Markets

On-chain data shows Bitcoin long-term holders continuing to ‘soak up supply’ around $30K

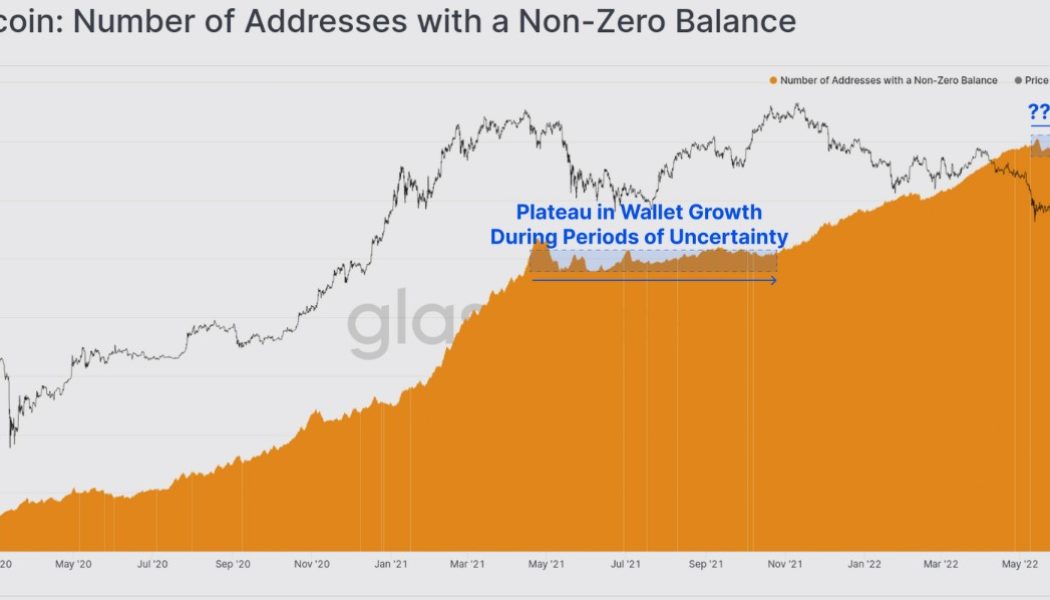

Bear markets are typically marked by a capitulation event where discouraged investors finally abandon their positions and asset prices either consolidate as inflows to the sector taper off or a bottoming process begins. According to a recent report from Glassnode, Bitcoin hodlers are now “the only ones left” and they appear to be “doubling down as prices correct below $30K.” Evidence of the lack of new buyers can be found looking at the number of wallets with non-zero balances, which has plateaued over the past month, a process that was seen after the crypto market sell-off in May of 2021. Number of Bitcoin addresses with a non-zero balance. Source: Glassnode Unlike the sell-offs that occurred in March 2020 and November 2018, which were followed by an upswing in on-chain activity tha...

