Markets

Bitcoin price dips under $23K after earnings report reveals Tesla sold 75% of its BTC

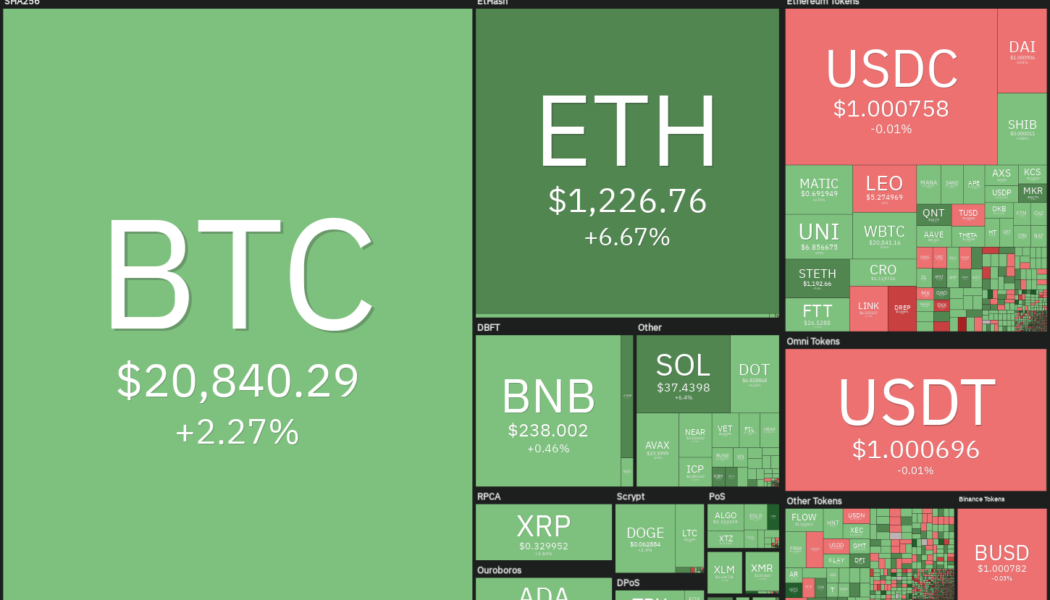

Easy come, easy go was the story on July 20 as the day started on a positive note with Bitcoin (BTC) climbing above $24,300, only to end the official trading day in the red after less than stellar Q2 earning news showed Tesla sold 75% of its Bitcoin and Minecraft reversed course by deciding to ban NFTs on its platform. Daily cryptocurrency market performance. Source: Coin360 A potential source of the afternoon downturn can be traced to Tesla’s Q2 earnings data, which showed that the electric car company sold off 75% of its Bitcoin holdings in order to add $963 million in cash to its balance sheet. So, not only forced selling from 3AC, $LUNA & $UST, but also Voyager, BlockFi and Celsius have been causing the markets to crash. On top of that, Tesla did sell 75% of their #Bitcoin pur...

Morgan Stanley encourages investors to buy battered El Salvador eurobonds

El Salvador’s Bitcoin (BTC) bet has somewhat backfired, with the top cryptocurrency currently trading at a 70% discount from its top. At a time when the Latin American nation is struggling with its debt, Morgan Stanley has given a buy call for the battered eurobond. Simon Waever, global head of emerging-market sovereign credit strategy at Morgan Stanley, told investors in a Tuesday note that El Salvador’s bonds are overly punished by the market conditions, despite the country having better financial metrics than many of its peers, reported Bloomberg. The note to investors read: “Markets are clearly pricing in a high probability of the autarky scenario in which El Salvador defaults, but there is no restructuring.” Waever noted that a country’s debt shouldn’t trade lower than $0.437 on the d...

