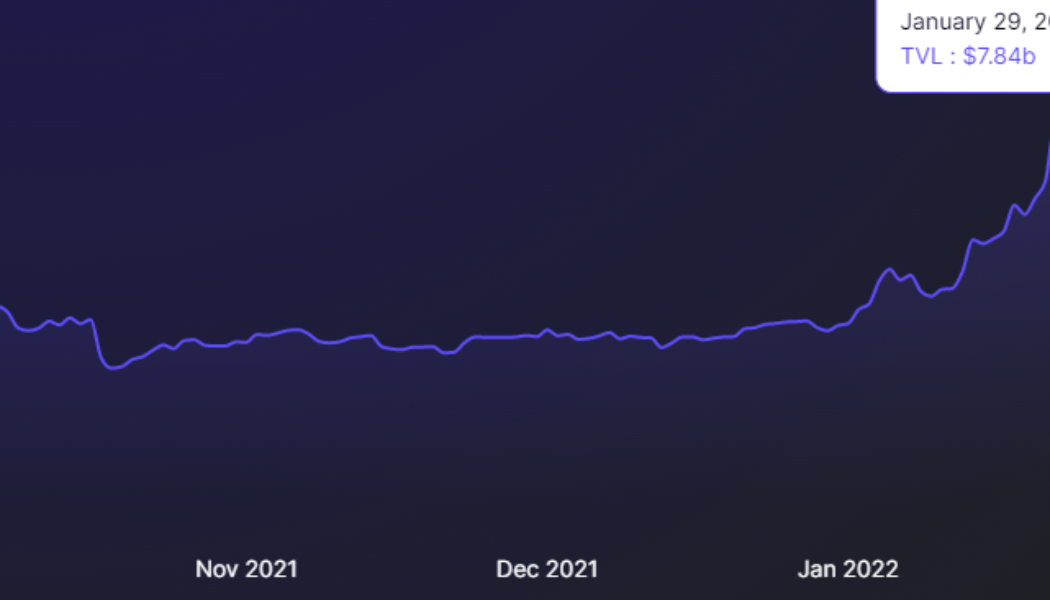

Interoperability is shaping up to be one of the main themes for the cryptocurrency market in 2022 as projects across the ecosystem unveil integrations that make their networks Ethereum (ETH) Virtual Machine (EVM) compatible. While this has been one of the long-term goals of the ecosystem as a step on the path to an interconnected network of protocols, it has also created a new decentralized finance (DeFi) market for multi-chain bridges and decentralized finance. Here are three of the top volume cross-chain bridges that the cryptocurrency community uses to transfer assets between blockchain networks. Multichain Multichain (MULTI), formerly known as Anyswap, is a cross-chain router protocol that aims to become the go-to router for the emerging Web3 ecosystem. According to data from Defi Llam...

Kyber Network (KNC) bucks the market-wide downtrend with a 57% gain in January

In the crypto market volatility continues to reign supreme, and fear, uncertainty and doubt (FUD) run rampant. This makes it challenging for any project to rise above the noise and post positive price gains but there are a few projects that are showing strength during the current downturn. Kyber Network (KNC) is a multi-chain decentralized exchange (DEX) and aggregation platform designed to provide decentralized finance (DeFi) applications and their users with access to liquidity pools that provide the best rates. Data from Cointelegraph Markets Pro and TradingView shows that since hitting a bottom of $1.18 on Jan. 6, the price of KNC has rallied 57% to a daily high at $1.87 on Jan. 27 despite the wider weakness in the crypto market. KNC/USD 4-hour chart. Source: TradingView Three re...

Weekly Report: Crypto markets suffer mid-week blow as SEC bins another Bitcoin ETF proposal

The SEC rejected yet another crypto ETF proposal and punted on two others Reddit follows Twitter in introducing NFT avatar support Thailand regulators are looking to curtail the use of crypto in settling payments US financial markets watchdog is probing top crypto platforms over high-yield crypto products The cryptocurrency sector is reeling from a broad mid-week sell-off triggered by remarks from Fed Chair Jerome Powell on the US monetary policy. Bitcoin lost grip on the $37,000 level earlier today and is currently trading at $36,250. Ethereum has lost 3.15% in the last 24 hours and is swinging around $2,370. Cardano, Solana and Terra native tokens are also down on the day with double-digit losses over the last seven days. Terra’s LUNA has the biggest slump, dipping almost 35% since...

Self-taught prodigy Gal Yosef introduces NFT collection with Eden Gallery support

Gal Yosef is launching the first installment of a series of his own collections Eden has earned global acclaim for its high-end curation of artwork First collection is made up of 12,000 breathtaking eagle avatars. Globally respected digital artist and self-taught prodigy Gal Yosef is launching the first installment of a series of his own collections with the support of Eden Gallery, according to a press release. The gallery, which has earned global acclaim for its high-end curation of artwork, will back Yosef’s Meta Eagle Club NFT collection. A watershed movement for the NFT industry The collaboration between Gal Yosef and Eden Gallery is a critical turning point in the NFT industry because it brings accredited artists to the forefront. Gal Yosef and Eden Gallery will br...

Fed’s latest meeting sends bearish wave – Here’s how top crypto coins stand a day later

The Federal Reserve Chairman confirmed that plans to hike interest rates are coming into play this March. Crypto markets, as well as stocks, reacted, with token prices plunging. At the time of writing, Bitcoin is down 3.15% and Ethereum 5.25%. Following a two-day Federal Open Market Committee (FOMC) meeting that concluded Wednesday, Federal Reserve Chair Jerome Powell issued a press conference to speak on the country’s plans in monetary policy. Powell said the Fed would halt asset purchases by March and also hold off on plans to hike interest rates till then. In the lead up to yesterday’s press conference, the markets were bullish and looked optimistic. Actually, minutes into the press conference, Bitcoin price ascended, clocking a $38,740 peak. However, half an hour into the b...

Ethereum bulls aim to flip $2.8K to support before calling a trend reversal

The dire predictions calling for the onset of an extended bear market may have been premature as prices appear to be in recovery mode on Jan. 26 following a signal from the U.S. Federal Reserve that interest rates will remain near 0% for the time being. After the Fed announcement from, prices across the cryptocurrency market began to rise with Bitcoin (BTC) up 4.11% and making a strong push for $39,000. This sparked a wave of momentum that helped to lift a majority of tokens in the market, but at the time of writing BTC price has pulled back to the $37,000 zone. Data from Cointelegraph Markets Pro and TradingView shows that the top smart contract platform Ethereum (ETH) also responded positively to the rise in bullish sentiment as its price climbed 8.11% on the 24-hour chart to hit a...

Price analysis 1/26: BTC, ETH, BNB, ADA, SOL, XRP, LUNA, DOGE, DOT, AVAX

Bitcoin (BTC) and most major altcoins have bounced off their strong support levels but could the rally sustain to the extent that traders feel confident that a bottom in place? Bloomberg Intelligence senior commodity strategist Mike McGlone said that Bitcoin’s price is “about 30% below its 20-week moving average,” roughly at the same position, which had led to bottom formations in March 2020 and July 2021. Although Bitcoin has corrected sharply in January, the exchanges’ balances dropped from 2.428 million Bitcoin on December 28 to 2.366 million Bitcoin on Jan. 24, according to data from CryptoQuant. This indicates that investors may be stashing away their recent purchases safely. Daily cryptocurrency market performance. Source: Coin360 However, it may not be a V-shaped recovery for ...