Top 5 cryptocurrencies to watch this week: BTC, ETH, XTZ, KCS, AAVE

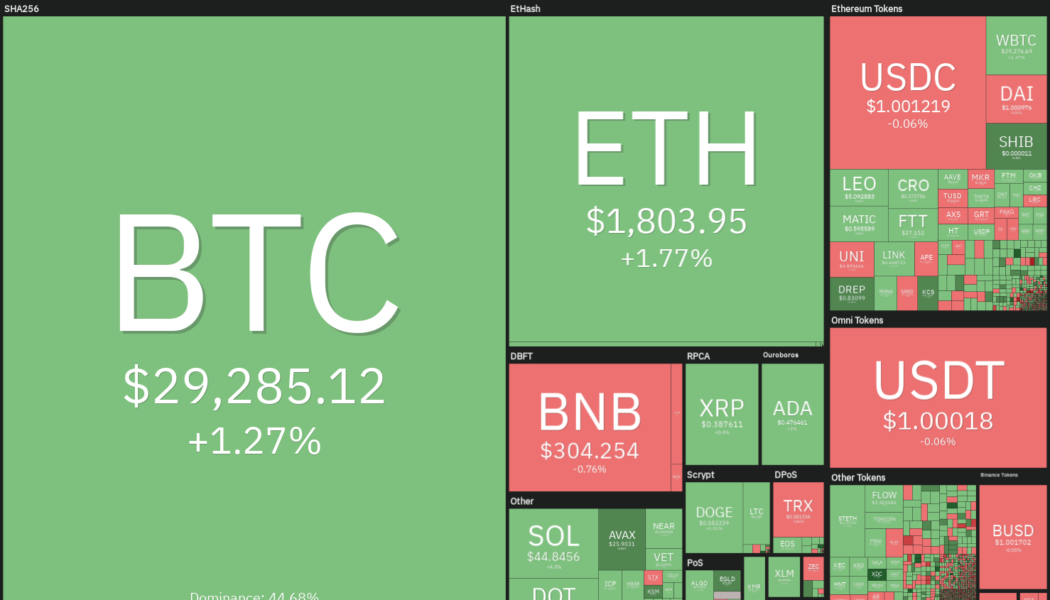

After declining for eight successive weeks, the Dow Jones Industrial Average rebounded sharply last week to finish higher by 6.2%. However, Bitcoin (BTC) has not been able to replicate the performance of the United States equities markets and is threatening to paint a red candle for the ninth week in a row. A positive sign is that Bitcoin whales have been buying the market correction. Glassnode data shows that the number of Bitcoin whale wallets with a balance of 10,000 Bitcoin or more has risen to its highest level since February 2021. The accumulation in the whale wallets suggests that their long-term view for Bitcoin remains bullish. Crypto market data daily view. Source: Coin360 Blockware Solutions highlighted that the Mayer Multiple metric which compares the 200-day simple moving aver...

On-chain data flashes Bitcoin buy signals, but the bottom could be under $20K

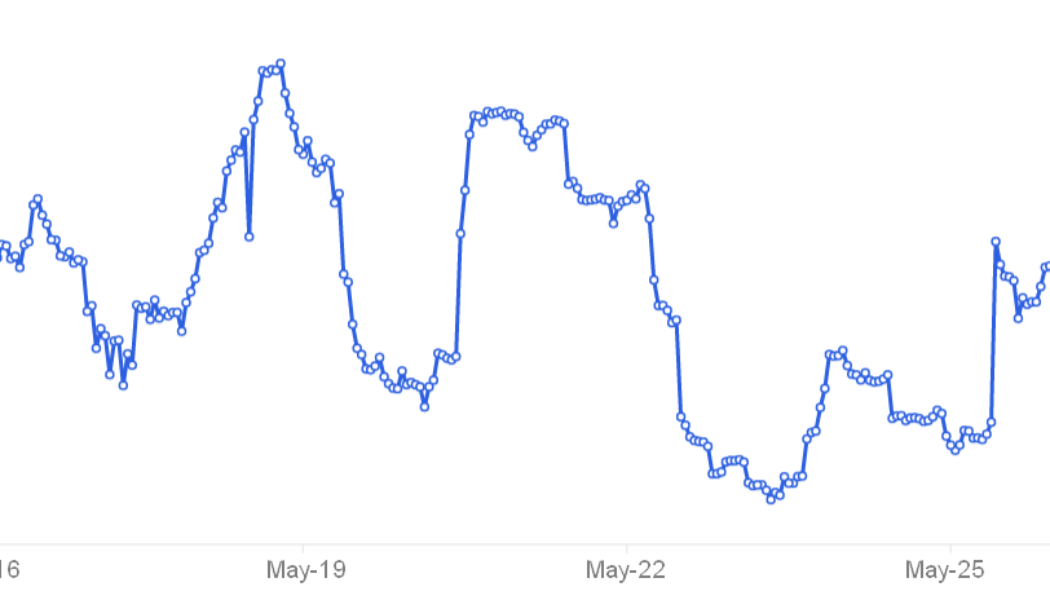

Every Bitcoin investor is searching for signals that the market is approaching a bottom, but the price action of this week suggests that we’re just not there yet. Evidence of this can be found by looking at the monthly return for Bitcoin (BTC), which was hit with a rapid decline that “translated to one of the biggest drawdowns in monthly returns for the asset class in its history,” according to the most recent Blockware Solutions Market Intelligence Newsletter. Bitcoin monthly returns. Source: Blockware Solutions Bitcoin continues to trade within an increasingly narrow trading range that is slowly being compressed to the downside as global economic strains mount. Whether the price continues to trend lower is a popular topic of debate among crypto analysts and the dominant opini...

3 metrics contrarian crypto investors use to know when to buy Bitcoin

Buying low and selling high is easier said than done, especially when emotion and volatile markets are thrown into the mix. Historically speaking, the best deals are to be found when there is “blood on the streets,” but the danger of catching a falling knife usually keeps most investors planted on the sidelines. The month of May has been especially challenging for crypto holders because Bitcoin (BTC) dropped to a low of $26,782, and some analysts are now predicting a sub-$20,000 BTC price in the near future. It’s times like these when fear is running rampant that the contrarian investor looks to establish positions in promising assets before the broader market comes to its senses. Here’s a look at several indicators that contrarian-minded investors can use to spot opportune moments for ope...

