Markets

Bitcoin bears beware! BTC holds $17K as support while the S&P 500 drops 1.5%

Bitcoin (BTC) bulls regained some control on Nov. 30 and they were successful in keeping BTC price above $16,800 for the past 5 days. While the level is lower than traders’ desired $19,000 to $20,000 target, the 8.6% gain since the Nov. 21, $15,500 low provides enough cushioning for eventual negative price surprises. One of these instances is the United States stock market trading down 1.5% on Dec. 5 after a stronger-than-expected reading of November ISM Services fueled concerns that the U.S. Federal Reserve (FED) will continue hiking interest rates. At the September meeting, FED Chairman Jerome Powell indicated that the point of keeping interest rates flat “will need to be somewhat higher.” Currently, the macroeconomic headwinds remain unfavorable and this is likely to remain ...

Bitcoin price consolidation could give way to gains in TON, APE, TWT and AAVE

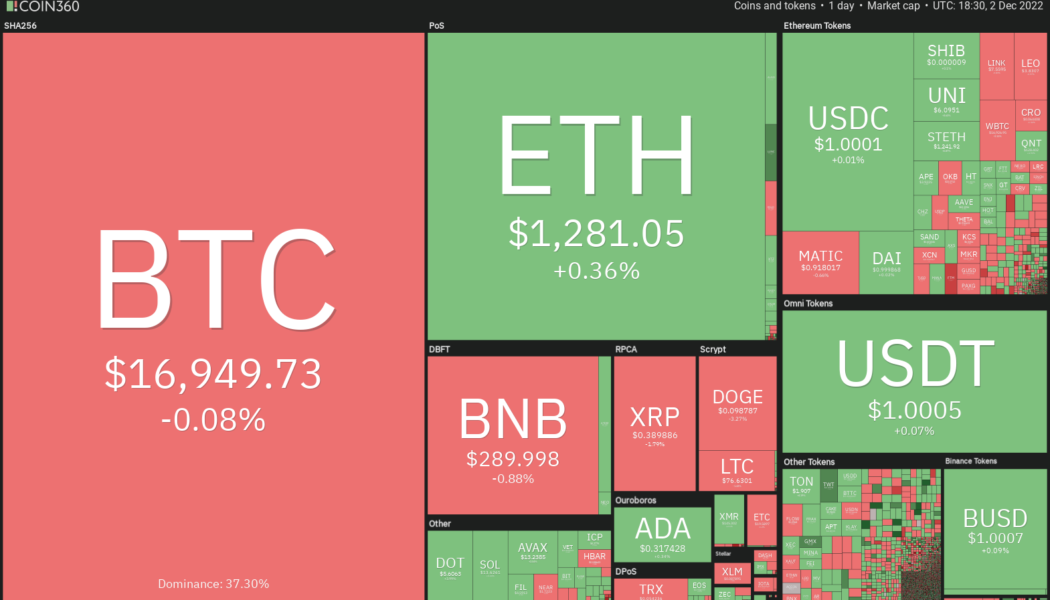

The United States equities markets shrugged off the hotter-than-expected labor data on Dec. 2 and recovered sharply from their intraday low. This suggests that market observers believe the Federal Reserve may not change its stance of slowing the pace of rate hikes because of the latest jobs data. Although the FTX crisis broke the positive correlation between the U.S. equities markets and Bitcoin (BTC), the recent strength in equities shows a risk-on sentiment. This could be favorable for the cryptocurrency space and may attract dip buyers. Crypto market data daily view. Source: Coin360 The broader crypto recovery may pick up steam after more clarity emerges on the extent of damage caused by FTX’s collapse. Until then, bullish price action may be limited to select cryptocurrencies. Let’s lo...

Price analysis 12/2: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, DOT, LTC, UNI

Non-farm payrolls in the United States rose by 263,000 in November, exceeding economists’ expectations of an increase of 200,000. Analysts believe that the numbers remain hot and do not allow much scope for the Federal Reserve to slow down its aggressive rate hikes. This is contrary to Fed Chair Jerome Powell’s remarks delivered at the Brookings Institution where he said that the central bank could reduce the pace of rate hikes “as soon as December.” That triggered a sharp rally in risk assets. After the latest jobs report, the market participants will closely watch the Fed’s comments and decision in its Dec. 13 and Dec.14 meeting. Daily cryptocurrency market performance. Source: Coin360 The Fed’s decision may also affect Bitcoin (BTC), which remains in a firm bear grip. Co...

