Markets

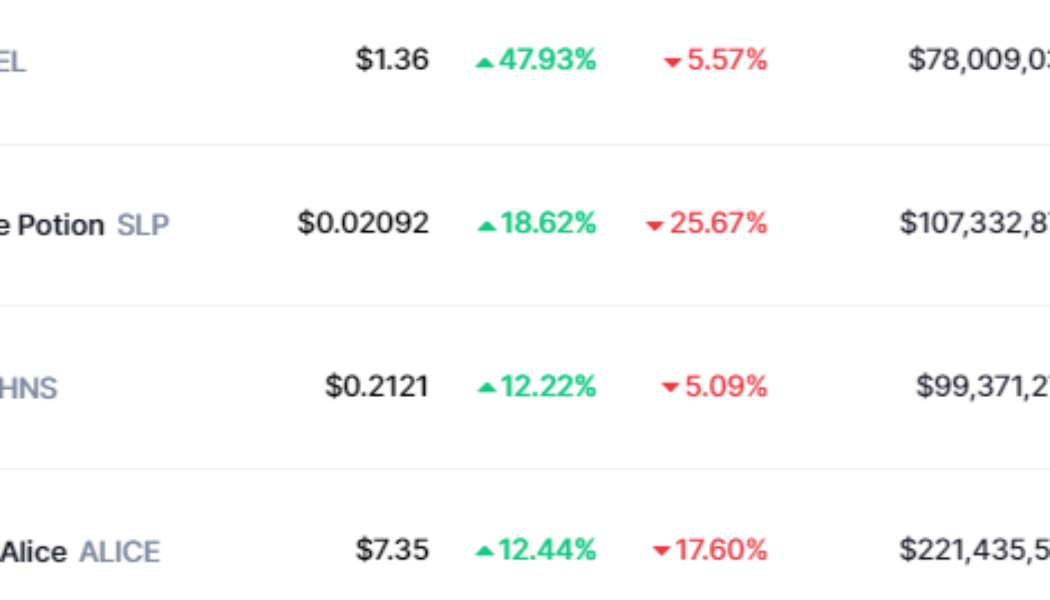

VOXEL, SLP and ALICE rally after protocol updates and a major exchange listing

Crypto markets are taking a beating but there are still a few standout performers even during this week’s volatility. One sector that has managed to rise above the noise are NFT-related altcoins and GameFi tokens. Top gainers in the collectible and NFT sector. Source: CoinMarketCap Data from Cointelegraph Markets Pro and CoinMarket Cap shows that three notable gainers over the past 48-hours were Voxies (VOXEL), Smooth Love Potion (SLP) and MyNeighborAlice (ALICE). Voxie Tactics launches its marketplace VOXEL is the native utility currency of Voxie Tactics, a free-to-play, 3-dimensional, role-playing game that combines the classic look of the popular tactical games of the 1990s and 2000s with modern game mechanics. Data from TradingView shows that after hitting a low of $0.90 on Feb. ...

Bitcoin slumps following Putin’s announcement of a military operation in Ukraine

Russian President Vladimir Putin has announced military action in Ukraine Bitcoin, alongside the majority of the crypto assets, have plunged as the market reacts to the news Tensions have been high across the month, with reports warning that Russia has been consolidating troops in areas bordering Ukraine. Russia has insistently maintained that it had no plans to invade Ukraine. However, the situation has changed dramatically in recent hours. Russia’s President Vladimir Putin announced early Thursday that the country’s military is advancing into Ukraine for what he referred to as a “special military operation” to conclude the “demilitarisation” of Ukraine. With reports of explosions in Ukraine’s Kyiv capital, worry is growing that this could turn in...

FTX CEO weighs in on Bitcoin market outlook amid Ukraine crisis

The world woke up to a “sea of red” that was not necessarily limited to the financial markets, as Russia declared war on Ukraine early Thursday. The traditional financial markets along with the crypto markets have been sliding bearishly for the past week and saw a rapid decline early on Thursday. Apart from crude oil prices, which jumped to an eight-year high above $100, the majority of stocks has lost over 5%. The Russian invasion on Thursday triggered the bears leading to a $500-billion crypto market sell-off, where the majority of the cryptocurrencies lost critical support to trade at a three-month low. The crypto market capitalization saw a 10% decline during early morning Asian trading hours, falling below the $1.5-trillion mark. Bitcoin (BTC) is considered an inflation hedge, and man...

