Markets

Bitcoin accumulation among whales surges as crypto market rallies

Bitcoin saw a ballistic upswing late yesterday, peaking at $44,000 The number of wallets holding more than 1,000 BTC has risen in the last 24 hours Bitcoin had a fairly decent run in February compared to January, when it fell from $46.73k at the start of the year to $37.45k on the last day of the month. Last month, the flagship cryptocurrency mostly traded above $42k in the first two weeks before paring down in the third week. The correction was followed by a steep crash to a monthly low of $34,459 last Thursday. A renewed rally kicking off late yesterday has put the coin in an uptrend, reclaiming $44k. Along with the price gains, the number of holders in different groups (based on the amount of bitcoin they hold) has increased. Whales are taking up crypto at a faster rate Data from CoinMe...

Bitcoin closes in on $44k as crypto hype surges again

Crypto markets are recovering, with most tokens recording more than 5% in growth on the day Over the last few days, crypto has established a ‘haven’ status for both Russians and Ukraine Bitcoin marshalled altcoins across a generally positive Monday as the crypto markets recovered from the effects of Russia’s recent military action. The flagship cryptocurrency Bitcoin crossed $40k for the first time since 20th February. After only recently dipping to reach $34,904 as the markets crashed last Thursday, Bitcoin is now trading $43,775, a 16.1% growth in the last 24-hours. Its 24-hr volume sits at $28.70 billion, according to data from CoinGecko. Altcoin ecosystems have also seen significant growth in the same period. Smart-contracts giant Ethereum has gained 12.6% over the la...

