Markets

Bitcoin investors are not giving up their holdings despite a shaky market

Investors are unwilling to let go of their Bitcoin to avoid making a sale they might regret later, according to Three Arrow Capital CEO Bitcoin’s daily active entities have hit mid-2019 numbers, but the activity remains on a rise Three Arrow Capital CEO Zhu Su has indicated that Bitcoin investors now have more patience and are not panic selling as they did for the Bitcoin copped between 2017-2018. On-chain data has revealed that the top digital asset holders have been hodling for more than an entire year despite the fluctuating prices and endless market corrections. A good number of the large Bitcoin investors have gone as far as adding more coins to their portfolios in that period. Su explained that traders who sold their holdings as the markets slumped between 2018 and 2019 soon en...

BSC whales have been taking up Cardano (ADA) despite the price not looking up

The largest BNB whale recently acquired in excess of 5.1 million worth of ADA BSC whales have also been dabbling in Dogecoin and ALPHA tokens On-chain monitoring tool WhaleStats revealed that the biggest BNB whale added $5.1 million worth of ADA to their portfolio on Sunday. The blockchain service, which tracks the top hodlers on the BSC and the tokens they own, published the information on its BSC-focused Twitter account @WhaleStatsBSC. More specifically, the giant investor copped 5,367,075 ADA tokens for a price of $5,106,208. To note is that the tokens in question are ADA BEP20 tokens, which exist purely on the BNB Chain. They are not actual ADA (Cardano native) tokens but rather tokens tied to ADA’s price on Binance’s chain, meaning such tokens cannot be transferred t...

Komodo (KMD) rallies 54% after major push to expand interoperability with AtomicDEX

Interoperability between separate blockchain networks has become a major theme in the cryptocurrency market over the past year, but several major exploits — such as the $321 million Wormhole exploit — have highlighted the difficulties in achieving cross-chain transfers in a secure manner. One protocol that has been gaining traction in February thanks to its alternative approach to achieving cross-chain interoperability is Komodo, an open, composable multichain platform that is home to the AtomicDEX wallet and non-custodial decentralized exchange. Data from Cointelegraph Markets Pro and TradingView shows that after hitting a low of $0.446 on Feb. 20, the price of the platform’s KMD token surged 54% to a daily high of $0.687 on Feb. 22. KMD/USDT 4-hour chart. Source: TradingView Three r...

OpenSea’s trading volume marginally above LooksRare’s – Here’s why

LooksRare has fallen back in trading volumes after it was confirmed that developers cashed out more than $30 million in wrapped ETH OpenSea suffered a phishing attack over the weekend that resulted in $1.7 million in stolen NFTs The NFT marketplace space has been in a frenzy over the last few days. The two major players – LooksRare and OpenSea, have made headlines for different reasons. LooksRare’s woes In LooksRare case, issues first emerged from reports that came out last week indicating that the marketplace’s developers had taken out at least $30 million in ETH rewards. While a LooksRare team member clarified that the finances were intended to compensate for the unpaid work and investment the team completed during the project’s development, the marketplace seems to hav...

Altcoins Back in The Green: SOL and LUNA Leading the Comeback

The cryptocurrency market has painted a picture of green into the new week in what is seemingly a trend for February This is the third week that the market has started strongly – last week, the market embarked on an uptrend on Tuesday Bitcoin and Ethereum recover Bitcoin, whose price plunged to a 24-hour low of $38,112 over the weekend, has bounced back and is currently trading at $39,025 against the dollar. Despite seeing a positive 2.01% 24-hour change, the coin is still down over 7.40% in the last seven days. Ethereum’s native coin has similarly bounced from a dip to a weekend low of $2,585.95 posted during yesterday’s trading session. Though Ether is still trading below $2,800 ($2,715) – it has seen approximately 3.33% of gains in the last 24 hours as per CoinMarketCap data. Here’s a l...

