Markets

Immutable X (IMX) gains 50% following the close of a $200M fundraising round

Non-fungible token (NFT) projects have been hard hit by the price decline across the cryptocurrency ecosystem and the current bearish conditions have spared few tokens from a price collapse. One project that is attempting to get back on solid footing is Immutable X (IMX), an NFT-focused layer-2 (L2) scaling solution for the Ethereum (ETH) network designed to offer near-instant transactions and zero gas fees for minting and trading. Data from Cointelegraph Markets Pro and TradingView shows that the price of IMX has climbed 69.6% since hitting a low of $1.09 on March 7 to hit a daily high of $1.86 on March 11. IMX/USDT 4-hour chart. Source: TradingView Three reasons for the reversal in IMX include the completion of a $200 million Series C funding round, the launch of new projects on the plat...

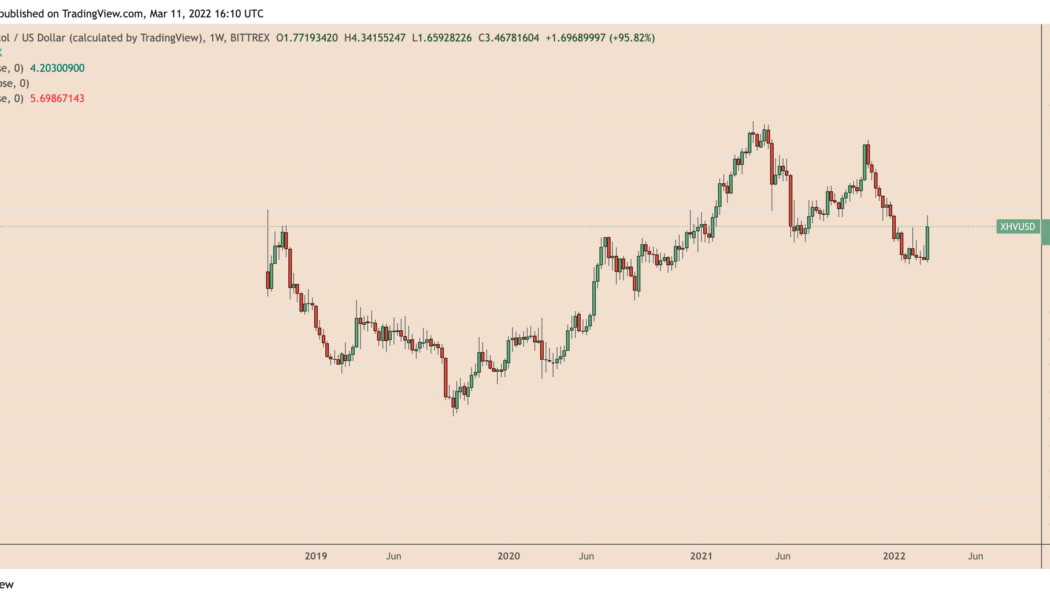

Haven Protocol (XHV) shows strong signs of bottoming out after crashing 90%

Haven Protocol (XHV) showed signs of returning to its bullish form as its price doubled in just five days of trading. What’s pumping Haven Protocol? XHV’s price surged by up to 107% week-to-date to climb above $3.60 on March 11, its highest level in more than three months. Interestingly, the move upside followed a period of aggressive selloffs that saw XHV’s value dropping from nearly $20 in November 2021 to as low as $1.60 in early February 2022 — an approximately 90% decline. XHV/USD weekly price chart. Source: TradingView Traders started returning to the Haven Protocol market against the prospects of two macroeconomic scenarios: U.S. President Joe Biden’s executive order that focuses on cryptocurrencies and hardline western sanctions on Russian oligarchs amid an ...

Price analysis 3/11: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

Bitcoin (BTC) has been volatile in the past few days but the long-term investors seem to be using the current weakness to buy. According to Whale Alert and CryptoQuant, about 30,000 BTC left Coinbase and was deposited in an unknown wallet. It is speculated to be a genuine purchase and not an in-house transaction. Although investors may be bullish for the long term, the short-term picture remains questionable. Stack Funds said in their recent weekly research report that they “expect sideways trading and possibly a potential dip” in the short term due to the increase in inflation and the lack of clarity regarding the conflict in Ukraine. Daily cryptocurrency market performance. Source: Coin360 While Bitcoin has been volatile, gold-backed crypto assets have made a strong showing in 2022...

