Markets

Astar (ASTR) price doubles as the network prepares to add 15 new projects in April

Following the successful completion of its initial parachain auctions, the Polkadot (DOT) ecosystem has begun to gain traction with the cryptocurrency community as the first chains begin to come online and integrate with Ethereum (ETH). Astar (ASTR) is one such Polkadot-based project that finished off the month of March on a hot streak after the multi-chain smart contract platform attracted the attention of retail and institutional crypto investors. Data from Cointelegraph Markets Pro and TradingView shows that after hitting a low of $0.107 on March 22, the price of ASTR has climbed 104% to a daily high at $0.208 on April 1 as demand for the token increased 20-fold. ASTR/USDT 4-hour chart. Source: TradingView Three reasons for the rally include the completion of a $22 million funding...

Michael Saylor: Financial markets are ‘not quite ready’ for Bitcoin bonds

MicroStrategy CEO and Bitcoin permabull, Michael Saylor believes that traditional financial markets aren’t quite ready for Bitcoin-backed bonds. Saylor told Bloomberg on Tuesday, that he’d love to see the day come where Bitcoin-backed bonds are sold like mortgage-backed securities, but warned that, “the market is not quite ready for that right now. The next best idea was a term loan from a major bank.” MacroStrategy, a subsidiary of @MicroStrategy, has closed a $205 million bitcoin-collateralized loan with Silvergate Bank to purchase #bitcoin. $MSTR $SIhttps://t.co/QYw2ZgeE3U — Michael Saylor⚡️ (@saylor) March 29, 2022 The remarks come two days after MicroStrategy’s (MSTR) Bitcoin-specific subsidiary MacroStrategy, announced that it had taken out a $205 million Bitcoin-...

Traders predict $3,800 Ethereum, but multiple data points suggest otherwise

Investors tend not to complain about a price rally, except when the chart presents steep downside risks. For example, analyzing Ether’s (ETH) current price chart could lead one to conclude that the ascending channel since March 15 is too aggressive. Ether price at FTX, in USD. Source: TradingView Thus, it is only natural for traders to fear that losing the $3,340 support could lead to a retest of the $3,100 level or a 12% correction down to $3,000. Of course, this largely depends on how traders are positioned along with the Ethereum network’s on-chain metrics. For starters, the Ethereum network’s total value locked (TVL) peaked at ETH 32.8 million on Jan. 23 and has since gone down by 20%. TVL measures the number of coins deposited on smart contracts, including decentralized fi...

DeFi sector TVL rises as investors return to a bullish crypto market

The month of March has been a tale of two halves for the cryptocurrency market and the weakness seen since the start of the year has began to fade. Bitcoin’s (BTC) strong move above the $40,000 level is helping to lift sentiment across the sector, and DeFi tokens are also beginning to move upward. Crypto Fear & Greed Index. Source: Alternative.me Data from cryptocurrency market intelligence firm Messari shows that a majority of the top tokens in the DeFi sector have posted double-digit gains over the past 30 days, led by THORChain (RUNE), which has increased by 199.81%, and Aave (AAVE), which has seen its price increase 53.95% Top 12 DeFi assets. Source: Messari Here’s a rundown of the state of DeFi as the sector attempts to get back to its former glory and kickstart a new ...

A retest is expected, but most analysts expect Bitcoin price to extend much higher

The mood across the cryptocurrency market has seen a notable improvement in the last week as prices are on the rise with Bitcoin (BTC) now trading near $48,000 while Ether (ETH) attempting to hold above $3,400. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin has been oscillating around $48,000 since it broke out above $45,000 early on March 28 and bulls are now debating whether a bull run to $80,000 is on the cards. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts in the market are saying about the outlook for BTC moving forward and what levels to keep an eye on in case of a price pullback or another breakout to the upside. Bitcoin breaks above its 1-year moving average “Keeping it simple is often best” accordi...

Wonky Mars Protocol launch shows ecosystem expansion may not add to network value

New protocols are launching every day on different networks in the crypto space and the trend is likely to continue through this year. When looking at the top five networks by total value locked (TVL) — Ethereum (ETH), Terra (LUNA), Binance Smart Chain (BSC), Avalanche (AVAX) and Solana (SOL) — according to data from DeFiLlama, Ethereum have 579 protocols (including L1 and L2); Terra has 25, BSC has 348, Avalanche and Solana have 187 and 64 protocols, respectively. The low number of protocols and high TVL from Terra surely stand out as the outlier here. Terra’s TVL reached an all-time high at $20 billion in December 2021 before dropping to $13 billion during the January 2022 crash. To date, the ecosystem has managed to boost its liquidity back to $26 billion. With only 25 protoco...

Ethereum targets $3,500 as Bitcoin touches a three-month high

Bitcoin raced past $48k during Monday’s trading session setting a new year-to-date high above $48,086 Ethereum’s native token Ether has today shot up to a multi-week high of $3,428.85 on the back of the broader market rally Bitcoin yesterday set a new yearly high north of $48,000 as its price reacted to bullish news of Terra acquiring more Bitcoin that will act as reserve for its TerraUSD stable coin. The price ascent means Bitcoin has erased the losses it has recorded thus far. Though it has since retreated to $47,540 at the time of writing, market data shows Bitcoin has made marginally over 11% in the last seven days. These gains have helped the Satoshi coin come off a two-month cycle of range-trading between $35,000 and $45,000. At its current price, Bitcoin has moved up by over 43% fro...

