Markets

Altcoin Roundup: Interoperability push puts attention back on Polkadot

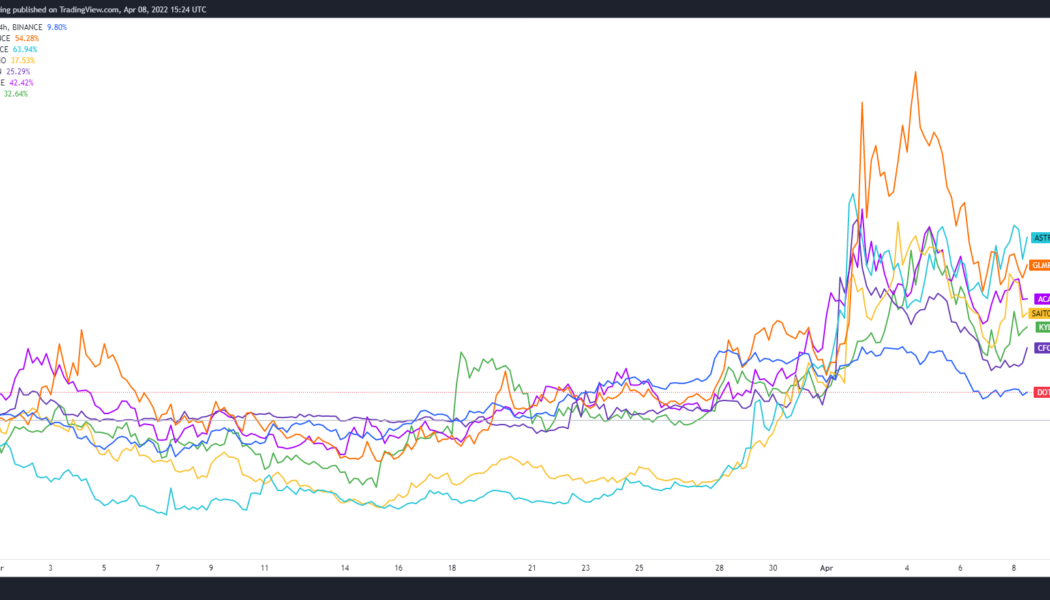

The Polkadot ecosystem sorely underperformed compared to other layer-1 networks in 2021, while the slow roll-out of parachain auctions and mainnet launches left the network playing catch-up in 2021. It appears that this trend came to an end in mid-March when numerous projects in the Polkadot ecosystem saw their prices climb higher after users began to engage with networks that expanded their offerings and made a push toward Ethereum Virtual Machine (EVM) compatibility. DOT, GLMR, ACA, ASTR, SAITO, CFG and KYL in USDT pairs. Source: TradingView Here’s a look at six top moving protocols in the Polkadot ecosystem that are helping to establish a presence in the cryptocurrency market. Interoperability is the key Interoperability has been one of the driving themes of the cryptocurrency market fo...

xASTRO staking and upcoming ‘Terra wars’ send Astroport price to new highs

Projects that launch on up-and-coming blockchain networks can often benefit from a low competition environment that allows them to attract new users and liquidity at a faster rate than crowded networks like Ethereum. A recent example of this is Astroport (ASTRO), an automated market maker (AMM) on the Terra (LUNA) network that has seen an influx of activity alongside the increased attention that is being focused on the Terra ecosystem and its Terra USD (UST) stablecoin. . Data from CoinGecko shows that since hitting a low of $1.28 on March 7, the price of ASTRO has exploded 194% to hit a new all-time high of $4.80 on April 5. ASTRO/USDT 4-hour chart. Source: TradingView Three reasons for the price appreciation seen in ASTRO include the increased attention the Terra ecosystem ha...

‘People should invest in all of the major layer-1s,’ says a veteran trader

Scott Melker, veteran trader and pocaster, is convinced that major layer-1 protocols should be part of everyone’s investment portfolio. Instead of picking individual crypto projects, such as NFTs or blockchain games, Melker thinks it makes more sense to bet on the blockchain infrastructure on which these projects are built. “Any of these small projects could absolutely go nuts. But you’re going to have trouble choosing what they are. You should just own the layer-1 and the infrastructure that they’re all built on,” he said in an exclusive interview with Cointelegraph. “You may not own a Bored Ape, but Ethereum holders have certainly benefited from the success of Bored Apes!” he pointed out. Talking about his portfolio construction, Melker revealed that about 6...

