Markets

Bitcoin.com completes private sale for new VERSE token

Bitcoin.com, an online cryptocurrency platform designed to introduce newcomers to cryptocurrency, said in a Thursday press release it completed the private sale of $33.6 million for its Bitcoin.com VERSE token. The VERSE token is a rewards and utility token for users who participate within the Bitcoin.com ecosystem. Several high-profile entities participated in the private sale, including Digital Strategies, KuCoin Ventures, Blockchain.com, Roger Ver, Jihan Wu, among many others. VERSE to be minted this summer According to the press release, Verse will be minted this summer as an ERC-20 token. It is comparable to other utility and rewards tokens such as Crypto.com’s CRO and Binance’s BNB. VERSE will also offer features that place it on the same playing field as Nexo, Celsius, a...

Markets are weak, but ALGO, FXS and HNT book a 20%+ rally — Here’s why

Large-cap cryptocurrency continue to slump as investors await comments from the Federal Open Markets Committee regarding the exact size of the next interest rate hike. There are, however, a few bright spots in the market and select altcoins managed to post double-digit gains in trading on May 3, thanks to a big-time partnership announcement and cross-protocol collaborations that led to a spike in demand. Data from Cointelegraph Markets Pro and TradingView shows that three of the biggest gainers over the past 24-hours were Algorand (ALGO), Frax Share (FXS) and Helium (HNT). Algorand The pure proof-of-stake blockchain network had, perhaps, one of the most notable partnership deals for a crypto project in recent months after this week’s announcement that it had been selected as the offi...

Markets are weak, but ALGO, FXS and HNT book a 20%+ rally — Here’s why

Large-cap cryptocurrency continue to slump as investors await comments from the Federal Open Markets Committee regarding the exact size of the next interest rate hike. There are, however, a few bright spots in the market and select altcoins managed to post double-digit gains in trading on May 3, thanks to a big-time partnership announcement and cross-protocol collaborations that led to a spike in demand. Data from Cointelegraph Markets Pro and TradingView shows that three of the biggest gainers over the past 24-hours were Algorand (ALGO), Frax Share (FXS) and Helium (HNT). Algorand The pure proof-of-stake blockchain network had, perhaps, one of the most notable partnership deals for a crypto project in recent months after this week’s announcement that it had been selected as the offi...

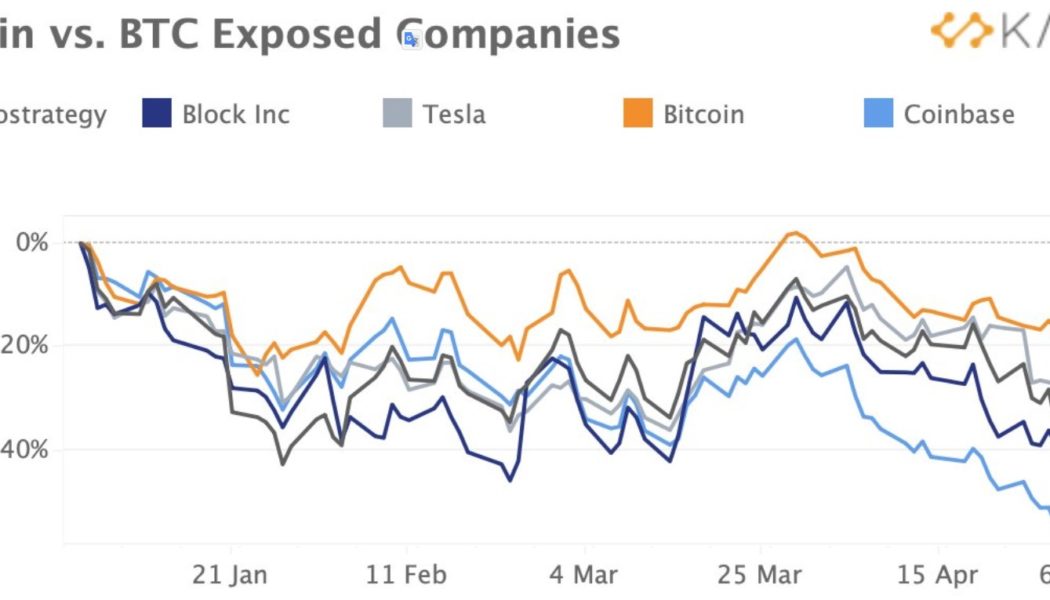

Fed FOMC comments and Bitcoin ‘bear channel’ could kickstart a decline to $28K

The start of May has seen a continuation of the weakness in crypto and equities markets and at the moment, there is no indication of any short-term factors that could reverse the bearish trend. Equities markets are also in a downtrend and according to researcher Clara Medalie, the price of stocks from companies with exposure to Bitcoin (BTC) have also taken a notable hit. Bitcoin vs. BTC exposed companies. Source: Twitter Medalie said: “Block, Tesla, Microstrategy and Coinbase are down between 20%–50%.” Data from Cointelegraph Markets Pro and TradingView shows that an early morning attempt by Bitcoin (BTC) bulls to rally above $39,000 was easily defended by bears, resulting in a pullback to the $38,200 level. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts ...