Last Bitcoin support levels above $20K come into play as BTC price faces ‘time of uncertainty’

Bitcoin (BTC) may yet reenter the $20,000 zone, but the coming weeks could provide a solid buying opportunity, a new report forecasts. In its latest market update on Feb. 24, trading platform Decentrader laid out the final areas of support between the current Bitcoin spot price and $20,000. Analyst eyes BTC’s 20-week and 200-week MA for cues Military action by Russia in Ukraine has markets in a spin Thursday, with stocks and crypto following a firm downtrend as uncertainty grips Asia, Europe and the United States alike. Bitcoin has already lost 12% in under 24 hours, and expectations are that the worst is not yet over —reactions to the Russian offensive continue to flow in, along with potential financial sanctions. As such, Decentrader, like many other analysts, is notably cautious o...

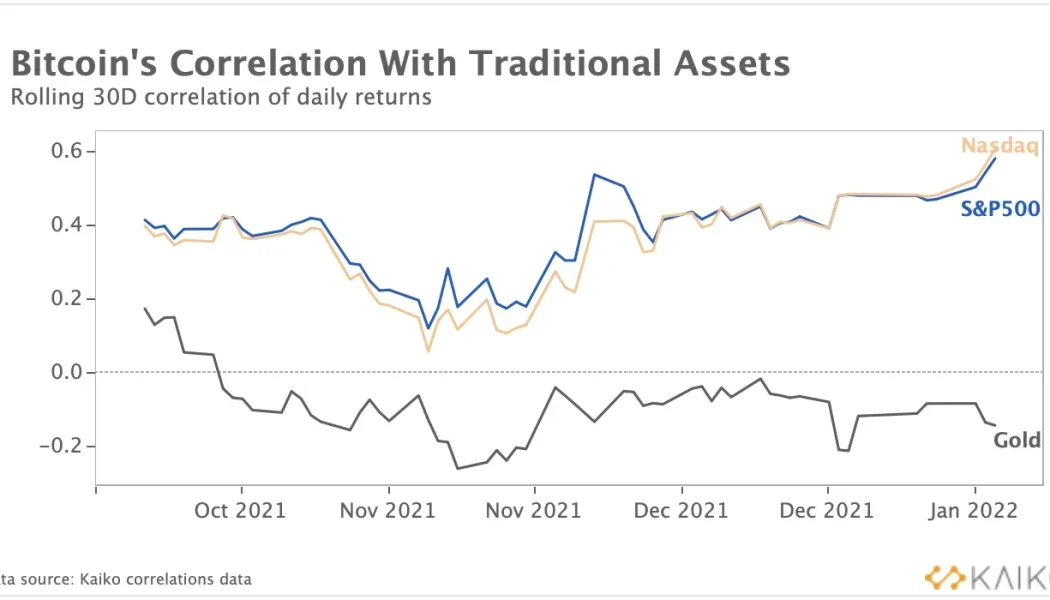

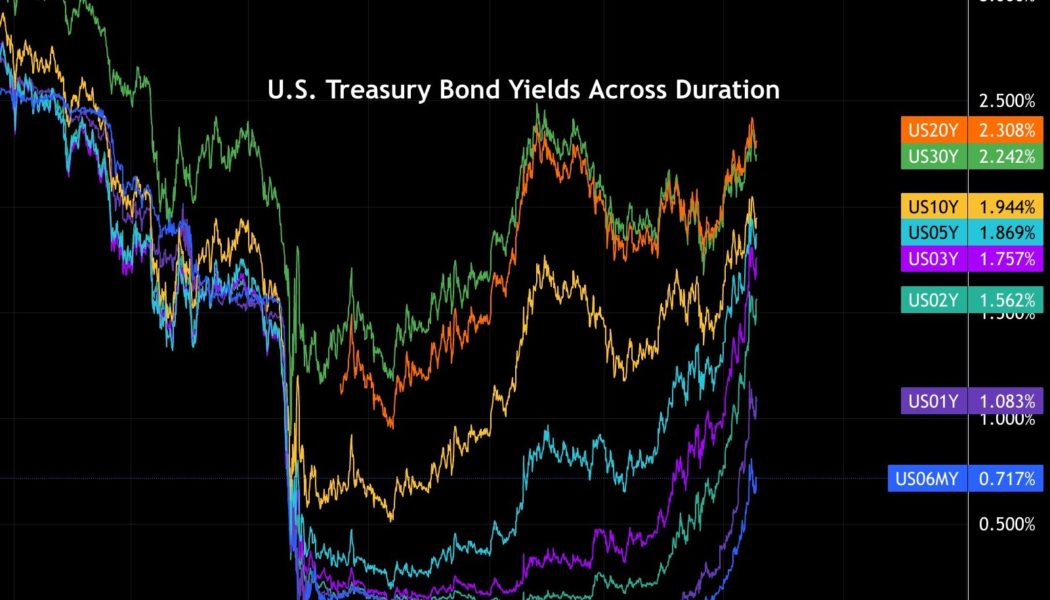

Hedge fund report says Bitcoin price is ‘at a relatively inexpensive place’

There has been a lot of focus on the performance of the stock and cryptocurrency markets over the past year or two as the trillions of dollars that have been printed into existence since the start of the COVID pandemic have driven new all-time highs, but analysts are now increasingly sounding the alarm over warning signs coming