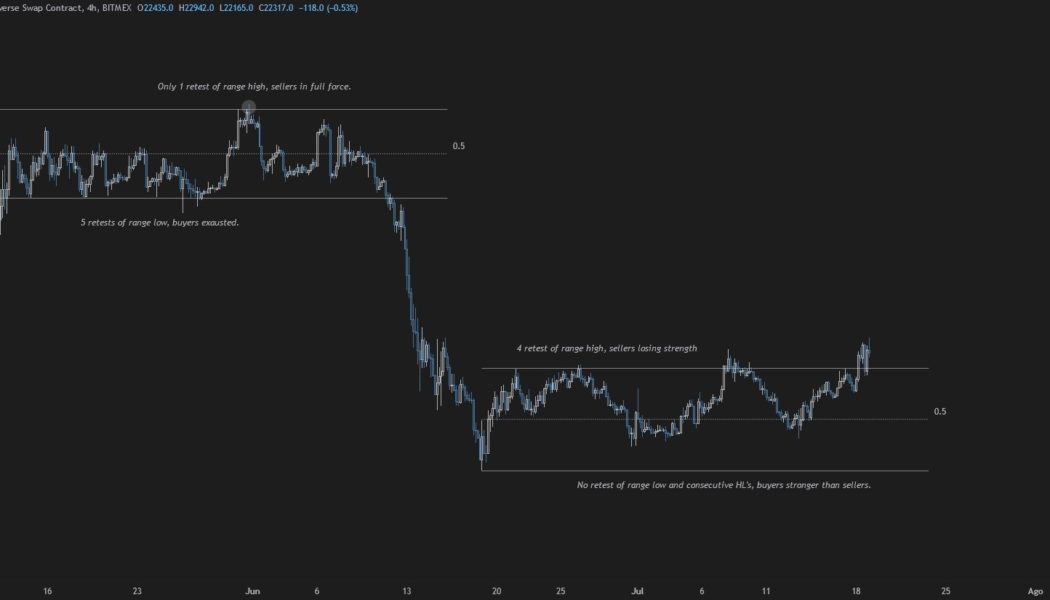

Bitcoin price holds $23.5K, leading bulls to say ‘it’s different this time’

Similar to Stockholm syndrome where captives develop a psychological bond with their captors, crypto winters have a way of flipping even the most bullish cryptocurrency supporters bearish in a short period of time. Evidence of this reality was on full display on July 19 after the recovery of Bitcoin (BTC) back above $23,000 was met with widespread warnings that the move was merely a fakeout before the market heads for new lows $BTC Not bad. But keep in mind that this still can turn into a classical fake out. My general thesis still remains, bear market rally pic.twitter.com/VxnH4mo6hW — Jimie (@Your_NLP_Coach) July 19, 2022 While the possibility of new lows being set in the future can’t be ruled out, here’s a look at analysts’ opinions on how this BTC breakout could be different than...

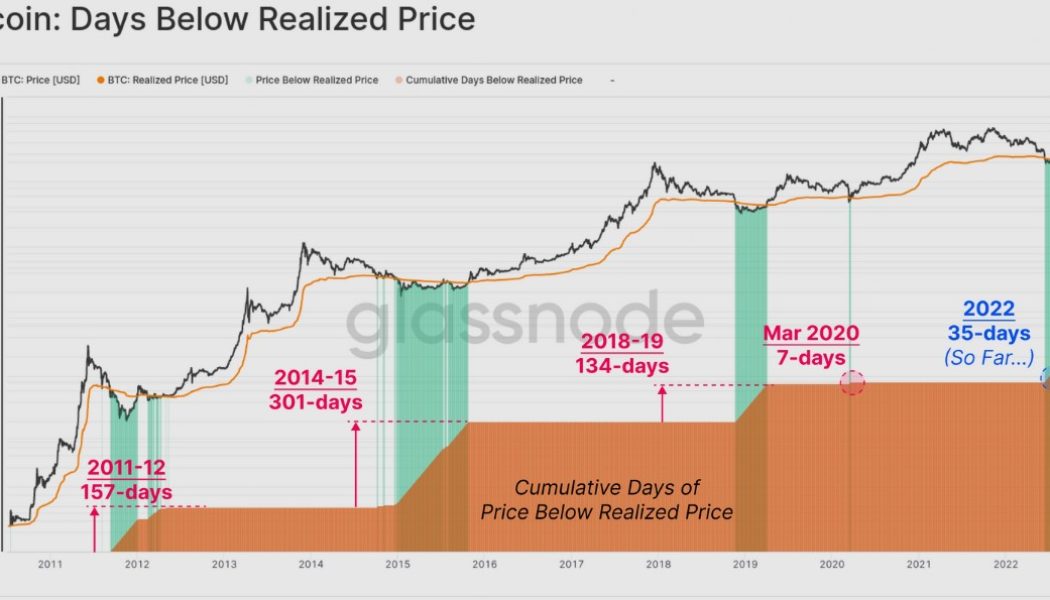

Data points to a Bitcoin bottom, but one metric warns of a final drop to $14K

“When will it end?” is the question that is on the mind of investors who have endured the current crypto winter and witnessed the demise of multiple protocols and investment funds over the past few months. This week, Bitcoin (BTC) once again finds itself testing resistance at its 200-week moving average and the real challenge is whether it can push higher in the face of multiple headwinds or if the price will trend down back into the range it has been trapped in since early June. According to the most recent newsletter from on-chain market intelligence firm Glassnode, “duration” is the main difference between the current bear market and previous cycles and many on-chain metrics are now comparable to these historical drawdowns. One metric that has proven to be a reliab...

Price analysis 7/18: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

Bitcoin (BTC) rose above $22,000 and Ether (ETH) traded above $1,500 on July 18, indicating that bulls are gradually returning to the cryptocurrency markets. This pushed the total crypto market capitalization above $1 trillion for the first time since June 13, raising hopes that the worst of the bear market may be behind us. In another positive sign, more than 80% of the total Bitcoin supply denominated in the United States dollar has been dormant for at least three months, according to crypto intelligence firm Glassnode. During previous bear markets, such an occurrence preceded the end of the bear phase. Daily cryptocurrency market performance. Source: Coin360 However, a report by Grayscale Investments voices a different opinion. It suggests that the current bear market in Bitcoin started...