Eco-friendly Bitcoin mining pool PEGA Pool set for public launch in Q1 2023

PEGA Pool, a Bitcoin mining pool that will allow ASIC miners to connect and cooperate in mining bitcoin, is set for public launch in Q1 2023. The mining pool is currently in the pre-launch phase. KEY TAKEAWAYS PEGA Pool is a Bitcoin mining pool. ASIC miners will be able to connect to the pool and cooperate in Bitcoin mining. PEGA Pool is currently in the pre-launch phase and will be open to public launch in Q1 2023. Those interested in mining bitcoin using the pool can join the early access waiting list. At the moment, the only clients mining bitcoin with PEGA Pool are a few beta testers and PEGA Mining, which is a sister company to PEGA Pool. PEGA Pool features PEGA Pool stands out since it is British-owned and operated in an era when most mining pools are Chinese. This makes PEGA Pool mo...

DeFi sparks new investments despite turbulent market: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. The prolonged crypto winter aided by the collapse of FTX has kept investors from backing a new protocol that merges DeFi and the foreign exchange market. A new Cosmos blockchain-based DeFi protocol has caught the eyes of investors who have put $10 million behind the project. Cardano-based leading stablecoin ecosystem Ardana abruptly stopped its development after several launch delays. However, the project remains open-source for others to add to it until they restart the development process. Aave community has now proposed a governance change after a failed $60 million short attack. The short attack was later trac...

Price analysis 11/25: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, DOT, LTC, UNI

FTX’s collapse dealt a major blow to the already fragile sentiment among cryptocurrency investors. Although a quick recovery is unlikely, Blockchain analysis firm Chainalysis said that the crypto universe could emerge stronger from this crisis. Chainalysis’ research lead Eric Jardine arrived at the conclusion after comparing FTX’s fall to that of Mt. Gox. Another calming statement came from Bloomberg Intelligence exchange-traded fund analyst James Seyffart, who said that there was a “99.9% chance” that the Grayscale Bitcoin Trust (GBTC) held the Bitcoin (BTC) it claimed. He added that GBTC was “unlikely” to be liquidated. Daily cryptocurrency market performance. Source: Coin360 The negative events of the past few days do not seem to have scared away the small investors who remain on an acc...

How bad is the current state of crypto? On-chain analyst explains

Despite the market downturn and the widespread negative sentiment in the industry in the wake of the FTX collapse, on-chain data still show reasons to be bullish on Bitcoin (BTC). As pointed out by on-chain analyst Will Clemente, it’s enough to look at the positions of long-term holders, which reached an all-time high despite their profitability being at an all-time low. “Long-term holders buy heavily into the bear market. They set the floor, […] and then those long-term holders distribute their holdings to new market participants in the bull market,” he told Cointelegraph in an exclusive interview. Another positive trend worth noticing after the FTX collapse, in Clemente’s opinion, is that the average crypto user is increasingly turning away from exchanges and taking self-cust...

