Markets

Price analysis 12/23: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

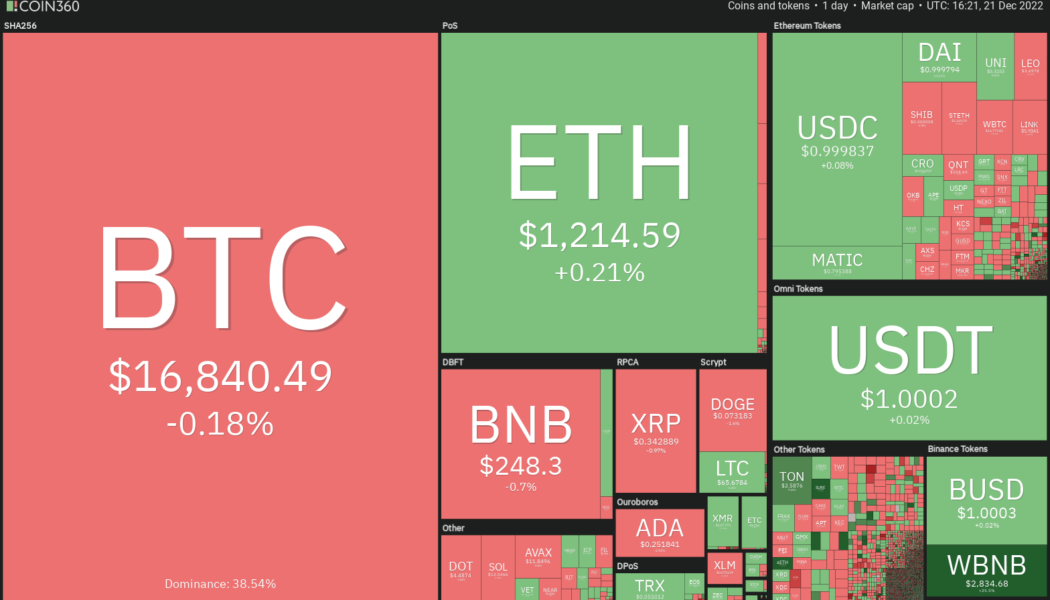

Bitcoin (BTC) is on track to end the year with a loss of about 65%. This would mark the third negative year for Bitcoin with the other two being 2014 and 2018. In comparison, the S&P 500 has fared much better but that is also down close to 20% in 2022. Although cryptocurrency prices have seen deep cuts this year, traders have continued to plow money into the space. An online survey conducted by Blockchain.com shows that 41% of the respondents bought crypto this year and 40% plan to purchase crypto in the next year. Daily cryptocurrency market performance. Source: Coin360 However, a sustained recovery in risk-assets may happen only after inflation shows signs of cooling. That would raise expectations of a pivot by the United States Federal Reserve from its aggressive monetary ...

Bitcoin rebound to $18.4K? BTC price derivatives show strength at key support zone

Bitcoin (BTC) price lost 11.3% between Dec. 14 and Dec. 18 after briefly testing the $18,300 resistance. The move followed a seven-day correction of 8% in the S&P 500 futures after United States Federal Reserve Chair Jerome Powell issued hawkish statements after raising the interest rate on Dec. 14. Bitcoin price retreats to channel support Macroeconomic trends have been the main driver of recent movements. For instance, the latest bounce from the five-week-long ascending channel support at $16,400 has been attributed to the Central Bank of Japan’s efforts to contain inflation. Bitcoin 12-hour price index, USD. Source: TradingView The Bank of Japan increased the limit on government bond yields on Dec. 20, which are now trading at levels unseen since 2015. However, not everything has be...

Price analysis 12/21: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

As the year comes to an end, investors will be keenly watching for a Santa Claus rally on Wall Street as many believe that if the rally does not happen, the next year may either remain flat or turn negative. Jurrien Timmer, director of global macro at asset management giant Fidelity Investments, tweeted on Dec. 19 that the United States equities markets may remain “sideways” and choppy in 2023. He expects “one or more retests of the 2022 low, but not necessarily much worse than that.” Daily cryptocurrency market performance. Source: Coin360 The cryptocurrency market has been largely correlated with the S&P 500 in 2022. Unless both markets decouple, the sideways or negative action in the equities markets may not bode well for the cryptocurrency market. Analysts remain divided on t...

