Markets

Renewed interest in the Metaverse sends Decentraland (MANA) price 75% higher

The influence of blockchain technology on the ongoing digital revolution cannot be overstated as the rise of the Metaverse and the integration of virtual reality is transforming the way humans interact on a global scale. One project that is beginning to gain traction in its effort to bridge the old world with the new is Decentraland (MANA), a virtual reality (VR) ecosystem built on the Ethereum network that allows users to create, engage with and monetize digital content through a variety of interactive experiences. Data from Cointelegraph Markets Pro and TradingView shows that over the past two weeks, the price of MANA has climbed 70% from a low of $1.70 on Jan. 22 to a daily high of $2.90 on Feb. 1 as the wider crypto market struggled under bearish pressure. MANA/USDT 1-day chart. ...

Winter is coming! Here are 5 ways to survive a crypto bear market

The cryptocurrency market has an interesting way of catching even the most seasoned veterans off guard as each bull and bear market initially shows similarities to previous cycles only to veer off in an unexpected direction and wipe out the fortunes of newly minted crypto millionaires. This was the case with the weak close of 2021 which completely went against the bullish $100,000 BTC price estimates that crypto analysts and influencers were peddling nonstop. Currently, Bitcoin price is more than 50% away from its $69,000 all-time high and altcoins have fared worse, with many down more than 60% in the last 2 months. In times like these, traders need to regroup and re-evaluate their investment strategy, rather than just buying every price dip. Here are five strategies traders can use ...

3 reasons why Telos (TLOS) price hit a new all-time high

It seems crypto winter is upon us and during times like these, projects that continue to forge ahead by focusing on development and expansion are often rewarded by traders who are looking to set up long positions where strong fundamentals trump the absence of short-term gains. One project that has weathered the storm in the crypto markets to establish a new all-time high is Telos (TLOS), a blockchain network created with the EOSIO software that aims to bring speed and scalability to smart contracts for decentralized finance (DeFi), nonfungible tokens (NFTs), gaming and social media. Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $0.42 on Jan. 10, the price of TLOS has soared 229% to a new high of $1.39 thanks in part to a record-high trading volume of...

Bitcoin price dips below $37K as a descending channel pattern comes back into play

The crypto market is once again in the red on Feb. 2 as global financial markets continue to see increased volatility. Data from Cointelegraph Markets Pro and TradingView shows that after spending the morning hovering around $38,200, BTC was hit with a wave of selling that pushed the price to $36,800. BTC/USDT 1-day chart. Source: TradingView Here is what several analysts and traders are saying about Wednesday’s Bitcoin price action and what areas to keep an eye on moving forward. Bulls are in trouble below $36,700 Insight into the major support and resistance zones of note for Bitcoin was provided by crypto trader and pseudonymous Twitter user ‘HornHairs’, who posted the following chart indicating a solid level of support near $37,400. BTC/USDT 1-hour chart. Source: Twitter Ac...

