Markets

Ethereum falls below $2,000 as top altcoins see mild mid-week losses

Ethereum has given up Tuesday’s gains after failing to sustain the grip on $2,000 Solana, Polygon, and Cardano native tokens are also trading in the red The cryptocurrency market appeared to have calmed on Tuesday following two weeks of heavy losses, but the latest winds have reversed the crypto market course again. Ethereum started the week trading marginally above $2,000, and even though it slipped below this mark during Monday’s trading session, the premier alt quickly recovered. Ether’s resilience is seemingly once again being tested in the face of a mild slump in the market on Wednesday. Other altcoins like Avalanche (AVAX) and Polygon (MATIC) have also pulled back during this period – some, markedly, by more significant margins than Ether. Ethereum price has suffered yet ...

Price analysis 5/18: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, AVAX, SHIB

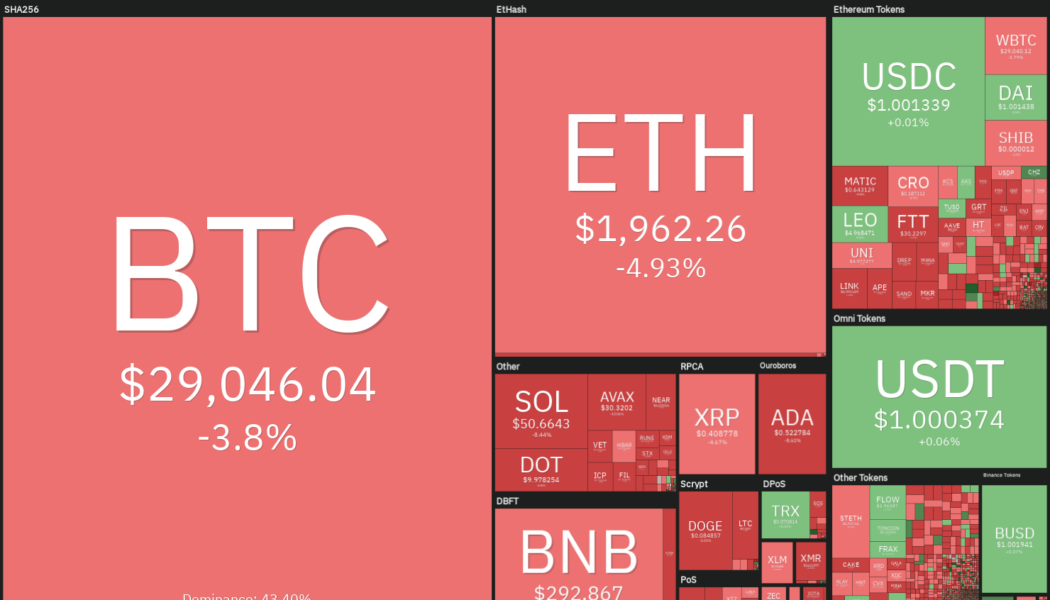

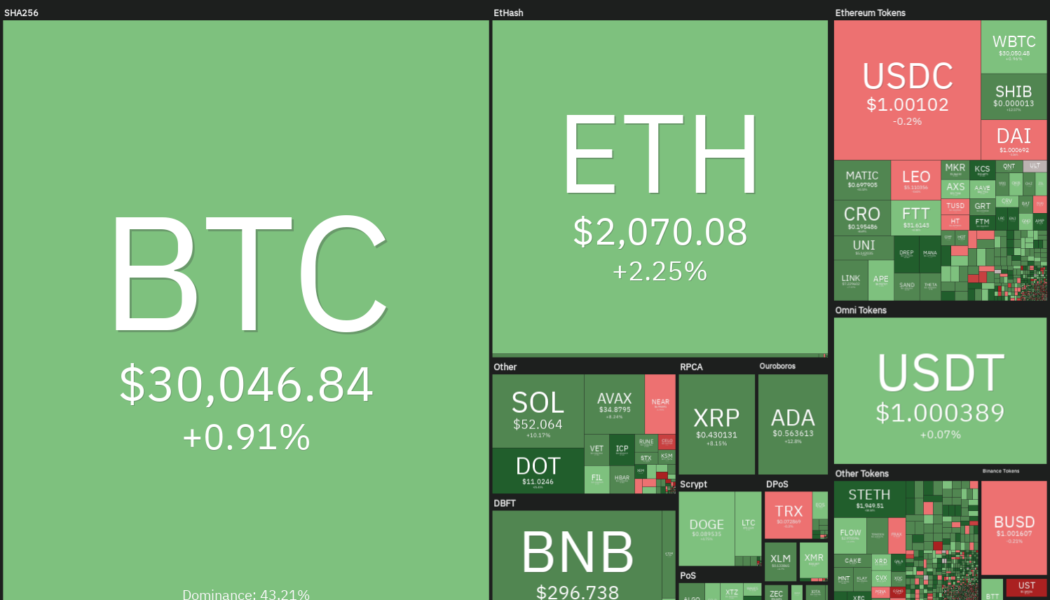

On May 17, United States Federal Reserve Chairman Jerome Powell told the Wall Street Journal that the 50-basis-point rate hikes would continue until inflation is under control. Powell’s emphasis on a hawkish policy suggests that monetary conditions are likely to remain tight in 2022, which could limit the upside in risky assets. On-chain market intelligence firm Glassnode said that historically, Bitcoin (BTC) has bottomed out when the price breaks below the realized price. However, barring the 2019 to 2020 bear market, during previous bear cycles, Bitcoin’s price stayed below the realized price for anywhere between 114 to 299 days. This suggests that if macro situations are not favorable, a quick recovery is unlikely. Daily cryptocurrency market performance. Source: Coin360 While the curre...

Was Terra’s UST cataclysm the canary in the algorithmic stablecoin coal mine?

The past week has not been an easy one. After the collapse of the third-largest stablecoin (UST) and what used to be the second-largest blockchain after Ethereum (Terra), the depeg contagion seems to be spreading wider. While UST has completely depegged from the U.S. dollar, trading at sub $0.1 at the time of writing, other stablecoins also experienced a short period where they also lost their dollar peg due to the market-wide panic. Tether’s USDT stablecoin saw a brief devaluation from $1 to $0.95 at the lowest point in May. 12. USDT/USD last week from May. 8–14th. Source: CoinMarketCap FRAX and FEI had a similar drop to $0.97 in May. 12; while Abracadabra Money’s MIM and Liquity’s LUSD dropped to $0.98. FRAX, MIM, FEI and LUSD price from May. 9 – 15th. Source: CoinMarketCap A...