WEMIX gains 200%+ after stablecoin and boosted staking rewards announcement

Blockchain-based gaming, also known as GameFi, is an up-and-coming sector that could potentially be one of the primary catalysts for kickstarting the mass adoption of blockchain technology. WEMIX, a gaming protocol that operates on the Klaytn network, aims to get in on the GameFi revolution and this week, the project’s native token (WEMIX) rallied even as the wider market continued to sell-off. Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $1.27 on May 12, WEMIX price climbed 269% to hit a daily high at $4.70 on May 25 as its 24-hour trading volume increased to $652 million. WEMIX/USDT 1-day chart. Source: TradingView Three reasons for the price reversal for WEMIX are the upcoming launch of WEMIX 3.0, a series of project launches and partnershi...

Falling wedge pattern points to eventual Ethereum price reversal, but traders expect more pain first

The cryptocurrency market was hit with another round of selling on May 26 as Bitcoin (BTC) price dropped to $28,000 and Ether (ETH) briefly fell under $1,800. The ETH/BTC pair also dropped below what traders deem to be an important ascending trendline, a move that traders say could result in Ether price correcting to new lows. ETH/USDT 1-day chart. Source: TradingView Here’s a rundown of what several analysts in the market are saying about the move lower for Ethereum and what it could mean for its price in the near term. Price consolidation will eventually result in a sharp move A brief check-in on what levels of support and resistance to keep an eye on was provided by independent market analyst Michaël van de Poppe, who posted the following chart showing Ether trading near its range ...

Polkadot parachains spike after the launch of a $250M aUSD stablecoin fund

Crypto prices have been exploring new lows for weeks and currently it’s unclear what it will take to reverse the trend. Despite the downtrend, cryptocurrencies within the Polkadot (DOT) ecosystem began to rally on May 24 and have managed to maintain gains ranging from 10% to 25%, a possible sign that certain sub-sectors of the market are on the verge of a breakout. Here’s a look at three Polkadot ecosystem protocols that have seen their token prices trend higher in recent days. Acala launches a $250 million aUSD ecosystem fund Acala (ACA) is the leading decentralized finance (DeF) platform on the Polkadot network, primarily due to the launch of aUSD, the first native stablecoin in the Polkadot ecosystem. Following the collapse of Terra’s LUNA and TerraUSD (UST), traders we...

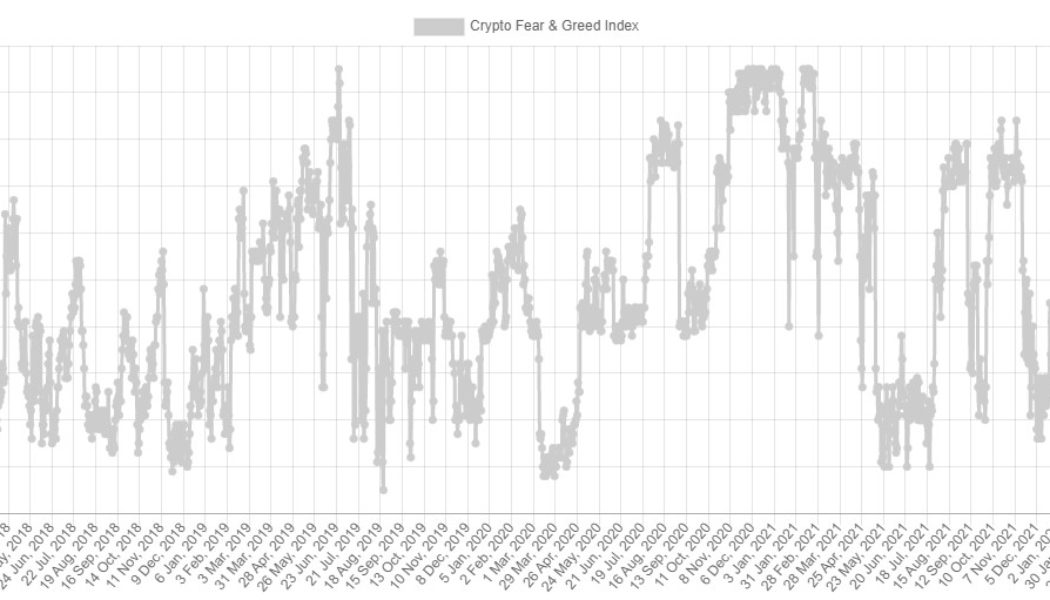

‘Extreme fear’ grips Bitcoin price, but analysts point to signs of a potential reversal

