Markets

Which Terra-based coins have the most explosive potential? | Find out now on The Market Report live

“The Market Report” with Cointelegraph is live right now. On this week’s show, Cointelegraph’s resident experts discuss which Terra-based coins you should be looking out for in 2022. But first, market expert Marcel Pechman carefully examines the Bitcoin (BTC) and Ether (ETH) markets. Are the current market conditions bullish or bearish? What is the outlook for the next few months? Pechman is here to break it down. Next up, the main event. Join Cointelegraph analysts Benton Yaun, Jordan Finneseth and Sam Bourgi as they debate which Terra-based coin has the most explosive potential. Will it be Bourgi’s pick of StarTerra, which capitalizes on blockchains’ biggest trends — play-to-earn, nonfungible tokens (NFTs) and staking — basically combining multiple multibillion-dollar industri...

Here’s what experts think about VanEck’s recently proposed ETF focused on BTC and Gold mining firms

The proposed ETF product will invest in companies involved in gold and Bitcoin mining The investment firm previously filed for a spot crypto ETF but got rejected New York-based ETF and mutual fund manager VanEck, earlier this month, applied a new ETF product with indirect exposure to cryptocurrency and precious metals. As per a recent SEC disclosure, the proposed offering will focus on securities in an index tracking digital assets and gold mining companies. The global investment firm, which had $81.7 billion worth of assets under management as of November last year, submitted its application to the US Securities and Exchange Commission last Thursday. The disclosure did not feature specific details around the fund’s ticker. A number of experts have found fault with the VanEck Gold and Digi...

Crypto markets recover from Monday’s brief dip with BTC eyeing $39k

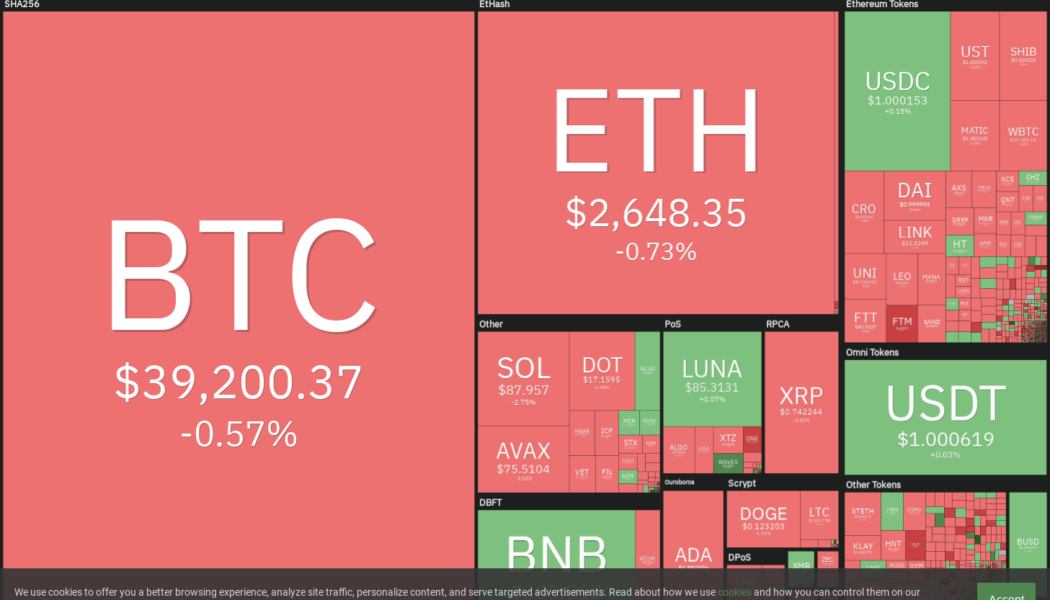

Market activity has been largely positive in the last few hours THETA price has shot up following the pullback while Ether has cut above $2,550 The cryptocurrency sector is still reeling from late Monday’s short-lived slump that saw tokens fall to their weekly lows. Bitcoin, which appeared to have cleared $39k earlier during the day, slid from $39,060 to a 7-day low of $37,387.92 in four hours, CoinGecko data shows. The king cryptocurrency has since bounced back and is changing hands at $38,860 – up 1.40% in the last 24 hours. Ether, whose ETH/USD hourly trading chart shows positive movement, has clawed its way back above $2,575. Yesterday, the token fell to an intraday low slightly below $2,460 – a price level last touched on February 24. The pair has moved up by 1.4% today and is t...

