Markets

Top 5 cryptocurrencies to watch this week: BTC, SOL, LTC, LINK, BSV

Bitcoin (BTC) plummeted to $17,622 on June 18. This marked the first time in Bitcoin’s history that it has fallen below its previous cycle high. The United States Federal Reserve’s aggressive monetary tightening, a crisis at crypto lending platform Celsius and liquidity issues at investment fund Three Arrows Capital are creating a sense of panic among traders. Markets commentator Holger Zschaepitz said that Bitcoin has crashed more than 80% four times in history. That puts the current fall of about 74% within historical standards. Previous bear markets have bottomed out just below the 200-week moving average, according to market analyst Rekt Capital. If history repeats itself, Bitcoin is unlikely to stay at the current depressed levels for a long time. Crypto market data daily view. Source...

Price analysis 6/17: BTC, ETH, BNB, ADA, XRP, SOL, DOGE, DOT, LEO, AVAX

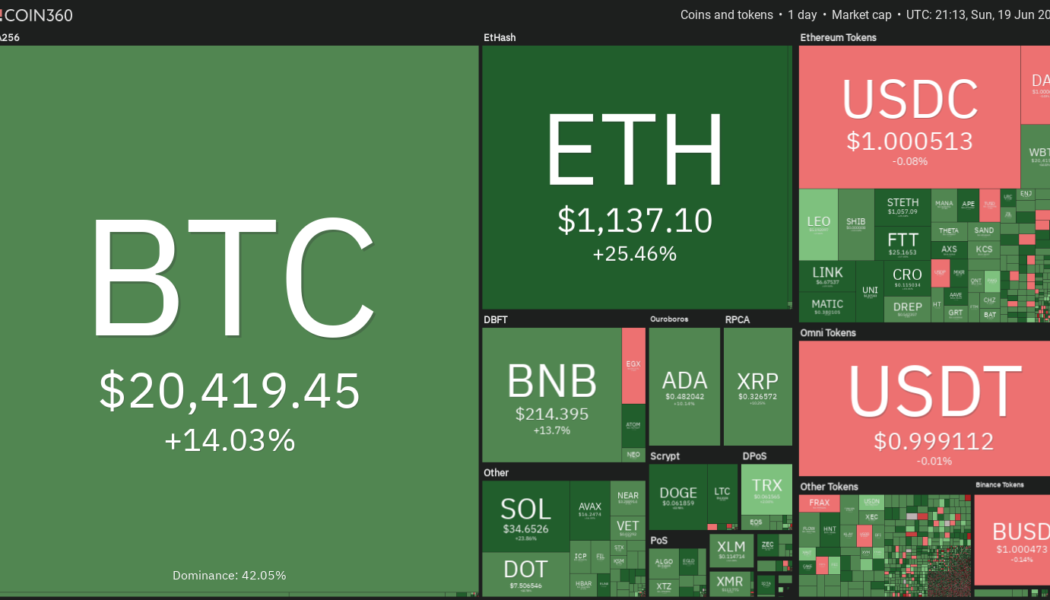

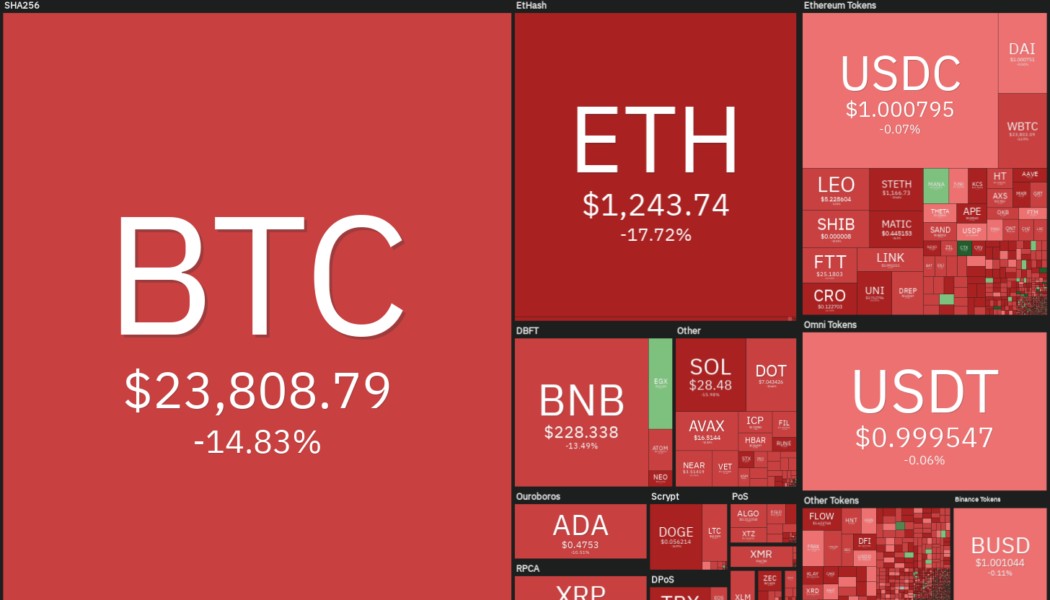

The sharp fall in cryptocurrencies has pulled the total crypto market capitalization below $900 billion. According to CoinGoLive, 72 out of the top 100 tokens have declined in excess of 90% from their all-time highs. In comparison, the top-10 coins have outperformed during the fall, dropping an average of 79% from their all-time high. Bitcoin (BTC) is down more than 70% from its all-time high but the bulls are struggling to arrest the decline. Jurrien Timmer, director of global macro of Fidelity, highlighted that Bitcoin could be “cheaper than it looks” considering the metric of price-to-network ratio, which is similar to the price-to-earnings ratio used in the equities market to value a stock. Daily cryptocurrency market performance. Source: Coin360 Billionaire investor Mark Cuban s...

