Markets

Hashstack Finance’s public testnet represents a ‘significant accomplishment’

Hashstack Finance, a DeFi platform focused on disrupting the DeFi lending market, officially announced its public testnet launch of its Open Protocol. The company said in a Friday press release its Open Protocol is the first of its kind to offer non-custodial, secure under-collateralized loans. Extracting maximum value DeFi users will now be able to experience first-hand how to extract maximum value from their collateral when borrowing. According to the press release, Hashstack’s Open Protocol is the only platform offering under-collateralized loans at a 1:3 collateral-to-loan ratio. For example, a user can borrow $300 after securing $100 worth of assets as collateral. From this, the user can withdraw $70 (up to 70% collateral) with the remaining $230 representing in-platform trading capit...

Coinbase lists Binance USDC and also adds support for ROSE

Coinbase, one of the leading crypto exchanges in the US, announced that it has listed trading pairs of Binance USD (BUSD) and Binance. Besides, On April 11 Coinbase published the list of the top 50 tokens that it was targeting to list during the Second Quarter (Q2) of 2022. Binance USD, a stablecoin that was issued by its greatest competitor Binance and also the fourth largest Stablecoin by market capitalization, was among the tokens to be listed in Q2. Following its listing on Coinbase, BUSD has become the eighth stablecoin to be offered by one of the leading exchanges. However, Coinbase noted that BUSD will not function in its native Binance Chain (BSC) but as an ERC-20 token on the Ethereum (ETH) network. In addition, the exchange also warned its users against sending their assets...

Yield Guild Games raises $15M to bolster P2E gaming ecosystem

Yield Guild Games Southeast Asia (YGG SEA), a Philippines-based subDAO of the gaming startup Yield Guild Games, said in a Tuesday press release it raised $15 million in two new rounds of funding. The company plans to use the proceeds to bolster the adoption of play-to-earn gaming across Southeast Asia. What is YGG SEA? YGG SEA is the first subDAO of YGG with direct exposure to players in Malaysia, Indonesia, Vietnam, and Thailand. According to the press release, YGG SEA is “at the core” of its expansion strategy that spans beyond the Asian region. The press release notes: “In YGG Ecosystem, the goal is not just to onboard players as scholars; but also to be the bridge that brings the Web2 community into Web3 space through GameFi. YGG SEA has been aggressively onboarding and creating a safe...

Altcoins sell-off as Bitcoin price drops to its ‘macro level support’ at $38K

The cryptocurrency market and wider global financial markets fell under pressure on April 26 after the hype surrounding Elon Musk’s purchase of Twitter began to fade and concerns about the state of the global economy took the forefront again. Tech-related stocks were some of the hardest-hit assets on April 26 and this pullback was followed by sharp declines in crypto prices as risk assets become persona non grata in these turbulent markets. Data from Cointelegraph Markets Pro and TradingView shows that after holding support at $40,500 through the early trading hours on April 26, the price of Bitcoin (BTC) dumped 6.21% in afternoon trading to hit a low of $38,009. BTC/USDT 1-day chart. Source: TradingView April 26’s price action looks to be a continuation of the weakness se...

Ethereum on-chain data hints at further downside for ETH price

Analyzing Ether’s (ETH) current price chart paints a bearish picture, which is largely justified by the 11% drop over the past month, but other traditional finance assets faced more extreme price corrections in the same period. The Invesco China Technology ETF (CQQ) is down 31% and the Russell 2000 declined by 8%. Ether price at FTX, in USD. Source: TradingView Currently, traders fear that losing the descending channel support at $2,850 could lead to a stronger price downturn, but this largely depends on how derivatives traders are positioned along with the Ethereum network’s on-chain metrics. According to Defi Llama, the Ethereum network’s total value locked (TVL) flattened in the last 30 days at 27 million Ether. TVL measures the number of coins deposited on smart contr...

