Markets

Weekly Report: Ether price could pull back to $1,700 as per Bloomberg’s February Crypto Report

Bloomberg analysts predict Ether to retreat to $1,700 before surging again Bybit exchange has announced a partnership with Cabital to bring more on-ramp integrations Canadian lawmaker tables bill to promote the growth of the cryptocurrency industry The cryptocurrency sector saw it all in the second week of February – from volatility in the market to major partnerships within the industry. Here is a rundown of the major stories that you might have missed Bloomberg analysts foresee Ethereum sliding back to $1,700 As markets struggle to recover from the January dump, Ethereum could not yet be out of the woods. A team of Bloomberg analysts has predicted that the second-largest crypto asset is likely to crash to $1,700, though the fundamentals are expected to remain unaffected. The Crypto Outlo...

Top 5 cryptocurrencies to watch this week: BTC, XRP, CRO, FTT, THETA

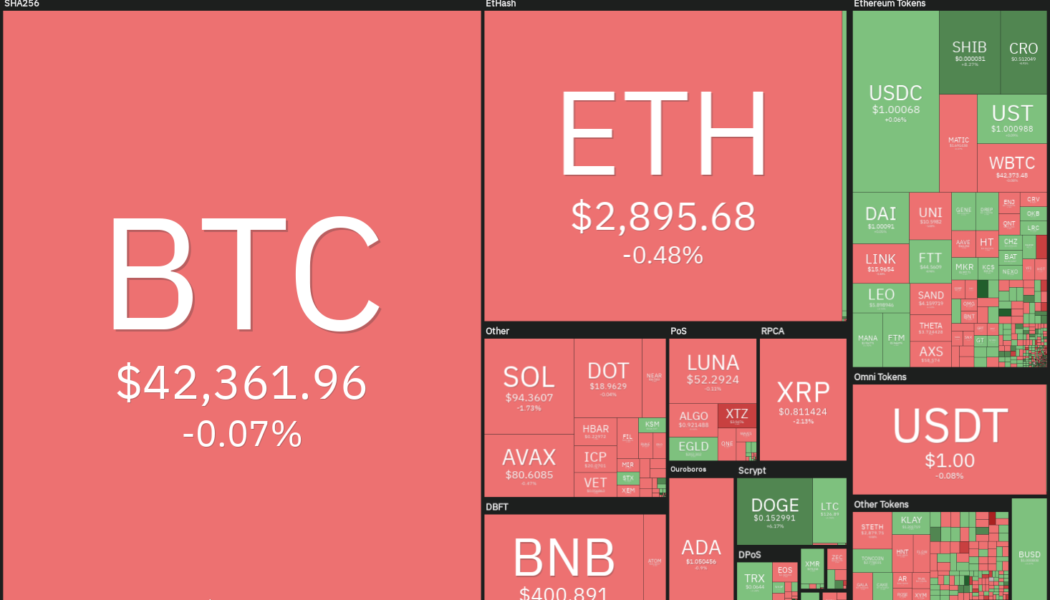

Bitcoin (BTC) has given back some of its recent gains, but on-chain data resource Ecoinometrics said that whales are accumulating because they believe the price is attractive from a long-term perspective. On the downside, analyst Willy Woo believes that $33,000 is a strong bottom for Bitcoin. Popular Twitter trader Credible Crypto citing data from PlanC said that the odds of Bitcoin declining below $30,000 are poor. Crypto market data daily view. Source: Coin360 Fidelity Digital Assets Head of Research Chris Kuiper believes that Bitcoin’s downside risk could be minimal when compared to other digital assets, but it could rally substantially if it manages to replace gold as a store of value. Could Bitcoin and altcoins stage a recovery after the recent pullback? Let’s study th...

Injective Protocol (INJ) rallies 100%+ after launching cross-chain support for Cosmos

Trading perpetual futures contracts in decentralized apps is a crypto sub-sector ripe for growth, especially as discussions of regulation, taxation and mandatory KYC at centralized exchanges continue to take place. One DEX platform that has begun to gain traction is Injective (INJ), an interoperable layer-one protocol designed to facilitate the creation of cross-chain Web3 decentralized finance (DeFi) applications. Data from Cointelegraph Markets Pro and TradingView shows that after hitting a low of $3.91 on Feb. 3, the price of INJ has rallied 157.8% to a daily high of $10.08 on Feb. 11 amidst a 1,756% spike in its 24-hour trading volume to $306 million. INJ/USDT 1-day chart. Source: TradingView Three reasons for the spike in demand for INJ include the addition of support for new assets i...