$16K retest the most likely path for Bitcoin, according to 2 derivative metrics

Bitcoin (BTC) broke below $16,800 on Dec. 16, reaching its lowest level in more than two weeks. More importantly, the movement was a complete turnaround from the momentary excitement that had led to i$18,370 peak on Dec. 14. Curiously, Bitcoin dropped 3.8% in seven days, compared to the S&P 500 Index’s 3.5% decline in the same period. So from one side, Bitcoin bulls have some comfort in knowing that correlation played a key role; at the same time, however, it got $206 million of BTC futures contracts liquidated on Dec. 15. Some troublesome economic data from the auto loan industry has made investors uncomfortable as the rate of defaults from the lowest-income consumers now exceeds 2019 levels. Concerns emerged after the average monthly payment for a new car reached $718, a 26% in...

The Federal Reserve’s pursuit of a ‘reverse wealth effect’ is undermining crypto

The Federal Reserve’s strategy to hike interest rates may continue, making it difficult for the crypto industry to bounce back. For crypto assets to become the hedge against inflation, the industry needs to explore ways to decouple crypto from traditional markets. Decentralized finance (DeFi) can perhaps offer a way out by breaking away from legacy financial models. How Federal Reserve policies are affecting crypto In the 1980s, Paul Volcker, the chairman of the Federal Reserve Board, introduced the interest hiking policy to control inflation. Volcker raised interest rates to over 20%, forcing the economy into a recession by reducing people’s purchasing capacity. The strategy worked, and the Consumer Price Index (CPI) went down from 14.85% to 2.5%. Even now, the Federal Reserve continues t...

Bitcoin’s boring price action allows XMR, TON, TWT and AXS to gather strength

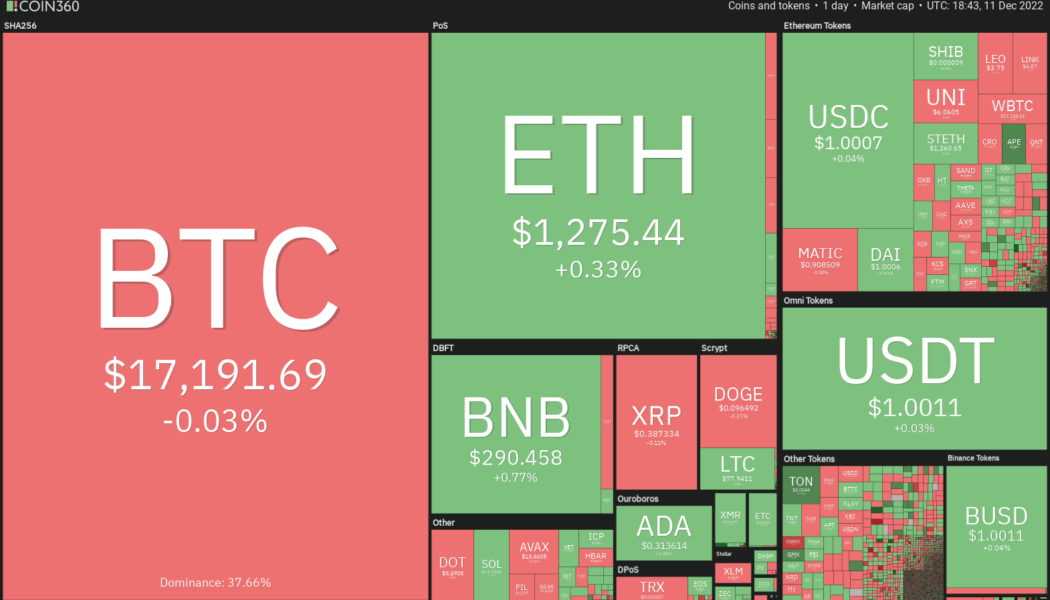

The relief rally in the United States equities markets took a breather this week as all major averages closed in the red. Traders seem to have booked profits before the busy economic calendar next week. The S&P 500 index dropped 3.37%, but a minor positive for the cryptocurrency markets is that Bitcoin (BTC) has not followed the equities markets lower. This suggests that crypto traders are not panicking and dumping their positions with every downtick in equities. Crypto market data daily view. Source: Coin360 The range-bound action in Bitcoin suggests that traders are avoiding large bets before the Federal Reserve’s rate hike decision on Dec. 14. However, that has not stopped the action in select altcoins, which are showing promise in the near term. Let’s look at the charts of Bitcoin ...

