Markets

Price analysis 1/6: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

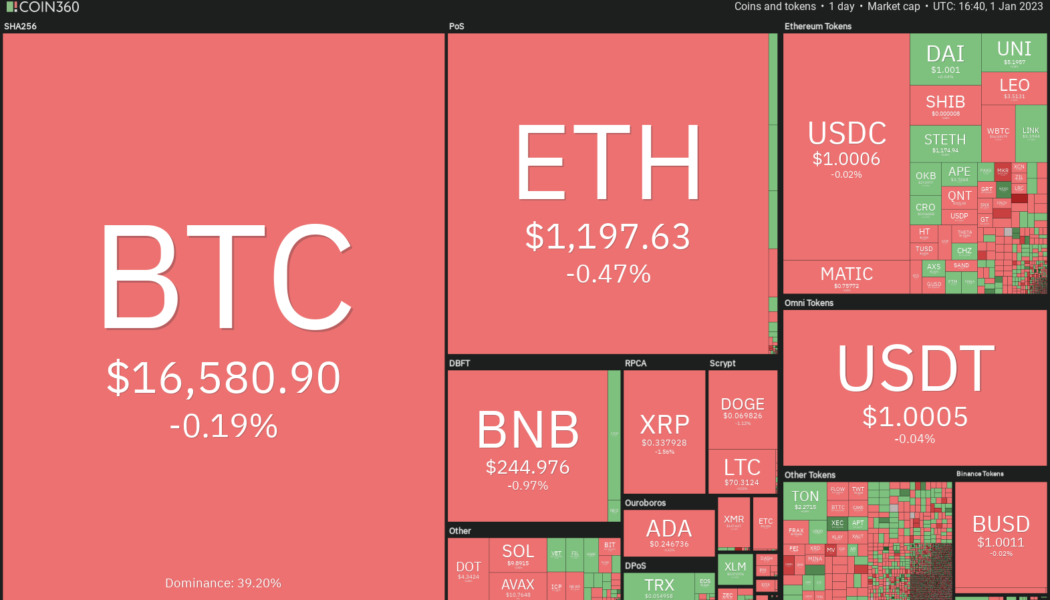

The United States December nonfarm payrolls report showed a growth of 223,000 jobs, above the market’s expectation of an increase of 200,000 jobs. While this shows that the economy remains strong, market observers shifted their focus to the slower wage growth of 0.3% for the month, below economists’ expectation of 0.4%. In addition, the euro zone’s headline inflation dropped from 10.1% in November to 9.2% in December. Both economic data boosted hopes that the central bank’s aggressive rate tightening may slow down. This triggered a rally in the U.S. and European stock markets. Daily cryptocurrency market performance. Source: Coin360 However, the reaction in the cryptocurrency space remains muted, with Bitcoin (BTC) continuing to trade inside a narrow range. The crypto investors...

Macroeconomic data points toward intensifying pain for crypto investors in 2023

Undoubtedly, 2022 was one of the worst years for Bitcoin (BTC) buyers, primarily because the asset’s price dropped by 65%. While there were some explicit reasons for the drop, such as the LUNA-UST crash in May and the FTX implosion in November, the most important reason was the U.S. Federal Reserve policy of tapering and raising interest rates. Bitcoin’s price had dropped 50% from its peak to lows of $33,100 before the LUNA-UST crash, thanks to the Fed rate hikes. The first significant drop in Bitcoin’s price was due to growing market uncertainty around potential rate hike rumors in November 2021. By January 2022, the stock market had already started showing cracks due to the increasing pressure of imminent tapering, which also negatively impacted crypto prices. BTC/USD daily price chart. ...