Polygon’s focus on building L2 infrastructure outweighs MATIC’s 50% drop from ATH

After a devastating 50% correction between Dec. 25 and Jan. 25, Polygon (MATIC) has been struggling to sustain the $1.40 support. While some argue this top-15 coin has merely adjusted after a 16,200% gain in 2021, others point to competing scaling solutions growth. MATIC token/USD at FTX. Source: TradingView Either way, MATIC remains 50.8% below its all-time high at an $11 billion market capitalization. Currently, the market cap of Terra (LUNA) stands at $37 billion, Solana (SOL) is above $26 billion and Avalanche (AVAX) is at a $19 billion market value. A positive note is that Polygon raised $450 million on Feb. 7, and the funding round was backed by some of blockchain’s most considerable venture funds, including Sequoia Capital. Polygon offers scaling and infrastructure support to Ethere...

Crypto market recedes after Wednesday’s rally, FTM and XMR down over 10%

The upwards momentum inspired by yesterday’s release of the Biden crypto executive order has waned The majority of the top cryptocurrencies are seeing losses in the range of 4% to 8% The price of most crypto coins soared late Tuesday and remained high for the larger part of Wednesday. The midweek upswing was as a result of the White House crypto directive that was released yesterday, albeit the Treasury department, through Janet Yellen, had inadvertently shown a glimpse of what the order would entail. Bitcoin and company surged as the markets welcomed the vague order, interpreting it as progressive for the sector. Crypto assets have nosedived The market outlook has, however, changed 24 hours later, with many crypto assets resuming a downtrend after failing to sustain the momentum. Co...

Crypto market rallies on reports of a ‘positive’ Biden crypto executive order

News of the release of a now-deleted Treasury response to Biden’s crypto executive order has sent bullish waves in the market Bitcoin has gained more than 8.25%, racing past $42,000, while Ethereum has retested $2,750 Reports of the highly-anticipated crypto executive order from the White House being bullish or neutral in the worst case have spurred a market rally on Wednesday morning. Treasury’s response hints Biden’s crypto executive is likely not bearish Late yesterday, US Secretary of Treasury Janet Yellen published a response to the Biden crypto order even before the latter was released. The incident struck as unintentional since the response shared was dated March 09 (today) yet went up live a day earlier. In the statement, Yellen ‘accidentally gave an inkling...

More than $195M liquidated in the last 24 hours as Bitcoin and altcoins rebound

The combined crypto market capital has swelled by over $115 billion in the last 12 hours Market data shows $195 million worth of leveraged positions have been closed on account of the unexpected rally Top crypto assets are soaring in the market led by Bitcoin and the premier altcoin – both have seen 24-hr price gains of more than 6.50%. The market upsurge started late yesterday following the accidental release of a statement from Treasury’s Janet Yellen acknowledging the White House’s ‘positive’ crypto directive. Through Yellen’s comments, the market construed the crypto executive order as pragmatic and even positive to some extent. This triggered a market-wide rally, with the total crypto market capital growing from $1.726 trillion to a peak of $1.847 trillion a few hours ago. Massive liq...