DeFi ‘Godfather’ Andre Cronje calls it quits as associated projects tank

Andre Cronje has officially left DeFi and crypto, with plans to move back into traditional finance Following the news, projects associated with the iconic DeFi builder plunged Founder of Yearn Finance Andre Cronje and technical advisor at the Fantom Foundation alongside his partner Anton Nell, a senior solutions architect at the Foundation, are leaving the crypto and DeFi scene. It had become apparent last week that Cronje, who quickly became an icon in DeFi with his yield optimisation protocol, was planning to leave since he cleared all of his Twitter activity, deactivated his profile, and updated his LinkedIn status to indicate he had left both Yearn Finance and Fantom Foundation. The exit of the two developers leaves a huge dent In a series of tweets, Nell explained that following their...

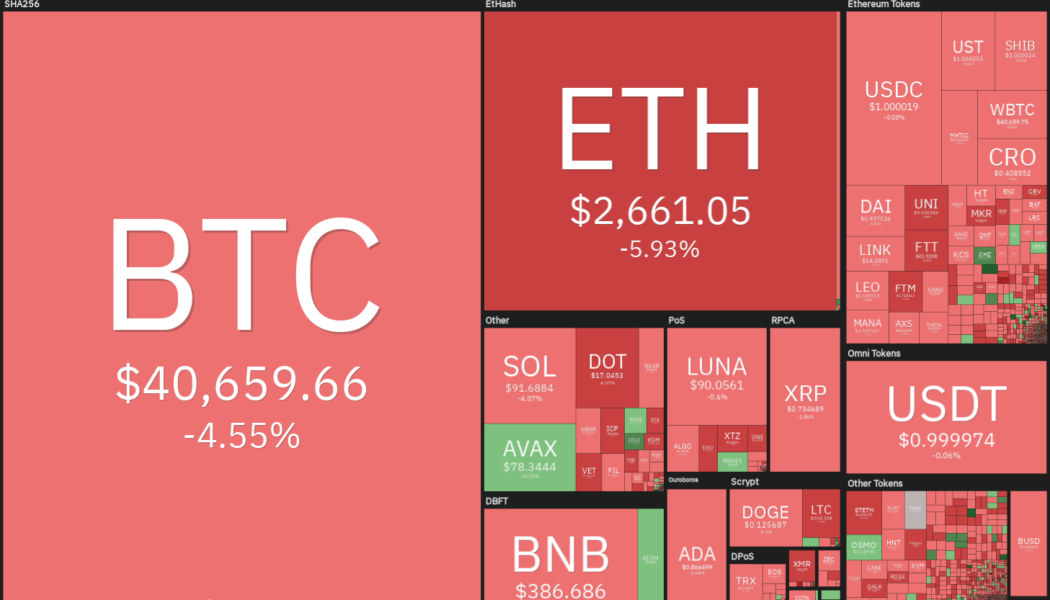

Price analysis 3/7: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

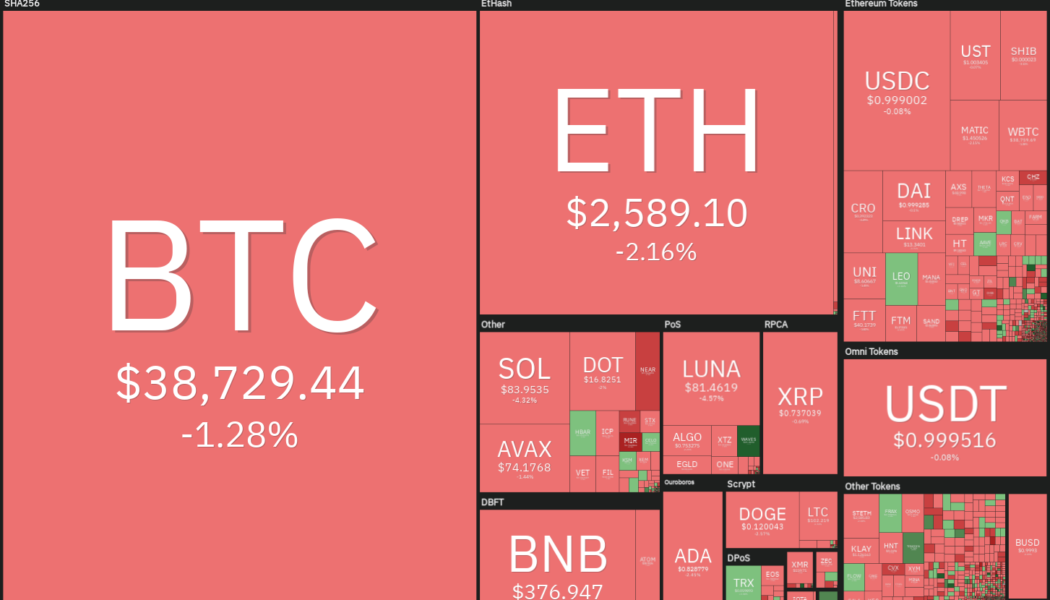

The geopolitical tension between Russia and Ukraine has resulted in investors seeking safe-haven assets. Contrary to expectations by crypto investors, Bitcoin (BTC) has failed to rise along with gold and it remains closely correlated with the U.S. stock markets. Lloyd Blankfein, the former CEO of Goldman Sachs, said that the actions of governments freezing accounts, blocking payments and inflating the U.S. dollar should all be positive for crypto but the price action suggests a lack of large inflows. Daily cryptocurrency market performance. Source: Coin360 On-chain data suggests that investors may be accumulating Bitcoin for the long term. Data from Santiment shows that 21 out of the past 26 weeks have seen Bitcoin move off the exchanges. Could Bitcoin climb back above $40,000 and pull alt...

Adobe’s Behance announces support for Phantom Wallet

Today, Adobe’s Behance has announced support for Phantom Wallet to allow people to showcase Solana-based NFTs on their profile, in addition to NFTs minted on Ethereum. Starting today, Behance users can connect their Phantom wallet and showcase Solana-based NFTs on their Behance profiles. The move resonates perfectly with Behance’s