Bitcoin hits $40K, investors pump Dogecoin (DOGE) after Musk confirms Twitter purchase

The cryptocurrency market fell under pressure in the early trading hours on April 25, but a brief spurt of bullish price action sparked after media headlines announced that Elon Musk had reached a deal to purchase Twitter for $44 billion. Data from Cointelegraph Markets Pro and TradingView shows that after dropping as low as $38,210 in the opening trading hours on Monday, Bitcoin (BTC) price staged a 5.72% rally to hit an intraday high at $40,366 as news of Twitter’s sale spread across news outlets. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what analysts and on-chain data have to say about Bitcoin’s short-term outlook. Declining exchange reserves point to strong accumulation The recent bearish sentiment that has dominated the crypto market was addressed b...

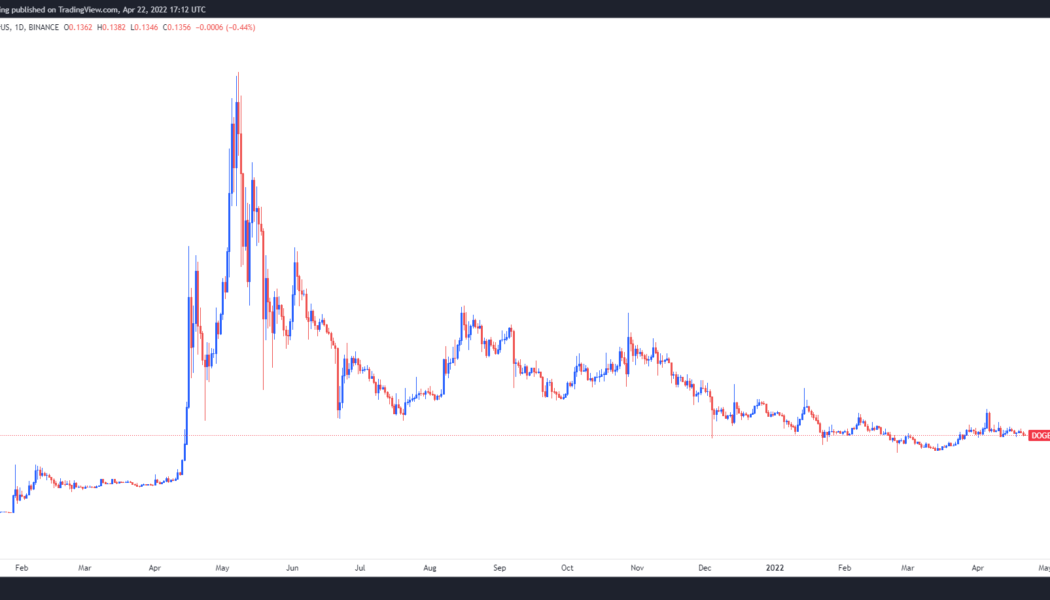

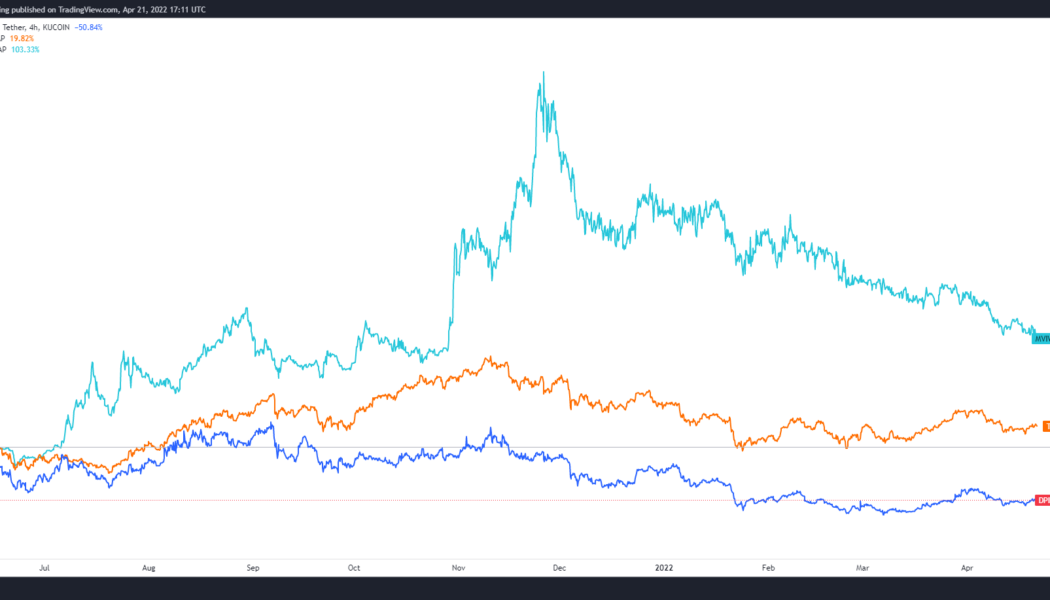

Memecoins eye major revamps in an effort to return to their former glory

Memecoins briefly took the cryptocurrency market by storm in 2021 after steady attention and shilling from big-name influencers like Elon Musk and Mark Cuban helped propel coins like Dogecoin (DOGE) to 100x gains. As one should expect, in the crypto market, rapidly rising prices have a tendency to reverse course just as fast and many of the formerly high-flying meme tokens now find themselves struggling for survival as the market matures and investors look for real-world use cases. Let’s take a look at some of the most popular memecoins of 2021 to see whether they were just a flash in the pan or if there are fundamental developments that may prove fruitful in the long-term. Dogecoin DOGE is the original memecoin and it helped kick off the rally of ‘21 after its price skyrockete...

Price analysis 4/22: BTC, ETH, BNB, XRP, SOL, ADA, LUNA, AVAX, DOGE, DOT

Bitcoin (BTC) turned down sharply on April 21, maintaining its tight correlation with the U.S. equity markets, which reversed direction after U.S. Federal Reserve Chair Jerome Powell hinted that a 50 basis point rate hike was “on the table” in May. The selling has continued on April 22 as investors trim risky assets in expectation of an aggressive stance from central banks to curb surging inflation. Veteran trader Peter Brandt said in a tweet recently that the Nasdaq 100 (NDX) was showing a formation similar to the one it had made before plunging in the year 2000. If history repeats itself then the NDX could witness a sharp correction. That may be negative for the crypto markets in the short term because of the close correlation between Bitcoin and the NDX. Daily cryptocurrency market...

