Markets

Here is how studying tokens’ price history helps patient traders enjoy consistent average gains.

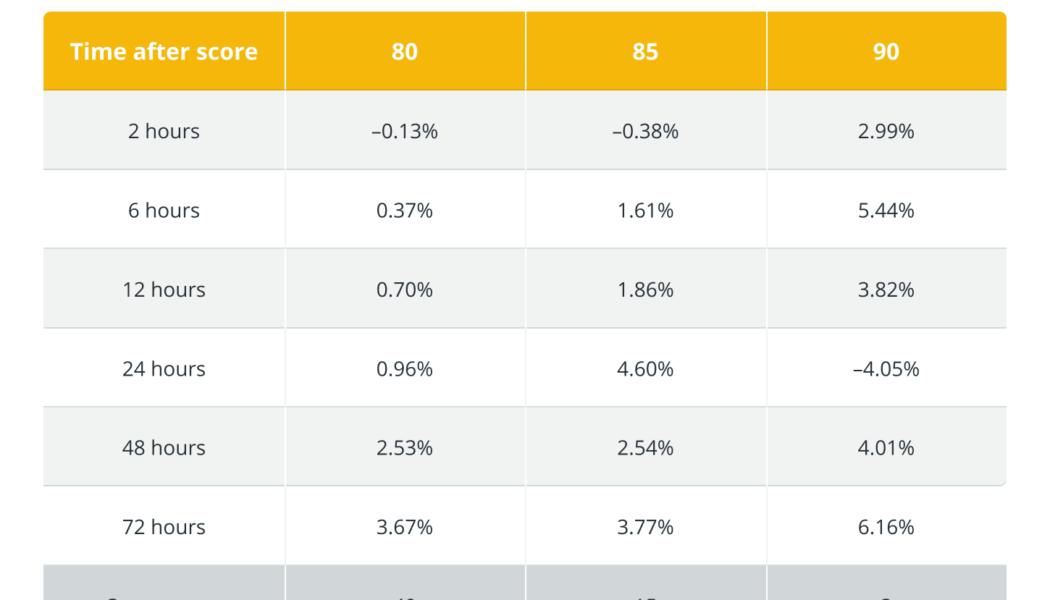

Whether you consider cryptocurrency trading as art, science or a game of skill, one thing is beyond dispute: Those who excel at it are not the traders who maintain the longest series of lucky one-offs but those who establish sustainable trading processes yielding consistent returns. Ask a sample of seasoned pros if they would prefer to catch one obscure token’s 300%-in-a-day brush with fame or learn a strategy that systematically generates a 3% return on investment. You will be surprised how many of them (likely close to 100% of the sample) prefer modest yet systematic profits. How does one make their trading processes more systematic? One way is to rely on automated data analytics tools with a proven track record of consistent performance. One such tool is the VORTECS™ Score, an ar...

Privacy coins are surging. Will regulatory pressure stall their stellar run?

Recent weeks saw a massive surge of the so-called privacy coins’ prices — namely Monero (XMR), Dash (DASH), Zcash (ZEC) and Haven Protocol (XHV). As many other cryptocurrencies and the industry at large faced immense regulatory pressure amid the war in Ukraine, one narrative that began taking hold in the crypto space was the potential of such privacy-enhancing assets to provide investors a greater level of financial anonymity. But, can privacy coins deliver on Bitcoin’s (BTC) original promise? A good month for privacy-focused assets Over the past month, Monero has almost doubled its tally. With some minor oscillations, it rose from $134 on Feb. 24 to over $200 on March 26. ZEC showed even more impressive dynamics that hiked from $88 to $202 over the same period. DASH also pulled off ...