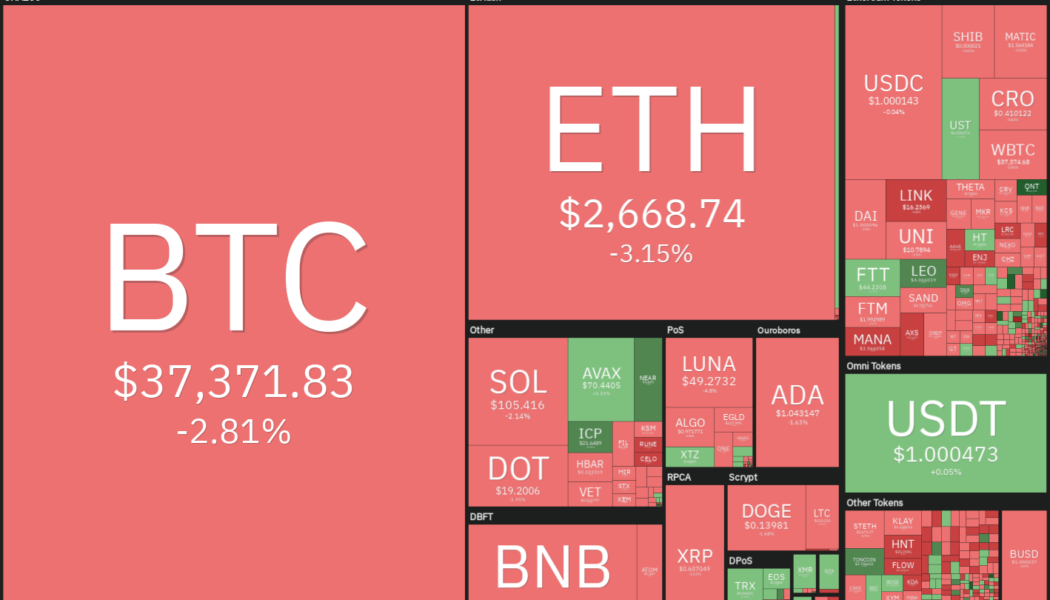

Price analysis 2/2: BTC, ETH, BNB, ADA, SOL, XRP, LUNA, DOGE, DOT, AVAX

Bitcoin (BTC) rose above $39,000 on Feb. 1 but the sharp fall in the shares of PayPal may have resulted in aggressive selling by the short-term traders. However, in the long-term, large investors seem to be viewing the decline as a buying opportunity. On-chain monitoring resource Whalemap said that whales holding between 100 to 10,000 BTC have accumulated during the recent decline. Fidelity recently released a paper dubbed “Bitcoin First,” which highlights that Bitcoin is the most “secure, decentralized form of asset” and is unlikely to be overtaken by any of the altcoins “as a monetary good.” The report said that Bitcoin combines “the scarcity and durability of gold with the ease of use, storage and transportability of fiat.” Daily cryptocurrency market performance. Source: Coin360 I...

MicroStrategy reveals it completed another BTC purchase worth about $25 million

MicroStrategy’s appetite for Bitcoin remains high as ever as it has continued accumulating more of the cryptocurrency The company’s executives have previously remarked that the company doesn’t intend to stop buying or to sell The Virginia-based business intelligence firm on Tuesday revealed that it completed another bitcoin purchase worth 25 million across January. A filing with the US Securities and Exchange Commission showed that the NASDAQ-listed company acquired 660 bitcoins last month at an average price of $37,865 inclusive of additional expenses. The January purchase is however significantly smaller than previous purchases the company has made. For context, the company bought 7,002 bitcoins between October and the end of November. Prior to that, it had made it’s a smaller ...

Market wrap: Circle’s USDC stablecoin market dominance rising as that of Tether diminishes

Circle’s USDC, which is the world’s second-largest stablecoin by market cap, is steadily growing and it is eroding the dominance of Tether (USDT), which is currently the largest stablecoin by market cap. Circle’s share of the stablecoin market stands at about 30% after hitting the 50 billion circulation USDC milestone. The shifting stablecoin landscape As the dynamic of the stablecoin landscape constantly shifts, one trend is very clear, and that is the diminishing Tether dominance. Circle, which is Tether’s main rival, reached 50 billion USDC coins in circulation today. Tether’s co-founder and CEO Jeremy Allaire tweeted saying: 50 BILLION USDC (w/ thread below) pic.twitter.com/5FEaPmXjup — Jeremy Allaire (@jerallaire) February 1, 2022 Allaire also added: “It’s the massive growth and ecosy...

El Salvador President affirms Bitcoin price surge is inevitable

Nayib Bukele believes that the price of Bitcoin will soon rocket El Salvador’s Minister of Finance has responded to the IMF’s demands to drop Bitcoin as a legal currency El Salvador President Nayib Bukele has once again publicly expressed his bullish view on Bitcoin, predicting that in “just a matter of time,” the crypto asset would see enormous gains in price. Scarcity to fuel Bitcoin price uptrend Yesterday, Bukele posited that Bitcoin’s maximum supply of 21 million coins might not be adequate to serve the demand as adoption rises. He anticipates that Bitcoin’s increased adoption and scarcity would be a catalyst for the predicted upthrust. “There are more than 50 million millionaires in the world. Imagine when each one of them decides they s...

Can Ethereum price reach $4K after a triple-support bounce?

Ethereum’s native token Ether (ETH) looks ready to continue its ongoing rebound move toward $4,000, according to a technical setup shared by independent market analyst Wolf. Classic bullish reversal pattern in the works? The pseudonymous chart analyst discussed the role of at least three support levels in pushing the ETH price up by nearly 30% from its local bottom of $2,160. These price floors included a 21-month exponential moving average, the 0.786 Fib level of a Fibonacci retracement graph drawn from $1,716-swing low to $4,772-swing high, and the lower boundary of an ascending triangle pattern. ETH/USD daily price chart featuring the three-supports. Source: TradingView Wolf noted that the triple-support scenario could push Ether price to $3,330. In doing so, ...