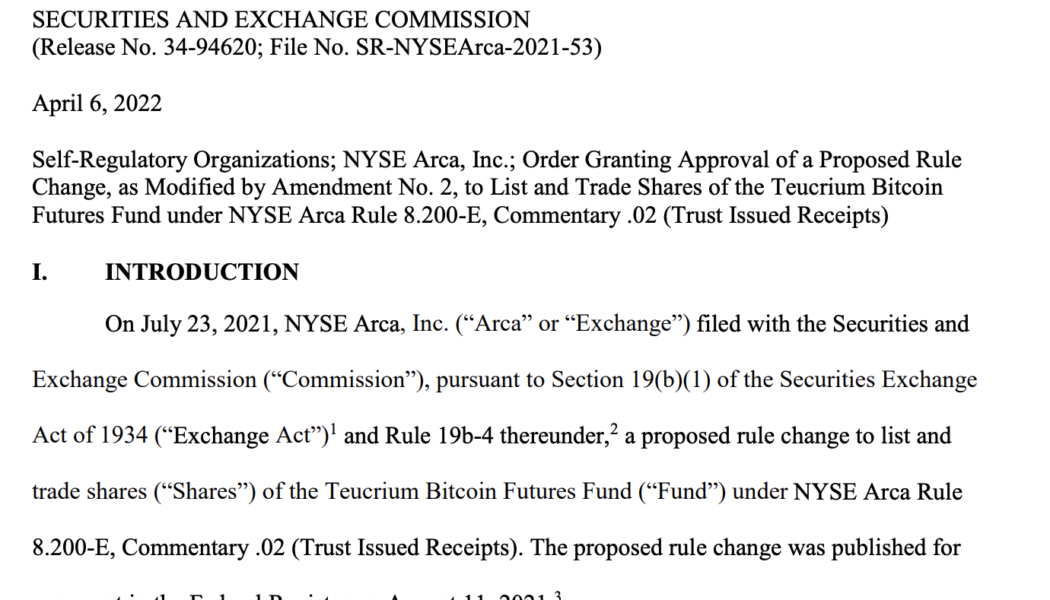

Grayscale CEO pleads Bitcoin spot ETF as SEC backs third BTC Futures ETF

Institutional investors rejoice, there is one more way to gain exposure to Bitcoin (BTC). The United States Securities and Exchange Commission (SEC) announced overnight the approval of a fourth Bitcoin futures exchange-traded fund (ETF). Fund group Teucrium is behind the most recently approved Bitcoin Futures ETF. The ETF joins a growing number of approved futures ETFs, complementing ProShares, Valkyrie, and VanEck Bitcoin Futures ETFs. The SEC filing for the Teucrium ETF. Source: SEC.gov Every Bitcoin spot ETF has been rejected to date, however, for one invested observer, the way in which the approval was made could be a boon for expectant spot investors. The plot thickens on the path to $GBTC’s spot #Bitcoin #ETF conversion… — Sonnenshein (@Sonnenshein) April 7, 2022 In a Tweet thread, G...

Ecosystem expansion and $45M funding round boost Boba Network (BOBA) price by 30%

The institutional adoption of cryptocurrencies has been gaining momentum over the past couple of years due to venture capitalists and money managers looking to the crypto market as the next investment class that will offer the greatest return. The Boba Network (BOBA) is the most recent protocol to benefit from institutional interest and the long search for an Ethereum (ETH) layer-two scaling solution capable of low-cost transactions and fast processing times. Data from Cointelegraph Markets Pro and TradingView shows that BOBA has gained 50.71% over the past week and a half after climbing from a low of $1.24 on March 27 to a daily high at $1.873 on April 5. BOBA/USDT 4-hour chart. Source: TradingView Three reasons for the climbing price of BOBA include the completion of a $45 million ...