Bitcoin is discounted near its ‘realized’ price, but analysts say there’s room for deep downside

There are early signs of the “dust settling” in the crypto market now that investors believe that the worst of the Terra (LUNA) collapse looks to be over. Viewing Bitcoin’s chart indicates that while the fallout was widespread and quite devastating for altcoins, BItcoin (BTC) has actually held up fairly well. Even with the May 12 drop to $26,697 marking the lowest price level since 2020 multiple metrics suggest that the current levels could represent a good entry to BTC. BTC/USDT 1-day chart. Source: TradingView The pullback to this level is notable in that it was a retest of Bitcoin’s 200-week exponential moving average (EMA) at $26,990. According to cryptocurrency research firm Delphi Digital, this metric has historically “served as a key area for prior...

Bitcoin clasping to remain above $30k as Solana leads altcoins in recovery

Bitcoin has mounted a slight recovery following last week’s crash to a multi-month low of $26,350 Many altcoins have charted green candles today, with Solana leading the way among the top ten coins by market cap Leading a recovery upwards of $30k this week, Bitcoin lost ground after briefly hovering above $31k yesterday. The leading digital asset had built momentum from $28,700 last Saturday, climbing as high as $31,305 early Monday before retracing as far as $29,260, CoinMarketCap data shows. The pioneer crypto has since recorded a series of minor gains and is now pushing towards $31,000 again. However, the ascent above $30,000 has not been without opposition from bears. At the time of writing, Bitcoin is exchanging hands at $30,215 – having gained approximately 1.77% in the last 24...

Asset manager Grayscale announces maiden ETF in Europe

The Grayscale Future of Finance UCITS ETF tracks the Bloomberg Grayscale Future of Finance Index The ETF will list on the Borsa Italiana, London Stock Exchange (LSE), and Deutsche Börse Xetra Digital asset management firm Grayscale on Monday issued a press release revealing that it is stretching its offering to European investors by listing its first European EFT. The Grayscale Future of Finance UCITS ETF will be a stark indicator of the evolution of Grayscale to the next level. The first in Europe The ETF offering is planned to get listed on the Borsa Italiana, London Stock Exchange (LSE), and Deutsche Börse Xetra under the ticker GFOF. It is structured to allow investors to interact with firms at the intersection of virtual assets, technology, and finance. The new offering will tra...

