Markets

Buy the dip, or wait for max pain? Analysts debate whether Bitcoin price has bottomed

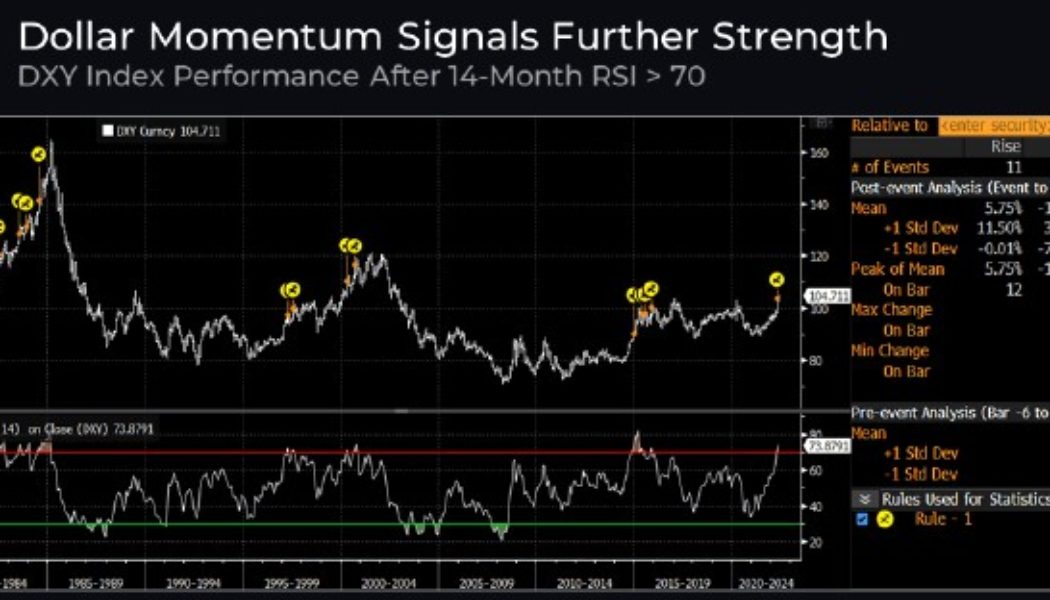

It has been a rough week for the cryptocurrency market, primarily because of the Terra ecosystem collapse and its knock-on effect on Bitcoin (BTC), Ethereum (ETH) and altcoin prices, plus the panic selling that took place after stablecoins lost their peg to the U.S. dollar. The bearish headwinds for the crypto market have been building since late 2021 as the U.S. dollar gained strength and the United States Federal Reserve hinted that it would raise interest rates throughout the year. According to a recent report from Delphi Digital, the 14-month RSI for the DXY has now “crossed above 70 for the first time since its late 2014 to 2016 run up.” DXY index performance. Source: Delphi Digital This is notable because 11 out of the 14 instances where this previously occurred “led to a strong...

Crypto-associated stocks hammered as COIN and HOOD drop to record lows

Bad news continues to dominate crypto media headlines and May 12’s juiciest tidbit was the unexpected collapse of the Terra ecosystem. In addition to the weakness seen in equities, listed companies with exposure to blockchain startups and cryptocurrency mining have also declined sharply. Bitcoin mining stocks continue bleeding… Mining investors probably wish they had simply bought bitcoin instead at the beginning of 2022, as most bitcoin mining stocks have underperformed bitcoin by a wide margin. pic.twitter.com/anSoUEoUJ1 — Jaran Mellerud (@JMellerud) May 11, 2022 While it may be easy to blame the current pullback solely on Terra’s implosion, the truth is that the price of Bitcoin mining stocks has largely mirrored the performance of BTC since reaching a peak in November...

