Markets

Low inflation or bust: Analysts say the Fed has no choice but to continue raising rates

As economic conditions continue to worsen, financial experts worldwide are increasingly placing the blame at the feet of the United States Federal Reserve after the central bank was slow to respond to rising inflation early on. Financial markets are currently experiencing their worst stretch of losses in recent history, and it doesn’t appear that there is any relief in sight. May 24 saw the tech-heavy Nasdaq fall another 2%, while Snap, a popular social media company, shed 43.1% of its market cap in trading on May 23. This past couple of months have been absolutely brutal for the markets… 8 consecutive weeks of red candles in the #SPX, #NASDAQ and #BTC… no significant bounces pic.twitter.com/hgU2VwIoxh — Crypto Phoenix (@CryptoPheonix1) May 24, 2022 Much of the recent turmoil again c...

ECB President declaring crypto as “worth nothing” is missing the point

It’s disappointing to see the President of the ECB, Christine Lagarde, declare that cryptocurrencies are “worth nothing” on Dutch television this past Sunday. I thought we were past that point. Sure, a big bulk of the market is likely worth nothing, but to have the head of the central bank publicly declare all cryptocurrencies as worthless in one swift sentence comes across as increasingly out-of-touch. “My very humble assessment is that (cryptocurrency) is worth nothing. It is based on nothing, there is no underlying assets to act as an anchor of safety”, she said. While she may be right that there are no underlying assets to a lot of these currencies, she’s missing the point. Network effects alone can render an asset worth something, even if there is nothing physical of value underneath....

Crypto funds under management drop to a low not seen since July 2021

Digital asset investment products saw $141 million in outflows during the week ending on May 20, a move that reduced the total assets under management (AUM) by institutional funds down to $38 billion, the lowest level since July 2021. According to the latest edition of CoinShare’s weekly Digital Asset Fund Flows report, Bitcoin (BTC) was the primary focus of outflows after experiencing a decline of $154 million for the week. The removal of funds coincided with a choppy week of trading that saw the price of BTC oscillate between $28,600 and $31,430. BTC/USDT 1-day chart. Source: TradingView Despite the sizable outflow, the month-to-date BTC flow for May remain positive at $187.1 million, while the year-to-date figure stands at $307 million. On a more positive note, the multi-asset cat...

Price analysis 5/23: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, AVAX, SHIB