Bitcoin critics say BTC price is going to $0 this time, but these 3 signals suggest otherwise

Like clockwork, the onset of a crypto bear market has brought out the “Bitcoin is dead” crowd who gleefully proclaim the end of the largest cryptocurrency by market capitalization. If #Bitcoin can collapse by 70% from $69,000 to under $21,000, it can just as easily fall another 70% down to $6,000. Given the excessive leverage in #crypto, imagine the forced sales that would take place during a sell-off of this magnitude. $3,000 is a more likely price target. — Peter Schiff (@PeterSchiff) June 14, 2022 The past few months have indeed been painful for investors, and the price of Bitcoin (BTC) has fallen to a new 2022 low at $20,100, but the latest calls for the asset’s demise are likely to suffer the same fate as the previous 452 predictions calling for its death. Bitcoin obitu...

Sweeping layoffs, hiring and firing as crypto prices take a massive downturn

Many in the crypto world have been glued to their screens with eyes dead set on financial conditions this week. That isn’t the case for everyone though, as thousands are suddenly experiencing thewoes of sudden unemployment. Words of encouragement and sympathy also poured out across Twitter and LinkedIn consoling individuals released from their responsibilities. Some expressed frustration, confusion and anger while others expressed gratitude, renewed vision and reflections. My heart is with those recently laid off. I too have been one of the lucky ones to be spared by massive layoffs on days where friends have been let go. This privileged situation has its own anxiety, displacement and upheaval. Sorry you’re going through this moment. — Matt Murray (@vintageneon) June 16, 2022 As...

Market selling might ease, but traders are on the sidelines until BTC confirms $20K as support

