Markets

API3 price gains 55% after new partnerships and exchange listings attract investors

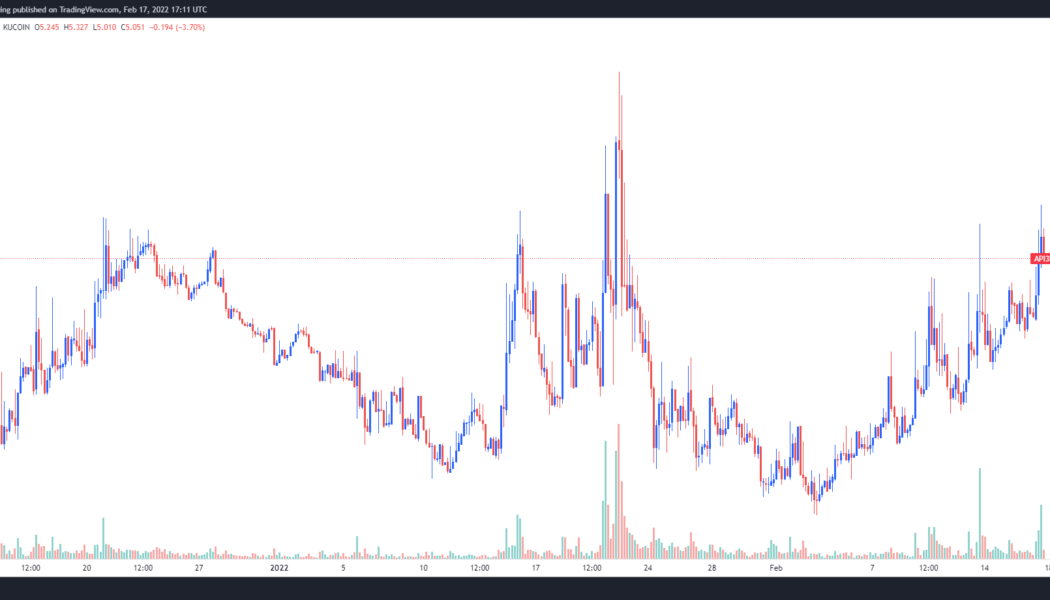

In the emerging Web3 world, data is the most valuable commodity, and oracle solutions provide a valuable role in facilitating the accurate and secure transmission of data between blockchains and data sources. One project that is taking a different approach to developing oracles is API3 (API3), a project which harnesses application programming interfaces (APIs) to create first-party oracles through the use of decentralized APIs capable of broadcasting data directly to blockchain networks. Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $3.22 on Feb. 3 the price of API3 climbed 72% to reach a daily high of $5.55 on Feb. 17 as the wider cryptocurrency corrected after news of Russia escalating it’s incursion into Ukraine made waves in the news....

KuCoin partners with Chingari to attract talent across India

Leading crypto exchange KuCoin has partnered with video sharing app Chingari to launch the Chingari Star Contest, giving users a chance to win $GARI tokens worth INR 20 million, CoinText learned from a press release. The Chingari Star Contest was launched on February 15, 2022. It will continue for one month and the biggest winners will go home with huge prizes. Identifying talent across India The Star Contest seeks to identify talents from the remotest corners of the country and promote them. It is open to current and potential new users. The partnership with KuCoin helps attract attention to the app and opens up the contest to a wider market base and audience. Sumit Ghosh, CEO and co-founder of Chingari commented that his team hopes the contest will bring out the best in content cre...

NEO price climbs after China’s BSN gives the project the green light on NFT marketplaces

As the field of viable layer-1 blockchain protocols continues to expand, with newer entrants trying to solve the issue of high transaction costs and slow processing times, older projects find themselves utilizing their history and track record to set themselves apart and secure a market share that will ensure their survival through the next market cycle. Neo (NEO) fits the bill described above, and the project is attempting to stage a revival in 2022 as governments around the world slowly open to the fact that blockchains and digital currencies have certain benefits and capabilities that can be integrated into public and private enterprise. Data from Cointelegraph Markets Pro and TradingView shows that the price of NEO has climbed 60%, since hitting a low of $16.10 on Jan. 24, to hit...