Loopring (LRC) price surges by 50% after GameStop NFT marketplace integration

Filling multiple needs within the cryptocurrency community is one way a project can set itself apart from the competition and new attract users and liquidity to its ecosystem. Loopring aims to do exactly this by aiming to offer a EVM-based solution with low fees where DeFi and NFT developers and investors can transact. The layer-two (L2) scaling solution utilizes zk-Rollups to provide fast, low-cost transactions and the project has been gaining traction throughout the month of March. Data from Cointelegraph Markets Pro and TradingView shows that the price of LRC gained 57% between March 21 and March 23 as its price increased from $0.78 to $1.23 amidst a spike in its 24-hour trading volume to $2.75 billion. LRC/USDT 4-hour chart. Source: TradingView Three developments that have helped...

Ethereum price hits $3.2K as anticipation builds ahead of the ‘Merge’

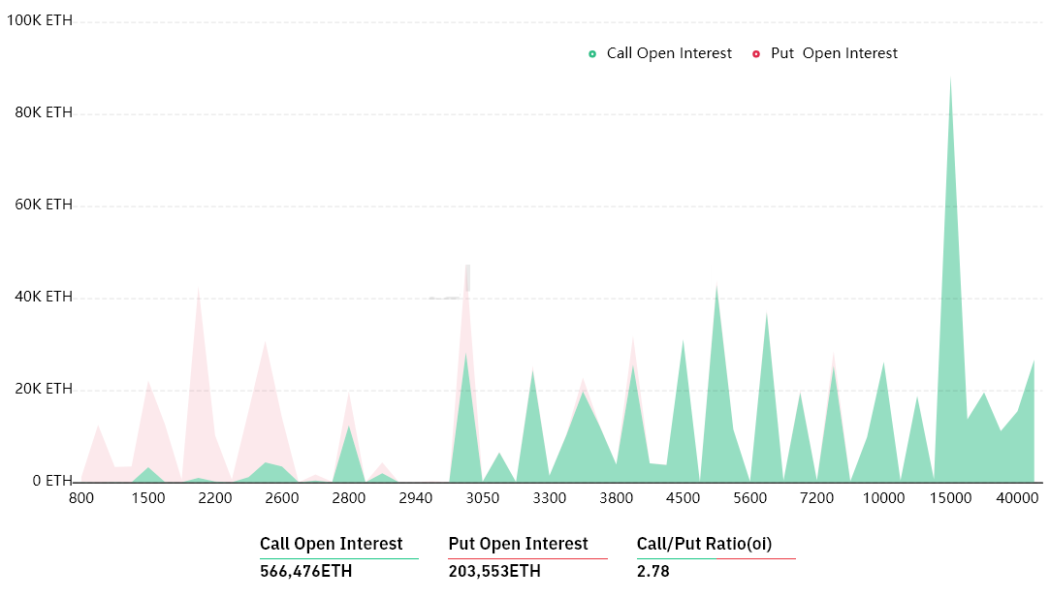

The week-long uptrend in the cryptocurrency market has begun to awaken bullish crypto investors and the successful March 15 launch of the Ethereum “merge” on the Kiln testnet has the community excited about the upcoming switch to proof-of-stake (POS). Data from Cointelegraph Markets Pro and TradingView shows that since the successful launch on Kiln, the price of Ether has climbed 25% from $2,500 to a daily high at $3,193 on March 25 as traders look to lock in their positions ahead of the merge. ETH/USDT 1-day chart. Source: TradingView Here’s a look at what analysts in the market are saying could happen with the price of Ether as the merge approaches and how the switch to POS could affect its price long term. A clear breakout from the downtrend The turnaround in Ether pri...

Russia is looking towards Bitcoin as a payment form for energy exports

Energy official Pavel Zavalny says Russia has lost all interest in the Euro and dollar On Wednesday, President Putin demanded that all unfriendlies must pay for Russian energy exports in the ruble Recent reports suggest that Moscow is exploring ways to save its economy and get it back on track amidst heavy sanctions from the west. The country is now leveraging one of its most valuable exports – gas. Russia already made it a requirement that all non-friendly nations seeking to buy gas from it must pay in the Russian ruble, while friendlies like China and Turkey can pay in their fiat currencies or the ruble. Bitcoin as an option for the ‘allies’ According to a top government official, the nation is open to accepting Bitcoin as payment for oil and gas exports. Chairman of the Stat...