Top 5 cryptocurrencies to watch this week: BTC, LEO, MANA, KLAY, XTZ

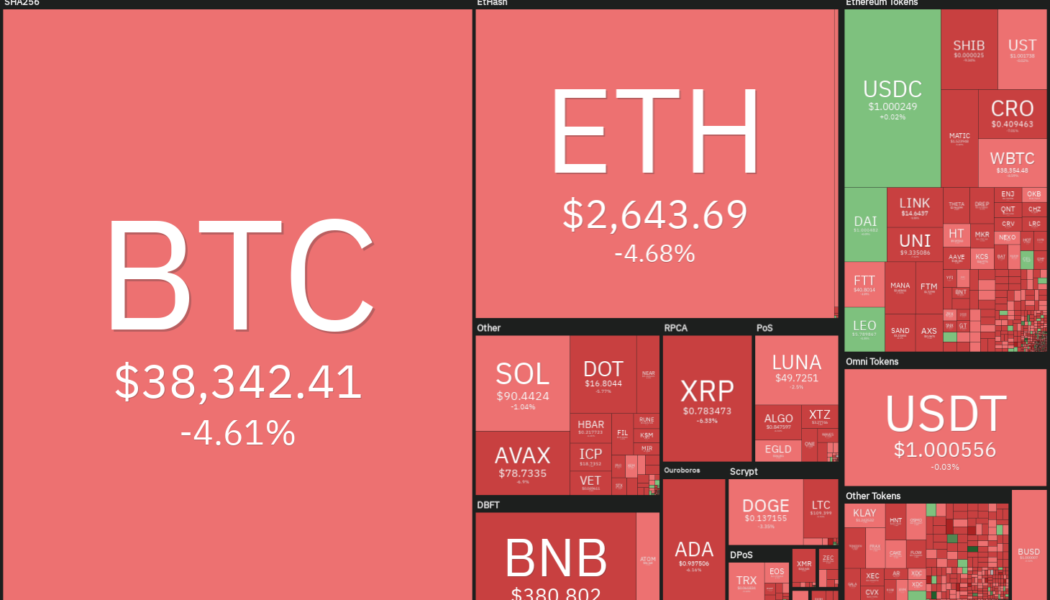

Russia’s massive build-up of soldiers, warplanes, equipment and extended military drills near Ukraine’s borders increased fears of a possible invasion within the next few days. That could have renewed selling in Bitcoin (BTC), which plummeted below the strong support at $39,600. Among the gloom and doom, there is a ray of hope for crypto investors because data from Glassnode shows that more than 60% of Bitcoin supply has not been used in any transaction for more than a year. This suggests that long-term hodlers are not dumping their positions in the downtrend. Crypto market data daily view. Source: Coin360 Mike McGlone, chief commodity strategist at Bloomberg Intelligence, warned that Bitcoin could be in for a “rough week ahead” and cautioned that “inflation is unlikely to drop...

Weekly Report: Regulators and authorities around the world hone in on the crypto sector

The US is strengthening its regulatory efforts against crime involving crypto and related assets Warren Buffet’s right-hand man Charlie Munger compares Bitcoin to a venereal disease Ukraine’s parliament, this week, passed a bill to legalise digital assets legal in the country, with the vote receiving the majority of votes Here are the major headlines from the cryptocurrency sector that you might have missed this week: US authorities crack the whip on crypto crime even harder Deputy Attorney General of the US Lisa Monaco told the virtual Munich Cyber Security Conference on Thursday that the FBI is forming a new team, the Virtual Asset Exploitation Unit. The division would include investigators and experts in cryptocurrencies, blockchain analytics, and digital asset confiscation....

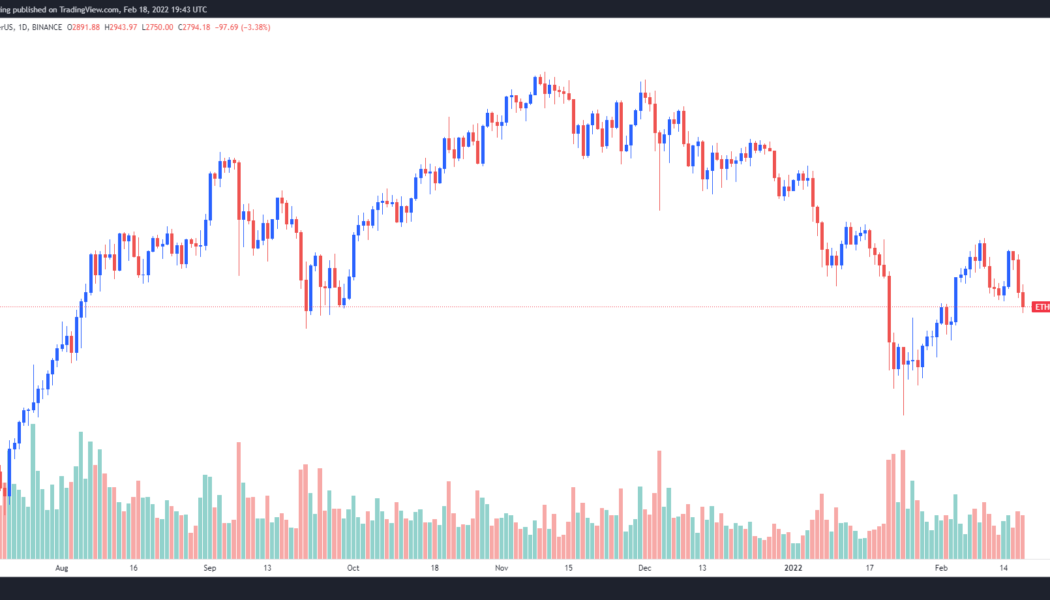

Analyst say Ethereum price could fall to $1,700 if the current climate prevails

Bitcoin (BTC) and Ether (ETH) price are still being hard hit by the current wave of volatility and this is leading traders to go back to the drawing board and readjust their short-term expectations. On Feb.17, Bitcoin price briefly dipped below $40,000 and Ether failed to hold support at $2,900, raises the chance of a drop to $2,500. Data from Cointelegraph Markets Pro and TradingView shows that after hovering near the $2,900 support level through the morning trading hours, Ether was hit with a wave of selling that dropped it to an intraday low of $2,752. ETH/USDT 1-day chart. Source: TradingView Here’s a look at what analysts are saying about the price drop for Ether and whether or not more downside is expected as global tensions continue to rise. Ethereum’s nex...