from the debt market. Despite holding interest rates at record low levels, the cracks in the system have become more prominent as yields for U.S. Treasury Bonds “have been rising dramatically” according to markets analyst Dylan LeClair, who posted the following chart showing the rise. U.S. Treasury bond yields across duration. Source: Twitter LeClair said, “Since November yields have been rising dramatically — bond investors begun to realize that w/ inflation ...

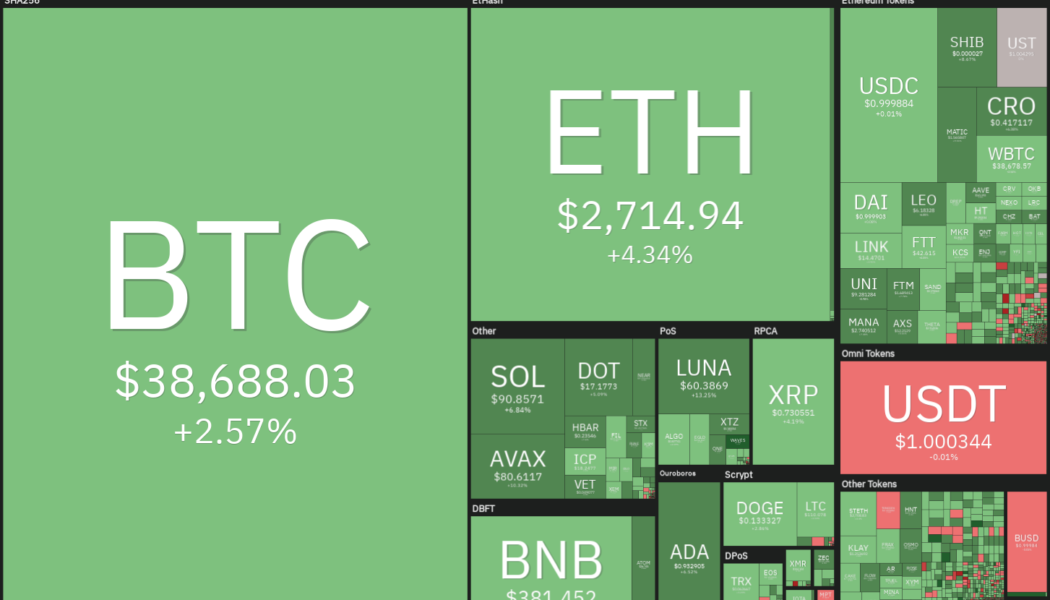

Price analysis 2/23: BTC, ETH, BNB, XRP, ADA, SOL, AVAX, LUNA, DOGE, DOT

Bitcoin (BTC) and several altcoins have bounced off their immediate support levels after buyers attempted to arrest the current decline. Bloomberg Senior Commodity Strategist Mike McGlone highlighted in a recent Tweet that Bitcoin was trading roughly 20% below its 50-week moving average and such discounted levels have “often resulted in good price support.” The bearish price action of the past few days does not seem to have deterred the institutional traders from accumulating at lower levels. According to CoinShares’ Feb. 22 “Digital Asset Fund Flows Weekly” report, institutional investors pumped about $89 million into Bitcoin funds between Feb. 14 and Feb. 18, taking the total inflows in the current month to $178.3 million. Daily cryptocurrency market performance. Source: Coin360 Crypto t...