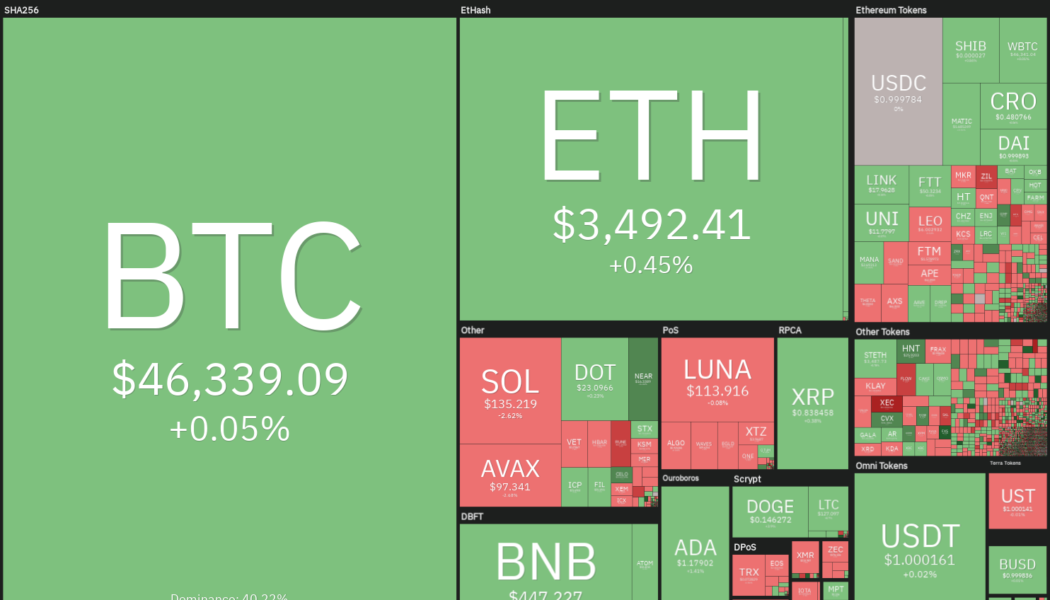

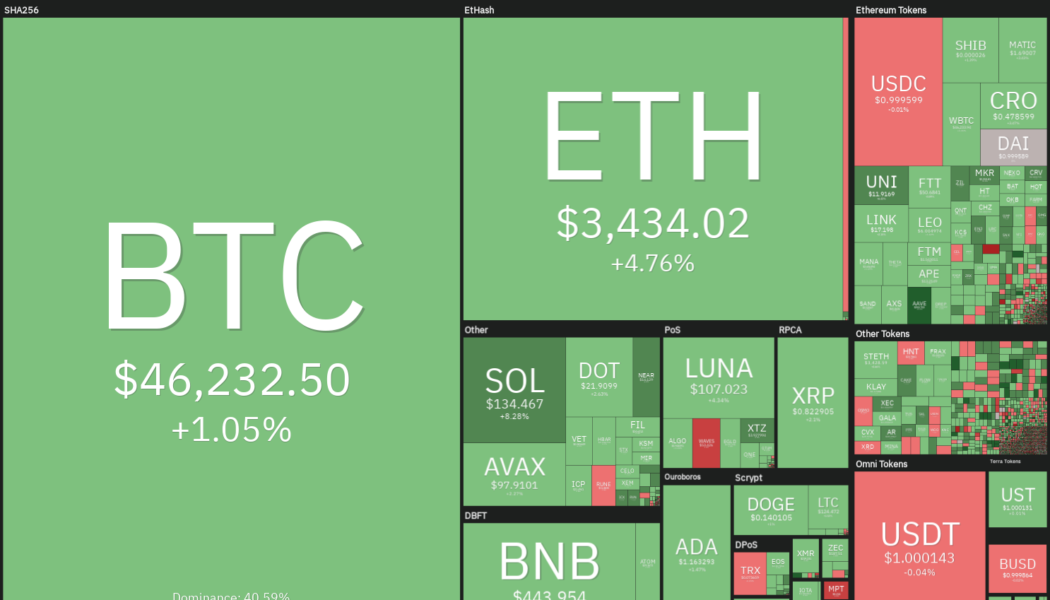

Bitcoin leads altcoins in setting up for a positive Q2

Ethereum has been consolidating around $3,500 for the last 24 hours ETH and ADA are gaining from imminent updates coming to the respective networks Recent days have seen Bitcoin enjoy a reasonable upswing in prices, carrying with it several other altcoins. The Satoshi coin has gained approximately 11% over the last two weeks and largely maintained above $45k. According to data by Coingecko, the world’s leading digital asset touched $44,347 on April 1, the lowest price level it has seen in the last week. Bitcoin was last seen changing hands at $46,160. The recent uptrend is a culmination of growth that has been building since mid-March. In the early days of last month, Bitcoin slumped, falling from $41,770 on March 1 to $39k support on March 6. Afterward, it started making signif...