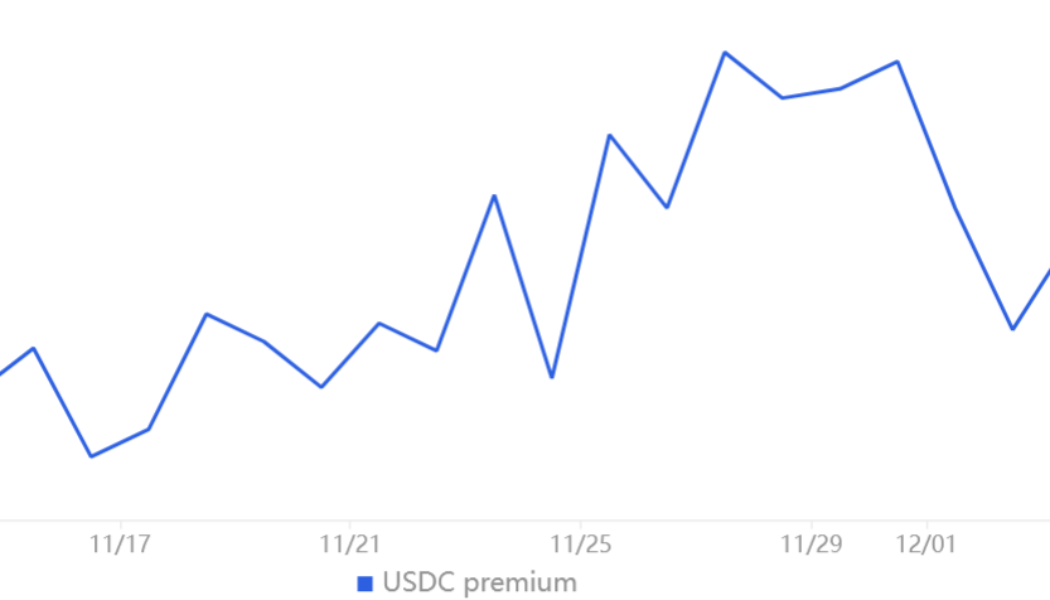

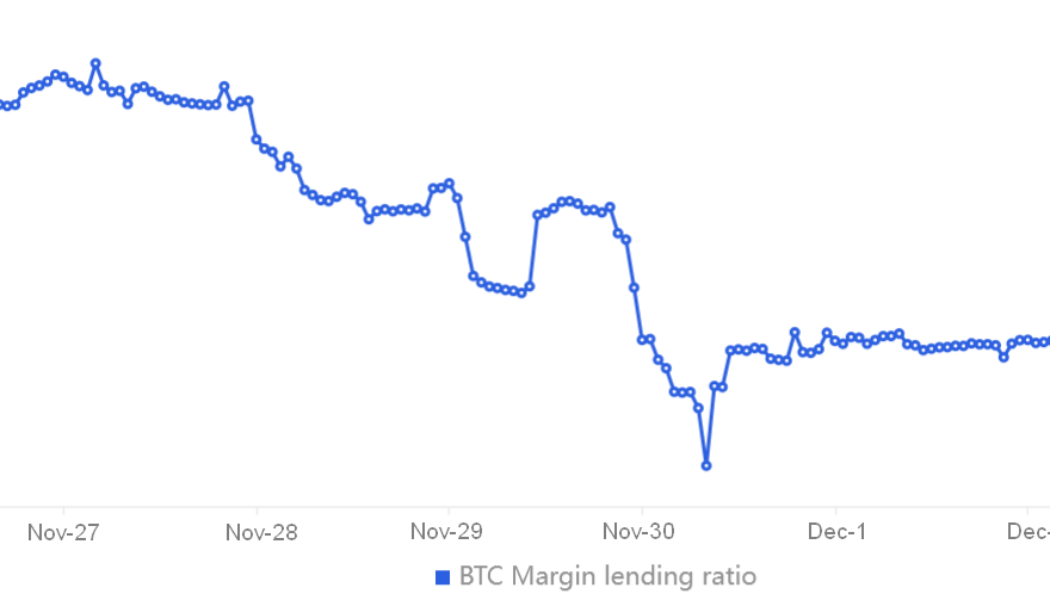

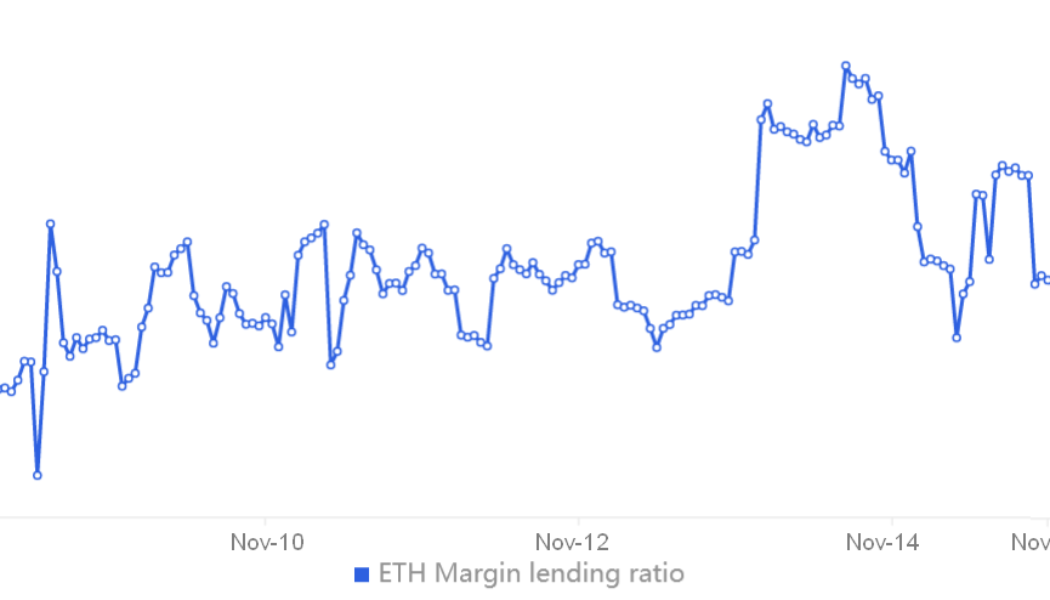

Ethereum price weakens near key support, but traders are afraid to open short positions

Ether (ETH) has been stuck between $1,170 to $1,350 from Nov. 10 to Nov. 15, which represents a relatively tight 15% range. During this time, investors are continuing to digest the negative impact of the Nov. 11 Chapter 11 bankruptcy filing of FTX exchange. Meanwhile, Ether’s total market volume was 57% higher than the previous week, at $4.04 billion per day. This data is even more relevant considering the collapse of Alameda Research, the arbitrage and market-making firm controlled by FTX’s founder Sam Bankman-Fried. On a monthly basis, Ether’s current $1,250 level presents a modest 4.4% decline, so traders can hardly blame FTX and Alameda Research for the 74% fall from the $4,811 all-time high reached in November 2021. While contagion risks have caused investors to drai...