Price analysis 7/15: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, AVAX

The recovery in the cryptocurrency markets is being led by Bitcoin (BTC), which has risen above the $21,000 level. However, BlockTrends analyst Caue Oliveira said that on-chain data shows a decline in “whale activity” since the month of May, barring the flurry of activity during the Terra (LUNA) — since renamed Terra Classic (LUNC) — collapse. A survey conducted in China shows that most participants believe that Bitcoin could fall much further. About 40% of the participants said they would buy Bitcoin if the price dropped to $10,000. Only 8% of the voters showed interest in buying Bitcoin if it drops to $18,000. Daily cryptocurrency market performance. Source: Coin360 Millionaire investor Kevin O’Leary told Cointelegraph that crypto markets are likely to witness “massive volatility” and en...

Top 5 cryptocurrencies to watch this week: BTC, ETH, MATIC, FTT, ETC

The United States equities markets recovered from their intra-week lows last week, suggesting demand exists at lower levels. On similar lines, Bitcoin (BTC) also recovered from $18,910 last week, indicating that traders may be getting back into risky assets. However, analysts remain divided in their opinion on the recovery in Bitcoin. While some believe that the relief rally is a bull trap, others expect the up-move to retest the crucial resistance at the 200-week moving average ($22,626). Crypto market data daily view. Source: Coin360 The current bear phase has damaged sentiment as seen from the Crypto Fear and Greed Index, which has remained in the “extreme fear” zone since May 6. According to Philip Swift, creator of on-chain analytics platform LookIntoBitcoin, the time spent...

Could Bitcoin miners’ troubles trigger a ‘death spiral’ for BTC price?

A July 9 post by @PricedinBTC on the “cost to mine Bitcoin” in the United States gathered the crypto community’s attention, especially considering the recent headlines that BTC miners have made. The crypto bear market and growing energy costs have caused a perfect storm for the mining sector and this has led some companies to lay off employees and others to defer all capital expenditures. Some went as far as raising concerns of Bitcoin miners hitting a “death spiral.” In bear markets like this, inevitably a Bitcoin critic comes out and says that Bitcoin will soon collapse from a “miner death spiral”, meaning that miners will go offline because it is not profitable to run their operations, and then Bitcoin’s hash rate will fall, causing its… — Cory Klippsten (@coryklippste...

2018 Ethereum price fractal suggests a $400 bottom, but analysts say the merge is a ‘wildcard’

There’s no rest for the weary during a bear market, and the Crypto Fear and Greed index shows that investor sentiment has been stuck in a state of “extreme fear” for a record 70 consecutive days. As the market looks for a catalyst to reverse the trend, there is little on the horizon besides the Ethereum (ETH) Merge that seems capable of sparking a rally. If that is indeed the case, the market could continue to trend down or sideways until the tentative Merge date of September 19. Data from Cointelegraph Markets Pro and TradingView shows that Ether price remains sandwiched in the trading zone it has been trading in since June 13 and it is currently running into the upper resistance near $1,240. ETH/USDT 1-day chart. Source: TradingView With the Merge still a couple of months awa...

UNI, MATIC and AAVE surge after Bitcoin price bounces back above $20K

Crypto investors found cause for celebration on July 14 as the market experienced a positive trading session just one day after the Consumer Price Index (CPI) posted a June print of 9.1%, its highest level since 1981. Daily cryptocurrency market performance. Source: Coin360 The move higher in the market wasn’t entirely unexpected for seasoned traders who have become familiar with a one to two-day bounce in asset prices following the most recent CPI prints. These traders also know there’s nothing to get too excited about as the bounces have typically been followed by more downside once people realize that the high inflation print is a negative development. Nevertheless, the green in the market is a welcome sight after the rough start to 2022. Top 5 coins with the highest 24-hour price...

Why is there so much uncertainty in the crypto market right now? | Market Talks with Crypto Jebb and Crypto Wendy O

In the fourth episode of Market Talks, we welcome YouTube media creator and crypto educator Crypto Wendy O. Crypto Wendy O is a YouTube media creator and crypto educator. Wendy became interested in cryptocurrency and blockchain technology in November of 2017. She has been into crypto full-time since the summer of 2018 and focuses on providing transparent marketing & media solutions for blockchain companies globally. Wendy also provides free education via YouTube and Twitter to her growing audience of over 170 thousand, giving her the largest following of any female crypto influencer in the world. Some of the topics up for discussion with Wendy are the new consumer price index (CPI) numbers and how they might impact the crypto market going forward, and why there is so much uncertai...