Crypto mining stocks crash as the market continues bleeding heavily

Bitcoin is down 13% in the last 24 hours, extending a bearish run that has wiped almost 30% of its value over the last seven days The massive-sell off has been felt by Bitcoin mining companies whose stock has registered declines Terra’s collapsing ecosystem has been the biggest headline in the crypto sector, but it isn’t the only crypto entity that has been affected by the market downturn. Its native token LUNA crumbled after continued losses totalling 98% in the last 24 hours. Its related stable coin, TerraUSD, has suffered a similar fate – down to $0.4711 against the dollar. Bitcoin is faring badly itself but is much better than Ethereum and many other altcoins. The flagship asset today fell below $28,000 – a low it hasn’t visited since December 2020. Notably, the latest b...

Bitcoin fights to hold $29K as fear of regulation and Terra’s UST implosion hit crypto hard

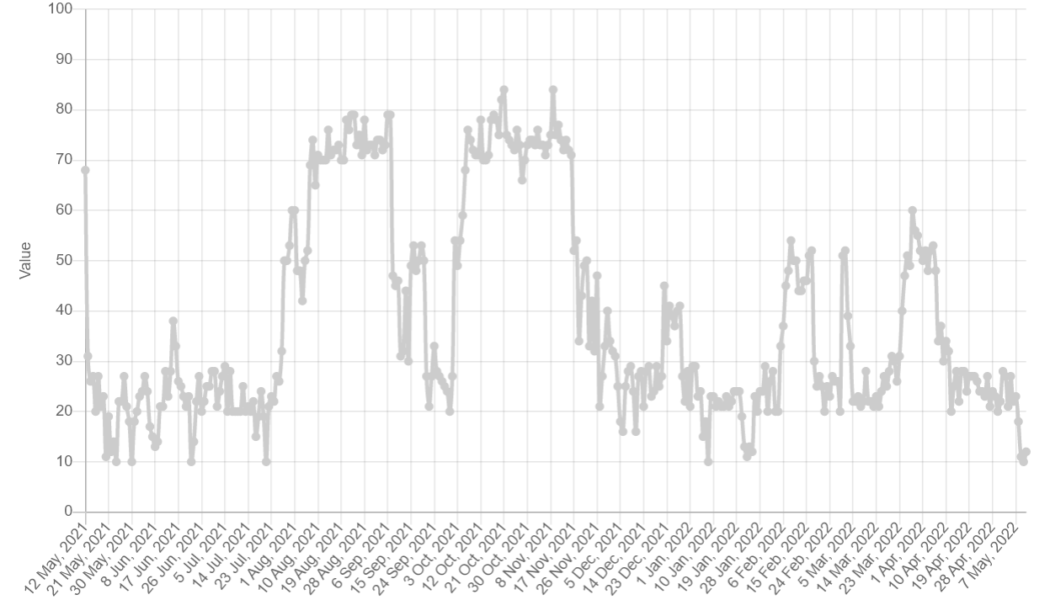

Bitcoin (BTC) price initially bounced from its recent low at $29,000 but the overall market sentiment after a 25% price drop in five days is still largely negative. Currently, the crypto “Fear and Greed Index,” which uses volatility, volume, social metrics, Bitcoin dominance and Google trends data, has plunged to its lowest level since March 2020 and at the moment, there appears to be little protecting the market against further downside. Crypto “Fear and Greed index”. Source: Alternative.me Regulation continues to weigh down the markets Regulation is still the main threat weighing on markets and it’s clear that investors are taking a risk-off approach to high volatility assets. Earlier this week, during a hearing of the Senate Banking Committee, United S...

Chairmen from the SEC and CFTC talk crypto regulation at ISDA meeting

The annual meeting of the International Swaps and Derivatives Association (ISDA) began Wednesday in Madrid. United States Securities and Exchange Commission (SEC) chairman Gary Gensler and U.S. Commodity Futures Trading Commission (CFTC) chairman Rostin Behnam were both featured as keynote speakers at the event, with Behnam speaking at the morning session, and Gensler in the afternoon. Behnam spoke at length about “a request for an amended order of registration as a derivatives clearing organization (DCO) by an entity seeking to offer non-intermediated clearing of margined products to retail participants,” which was transparently a reference to FTX US’s request. “As other registered entities have expressed interest in exploring similar models, and given the potential impact on clear...