Price analysis 2/28: BTC, ETH, BNB, XRP, ADA, SOL, AVAX, LUNA, DOGE, DOT

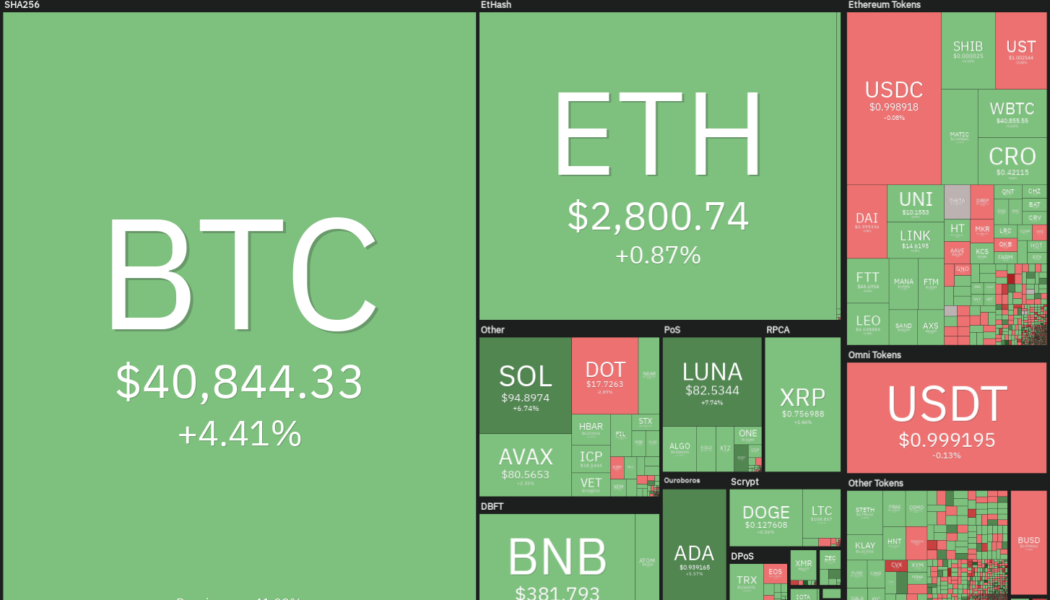

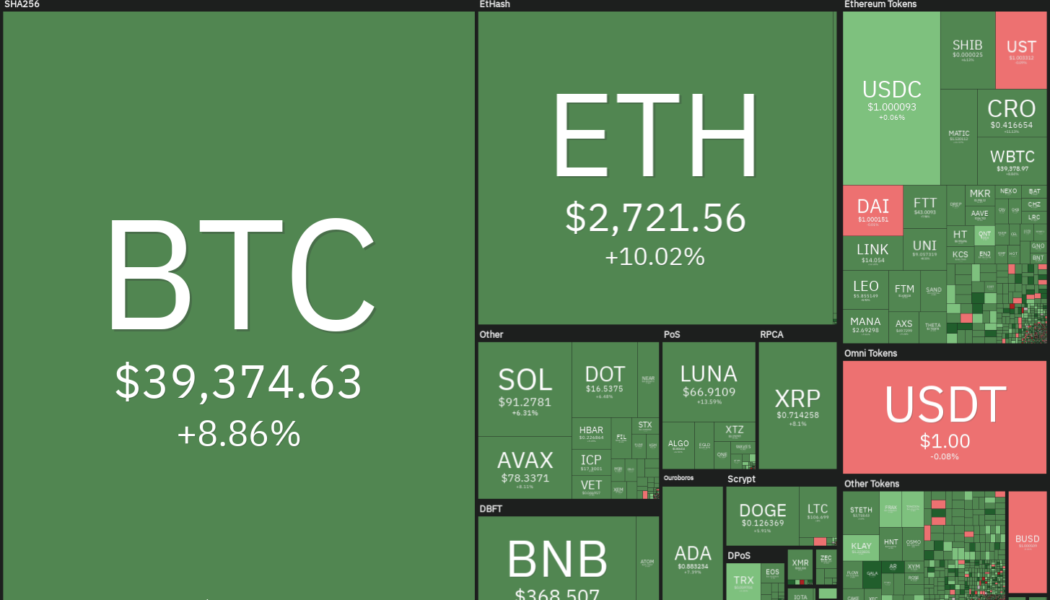

Bitcoin (BTC) soared above $40,000 on Feb. 28 even though the S&P 500 remained soft. This suggests that the correlation between Bitcoin and the U.S. equity markets may be showing the first signs of decoupling. If bulls sustain the price above $38,500 till the end of the day, Bitcoin would avoid four successive months of decline. The volatility of the past few days does not seem to have shaken the resolve of the long-term investors planning to stick with their positions. Data from on-chain analytics firm Glassnode showed that the amount of Bitcoin supply that last moved between three to five years ago soared to more than 2.8 million Bitcoin, which is a four year high. Daily cryptocurrency market performance. Source: Coin360 Interestingly, an experiment by Portuguese software developer T...

Price analysis 2/25: BTC, ETH, BNB, XRP, ADA, SOL, AVAX, LUNA, DOGE, DOT

The U.S. equity markets and Bitcoin (BTC) have rebounded sharply from their Feb. 24 lows while gold has made a retreat from its recent highs. This indicates that investors may be buying risky assets and reducing exposure to assets perceived as a safe haven. Recent reports also suggest that Russian President Vladimir Putin may send a delegation to negotiate with Ukraine and this raises hope that the conflict could end sooner than analysts expect. Some analysts believe that the U.S. Federal Reserve may not raise rates aggressively in March due to the geopolitical situation. Allianz chief economic advisor Mohamed El-Erian believes that the March 50 basis point rate hike is “completely off the table.” Daily cryptocurrency market performance. Source: Coin360 Dr. Raullen Chai, the co-f...

Top 5 cryptocurrencies to watch this week: BTC, LUNA, AVAX, ATOM, FTM

The geopolitical news flow is likely to result in volatile moves in Bitcoin (BTC) and altcoins in the next few days. News of Russian President Vladimir Putin ordering the nuclear deterrence forces on high alert may be viewed as a negative, but reports of talks between the warring nations could be positive as it raises hopes of an end to the conflict. The crypto community came into focus as the Ukrainian government called for help and sought crypto donations. Some individuals on social media said their Ukrainian credit cards had stopped working and they were not able to withdraw money from their banks. They highlighted how crypto was the only money left with them. Crypto market data daily view. Source: Coin360 While some analysts are projecting that Bitcoin may have bottomed out, Cointelegr...