Bitcoin price is ‘likely starting the next push up’ if $42K holds as support

The cryptocurrency market remains in a state of flux as investors are once again focused on what steps the U.S. Federal Reserve might take to combat rising inflation and markets wobble as the situation in Ukraine remains tense. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin (BTC) has hovered around the $44,000 support level and traders are hopeful that an inverse head and shoulders chart pattern will lead to a sustained bullish breakout. BTC/USDT 1-day chart. Source: TradingView Here’s a survey of what several analysts in the market are keeping an eye on moving forward as global issues from inflation to war continue to make their presence felt in the cryptocurrency market. On-Balance Volume shows a bullish reversal Insight into what may lie ahead for Bi...

Binance Chain, Binance Smart Chain morph into BNB Chain

Binance has renamed its blockchain ecosystem to reflect changes the chain has undergone since its launch The exchange also introduced ‘MetaFi’, an amalgamation of cutting-edge DeFi infrastructure and projects, including the metaverse. The world’s largest crypto exchange Binance has rebranded its Binance Chain and Binance Smart Chain blockchains into a single unified name; BNB Chain, or Build and Build Chain. The new name is expected to take a more prominent role in the blockchain’s branding. According to an announcement made on Tuesday, Binance said the BNB Chain shows the evolution of the Binance Smart Chain. The ‘new’ name would represent the crypto exchange’s governance and staking platform BNB Beacon Chain (previously Binance Chain) and its Eth...

Traders say $4,000 Ethereum back on the cards ‘if’ this bullish chart pattern plays out

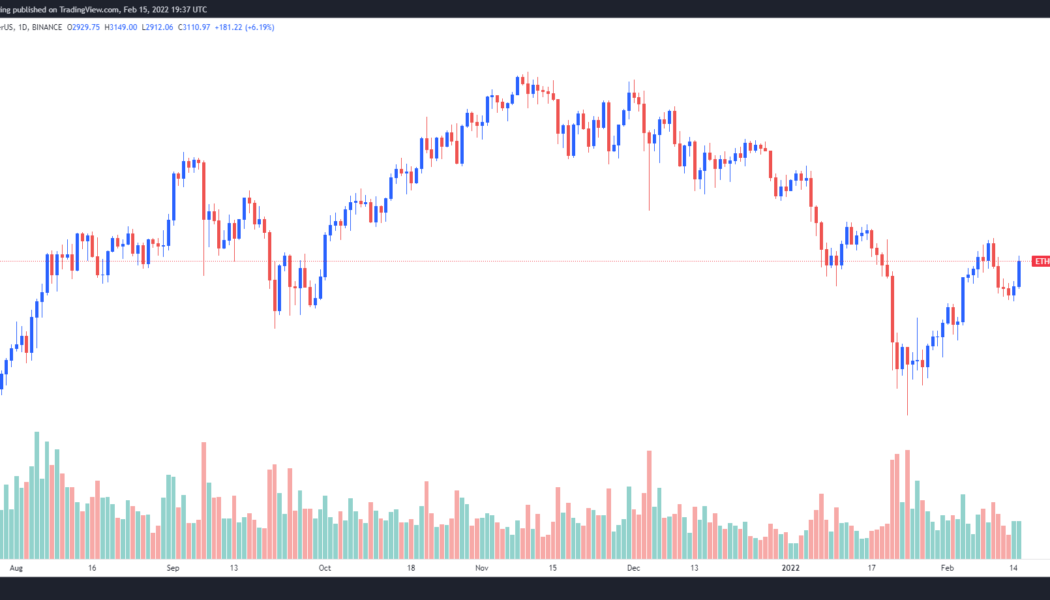

Global and macroeconomic concerns ranging from rising inflation rates in the United States to the prospect of Russia invading Ukraine continue to spark volatility in financial markets. To the surprise of many analysts, the mood in the cryptocurrency market shifted in a positive direction on Feb. 15 after Bitcoin (BTC) climbed to $44,500 and Ether (ETH) regained support at $3,100. Data from Cointelegraph Markets Pro and TradingView shows that after bouncing off a low of $2,826 in the early trading hours on Feb. 15, the price of Ether rallied 11.4% to a daily high of $3,148. ETH/USDT 4-hour chart. Source: TradingView Here’s a look at what several traders in the market are saying about the recent price action for Ether and what to be on the lookout for in the weeks ahead. Ether is in a heavy ...