5 tips for investing during a global recession

The economy is facing an outlook bleaker than a Welsh weather forecast, and few are rushing to buy risk assets. Here are a few tips for weathering unfavorable market conditions. Option #1: Save cash There’s no shame in sitting on the sidelines and saving cash or stablecoins. When bullish momentum returns, you will have plenty of dry powder to make big allocations. In the meantime, there are still lots of opportunities to earn yield across crypto markets as long as you trust the protocol you’re using. But isn’t this timing the market, which is impossible? Possibly. But this is more about spotting momentum and general market trends as opposed to more focused price targeting or calling reversals. Larger trends are easier to spot. However, if that’s a bit risky, there’s another option. Option ...

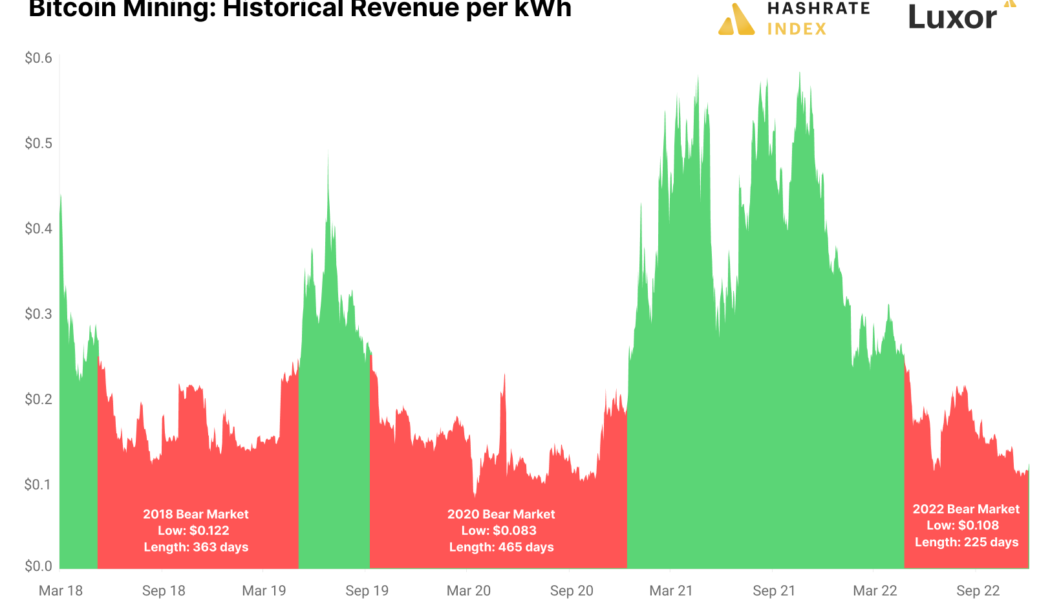

Data shows the Bitcoin mining bear market has a ways to go

Bitcoin (BTC) mining is the backbone of the BTC ecosystem and miners’ returns also provide insight into BTC’s price movements and the health of the wider crypto sector. It is well-documented that Bitcoin miners are struggling in the current bear market. Blockstream, a leading Bitcoin miner recently raised funds at a 70% discount. Current mining activity shares similarities to historic BTC bear markets with a few caveats. Let’s explore what this means for the current Bitcoin cycle. Analysis shows that based on previous cycles the bear market may continue Bitcoin mining profitability can be measured by taking the miner’s revenue per kilowatt hour (kWh). According to Jaran Mellerud, a Bitcoin analyst for Hashrate Index, a BTC mining bear market has a sustained period of revenue per kWh of les...