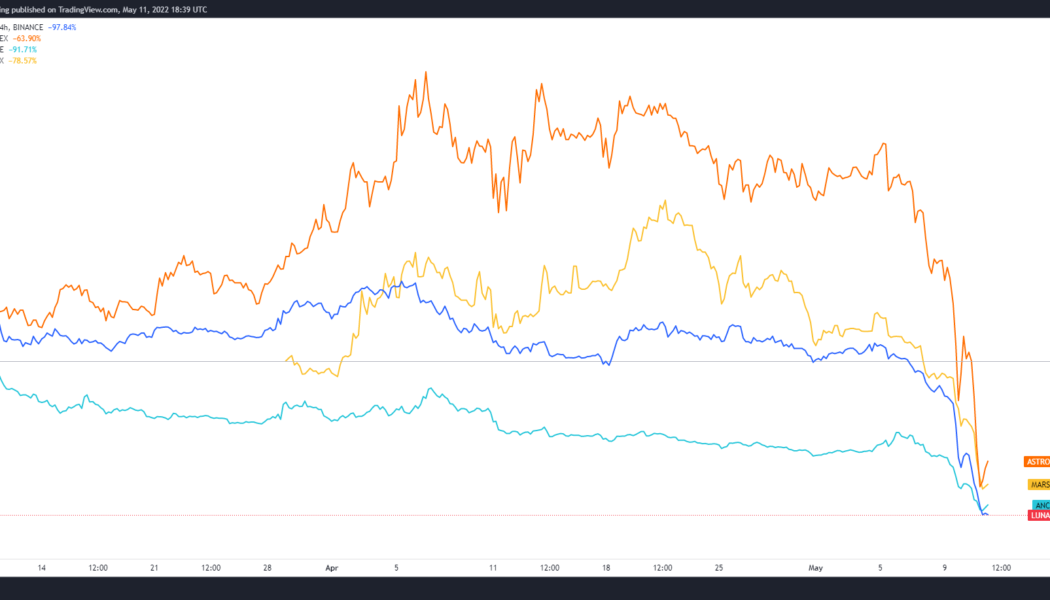

Terra contagion leads to 80%+ decline in DeFi protocols associated with UST

The knock-on effect of the collapse of Terra (LUNA) and its TerraUSD (UST) stablecoin have spread wide across the cryptocurrency market on May 11 as projects with any kind of association with the DeFi ecosystem have seen their prices hammered. The forced selling of the Bitcoin (BTC) holdings backing a portion of UST also influenced BTC’s current drop to $29,000 and analysts fear that DeFi platforms that have liquidity pools primarily comprised of UST and LUNA will collapse. LUNA, ANC, ASTRO and MARS in USDT pairings. 4-hour chart. Source: TradingView Terra-based protocols suffer Projects with the direst of outlooks are those that are hosted on the Terra protocol including Anchor Protocol (ANC), Astroport (ASTRO) and Mars Protocol (MARS). As shown in the chart above, ...

De-pegged UST sends LUNA tumbling: Token price down almost 95% in the last 24 hours

LUNA has seen an extended downturn as investors rush to sell off The token has lost more than 90% on the day, sinking below $2.00 Crypto markets are seeing the worst of volatility caused by their correlation with stock markets, which are, on the other hand reacting to the US Federal Reserve’s aggressive monetary policy against inflation. However, some are feeling the pinch more than others, and the Terra ecosystem is one such network as it is barely holding on for survival in this bear market. Terra’s LUNA token has seen a large-scale sell-offs as holders rush to cut their losses and dump the asset. This comes after the LUNA/USD pair plunged to single-digit figures – a month after hitting as high as $120 in early April. CoinMarketCap data shows that LUNA is trading below at $2.0...