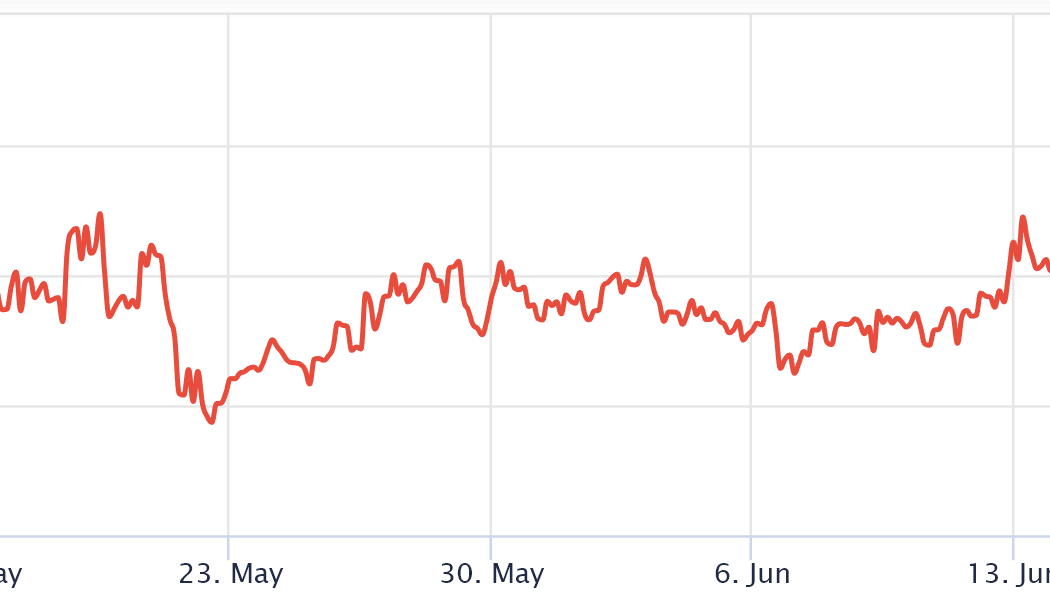

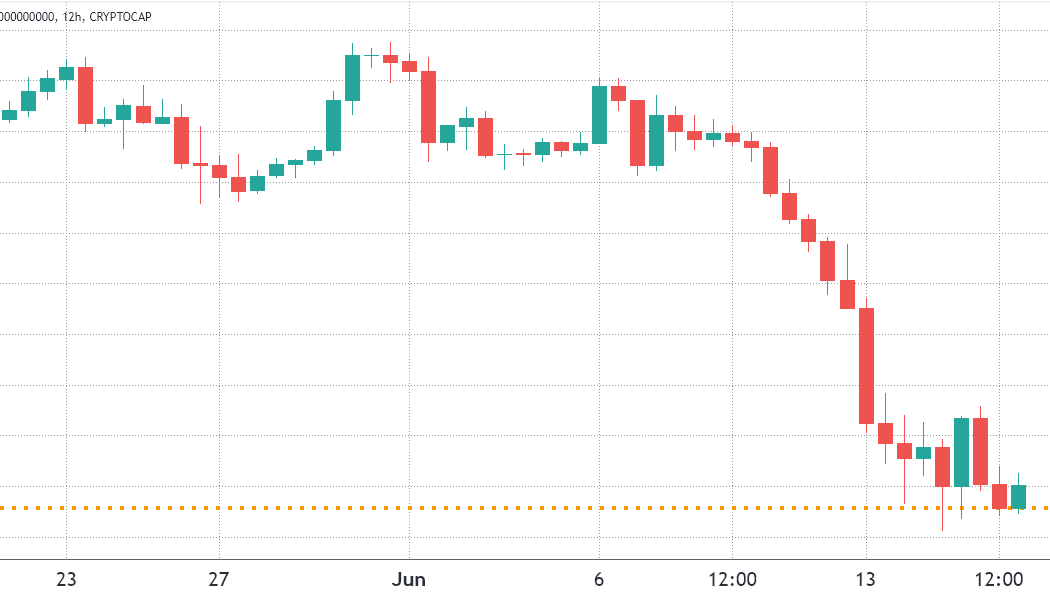

The total crypto market capitalization fell off a cliff between June 10 and 13 as it broke below $1 trillion for the first time since January 2021. Bitcoin (BTC) fell by 28% within a week and Ether (ETH) faced an agonizing 34.5% correction. Total crypto market cap, USD billion. Source: TradingView Presently, the total crypto capitalization is at $890 million, a 24.5% negative performance since June 10. That certainly raises the question of how the two leading crypto assets managed to underperform the remaining coins. The answer lies in the $154 billion worth of stablecoins distorting the broader market performance. Even though the chart shows support at the $878 billion level, it will take some time until traders take in every recent event that has impacted the market. For example, the U.S...