Grayscale Bitcoin ETF proposal sees support from the public

The US Securities and Exchange Commission (SEC) made a provision for comments from the people on the subject of Grayscale converting its BTC Trust into a spot ETF The financial watchdog has in the past publicly shown inclination towards indirect crypto ETFs as opposed to spot ETFs Earlier this month, the SEC shared its concerns on the Grayscale Bitcoin Trust exchange-traded fund (ETF) conversion proposal – mostly revolving around manipulation, fraud and investor protection. The commission also expressed its uncertainty over the propriety of Bitcoin as the underlying asset, asking the public to give its views on the same. The agency set a 21-day window for providing the comments and 14 days for replies to the shared view. The US markets regulator has since received many comments regarding t...

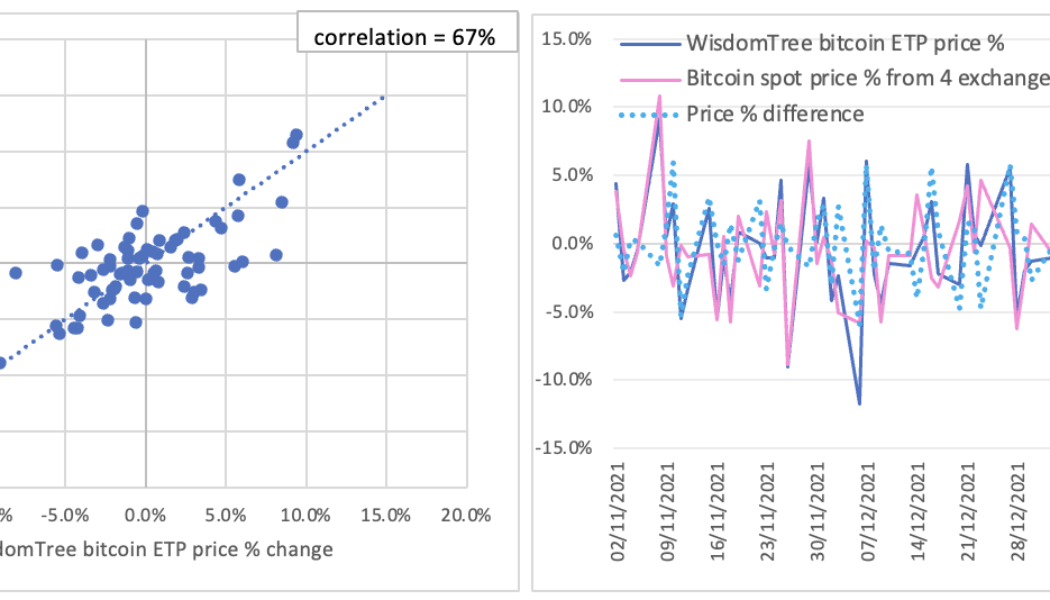

Here’s why the SEC keeps rejecting spot Bitcoin ETF applications

It is not the first time the U.S. Securities and Exchange Commission (SEC) rejected proposals for a Bitcoin spot exchange traded product (ETP), but efforts continue to be made by different financial institutions. The recent attempt made by Cboe BZX Exchange on Jan. 25 to list the Fidelity Wise Origin Bitcoin Trust as a Bitcoin ETP has also failed. The SEC letter published on Feb. 8 pointed out that the exchange has not met its burden to demonstrate the fund is “designed to prevent fraudulent and manipulative acts” and “to protect investors and the public interest”. Although proposals of Bitcoin spot ETPs have never been approved by the SEC and such products are not available in the U.S. market, they do exist in the European market. By investigating the prices of these ETPs traded in ...

India’s social media giant Chingari debuts an in-app crypto wallet

Chingari, the TikTok rival that launched its native $GARI token last month, is bringing more integrations onboard The giant social media platform has debuted its integrated-token wallet and plans to unveil an NFT marketplace soon India’s short video platform, Chingari, has revealed it is integrating its native $GARI token and an associated Solana wallet into the social media app. The $GARI token had already launched to 500 community members in the beta testnet at the end of last year. This was followed by the token debut on the global stage to international traders last month. Growth through incentivising content Chingari hopes to foster an expanding in-app economy which would open many innovative doors on the social media platform. Users can withdraw or deposit tokens effortlessly v...