Here’s why AI-equipped NFTs could be the real gateway to the Metaverse

Nonfungible tokens (NFTs) have been largely acquired as proof-of-profile pictures (PFPs) that represent a brand, embody culture or ultimately, reflect as a static status symbol. Blue-chip NFTs like the Bored Ape Yacht Club or Cool Cats were not originally backed by any tangible utility other than speculative value and hype, along with the promise of an illustrative roadmap, but in 2022, investors are looking for a little bit “more.” However, nonfungible tokens are finding their use beyond branding and status symbols by attempting to build out an existence in the Metaverse and some are ambitious enough to start within it. The Altered State Machine (ASM) Artificial Intelligence Football Association (AIFA) has introduced a novel concept to NFTs called nonfungible intelligence or NFI. By...

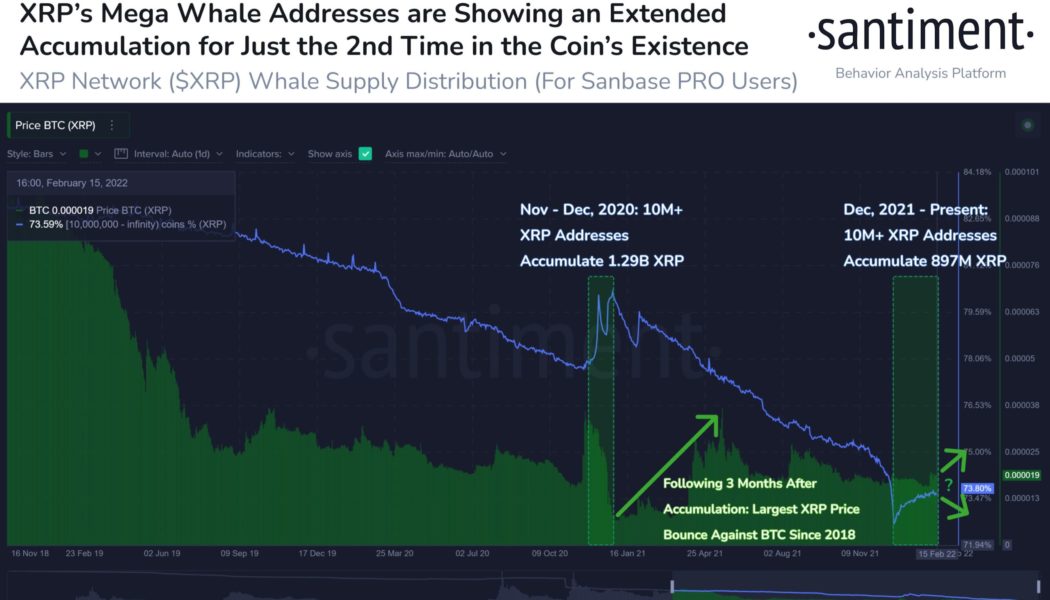

XRP ‘mega whales’ scoop up over $700M in second-biggest accumulation spree in history

XRP addresses that hold at least 10 million native units have returned to accumulating more in the past three months, a similar scenario that preceded a big rally for the XRP/USD and XRP/BTC pairs in late 2020. The return of XRP ‘mega whales’ A 76% spike in XRP “mega whale” addresses since December 2021 has been noted by analytics firm Santiment showing that they added a total of 897 million tokens, worth over $712 million today, to their reserves. The platform further highlighted that the XRP accumulation witnessed in the last three months was the second-largest in the coin’s existence. The first massive accumulation took place in November-December 2020 that saw whales depositing a total of 1.29 billion XRP to their addresses. XRP supply into ...

Ethereum whales are bullish on meme coin Shiba Inu, on-chain data shows

Shiba Inu ownership among the top 1000 Ethereum whales only lags Ether’s The whales are riding the wave of increased adoption of the meme token Shiba Inu investments by top Ethereum investors have been growing. The token has frequently appeared on previous occasions as the asset with the top holding (besides ETH) among the top 1000 Ethereum whales. On-chain monitoring tool WhaleStats yesterday observed that the whales’ holdings in Shiba Inu had once again crossed $2 billion. Shiba Inu, FTX tokens and USD Coin on the radar of Ethereum whales With the exact Shiba Inu ownership raking up as much as $2,761,646,130 (18,260,127,622,912 tokens) in value, this contributed to 23.01% of their portfolios ranking first among in all crypto holding excluding Ethereum. Though this figure has ...