Singapore-based crypto exchange Bitrue to debut ADA base pairs

The Singaporean crypto exchange intends to introduce ADA as a base currency for tokens, including SOL, AVAX, and MATIC Bitrue has shown commitment to advancing growth in the Cardano network through a series of initiatives Singapore-based Bitrue crypto exchange, popular with Ripple’s XRP, has become the latest entity in the crypto sector to launch an initiative to propel the growth of Cardano. The crypto exchange announced yesterday that it would be adopting Cardano’s ADA as the sixth spot trading base currency. With the announcement, the first ADA pairs will go live tomorrow, 24th February. These will include pairs for ETH, SHIB, XDC, MATIC, SOL, AVAX, LTC, GALA, ICP, and MANA. Users will gain the ability to use a flurry of features that come with the said trading pairs – such ...

Ethereum to $10K? Classic bullish reversal pattern hints at potential ETH price rally

Ethereum’s native token, Ether (ETH), could reach above $10,000 in the coming weeks as it paints what appears to be an “ascending triangle” technical pattern. Ether’s price technicals: Bullish signs Ascending triangles are bullish continuation setups that appear during an uptrend. Analysts confirm their presence after the price rises upward inside a rising right-angle triangle structure, thus forming a sequence of lower highs on the lower trendline with resistance in place at the upper one. As the pattern develops, volumes typically drop. So far, Ether has been forming a similar upside pattern on its weekly chart. In detail, the triangle’s lower trendline has been acting as an accumulation range since the beginning of 2021, with high selling pressure at the upper trendline, as shown b...

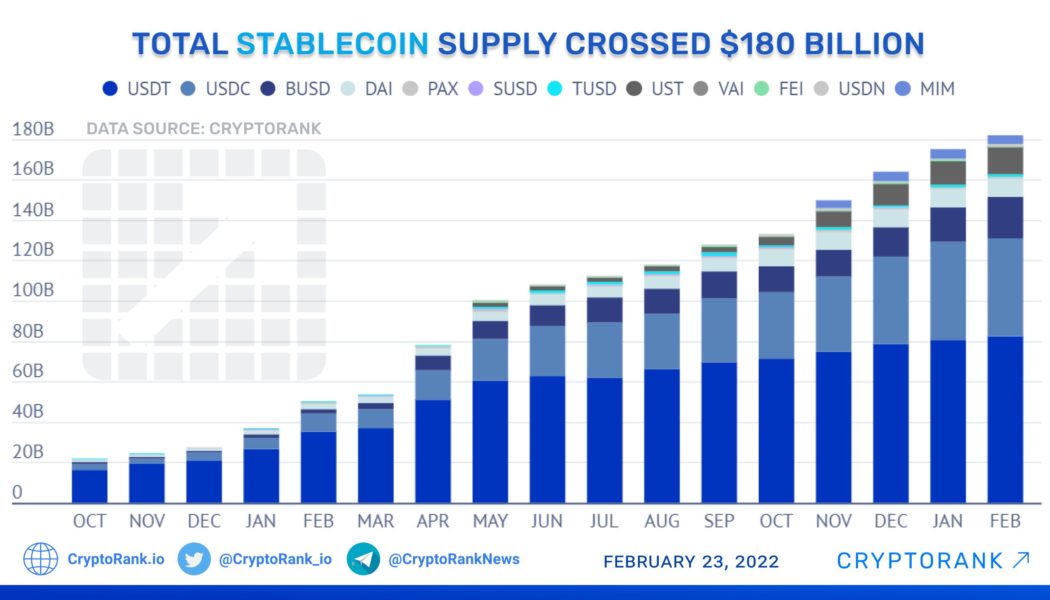

Total stablecoin supply hits $180 billion: Report

Move aside Bitcoin (BTC), stablecoins are holding the spotlight. Crypto research outlets Arcane Research and CryptoRank confirm that the stablecoin supply has hit the milestone amount of $180 billion. The growth in stablecoins continues to outpace the rest of the market, up 6% in the past 30 days. In times of market volatility, stablecoins can offer price stability, backed by specific assets or algorithms. Source: CryptoRank Over the month of February, three stablecoins entered the top 10 coins by market capitalization as Binance USD (BUSD) briefly entered. According to Arcane Research, the three largest stablecoins, Tether (USDT), USD Coin (USDC) and BUSD now account for a total of “9% of the total crypto market cap.” Plus, while volatility reigns proud, the stablecoin sup...