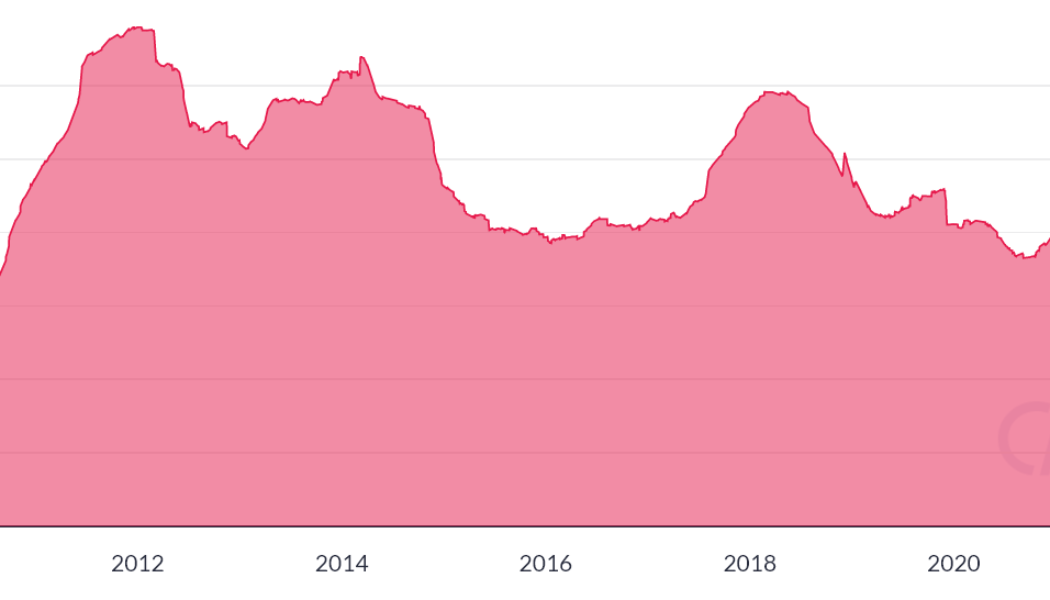

Top 5 cryptocurrencies to watch this week: BTC, VET, THETA, RUNE, AAVE

Bitcoin (BTC) is attempting to hold above its closest support level, and traders are watching to see if the price can remain strong and close above the 2022 yearly open price at $46,200 for the second week in a row. April has historically been the best performing month of the year for the S&P 500, according to Sam Stovall, chief investment strategist at CFRA. If history repeats itself and the close correlation between the United States equity markets and Bitcoin continues, it could bode well for the crypto markets in the near term. Crypto market data daily view. Source: Coin360 Another sentiment booster could be that the 19th million Bitcoin entered circulation on April 1. For the remaining 2 million BTC, the crypto markets will have to wait for a long time because the last Bitcoin is ...