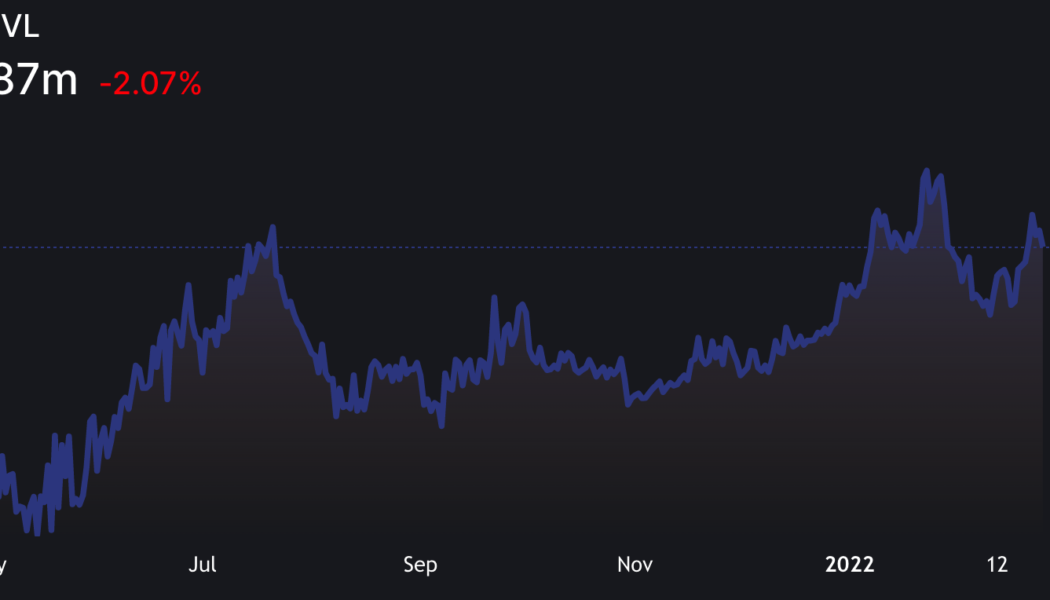

3 reasons why Lido DAO Token could be on the verge of breaking its downtrend

Ethereum (ETH) and decentralized finance (DeFi) are undergoing a seismic shift as the transition to Eth2 and a proof-of-stake consensus mechanism is helping to increase the value proposition for the network which has historically has been plagued with scaling issues and high transaction costs. Alongside this transition has been the introduction of liquid staking, which is helping to add utility to DeFi and giving investors the option to do more with their assets than just lock them up indefinitely. Liquid staking could also help investors build more capital efficient portfolios. One protocol that has benefited from the shift toward liquid staking is Lido (LDO), a platform that allows investors to earn staking rewards on their tokens while also enabling them to put the resulting...

Bitcoin traders say $34K was the bottom, but data says it’s too early to tell

Bitcoin (BTC) price traded down 23% in the eight days following its failure to break the $45,000 resistance on Feb. 16. The $34,300 bottom on Feb. 24 happened right after the Russian-Ukraine conflict escalated, triggering a sharp sell-off in risk assets. While Bitcoin reached its lowest level in 30 days, Asian stocks were also adjusting to the worsening conditions, a fact evidenced by Hong Kong’s Hang Seng index dropping 3.5% and the Nikkei also reached a 15-month low. Bitcoin/USD at FTX. Source: TradingView The first question one needs to answer is whether cryptocurrencies are overreacting compared to other risk assets. Sure enough, Bitcoin’s volatility is much higher than traditional markets, running at 62% per year. As a comparison, the United States small and mid-cap stock ...

Weekly Report: Crypto market maintains recovery run into the weekend

Key takeaways: The crypto sector has bounced back and seen some calm after Thursday’s crash that was set off by Russia’s invasion of Ukraine Animoca Brands’ Yat Siu believes BitsCrunch will play a significant role in the metaverse future NGO founded to support Ukraine military sees more than $5.3 million in crypto donations US court fines BitMEX founders who pleaded guilty to money laundering Coinbase forecasts that Ethereum staking rewards will rise significantly post-merge Terra’s native token LUNA leads altcoins in the market rebound Thursday morning’s news of Russia invading Ukraine sent the market hurtling, with many of the top cryptocurrencies nosediving. The crypto sector has since made a comeback and conserved the uptrend. Bitcoin (BTC) is up 1.08% in ...

Ethereum futures premium hits a 7-month low as ETH tests the $2,400 support

Ether (ETH) reached a $3,280 local high on Feb. 10, marking a 51.5% recovery from the $2,160 cycle low on Jan. 24. That price was the lowest in six months, and it partially explains why derivatives traders’ main sentiment gauge plummeted to bearish levels. Ether’s futures contract annualized premium, or basis, reached 2.5% on Feb. 25, reflecting bearishness despite the 11% rally to $2,700. The worsening conditions depict investors’ doubts regarding the Ethereum network’s shift to a proof-of-stake (PoS) mechanism. As reported by Cointelegraph, the much-anticipated sharding upgrade that will significantly boost processing capacity should come into effect in late 2022 or early 2023. Analyzing Ether’s performance from a longer-term perspective provides a more appealing sentiment, as the crypto...

Bitcoin price spike to $39K leads traders to say ‘the panic is over for a few days’

Global financial markets and crypto markets were pummeled over the past 24-hours as the invasion of Ukraine by Russian forces sent investors scrambling and sell-offs took place across most asset classes. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin (BTC) hit a low of $34,333 in the early trading hours on Feb. 24, shortly after the Ukraine incursion began, and has since climbed its way back to $38,500 after an unexpected short-squeeze may have rapped bearish investors on the knuckles. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts are saying about BTC price and how the ongoing conflict could impact crypto markets in the short-term. BTC in a “great buy area” Bitcoin’s collapse on the night of Feb. 23 was not unexp...