Ethereum’s Shanghai upgrade could supercharge liquid staking derivatives — Here’s how

The crypto market witnessed the DeFi summer of 2020, where decentralized finance applications like Compound and Uniswap turned Ether (ETH) and Bitcoin (BTC) into yield-bearing assets via yield farming and liquidity mining rewards. The price of Ether nearly doubled to $490 as the total liquidity across DeFi protocols quickly surged to $10 billion. Toward the end of 2020 and early 2021, the COVID-19-induced quantitative easing across global markets was in full effect, causing a mega-bull run that lasted almost a year. During this time, Ether’s price increased nearly ten times to a peak above $4,800. After the euphoric bullish phase ended, a painful cool-down journey was exacerbated by the UST-LUNA crash which began in early 2022. This took Ether’s price down to $800. A ray of hope eventually...

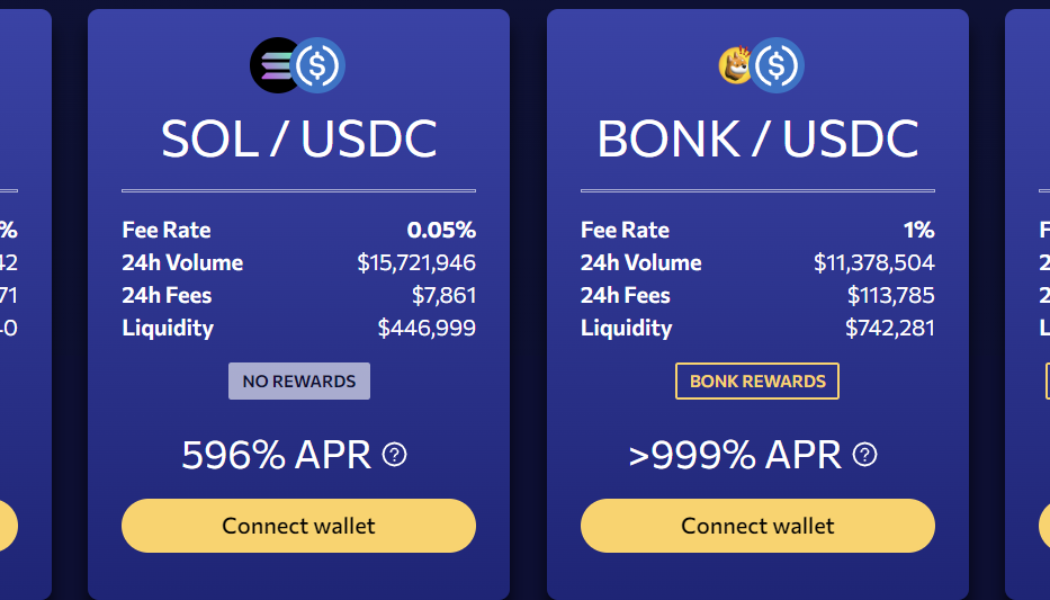

Bonk token goes bonkers as traders chase after high yields in the Solana ecosystem

Bonk, a meme token modeled after Shiba Inu (SHIB) that launched on Dec. 25, is skyrocketing and some traders believe the token’s trading volume is potentially driving Solana’s (SOL) price up. Over the past 48 hours, SOL price has gained 34%, and in the past 24 hours, Bonk has climbed 117%, according to data from CoinMarketCap. While the wider crypto market remains suppressed, traders are hoping that Bonk could present new opportunities during the downturn. According to the project’s website, Bonk is the first dog token on the Solana blockchain. Initially, 50% of the token supply was airdropped to Solana users with a mission to remove toxic Alameda-styled token economics. The airdrop resulted in more than $20 million in trading volume according to the Solana decentralized exchange Orc...

These 4 altcoins may attract buyers with Bitcoin stagnating

Bitcoin’s (BTC) volatility remained subdued in the final few days of the last year, indicating that investors were in no hurry to enter the markets. Bitcoin ended 2022 near $16,500 and the first day of the new year also failed to ignite the markets. This suggests that traders remain cautious and on the lookout for a catalyst to start the next trending move. Several analysts remain bearish about Bitcoin’s near-term price action. David Marcus, CEO and founder of Bitcoin firm Lightspark, said in a blog post released on Dec. 30 that he does not see the crypto winter ending in 2023 and not even in 2024. He expects that it will take time to rebuild consumer trust but believes the current reset may be good for legitimate firms over the long term. Crypto market data daily view. Source: Coin360 The...