5 indicators traders can use to know when a crypto bear market is ending

The bull market is gone and the reality of a long crypto winter is surely giving traders a bad case of the shivers. Bitcoin’s (BTC) price has fallen to lows not even the bears expected, and some investors are likely scratching their heads and wondering how BTC will come back from this epic decline. Prices are dropping daily, and the current question on everyone’s mind is: “when will the market bottom and how long will the bear market last?” While it’s impossible to predict when the bear market will end, studying previous downtrends provides some insight into when the phase is coming to a close. Here’s a look at five indicators that traders use to help know when a crypto winter is coming to a close. The crypto industry begins to recover One of the classic signs that a crypto winter ha...

Crypto casinos: What are they, and should you try them?

Cryptocurrencies are flourishing like never before, and every day, more and more governments and other authorities are starting to take them seriously. The currencies are slowly, but surely spreading to all corners of society – and recently, they’ve caused a shift in the gambling industry as well. With the rise of the so-called crypto casinos, gamblers can now make bets and game the night away using only crypto as payment. While this presents a host of new opportunities, it also raises many questions about safety, regulations and rules. Below, we’ll go through some of these and explain the new casino concept to you. What are crypto casinos? First and foremost, let’s start by defining what exactly it is that sets crypto casinos apart from the ones you might be familiar with. It’s...

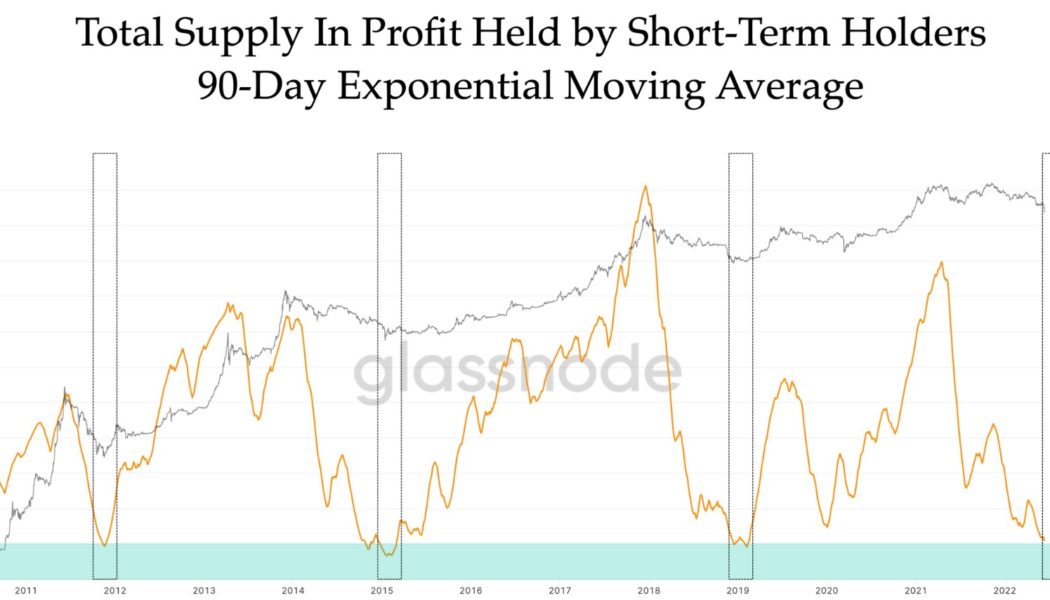

Further downside is expected, but multiple data points suggest Bitcoin is undervalued

The outlook across the cryptocurrency ecosystem continue to dim as the sharp downtrend that was initially sparked by the collapse of Terra now appears to have claimed the Singapore-based crypto venture capital firm Three Arrows Capital (3AC) as its next victim. As large crypto projects and investment firms begin to collapse on a weekly basis, the prospect of a long, drawn out bear market is a reality investors are beginning to accept. Based on a recent Twitter poll conducted by market analyst and pseudonymous Twitter user Plan C, 41.6% of respondents indicated that they thought the Bitcoin (BTC) bottom will fall between the $17,000 to $20,000 range. Total Bitcoin supply in profit held by short-term holders. Source: Twitter Addresses holding at least 1 BTC hits a new ...