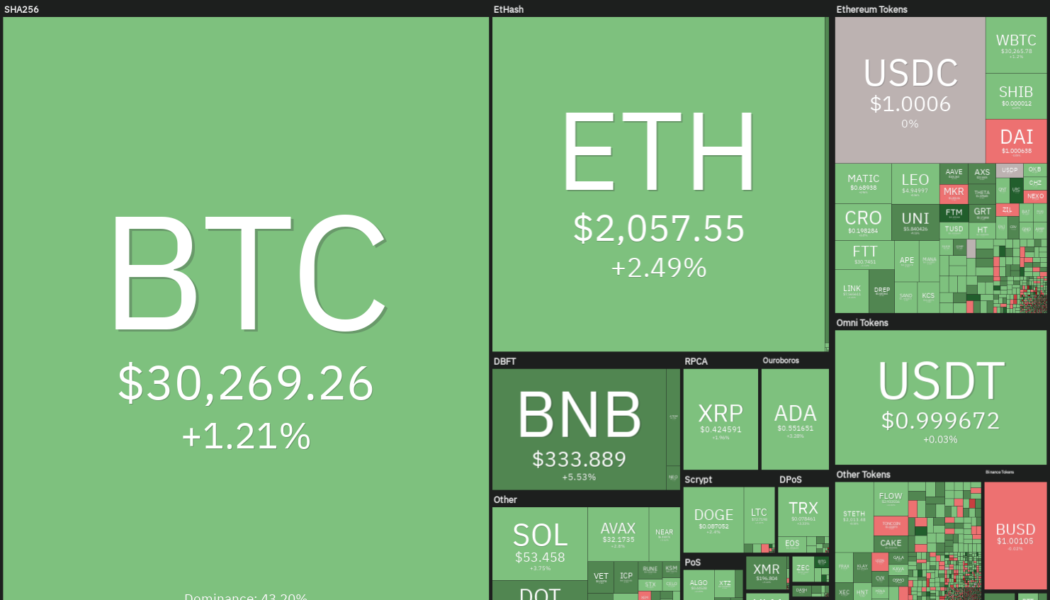

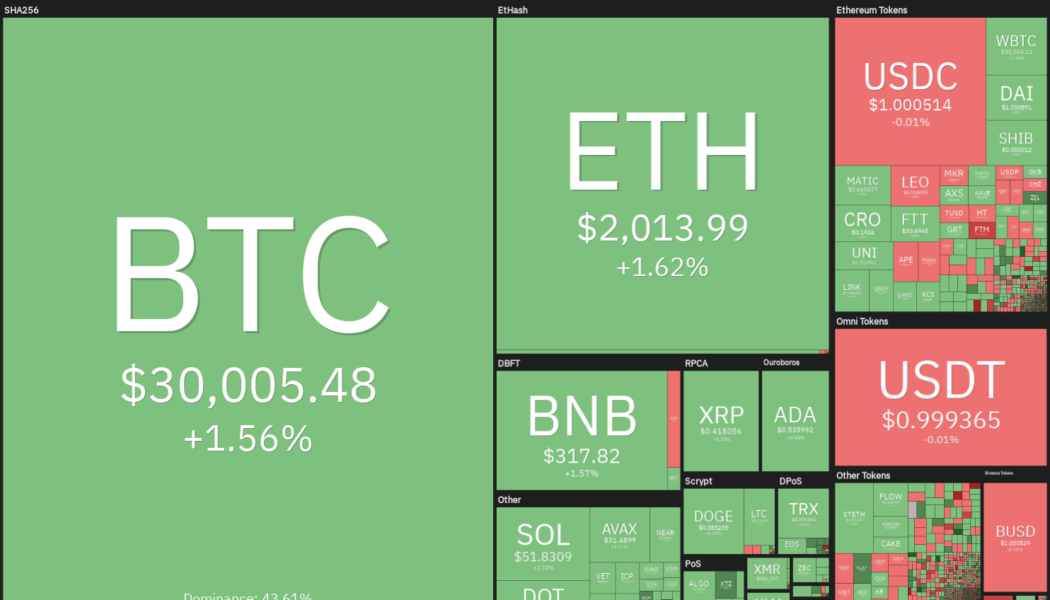

The United States equity markets are attempting a recovery after weeks of relentless selling. Along similar lines, on-chain monitoring resource Material Indicators expects the crypto market to recover, but they anticipate Bitcoin (BTC) to spend some time in a range before “a real breakout.” The seven-day moving average of the on-chain transaction volume tracked by Glassnode hit a nine-month low on May 23. This suggests that Bitcoin’s lackluster price action in 2022 has led to reduced participation from traders. Daily cryptocurrency market performance. Source: Coin360 While signs of a short-term recovery are visible, a sustained recovery could be difficult because the macro conditions remain challenging. International Monetary Fund managing director Kristalina Georgieva wrote in a blog post...

Top 5 cryptocurrencies to watch this week: BTC, BNB, XMR, ETC, MANA

The Dow Jones Industrial Average has declined for eight consecutive weeks, the first such losing streak since 1923. On May 20, the S&P 500 briefly fell into bear market territory, indicating that traders continue to sell risky assets in fear of a recession. Due to its tight correlation with US equities markets, Bitcoin (BTC) has remained under pressure for many weeks. The bulls are attempting to push Bitcoin higher during the weekend and avert an even longer losing streak. Crypto market data daily view. Source: Coin360 Bitcoin’s performance in the first five months has been the worst since 2018, indicating that sellers are in control. However, after several weeks of weakness, the crypto markets may be on the cusp of a bear market rally. What are the critical levels that may signa...

Top 5 cryptocurrencies to watch this week: BTC, BNB, XMR, ETC, MANA

The Dow Jones Industrial Average has declined for eight consecutive weeks, the first such losing streak since 1923. On May 20, the S&P 500 briefly fell into bear market territory, indicating that traders continue to sell risky assets in fear of a recession. Due to its tight correlation with US equities markets, Bitcoin (BTC) has remained under pressure for many weeks. The bulls are attempting to push Bitcoin higher during the weekend and avert an even longer losing streak. Crypto market data daily view. Source: Coin360 Bitcoin’s performance in the first five months has been the worst since 2018, indicating that sellers are in control. However, after several weeks of weakness, the crypto markets may be on the cusp of a bear market rally. What are the critical levels that may signa...

3 red flags that signal a crypto project may be misleading investors

Satoshi Nakamoto left a large pair of shoes to fill after releasing the code for Bitcoin (BTC) to the world, helping to establish the network, then vanishing without so much as a trace. Over the years, the crypto ecosystem has seen many developers and protocol creators rise in stature to become crypto messiahs for faithful holders who eventually have their best-laid plans end in catastrophe when the protocol is hacked, rugged or abandoned by whimsical developers. 2022 is hardly halfway complete and the year has already seen a particularly bad stretch of good intentions gone awry, which have collectively helped plunge the market into bear-market territory. Here’s a closer look at each of these instances to help provide insight into how similar outcomes can be avoided in the future. So...