Analysts say Bitcoin has ‘already capitulated,’ target $41.3K as the most hold level

Traders’ struggle to build sustainable bullish momentum persisted across the cryptocurrency market on April 20 after prices slid lower during the afternoon trading session and ApeCoin (APE) appaers to be one of the few tokens that is defying the current market-wide downturn. Data from Cointelegraph Markets Pro and TradingView shows that an early morning attempt by Bitcoin (BTC) bulls to breakout above $42,000 was soundly rejected by bears, resulting in a pullback to a daily low of $40,825 before the price was bid back above $41,000. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several market analysts are saying about the weakness in Bitcoin and what levels traders are looking at as a good spot for opening new positions. Whales accumulate near $...

ADA slips below LUNA and SOL, USDT holds onto the third-largest stablecoin rank

Cardano’s native token ADA has lost ground and is down to ninth in market capital rankings Terra’s USD stable coin surpassed Binance USD in market capital earlier this week The crypto market is calm on Wednesday morning, with the majority of the crypto assets posting gains between 2% and 5% on the day. Solana (SOL) and Terra (LUNA) are the notable altcoins in the top ten – both registering price increases of marginally over 5% in the last 24 hours. The two tokens have surpassed Cardano’s ADA in market capital rankings on the back of this ascent. Market data shows the latter has retreated to ninth with a circulating value of just over $32 billion. SOL and LUNA, on the other hand, have equivalent figures of $35.8 billion and $33.5 billion, respectively. Terra’s stable coin races past B...

Bitcoin trading volume in Q1 fell 60% compared to the volume in Q1 2021

The overall downtrend in the crypto market has affected Bitcoin trading volume Market data shows Bitcoin trading volume in Q1 was less than half that recorded last year over the same period Many cryptocurrencies shed significant value in the first two months of 2022. While figures from the second half of March indicated a steady price uptrend, gains were not huge enough to upset the heavy losses recorded between January and February. Effects of this bearish market have been reflected in the trading volume figures. Bitcoin trading volume in Q1 2022 The interest in Bitcoin from investors, in particular, has been on a steep decline as the crypto market. The flagship cryptocurrency saw a decrease of $3.6 trillion in trading volume from around $6.02 trillion ...