Cake DeFi offers hope as uncertainty rocks the crypto DeFi space

This week has been nothing short of “Maniac Week’ for the crypto community as crypto prices continue to fall. Bitcoin (BTC) has been leading the fall and it is currently barely holding above $20,000. Alongside the plunge, crypto services providers are starting to become shaky with a few already being forced to pause services. On Monday, DeFi participants woke to the shocking news that the crypto lending giant Celsius was pausing withdrawals, transfers, and swaps indefinitely and the services are yet to resume to date. There are also rumors that the crypto lender may be insolvent; although the company has not responded to this. But fast forward to Cake DeFi, a Singapore-based staking, lending, and liquidity pool platform that enables users to deposit and earn a yield on a variety of digital...

Ethereum price falls below $1.1K and data suggests the bottom is still a ways away

Ether (ETH) price nosedived below $1,100 in the early hours of June 14 to prices not seen since January 2021. The downside move marks a 78% correction since the $4,870 all-time high on Nov. 10, 2021. More importantly, Ether has underperformed Bitcoin (BTC) by 33% between May 10 and June 14, 2022, and the last time a similar event happened was mid-2021. ETH/BTC price at Binance, 2021. Source: TradingView Even though Bitcoin oscillated in a narrow range two weeks before the 0.082 ETH/BTC peak, this period marked the “DeFi summer” peak when Ethereum’s total value locked (TVL) catapulted to $93 billion from $42 billion two months earlier. What’s behind Ether’s 2021 underperformance? Before jumping to conclusions, a broader set of data is needed to understand what led to the 3...

Price analysis 6/13: BTC, ETH, BNB, ADA, XRP, SOL, DOGE, DOT, LEO, AVAX

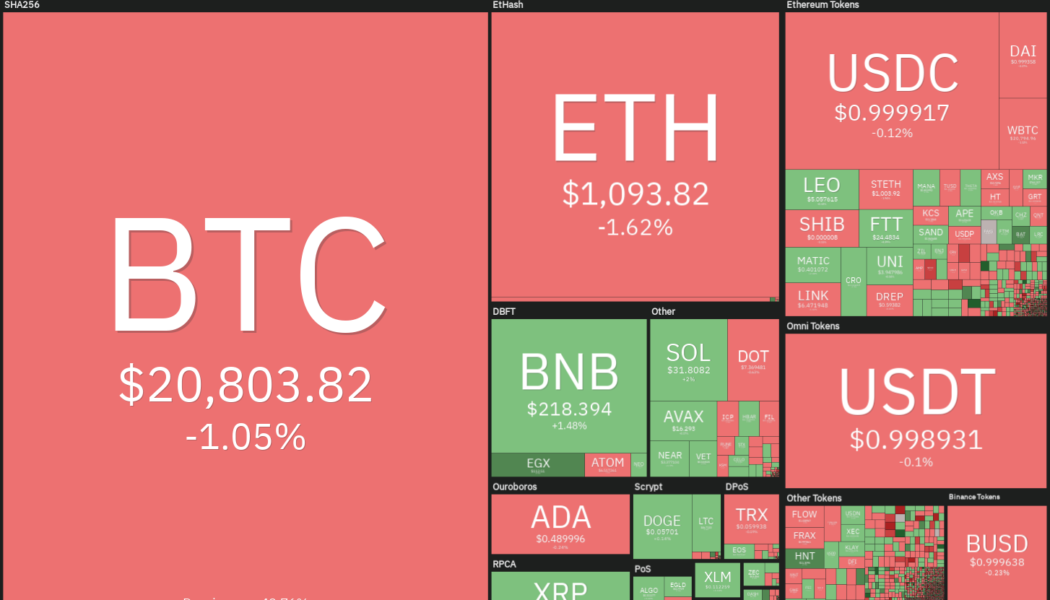

The United States equities markets extended their decline to start the week on June 13. The S&P 500 hit a new year-to-date low and dipped into bear market territory, falling more than 20% from its all-time high made on Jan. 4. The cryptocurrency markets are tracking the equities markets lower and the selling pressure further intensified due to the rumored liquidity crisis of major lending platform Celsius and traders possibly selling positions to meet margin calls. This pulled the total crypto market capitalization below $1 trillion. Daily cryptocurrency market performance. Source: Coin360 The sharp declines have led some analysts to project extremely bearish targets. While anything is possible in the markets and it is difficult to call a bottom, capitulations usually tend to sta...