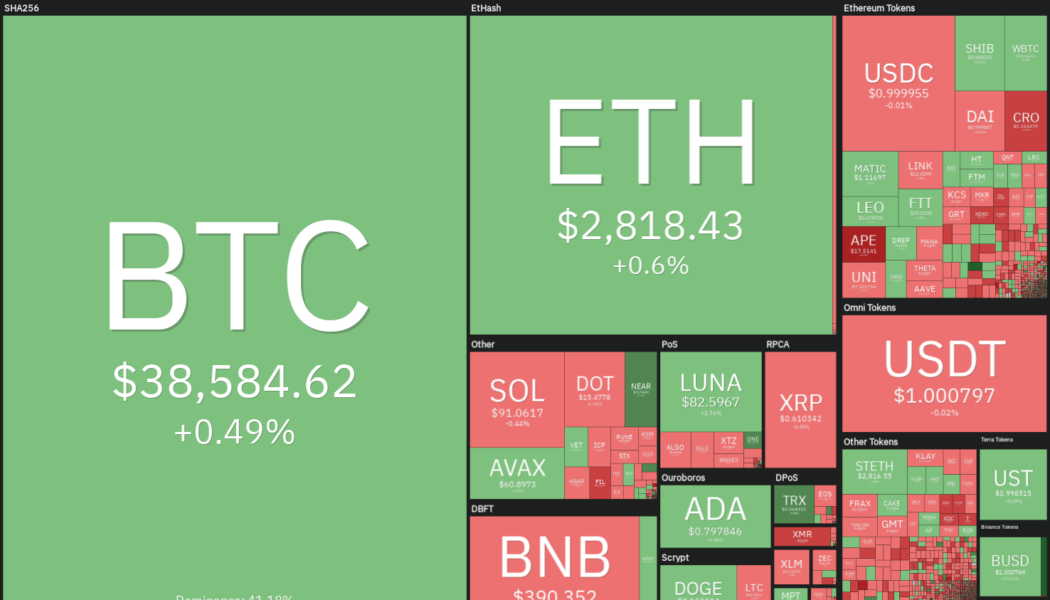

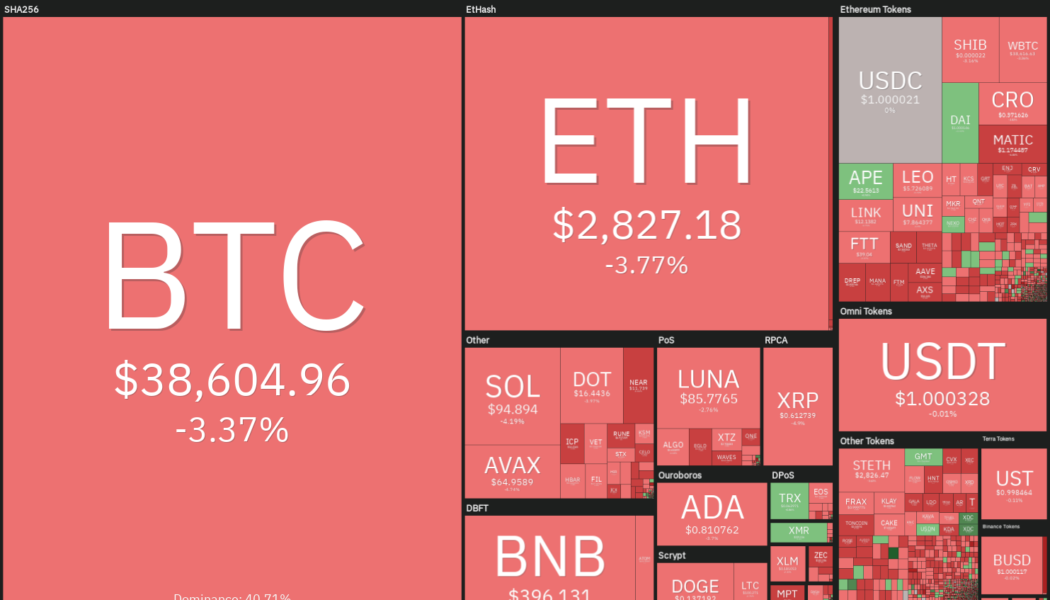

Top 5 cryptocurrencies to watch this week: BTC, LUNA, NEAR, VET, GMT

The month of April has been a forgettable one for equities and cryptocurrency investors. Bitcoin (BTC) plummeted 17% in April to record its worst ever performance in the month of April. Similarly, the Nasdaq Composite plunged 13.3% in April, its worst monthly performance since October 2008. However, a major positive for crypto investors is that Bitcoin is still above its year-to-date low near $33,000. In comparison, the Nasdaq 100 has hit a new low for 2022 while the S&P 500 is just a whisker away from making a new year-to-date low. This suggests that Bitcoin has managed to avoid a major sell-off, indicating demand at lower levels. Crypto market data daily view. Source: Coin360 Along with Bitcoin, Ether (ETH) has also managed to sustain well above its year-to-date low. Accor...

Price analysis 4/29: BTC, ETH, BNB, SOL, LUNA, XRP, ADA, DOGE, AVAX, DOT

The U.S. dollar index (DXY) turned down from its 20-year high on April 29 but that has not changed the bearish price action seen in Bitcoin (BTC) and the U.S. equity markets. Equities remain under pressure and this week, Amazon stock saw its biggest intraday drop since 2014 after uncertainty over the U.S. Federal Reserve’s tightening measures placed investor sentiment back into choppy waters. If Bitcoin extends its correction, on-chain analysis platform Whalemap believes that the $25,000 to $27,000 zone may be the best place “to go all-in” on Bitcoin. Long-term investors do not appear to be panicking over the current weakness in Bitcoin and on-chain data from CryptoQuant shows that the combined BTC reserves of 21 crypto exchanges has plummeted to levels not seen since September 2...

Smart money is accumulating Ethereum even as traders warn of a drop to $2.4K

The upcoming Ethereum merge is one of the most widely discussed topics in the crypto sector and analysts have a wide range of perspectives on how the transition to proof of stake could impact Ether’s price. ETH/USDT 1-day chart. Source: TradingView Whales accumulate ahead of the merge A deeper dive into the ongoing accumulation of Ether by whale wallets was provided by cryptocurrency intelligence firm Jarvis Labs, which posted the following chart looking at the percentage change in whale wallet holdings versus ET price. Ether whale holding change. Source: Twitter The color of the dots relates to the price of Ether, with the chart showing that whale wallets began decreasing their holdings when the price was above $4,000 and they didn’t start to reaccumulate unti...