2 key indicators cast doubt on the strength of the current crypto market recovery

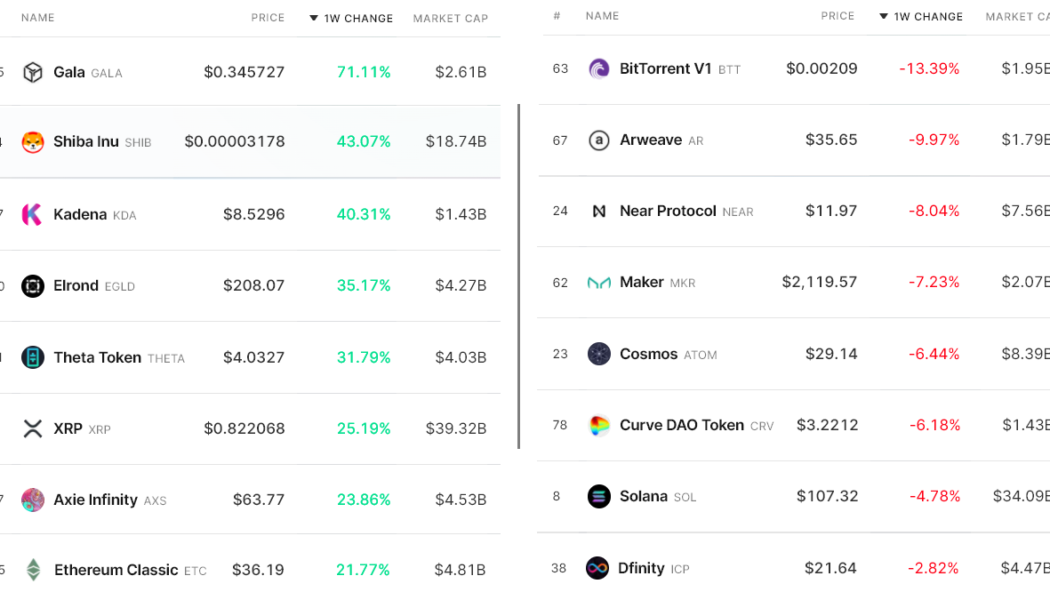

Analyzing the aggregate cryptocurrency market performance over the past 7 days could give investors the impression that the total market capitalization grew by a mere 4% to $2.03 trillion, but this data is heavily impacted by the top 5 coins, which happen to include two stablecoins. Excluding Bitcoin (BTC), Ether (ETH), Binance Coin (BNB) and stablecoins reflects a 9.3% market capitalization increase to $418 billion from $382 billion on Feb 4. This explains why so many of the top-80 altcoins hiked 25% or more while very few presented a negative performance. Winners and losers among the top-80 coins. Source: Nomics Gala Games (GALA) announced on Feb. 9 a partnership with world renowned hip-hop star Snoop Dogg to launch his new album and exclusive non-fungible token (NFT) campaign. Gala Game...

Polygon price risks 50% drop as MATIC paints inverted cup and handle pattern

Polygon (MATIC) has dropped by more than 40% from its record high of $2.92, established on Dec. 27, 2021. But if a classic technical indicator is to be believed, the token has more room to drop in the sessions ahead. MATIC price chart painting classic bearish pattern MATIC’s recent rollover from bullish to bearish, followed by a rebound to the upside, has led to the formation of what appears like an inverted cup and handle pattern — a large crescent shape followed by a less extreme upside retracement, as shown in the chart below. MATIC/USD three-day price chart featuring inverted cup and handle pattern. Source: TradingView In a “perfect” scenario, inverted cup and handle setups set the stage for a downturn ahead. As they do, the price tends to fall towards levels tha...

DeFi flashes early revival signs as retail and institutional inflows trickle in

Decentralized finance (DeFi) has had a rough go so far in 2022, and data from Messari shows the top ten-ranked DeFi assets currently down between 10% to 50% since the start of the year. Top ten DeFi tokens by market capitalization. Source: Messari A positive is, the situation may change soon as funds have began to flow back into the DeFi ecosystem following a month of declines as data shows institutional and retail funds returning to crypto markets. Data from Defi Llama shows that the total value locked in all of DeFi platforms has climbed to $211.1 billion on Feb. 11, up from a low of $185.14 billion on Jan. 31 Total value locked in DeFi. Source: Defi Llama A closer look at the individual protocols that contribute to the total TVL shows that the biggest drawdowns in TVL over the past 30 d...