20% drop in the S&P 500 puts stocks in a bear market, Bitcoin and altcoins follow

Whoever coined the phrase “sell in May and go away” had brilliant insight and the performance of crypto and stock markets over the past three weeks has shown that the expression still rings true. May 20 has seen a pan selloff across all asset classes, leaving traders with few options to escape the carnage as inflation concerns and rising interest rates continue to dominate the headlines. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin (BTC) taking on water below $29,000 and traders worry that losing this level will ensure a visit to the low $20,000s over the coming week. BTC/USDT 1-day chart. Source: TradingView As reported by Cointelegraph, some analysts warn that BTC could possibility decline to $22,700 based on its historical price performance fo...

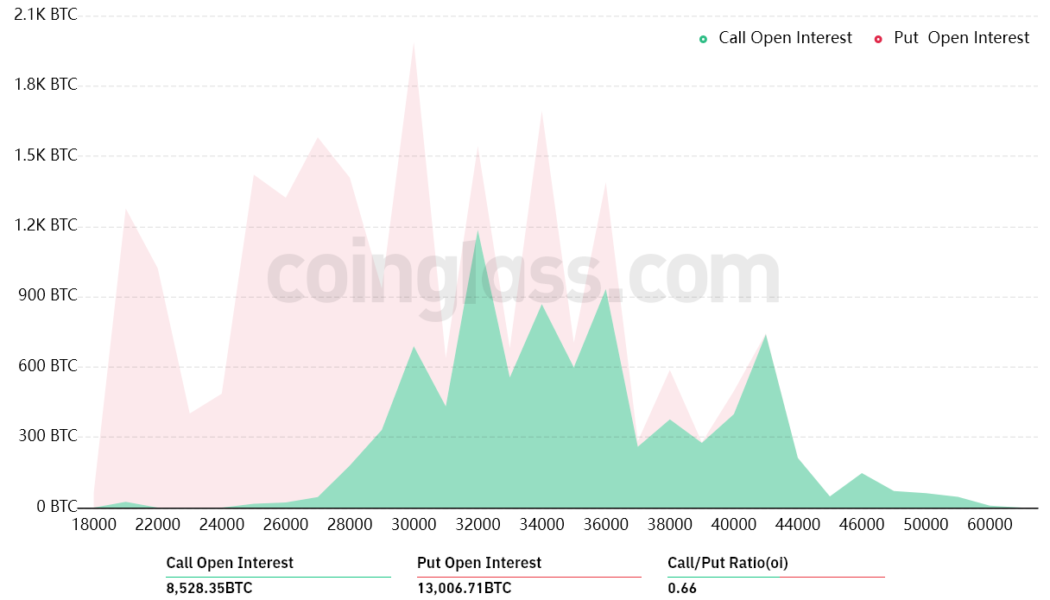

Contrarian Bitcoin investors identify buy zones even as extreme fear grips the market

Bitcoin (BTC) support at the $30,000 level has proven to be quite resilient amidst the turmoil of the past two weeks with many tokens in the top 100 now showing signs of consolidation after prices bounced off their recent lows. Fear & Greed Index. Source: Alternative.me During high volatility and sell-offs, it’s difficult to take a contrarian view and traders might consider putting some distance from all the noise and negative news-flow to focus on their core convictions and reason for originally investing in Bitcoin. Several data points suggest that Bitcoin could be approaching a bottom which is expected to be followed by a lengthy period of consolidation. Let’s take a look at what experts are saying. BTC may have already reached “max pain” The spike in realize...

PLC Ultima, the new cryptocurrency that overtook bitcoin: Is it worth investing now, or is it too late?

In 2021, Bitcoin rose to its highest-ever price level, doing so amid a mega bull rally for the cryptocurrency market. The same year, a new coin hit the market and literally went on to overtake bitcoin. PLC Ultima (PLCU) is that cryptocurrency. It was launched at the end of December 2021, with PLCU’s value rising from $0.10 to $100,000 within six months. The coin’s value soared to highs of $116,000. Today, the price of PLCU is almost double that of Bitcoin. Now the big question: Is it still possible to earn on PLCU? Briefly below, we highlight some of the growth factors behind this project’s meteoric market performance. Infrastructure as a critical driver of cryptocurrency growth: how Alex Reinhardt created PLCU Coin Who created PLC Ultima? The creator of PLC Ultima is Alex Reinhardt, a ser...