Avalanche (AVAX) loses 30%+ in April, but its DeFi footprint leaves room to be bullish

Avalanche (AVAX) price is down more than 30% in April, but despite the negative price move, the smart contract platform remains a top contender for decentralized applications due to its scalability, low-cost transactions and its large footprint in the decentralized finance (DeFi) landscape. AVAX token/USD at FTX. Source: TradingView The network is compatible with the Ethereum Virtual Machine (EVM) and unique in that it does not face the same operational bottlenecks of high transaction fees and network congestion. Avalanche was able to amass over $9 billion in total value locked (TVL) by offering a proof-of-stake (PoS) layer-1 scaling solution. This indicator is extremely relevant because it measures the deposits on the network’s smart contracts. For instance, the BNB Chain, running since S...

Here are 3 ways hodlers can profit during bull and bear markets

For years, cryptocurrency advocates have touted the world-changing capability of digital currency and blockchain technology. Yet with the passing of each market cycle, new projects come and go, and the promised utility of these “real-world use case” projects fails to satisfy. While a majority of tokens promise to solve real-world problems, only a few achieve this, and the others are mere speculative investments. Here’s a look at the three things cryptocurrency investors can actually “do” with their coins. Lending Perhaps the simplest use case offered to cryptocurrency holders is also one of the oldest monetary applications in finance: lending. Ever since the decentralized finance (DeFi) sector took off in 2020, the opportunities available for crypto holders to lend out their tokens in exch...

2 key metrics point toward further downside for the entire crypto market

The total crypto market capitalization has been holding a slightly ascending trend for the past 3 months and the $1.75 trillion support was most recently tested on April 27 as Bitcoin (BTC) bounced at $38,000 and Ether (ETH) at $2,800 on April 27. Total crypto market cap, USD billion. Source: TradingView The crypto market’s aggregate capitalization showed a 3.5% decrease in the last 7 days and notable losers were a 18.8% loss from XRP, a 10.2% loss from Cardano (ADA), and 9.7% drop in Polkadot (DOT) price. Analyzing a broader range of altcoins provides a more balanced picture, that includes 25% gains from some gaming and Metaverse projects in the same time period. Weekly winners and losers among the top 80 coins. Source: Nomics Apecoin (APE) rallied 44% due to the upcoming Otherside metave...