MakerDAO price rebounds as DAI holds its peg and investors search for stablecoin security

Its been a rough couple of weeks for the cryptocurrency market. Bitcoin (BTC) price is nowhere near the price estimates of most analysts, multiple stablecoins lost their peg and the demise of one of the top decentralized finance (DeFi) platforms sparked an event that resulted in $900 billion vanishing from the total crypto market capitalization. In the midst of the widespread fallout, MakerDAO (MKR) managed to turn crisis into opportunity and the collapse of TerraUSD (UST) has brought renewed attention to DAI, the longest-running decentralized stablecoin. Data from Cointelegraph Markets Pro and TradingView shows that as the collapse of Terra (LUNA) price accelerated from May 9 to May 12, MKR climbed 66.2% from a low of $952 on May 12 to its current value of $1,587. MKR/USDT 1-da...

BIFI gains 100%+ after Beefy Finance adds new vaults and stablecoin liquidity pools

Winston Churchill’s statement to “never let a crisis go to waste” can be applied across many aspects of society, including the recent carnage seen in the crypto market. Last week’s volatility is likely to have newer investors and those who took on heavy losses questioning the future of the burgeoning asset class, but in every bear trend there is a silver lining. One platform that appears to be capitalizing on the void created by TerraUSD’s (UST) collapse is Beefy Finance (BIFI), a multi-chain yield optimizing decentralized finance protocol. Data from Cointelegraph Markets Pro and TradingView shows that after hitting a low of $387.80 on May 14, BIFI spiked 168.13% to hit a daily high of $1,040 on May 16 amids a 684% increase in its 24-hour trading volume. BIFI/USDT 4-hour chart. Sourc...

Niftables launches cutting-edge NFT platform

Niftables has launched the world’s flagship all-in-one NFT technology that gives creators and brands the fastest path from the idea to their own white-label NFT platforms, CoinText learned from a press release. Tens of well-known, reputable brands and creators have developed their NFT platforms with Niftables. Eliminating entry barriers Niftables is eliminating barriers to NFT market entry, which remain high, by creating a cutting-edge full-suite NFT platform for users, brands, and creators. It is driving the mass adoption of NFTs. Niftables Co-founder Jordan Aitali said: A one-stop-shop doesn’t mean one-size-fits-all. That’s why Niftables is built to let creators and brands fully customize their white-label NFT platforms from the get-go. We ensure that each creator’s NFT platf...

Price analysis 5/13: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, AVAX, SHIB

Bitcoin (BTC) rebounded sharply after dropping near its realized price of $24,000 on May 12, suggesting some bulls went against the herd and bought the dip. According to on-chain analytics platform CryptoQuant, the exchange balances declined by more than 24,335 Bitcoin on May 11 and 12, indicating that bulls may have started bottom fishing. However, macro investor Raoul Pal is not confident that a bottom has been made. In an exclusive interview with Cointelegraph, Pal said that if equity markets witness a capitulation phase, crypto markets are also likely to plunge before forming a bottom. He anticipates the current bear phase to end after the United States Federal Reserve stops hiking rates. Daily cryptocurrency market performance. Source: Coin360 Bear markets are known for sharp relief r...

Bitcoin and Ethereum had a rough week, but derivatives data reveals a silver lining

This week the crypto market endured a sharp drop in valuation after Coinbase, the leading U.S. exchange, reported a $430 million quarterly net loss and South Korea announced plans to introduce a 20% tax on crypto gains. During its worst moment, the total market crypto market cap faced a 39% drop from $1.81 trillion to $1.10 trillion in seven days, which is an impressive correction even for a volatile asset class. A similar size decrease in valuation was last seen in February 2021, creating bargains for the risk-takers. Total crypto market capitalization, USD billion. Source: TradingView Even with this week’s volatility, there were a few relief bounces as Bitcoin (BTC) bounced 18% from a $25,400 low to the current $30,000 level and Ether (ETH) price also made a brief rally to $2,100 af...

Bitcoin price could bounce to $35K, but analysts say don’t expect a ‘V-shaped recovery’

Altcoins saw a relief bounce on May 13 as the initial panic sparked by Bitcoin’s sell-off Terra’s UST collapse and multiple stablecoins losing their dollar peg begins to decrease and risk loving traders look to scoop up assets trading at yearly lows. Daily cryptocurrency market performance. Source: Coin360 Despite the significant correction that occurred over the past week, Bitcoin (BTC) bulls have managed to claw their way back to the $30,000 zone, a level which has been defended multiple times during the 2021 bull market. Here’s a look at what several analysts have to say about the outlook for Bitcoin moving forward as the price attempts to recover in the face of multiple headwinds. Is a short squeeze pending? Insight into the minds of derivatives traders was provided by ...