Bitcoin hits $44K, but traders want to see a few daily closes here before a move higher

Morale across the cryptocurrency ecosystem is rising on March 24 as several days of positive moves have helped lift Bitcoin (BTC) back above $44,000 and Ether bulls took control at $3,100. The climbing price of BTC comes amid a backdrop of surging inflation and rising interest rates, which could see up to seven hikes over the course of 2022, according to Minneapolis Federal Reserve President Neel Kashkari. BTC/USDT 1-day chart. Source: TradingView Data from Cointelegraph Markets Pro and TradingView shows that after trading near $43,000 throughout the morning session on March , a midday spike lifted the price of BTC to an intraday high at $44,186 where it bumped up against a major resistance zone. Bitcoin needs to flip $44,000 into support A look at the weekly chart shows that “Bitcoi...

Ethereum price breaks through $3K, but analysts warn that a retest is needed

The cryptocurrency market continues to forge ahead on March 23 despite facing headwinds on multiple fronts. At the moment, global conflict, rising inflation and widespread economic uncertainty are taking a toll on financial markets and helping to highlight the need for a diversified investmen portfolio. Altcoins have managed to gain some ground in recent days, led by Ethereum, the top smart contract platform, which managed to climb back to the major support and resistance zone at $3,000 where bulls are now battling for control. ETH/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts in the market are saying about the path forward for Ether and whether or not further upside is expected in the short-term. Upcoming test of $3,125 A general overview of the recent...

Fetch.ai (FET) gains 43% after $150M development fund and Cosmos IBC announcement

Development across the cryptocurrency ecosystem continues to move forward despite the day-to-day whipsaw price movements and this progress is furthering the public’s awareness of Web3 and the value of blockchain technology. One project that has been climbing the charts amid a marketing push to develop better brand recognition is Fetch.ai, a protocol focused on building a token-based decentralized machine learning network capable of supporting the smart infrastructure being built around the digital economy. Data from Cointelegraph Markets Pro and TradingView shows that the price of FET has climbed 43.13% over the past two days, rallying from a low of $0.322 on March 21 to an intraday high at $0.46 on March 23 as its 24-hour trading volume underwent a five-fold increase. FET/USDT 4-hou...

Bitcoin bulls take aim at $45K while some analysts warn of possible correction

The bullish narrative is beginning to build across the cryptocurrency ecosystem on March 22 as the price of Bitcoin (BTC) briefly spiked above $43,000 while Ether (ETH) has reclaimed support at $3,000 following a deposit of $110 million worth of ETH into Lido’s liquidity pools. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin rallied 6.15% from a low of $40,884 in the early hours of Tuesday to an intraday high at $43,380 before consolidating around support at $42,300. BTC/USDT 1-day chart. Source: TradingView Here’s what several analysts are saying about Bitcoin’s recent price action and which support and resistance levels to keep an eye on moving forward. BTC price could correct lower A foreshadowing of Bitcoin’s move on March 22 was pro...

Bitcoin Cash and Ethereum Classic up double digits as 24-hour trading volume eclipses $100 BN

Ethereum has cleared resistance at $3,000 on Tuesday morning Other top altcoins including ADA, DOT, and XRP are trading in the green as well The majority of top cryptocurrencies appear to be gaining ground on Tuesday with the total market capital peaking above $2 trillion. Bitcoin price shot up to a multi-week high of $43,116 in the early Asian trading hours, CoinMarketCap data shows. Although the OG crypto has retreated to around $42,470 as of this writing, it is still trading in the green – up approximately 3% in the last 24 hours. Ether price crossed $3,00o on the strength of the sharp overnight ascent, touching a five-week high of $3,040. Market data further shows that ETH’s 24 hr trading volume has swelled by almost 42% to $19.688 billion. Bitcoin Cash and Ethereum Classic leading gai...