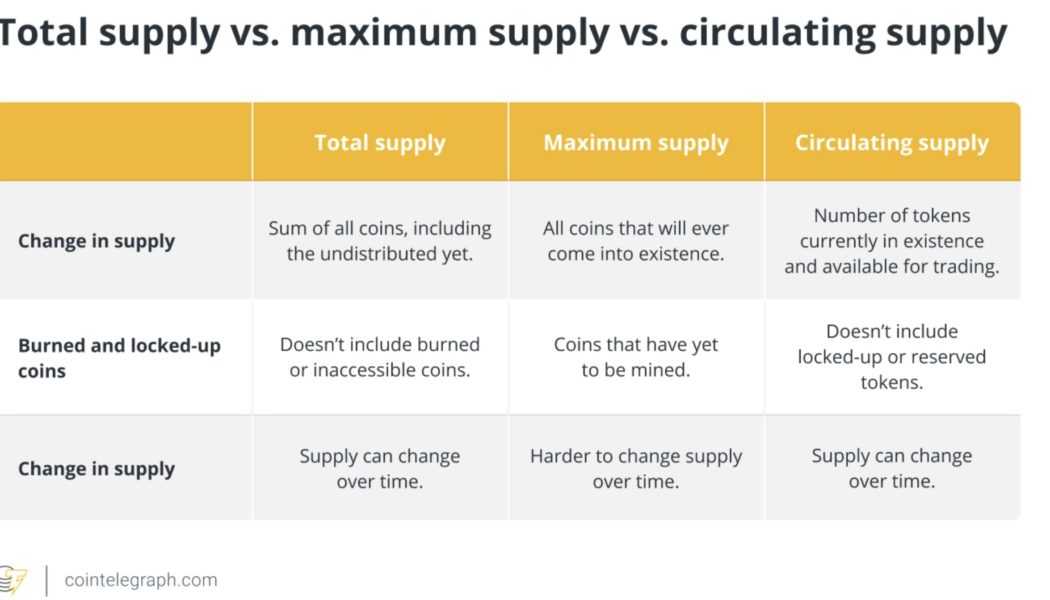

New research indicates boomers make better crypto investors

As a millennial, it’s hard to say this, but boomers are doing crypto better. They are taking research methods used in the traditional markets and applying them to crypto projects, according to a new report from Bybit and consumer research company Toluna. The report says that 34% of boomers spend “a few days” doing due diligence on a project before investing — 50% more than other generations. More concerning still, “64% of North American investors spend less than two hours or don’t DYOR at all.” Boomers are also more likely to focus their research on technical factors such as tokenomics, revenue and competitor landscape. Compare this with their younger compatriots, who are more likely to prize reputational elements such as a charismatic founder and “website aesthetics.” This shows that bein...