Binance suspends LUNA and UST withdrawals

Binance, a crypto exchange, has announced that it has suspended the withdrawal of UST and LUNA stablecoins temporarily due to bottleneck processes. This comes after the TerraUSD (UST) stablecoin de-pegged from the US dollar causing its price and that of LUNA to drop drastically. LUNA, for instance, has dropped by more than 85% today. In an official announcement issued yesterday, Binance said: ‘’Withdrawals for LUNA and UST tokens on the Terra (LUNA) network were temporarily suspended on 2022-05-10 at 02:20 AM (UTC) due to a high volume of pending withdrawal transactions. This is caused by network slowness and congestion. Binance will reopen withdrawals for these tokens once we deem the network to be stable and the volume of pending withdrawals has reduced. We will not notify users in a fur...

Michael Saylor assuages investors after market slumps hurts MSTR, BTC

MicroStrategy’s CEO and Bitcoin proponent Michael Saylor is confident his firm’s BTC holdings will more than cover a potential margin call on Bitcoin-backed loans. The American business intelligence and software giant made headlines in 2021 with a number of major investments into Bitcoin. Saylor was a driving force behind MicroStrategy’s decision to convert its treasury reserve into BTC holdings. Global markets have suffered major losses in early May and Microstrategy’s stock has not been spared. MSTR has seen its value drop by 24% and the value of Bitcoin has also slumped considerably along with the wider cryptocurrency markets. This is cause for concern as the company’s subsidiary MacroStrategy took out a $205 million loan from Silvergate Bank in March 2022, with a portion of MicroStrate...

Altcoins stage a relief rally while Bitcoin traders decide whether to buy the dip

The similarity in price action between the crypto and traditional financial markets remains quite strong on May 10 as traders enjoyed a relief bounce across asset classes following the May 9 rout, which saw Bitcoin (BTC) briefly dip to $29,730. Market downturns typically translate to heavier losses in altcoins due to a variety of factors, including thinly traded assets and low liquidity, but this also translates into larger bounces once a recovery ensues. Daily cryptocurrency market performance. Source: Coin360 Several projects notched double-digit gains on May 10, including a 15.75% gain for Maker (MKR), the protocol responsible for issuing the DAI (DAI) stablecoin, which likely benefited from the fallout from Terra (LUNA) and its TerraUSD (UST) stablecoin. Other notable gainers incl...

Bitcoin falls below $30k to retouch a ten-month low: Here is what is happening?

Crypto and traditional markets continue seeing wide-scale sell-offs in response to the Fed’s tighter monetary policy Glassnode says the rush to de-risk from assets such as Bitcoin pushed the token’s network transaction costs 15% higher than average Cryptocurrency markets have been in the red since the value of the largest crypto-token, Bitcoin, plunged below the $40k on April 28. Since last Thursday, the fall has been even more intense. Yesterday, the price of Bitcoin fell below $30k for the first time since July 2021, as markets – traditional and cryptocurrency – saw increased sell-offs in reaction to the US Federal Reserve’s renewed aggressive monetary policy. The price of the flagship crypto was spotted as low as $29,944 on CoinMarketCap during yesterday’s session. Though it...

What are the top social tokens waiting to take off? | Find out now on The Market Report

“The Market Report” with Cointelegraph is live right now. On this week’s show, Cointelegraph’s resident experts discuss the social tokens you should be keeping a close eye on. But first, market expert Marcel Pechman carefully examines the Bitcoin (BTC) and Ether (ETH) markets. Are the current market conditions bullish or bearish? What is the outlook for the next few months? Pechman is here to break it down. Next up: the main event. Join Cointelegraph analysts Benton Yaun, Jordan Finneseth and Sam Bourgi as each makes his case for the top social token. First up, we have Bourgi with his pick of STEEM, the native token of the Steem social blockchain network, which rewards users for content creation. Its aim is to give back value to content creators who contribute on the platform. Although is ...