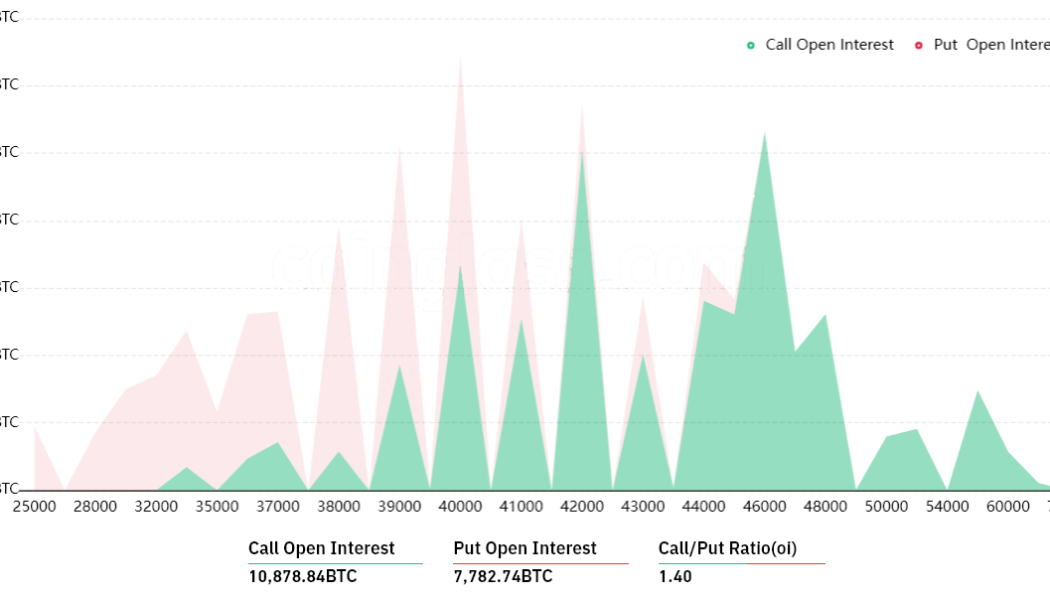

Bitcoin rallied, but analysts say it’s ‘more of the same’ until $46K becomes support

“Volatility” is the word of the month and that is exactly what cryptocurrency investors saw today as Bitcoin rallied after concerns over the Biden administration’s executive order on crypto turned out to be a ‘nothingburger’. Data from Cointelegraph Markets Pro and TradingView shows that after trading near the $39,000 mark for the past few days, the price of Bitcoin (BTC) spiked 10.42% to an intraday high at $42,606 on as cautious traders flooded back into the market. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what traders and analysts in the market are saying about this latest move and the areas of support and resistance to keep an eye on. “Different pump, same story” Wednesday’s move for Bitcoin was just a repeat of recent be...

P2P file-sharing platform LimeWire stages a comeback as an NFT marketplace

The discontinued file sharing platform will launch as an NFT marketplace in May The NFT marketplace project is yet to conduct external funding but will soon launch a LimeWire token Defunct software peer-to-peer file sharing (P2P) client LimeWire has today announced that it’s coming back but not in the same way it used to be. LimeWire intends to relaunch as an NFT marketplace. At the height of its prominence, LimeWire was popular for its service that allowed users to share and download music at no cost. However, its run came to an end and had to shut down in 2010 after a federal court found that LimeWire had caused large-scale copyright infringement via the service it offered users. Here is what to expect Austrian brothers Julian and Paul Zehetmayr, who acquired LimeWire’s intel...

Cake DeFi launches groundbreaking tech firm growth accelerator CDV

Cake DeFi, a fully transparent, highly innovative and regulated global fintech platform, has launched Cake DeFi Ventures. The venture arm, worth $100 million, will be vested in accelerating growth of tech firms with a focus on gaming, web3, and fintech, CoinText learned from a press release. $1B+ managed in customer assets With over $1 billion managed in customer assets, Cake DeFi helps its user base of more than half a million registered members to profit from their digital asset investments. Focus on investments in tech startups Cake DeFi Ventures (CDV) will turn attention to tech startups across the metaverse, the NFT space, Web3, gaming, fintech, and esports. The venture arm will look for investment opportunities in startups across the globe. CDV portfolio companies will get str...

Elrond announces strategic support for Web3 data brokerage system Itheum

Elrond has announced its strategic support for Web3 data brokerage platform Itheum, which will debut on Elrond’s strategic launch platform, the Maiar Launchpad, CoinText learned from a press release. Itheum will allow everyone to manage their personal data By taking advantage of Elrond Network’s scalable blockchain technology, Itheum will give everyone everywhere a chance to manage their personal data as assets. Itheum is also working on NFT technology to create NFMe IDs, data avatars for the Metaverse. Beniamin Mincu, CEO of Elrond Network commented: The elements are in place for building a compelling environment where adventure, exploration, and curiosity are elevated to unprecedented levels of immersion and unique relevance. Data will be the building blocks of the Metaverse,...