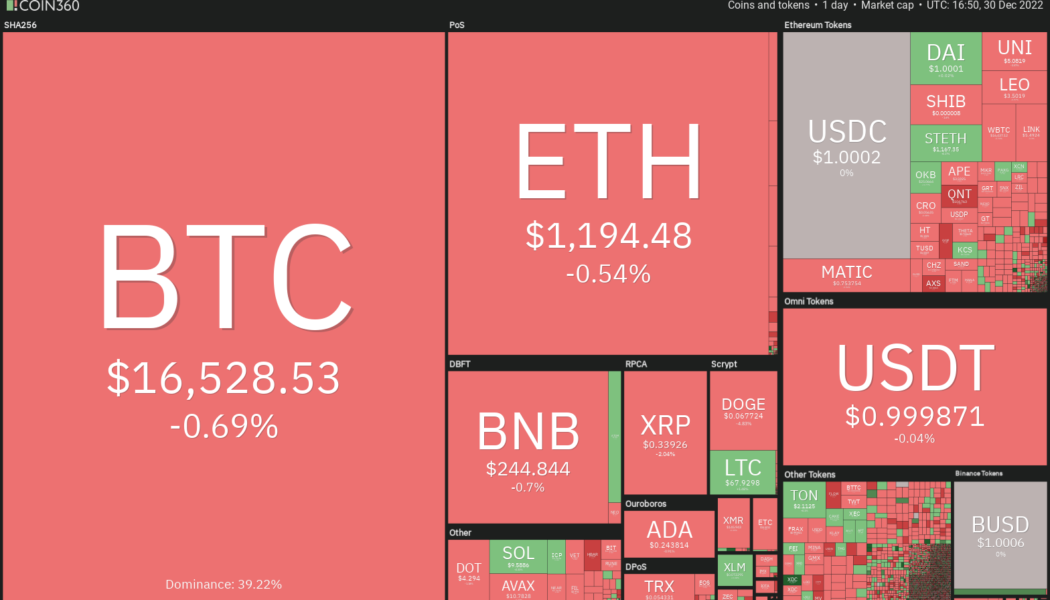

Price analysis 12/30: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

Investors have faced a tumultuous year in 2022 as stocks, bonds, and the cryptocurrency sector have all witnessed sharp declines. As of Nov. 30, the performance of a traditional portfolio comprising 60% stocks and 40% bonds has been the worst since 1932, according to a report by Financial Times. The next big question troubling crypto investors is whether the pain in Bitcoin (BTC) is over or will the downtrend continue in 2023. Analysts seem to be divided in their opinion for the first quarter of the new year. While some expect a drop to $10,000 others anticipate a rally to $22,000. Daily cryptocurrency market performance. Source: Coin360 While the near-term remains uncertain, research and trading firm Capriole Investments said in its latest edition of the Capriole Newsletter that Bitcoin c...

Price analysis 12/28: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

Gold has been an outperformer in 2022 compared to the United States equities markets and Bitcoin (BTC). The yellow metal is almost flat for the year while the S&P 500 is down more than 19% and Bitcoin has plunged roughly 64%. The sharp fall in Bitcoin’s price has hurt both short-term and long-term investors alike. According to Glassnode data, 1,889,585 Bitcoin held by short-term holders was at a loss as of Dec. 26 while the loss-making tally of long-term holders was 6,057,858 Bitcoin. Daily cryptocurrency market performance. Source: Coin360 In spite of gold’s good showing and Bitcoin’s dismal performance in 2022, billionaire investor Mark Cuban continues to favor Bitcoin over gold. While speaking on Bill Maher’s Club Random podcast, Cuban told Maher, “If you have gold, you’re dum...

Bitcoin and these 4 altcoins are showing bullish signs

Cryptocurrency markets lack any signs of volatility going into the year-end holiday season. This suggests that both the bulls and the bears are playing it safe and are not waging large bets due to the uncertainty regarding the next directional move. This indecisive phase is unlikely to continue for long because periods of low volatility are generally followed by an increase in volatility. Willy Woo, creator of on-chain analytics resource Woobull, anticipates that the duration of the current bear market may “be longer than 2018 but shorter than 2015.” Crypto market data daily view. Source: Coin360 The crypto winter has resulted in a loss of more than $116 billion to the personal equity of 17 investors and founders in the cryptocurrency space, according to estimates by Forbes. The carnage ha...

Crypto billionaires lost $116B since March: Report

The bear market and the wave of bankruptcies in the crypto industry drained $116 billion from the pockets of founders and investors in the past nine months, according to recent estimates by Forbes. The loss represents the combined personal equity of 17 people in the space, with over 15 losing more than half of their fortunes since March. As a result, 10 names were removed from the crypto billionaires list. One of the major losses was attributed to Binance CEO Changpeng “CZ” Zhao. In March, his 70% stake in the crypto exchange was valued at $65 billion, but it is now worth $4.5 billion. Coinbase CEO Brian Armstrong has a net worth estimated at $1.5 billion, down from $6 billion in March. The fortune of Ripple’s co-founder Chris Larsen was reduced from $4.3 billion to...