mission to help creators to build their careers without being dictated by third parties. Behance is built for freelancers, full-time gig sellers, those looking for subscriptions, those who want to sell templates, and those who want to live stream as well as those who want to sell NFTs. Before today’s announcement, Behance users were only able to showcase NFTs minted on Ethereum. But there have been concerns about the amount of Energy used by Ethereum in add...

3 reasons why Bitcoin can rally back to $60K despite erasing last week’s gains

Bitcoin (BTC) plunged to below $38,000 on Monday, giving up all the gains it had made last week, which saw BTC/USD rally over $45,000. BTC back below $40K as oil soars The losses appeared primarily in part due to selloffs across the risk-on markets, led by the 18% rise in international oil benchmark Brent crude to almost $139 per barrel early Monday, its highest level since 2008. Nonetheless, Bitcoin’s inability to offer a hedge against the ongoing market volatility also raised doubts over its “safe haven” status, with its correlation coefficient with Nasdaq Composite reaching 0.87 on Monday. BTC/USD weekly price chart featuring its correlation with Nasdaq and Gold. Source: TradingView Conversely, Bitcoin’s correlation with its top rival gold came to be minus 0...

Bitcoin’s recent correction below $40k conforms to a previously bullish triangle pattern, crypto analyst notes

A top crypto analyst has set forth that Bitcoin’s rejection at $45k indicates the asset is now in a triangle trading pattern Credible Crypto also explained that it is unlikely Bitcoin will plunge below $30k as it recently grew above $44,700 Popular crypto markets analyst Credible Crypto has predicted that Bitcoin’s recent rejection at $45k and correction downwards below $40k indicates that the asset is preparing for a surge towards $50k in the coming weeks. In a post shared to his 313k-large Twitter following, the pseudonymous crypto strategist said that following its recent rejection at $45,069, the asset is now fitting into a triangle structure, similar to the one it showed when the price was at $10k. He explained that should the daily demand hold at $38k, then Bitcoin could comple...