Interoperability-focused Stargate Finance (STG) aims to kick off DeFi 3.0

“Stargate Finance” has been trending on Twitter for the past week and while it’s too early to call for a full-blown DeFi bull market, traders have been shoveling funds into the project, which claims to be a “composable omni-chain native asset bridge.” Data from Cointelegraph Markets Pro and TradingView shows STG was listed on exchanges on March 17 and its price has climbed 438% from a low of $0.665 to a high of $3.58 on March 25. STG/USDC 1-hour chart. Source: TradingView Here’s a look at some of the developments with the protocol that have attracted DeFi users and boosted the price of STG ahead of its initial community auction. Cross-chain composability Interoperability has been a growing theme across the cryptocurrency ecosystem and this theme continues to expand as inv...

Ether and Solana see $230M in Combined 24-Hr Liquidations as Bitcoin Clears $47,500

A late Sunday upward momentum has pushed the majority of cryptocurrencies in the market above previously challenging resistance zones. Bitcoin records a close above $47,200 The price of Bitcoin, the market leader, has increased by 6.29% in the last 24 hours as per market data at the time of writing. The flagship cryptocurrency cleared resistance at $47,000, breaking into the range of January highs late on Sunday. It maintained its uptrend into Monday, setting a new year-to-date high of $47,656 only a few hours ago as per CoinMarketCap data. The market swell appears to be a result of several bullish factors across the cryptocurrency sector. Most notable is the recent revelation of a $1o billion worth of Bitcoin ‘reserve’ plan by Terra blockchain founder Do Kwon. Another factor c...

Bitcoin retreats below $47k after closing in on its yearly high

Bitcoin climbed above $47,200 late on Sunday and continued hovering around this range in the morning Asian trading hours Analysts expect the Satoshi coin to maintain the uptrend in the short term The majority of cryptocurrencies in the market are trading in the green, having recorded decent profits on Sunday. Bitcoin, the market leader, surged from around $44,720 on 11:00pm (UTC +3 hours) Sunday to a multi-week high of $47,290 on 3:40am (UTC +3 hours) Monday as per CoinMarketCap data. Markedly, the ascent past $47,200 represents the first time Bitcoin hit breakeven since the turn of the year. After starting the year at $46,700, Bitcoin consistently posted gains in the first three days, peaking above $47,730. It has, however, failed to reclaim this level with every attempt – except ye...

Top 5 cryptocurrencies to watch this week: BTC, ADA, AXS, LINK, FTT

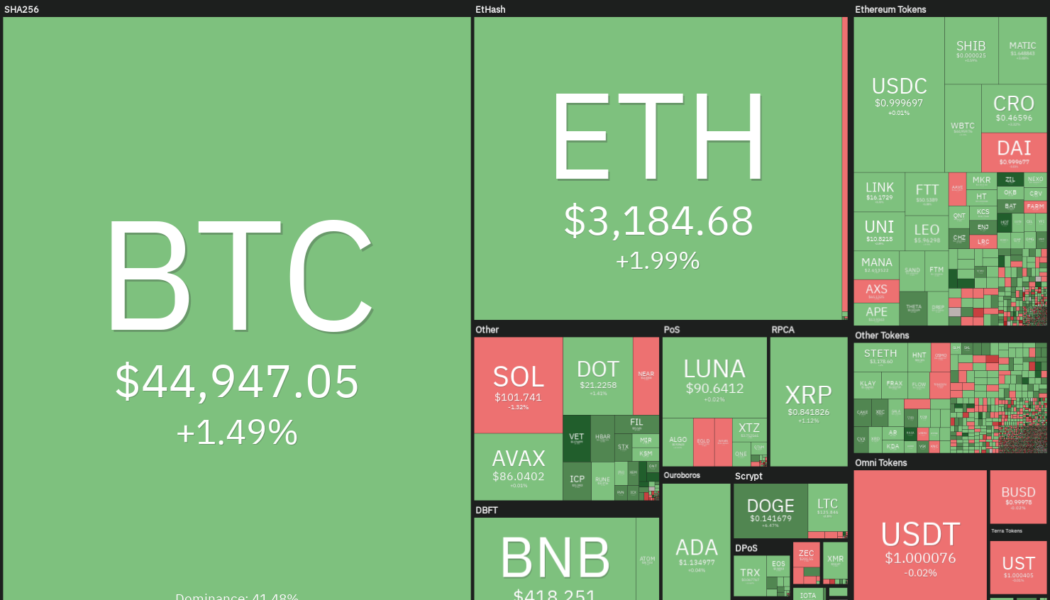

Bitcoin (BTC) is attempting to notch its second successive weekly gains and end at the highest weekly closing price year-to-date. According to on-chain data from Glassnode, the recovery in Bitcoin’s price was driven by demand in the spot markets. This is likely to cheer the bulls because history suggests that spot market demand leads to sustained upside. Another positive sign is the strong demand for the ProShares Bitcoin Strategy exchange-traded fund (BITO) in the past two weeks, which pushed its exposure to a record high. Arcane Research said the strong inflows “suggest that Bitcoin appetite through traditional investment vehicles is increasing.” Crypto market data daily view. Source: Coin360 Along with Bitcoin, the broader crypto space is also attracting investors. According to re...