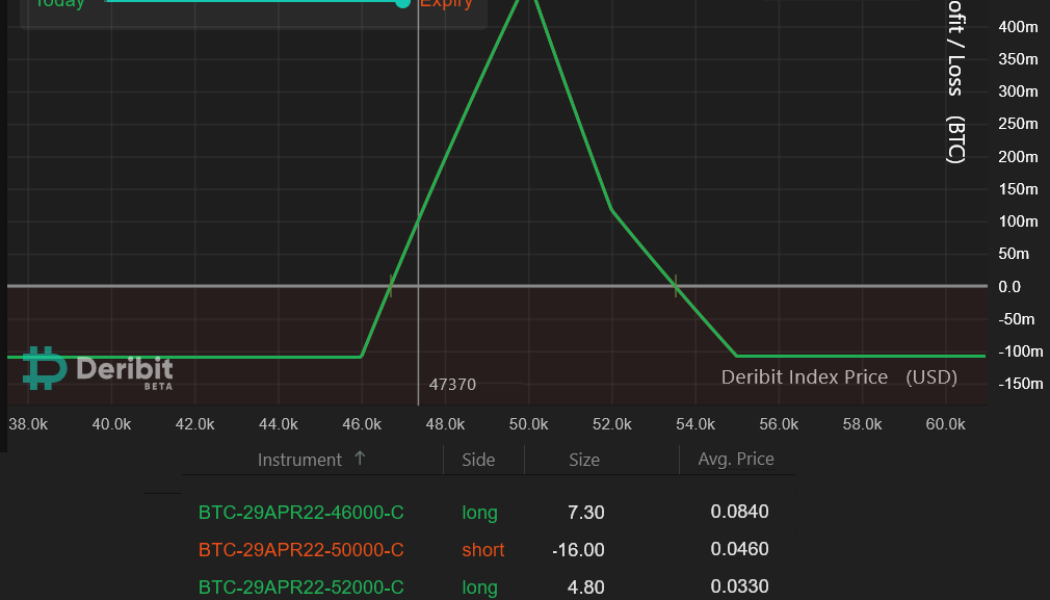

Here’s how pro traders use Bitcoin options to profit even during a sideways market

Bitcoin (BTC) price swings might be impossible to predict, but there is a strategy frequently used by pro traders that yields high returns with minimal cost. Typically, retail traders rely on leveraged futures positions which are highly susceptible to forced liquidations. However, trading Bitcoin options provide excellent opportunities for investors aiming to maximize gains while limiting their losses. Using multiple call (buy) options can create a strategy capable of returns six times higher than the potential loss. Moreover, these can be used in bullish and bearish circumstances, depending on the investors’ expectations. The regulatory uncertainty surrounding cryptocurrencies has long been a significant setback for investors and this is another reasons why neutral market strategies...

AVAX traders anticipate a new ATH even as Avalanche DApp use slows

Avalanche (AVAX) jumped 43.8% between March 14 and March 31 to a $97.50 daily close, which is the highest level since Jan. 5. This layer-1 scaling solution uses a proof-of-stake (PoS) model and has amassed $9 billion in total value locked (TVL) deposited on the network’s smart contracts. AVAX token/USD at FTX. Source: TradingView Subnet adoption propels the recent price rally Some analysts attribute the rally to Avalanche’s incentive program to accelerate the adoption of subnets which was announced on March 9. According to the Avalanche Foundation, subnets enable functions that are only possible with “network-level control and open experimentation.” The program will allocate up to four million AVAX, worth roughly $340 million, to fund decentralized applications focused on gaming, nonfungib...

Price analysis 4/1: BTC, ETH, BNB, SOL, XRP, ADA, LUNA, AVAX, DOT, DOGE

Bitcoin (BTC) has clawed back much of the losses that took place in January and now the focus of traders shifts to April, which has historically been a strong month for the cryptocurrency. According to Coinglass data, Bitcoin has closed April in the red on onlthree occasions and the worst monthly loss was a 3.46% drop in 2015. Although history favors the bulls, the Whale Shadows indicator has noticed that more than 11,000 Bitcoin has left a wallet in which it had been lying dormant for seven to ten years. The movement of similar-sized quantities from dormant accounts has generally resulted in a major top, according to independent market analyst Phillip Swift. Daily cryptocurrency market performance. Source: Coin360 Along with keeping an eye on the crypto markets, traders should ...

Bitcoin recovers the $46K level, but several factors could prevent a stronger breakout

After dropping below $45,000 on March 31, Bitcoin (BTC) surprised investors with a quicker-than-expected recovery to the $46,500 level. Data from Cointelegraph Markets Pro and TradingView shows that bears managed to drop BTC to an overnight low of $44,210 before bulls showed up in force to lift the price back above $46,500 by midday. BTC/USDT 1-day chart. Source: TradingView Here’s what several analysts are saying about the short-term outlook for Bitcoin moving forward and what developments could present headwinds for the top cryptocurrency as a new month gets underway. The macro environment continues to impact BTC price Events in the global financial market continue to have a large impact on cryptocurrency markets and are likely to continue to do so for the foreseeable future. Accord...