The cryptocurrency market settled into a holding pattern on May 25 after traders opted to sit on the sidelines ahead of the midday Federal Open Market Committee (FOMC) meeting where the Federal Reserve signaled that it intends to continue on its path of raising interest rates. According to data from Alternative.me, the Fear and Greed Index seeing its longest run of extreme fear since the market crash in Mach 2020. Crypto Fear & Greed Index. Source: Alternative Data from Cointelegraph Markets Pro and TradingView shows that the price action for Bitcoin (BTC) has continued to compress into an increasingly narrow trading range, but technical analysis indicators are not providing much insight on what direction a possible breakout could take. BTC/USDT 1-day chart. Source: TradingView Here’s ...

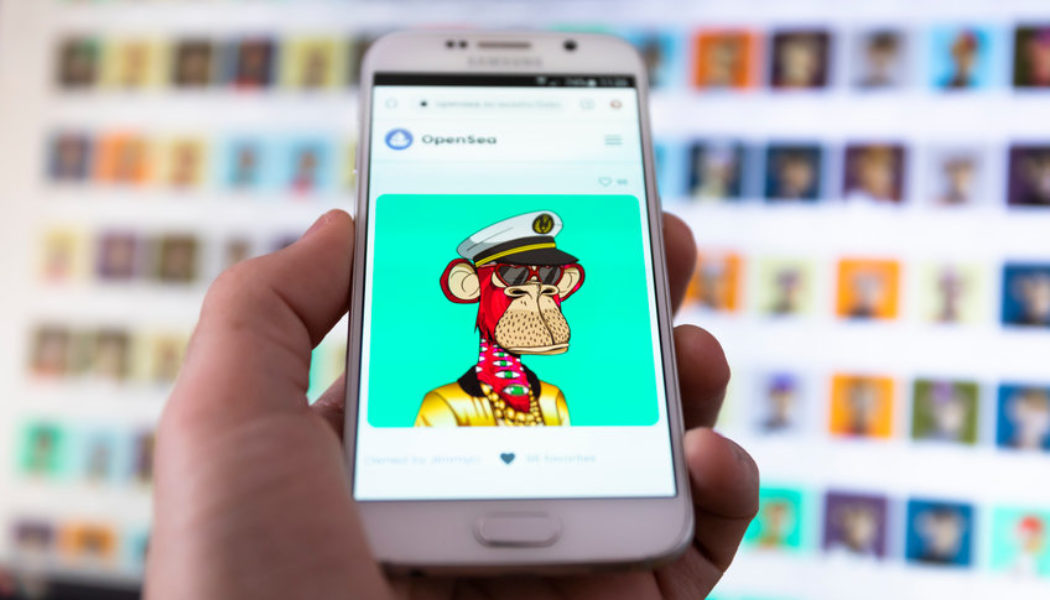

Bored Ape Yacht Club NFT daily sales volume up more than 300% in the last 24 hours

The NFT collection is second in 24 hr. daily sales volume behind Otherdeed, which has more buyers and transactions on the day Earlier this week, the all-time sales volume of the mutant serums for BAYC crossed $1.5 billion The MAYC NFT collection has grown to be among only six platforms to reach the billion-dollar platform since its launch, the others including Axie Infinity, CryptoPunks, NBA Top Shot and its original highly successful derivative BAYC. The offshoot NFT from the Bored Ape Yacht Club (BAYC) this week surpassed $1.5 billion and, at the time of writing, has logged $1.531 billion for an average of about $39,360. The NFT collection currently ranks fourth in sales volume and has recorded 38,896 transactions, CryptoSlam data shows. The Mutant Ape Yacht Club NFT collecti...

Weak stocks and declining DeFi use continue to weigh on Ethereum price

Ether’s (ETH) 12-hour closing price has been respecting a tight $1,910 to $2,150 range for twelve days, but oddly enough, these 13% oscillations have been enough to liquidate an aggregate of $495 million in futures contracts since May 13, according to data from Coinglass. Ether/USD 12-hour price at Kraken. Source: TradingView The worsening market conditions were also reflected in digital asset investment products. According to the latest edition of CoinShare’s weekly Digital Asset Fund Flows report, crypto funds and investment products saw a $141 million outflow during the week ending on May 20. In this instance, Bitcoin (BTC) was the investors’ focus after experiencing a $154 weekly net redemption. Russian regulation and crumbling U.S. tech stocks escalate the situation Regula...