LooksRare official explains reason behind the recent cash-out

The LooksRare team on Monday confirmed it had received in excess of $30 million in rewards The report and explanation provided raised split opinions within the LooksRare community The team behind NFT marketplace LooksRare has revealed that it cashed out $30 million in ETH, much to the community’s disapproval. One member of the team elucidated that the earnings the team received have never been secret, providing details to prove so. The team member, Zodd, said that the funds were directed to more than ten team members. He explained that to keep the project afloat, the contributors worked around the clock for more than six months without any remuneration until their first WETH earnings came through. He added that the members collectively incurred up to 7 figure pre-launch costs. “...

Bitcoin price consolidates in critical ‘make or break’ zone as bulls defend $42K

The waiting game continues for crypto traders after Bitcoin (BTC) is once again pinned below resistance at $43,000 and awaiting some spark in momentum that can sustain a rally back to the $50,000 range. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin has traded in a range between $41,500 and $43,000 over the past couple of days and with tensions between Ukraine and Russia escalating, many traders are less than optimistic about Bitcoin’s short-term prospects. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what analysts are saying about their short-term expectations for Bitcoin price. Is Bitcoin on a path to zero? Well-known cryptocurrency perma-bear Peter Schiff made sure to chime in on the latest struggles for Bitcoin by post...

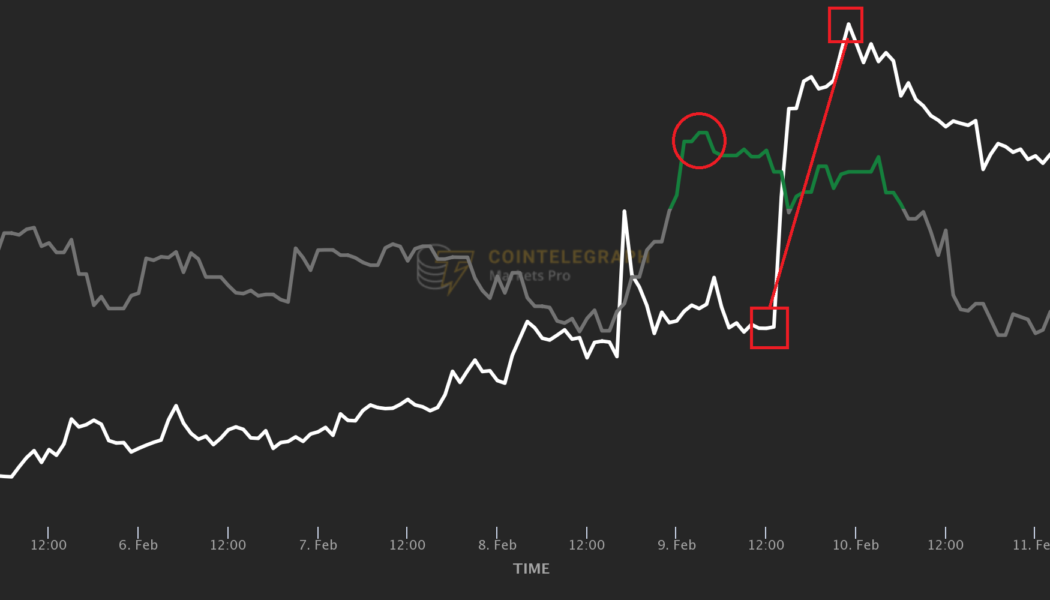

Here’s how traders got alerted to some of the biggest rallies of this week’s resurging market

This crypto winter wasn’t a very long one. Having briefly touched $34,000 in the second half of January, Bitcoin (BTC) is on its way up again, touching the $45,000 mark on Feb. 10. Many altcoins have been catching up as well and posting double-digit weekly returns. However, not all relief rallies were equally impressive. Is there a way for traders to pick the assets that are about to pull off the strongest rebounds? Luckily, bullish marketwide reversals tend to look similar in terms of both price movement and other variables that shape market activity: rising trading volumes, spikes of online attention to individual tokens, and the elevated sentiment of social media chatter around them. Furthermore, the conditions that underlie individual assets’ rallies in a resurging crypto market often ...