DeFi flashes early revival signs as retail and institutional inflows trickle in

Decentralized finance (DeFi) has had a rough go so far in 2022, and data from Messari shows the top ten-ranked DeFi assets currently down between 10% to 50% since the start of the year. Top ten DeFi tokens by market capitalization. Source: Messari A positive is, the situation may change soon as funds have began to flow back into the DeFi ecosystem following a month of declines as data shows institutional and retail funds returning to crypto markets. Data from Defi Llama shows that the total value locked in all of DeFi platforms has climbed to $211.1 billion on Feb. 11, up from a low of $185.14 billion on Jan. 31 Total value locked in DeFi. Source: Defi Llama A closer look at the individual protocols that contribute to the total TVL shows that the biggest drawdowns in TVL over the past 30 d...

Analysts say Bitcoin price is in the ‘profit-taking’ zone with a ceiling at $45K

The price action for Bitcoin (BTC) continues to tantalize investors and once again, concerns over the state of the global economy and rising inflation have prompted warnings that the Fed’s upcoming interest rate hikes could do more damage then good to the state of the market. Data from Cointelegraph Markets Pro and TradingView shows that the price of BTC has hovered near the $43,000 support level in trading on Feb. 11 after rallying 20% from the $37,000 leve over the past week. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what analysts expect next for BTC and the wider cryptocurrency market. “Expecting a move to $40,000” Insight into the bullish and bearish scenarios related to Bitcoin price was offered by crypto trader and pseudonymous Twitter analyst ‘Crypto_Ed_NL’, w...

Analysts say Bitcoin price is in the ‘profit-taking’ zone with a ceiling at $45K

The price action for Bitcoin (BTC) continues to tantalize investors and once again, concerns over the state of the global economy and rising inflation have prompted warnings that the Fed’s upcoming interest rate hikes could do more damage then good to the state of the market. Data from Cointelegraph Markets Pro and TradingView shows that the price of BTC has hovered near the $43,000 support level in trading on Feb. 11 after rallying 20% from the $37,000 leve over the past week. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what analysts expect next for BTC and the wider cryptocurrency market. “Expecting a move to $40,000” Insight into the bullish and bearish scenarios related to Bitcoin price was offered by crypto trader and pseudonymous Twitter analyst ‘Crypto_Ed_NL’, w...

Unique PoS blockchain Concordium launches token on two leading exchanges

Concordium has officially listed CCD, its native token, on major crypto exchanges Bitfinex and BitGlobal, Invezz learned from a press release. Trading of the public, proof-of-stake blockchain’s token opens on February 10 and 11. CCD token trading will first start on Bitfinex. It opens at 10:00 AM CET today. On BitGlobal, trading will open same time tomorrow. About Bitfinex Bitfinex was established a decade ago, making it one of the first cryptocurrency exchanges. It offers a suite of diverse, highly advanced trading features, unparalleled support level, and high quality charting tools. About BitGlobal BitGlobal offers security mechanisms on par with the highest international standards and a user-friendly digital asset ecosystem with increased liquidity. The exchange aims to make it ...

Report indicates BlackRock plans to bring crypto trading support

The New York-based investment management company will allow its clients to trade crypto assets via its Aladdin platform Some of the moves the firm has made in recent days have been an indication of its interest in the cryptocurrency sector BlackRock, the world’s largest asset management firm, is looking to provide crypto trading services based on a report from CoinDesk that cited three unnamed parties in the know. One source, as CoinDesk detailed, said that the asset manager would leverage its Aladdin investment platform to support the same. The proprietary platform’s name is a contraction of Asset, Liability, Debt and Derivative Investment Network. The firm, which had $10 trillion worth of assets under management as of last month, will also debut a credit facility alongside th...

Alchemy Pay gains 77% after exchange listings and cross-chain integrations

The cryptocurrency ecosystem has come a long way since the launch of Bitcoin (BTC) and in the last few years smart contracts have revolutionized the industry. With that said, there is still plenty of progress to be made when it comes to integrating blockchain technology to peer-to-peer, business to business and business to consumer payment systems. Alchemy Pay aims to further the adoption of cryptocurrencies through its hybrid payments system and in the last week its ACH token gained 77% to trade at $0.0625 on Feb. 9. ACH/USDT 4-hour chart. Source: TradingView Three reasons for the uptick in ACH price include the cross-chain launch of ACH on the Binance Smart Chain (BSC), multiple new exchange listings that have helped expand access to the token and the integration of Alchemy Pay wit...