Top 5 cryptocurrencies to watch this week: BTC, XRP, NEAR, XMR, WAVES

Bitcoin (BTC) plunged below $40,000 on March 4 and has been trading below the level throughout the weekend. Although the crypto price action has been volatile in the past few days, Glassnode data shows that institutional investors have been gradually accumulating Bitcoin through the Grayscale Bitcoin Trust (GBTC) shares since December 2021. Another positive sign has been that fund managers have not panicked and dumped their holdings in GBTC. This suggests that managers possibly are bullish in the long term, hence they are riding out the short term pain. Crypto market data daily view. Source: Coin360 Bloomberg Intelligence said in their crypto market outlook report on March 4 that Bitcoin may remain under pressure if the U.S. stock markets keep falling, but eventually, they expect crypto to...

Price analysis 3/4: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

The equity markets in Europe and the United States are seeing a sea of red as traders continue to sell risky assets due to the geopolitical situation. Bitcoin (BTC) and several major cryptocurrencies are also witnessing profit-booking after the recent rise. Another reason that could be keeping investors on the edge is the upcoming Federal Open Market Committee (FOMC) meeting on March 16. A statement from Fed hair Jerome Powell on March 2 highlighted that the central bank is likely to hike rates this month. Fitch Ratings chief economist Brian Coulton expects core inflation to remain high in 2022 and the Fed to boost the “Fed fund rate to 3% by the end of 2022.” Daily cryptocurrency market performance. Source: Coin360 ExoAlpha managing partner and chief investment officer David Lifchit...

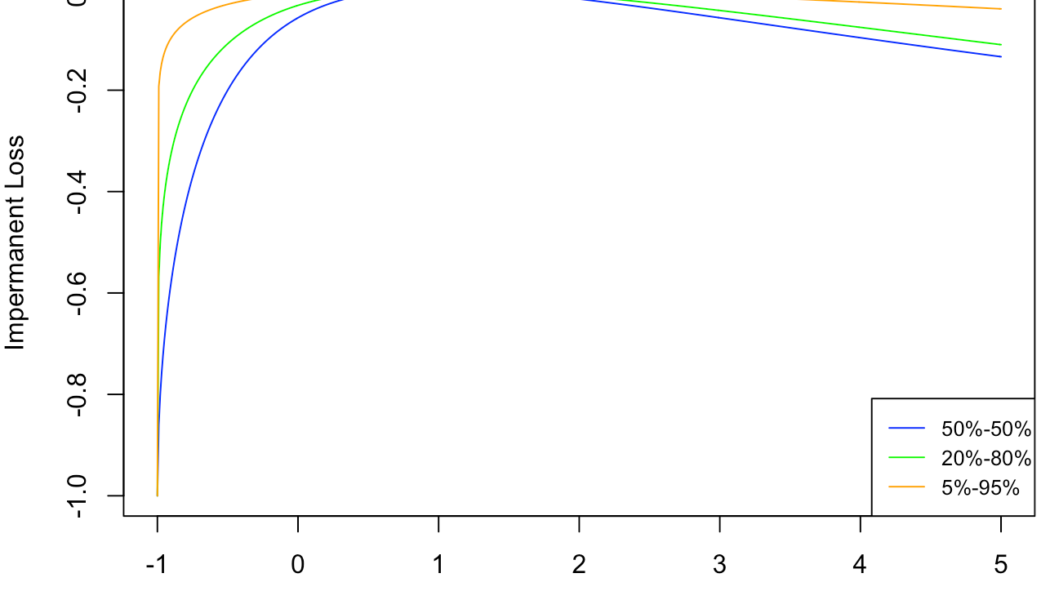

Impermanent loss challenges the claim that DeFi is the ‘future of France’

Impermanent loss is one of the most recognized risks that investors have to contend with when providing liquidity to an automated market maker (AMM) in the decentralized finance (DeFi) sector. Although it is not an actual loss incurred from the liquidity provider’s (LP) position — rather an opportunity cost that occurs when compared with simply buying and holding the same assets — the possibility of getting less value back at withdrawal is enough to keep many investors away from DeFi. Impermanent loss is driven by the volatility between the two assets in the equal-ratio pool — the more one asset moves up or down relative to the other asset, the more impermanent loss is incurred. Providing liquidity to stablecoins, or simply avoiding volatile asset pairs, is an easy way to reduce impermanen...