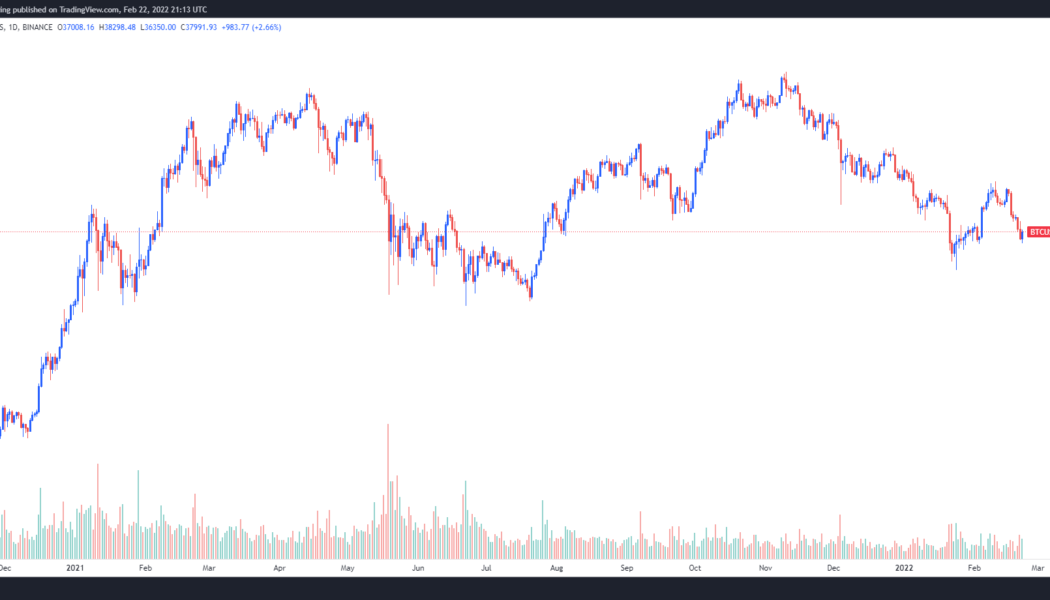

Bitcoin price could ‘probe lower’ as volumes dip and macroeconomic issues loom overhead

Bitcoin’s sell-off appears to be taking a pause even though the United States rolled out new sanctions against Russia on Feb 22. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin (BTC) continues to hover slightly below $38,000, which some analysts have identified as a significant support and resistance zone. BTC/USDT 1-day chart. Source: TradingView Here’s a closer look at what analysts are saying about Bitcoin price and what levels to keep an eye on in the short-term. 25% of entities are underwater On-chain data outlet, Glassnode, posted the following chart analyzing the percentage of entities in profit and the analysts concluded “that the proportion of on-chain entities in profit is oscillating between 65.78% and 76.7% of the network.” Percent...

Market crash sees ADA fall to a multi-month low, DOT and AVAX drop out of the top ten

The price of Cardano’s native token ADA sank to $0.82 after enduring more losses today Binance USD has moved to 9th in market capital, displacing Avalanche and Polkadot that have suffered heavy losses today Cryptocurrencies are trading in the red on Tuesday as the bloodbath persists on account of the growing tensions between Russia-Ukraine. Market data shows that only Terra’s LUNA has registered a green candle in the last few hours. Bitcoin dropped below $36,500 earlier today for the first time since 4th February, setting a multi-week low of $36,488 as per CoinMarketCap. Though the OG cryptocurrency has since steadily climbed back to $37,600 as of writing, it is still down 2.85% in the last 24 hours. The current Bitcoin price means it has shed almost 14% in one week. Ether has ...

Glassnode theorises an extended BTC bear market, points to on-chain metrics

Analytics firm Glassnode says sizeable investor losses and recency bias are likely to sustain a prolonged bear market Despite the currently unimposing number of daily active users, Glassnode notes that long term hodlers are increasing linearly in the long term In its February 21 newsletter, blockchain data and intelligence provider Glassnode has suggested that Bitcoin investors are seeing a significantly growing number of motivations to sell their holdings. As volatility pushed Bitcoin to either side of the $40k psychological support last week, it peaked close to $45k but eventually closed nearer $38k. The blockchain analytics firm observed that external factors, including anticipation of the Fed’s March meeting and geopolitical issues globally, are cause for the dwindling price leve...